Bitcoin Plunge: K33 Research Warns of “Extremely Dangerous” Market Setup and Looming Liquidation Risk

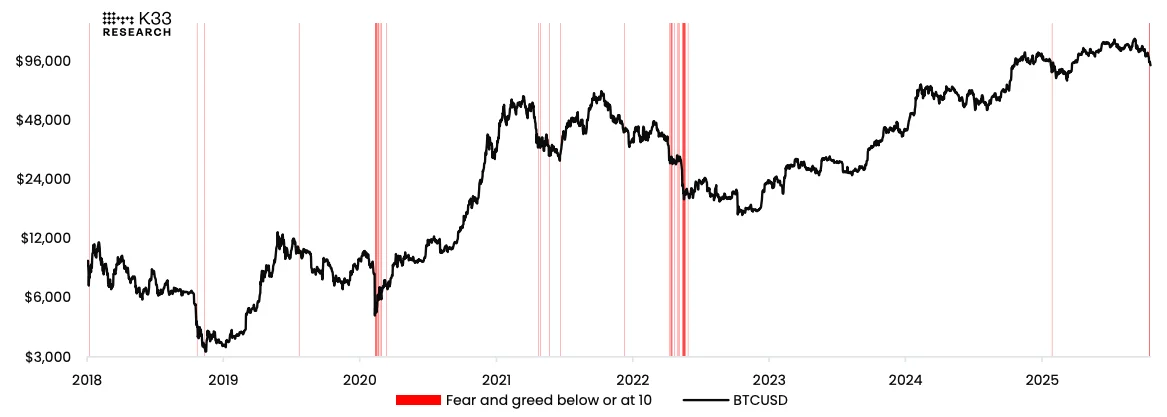

Bitcoin’s recent downturn has intensified, with the cryptocurrency briefly dipping to $88,616.69 earlier today (June 20th), marking its lowest point since April and a 10% weekly decline. As prices continue their descent, leading cryptocurrency research firm K33 Research has issued a stark warning: the derivatives market is forming an “extremely dangerous” structural pattern, brimming with leveraged funds attempting to “buy the dip.” Should a rebound fail to materialize, the market faces the risk of a cascade of liquidations.

Derivatives Market Braces for Impact: A “Falling Knife” Scenario

In its latest report, K33 Head of Research Vetle Lunde highlighted a concerning trend: Bitcoin perpetual futures open interest has surged by over 36,000 BTC in just one week—the largest increase since April 2023. This rapid expansion is accompanied by escalating funding rates, signaling that bullish traders are paying significant premiums to maintain their positions, betting on a swift recovery after Bitcoin broke its six-month low.

Lunde cautions that this aggressive positioning is not a defensive strategy but rather a classic case of “catching a falling knife.” He elaborated:

“The surge in funding rates is a direct consequence of a flood of pre-placed limit orders being triggered. These orders are premised on the belief that Bitcoin will quickly rebound after breaching its 6-month low. The harsh reality, however, is that no such rebound has occurred.”

“These accumulating leveraged positions have now become a significant source of market pressure, substantially increasing the risk of heightened volatility driven by potential liquidations.”

While perpetual futures markets typically balance long and short positions in nominal value, making both sides susceptible to squeezes, the current spike in funding rates clearly indicates a disproportionate surge in demand for long exposure. This imbalance amplifies the fragility of these leveraged long positions if Bitcoin’s price continues its downward trajectory.

Institutional Caution vs. Retail Aggression: A Historic Precursor?

In stark contrast to the speculative fervor in the perpetual futures market, the CME Bitcoin futures market, primarily driven by institutional investors, exhibits extreme caution. K33’s analysis reveals that CME futures premiums are near annual lows, with a flattened term structure, reflecting a strong hedging sentiment among institutional players.

Vetle Lunde warns that this divergence—where retail investors aggressively go long while institutions adopt a conservative, risk-off stance—has historically preceded further price declines. He noted:

“This alarming market structure has manifested in seven similar scenarios over the past five years. Statistical data shows that in six of these instances, Bitcoin’s price continued to fall in the subsequent month, averaging a 16% decline.”

“While we maintained a bullish outlook at the onset of this downturn, the current signals present a sufficiently dangerous ‘omen.’ We strongly advise investors to reduce their overall risk exposure.”

Spot ETF Outflows and Potential Price Targets

Beyond the ticking time bomb in the derivatives market, the selling pressure on Bitcoin spot ETFs shows no signs of abating. K33’s report indicates net outflows exceeding 20,000 Bitcoins in the past week, accumulating to nearly 40,000 Bitcoins lost over the last 30 days.

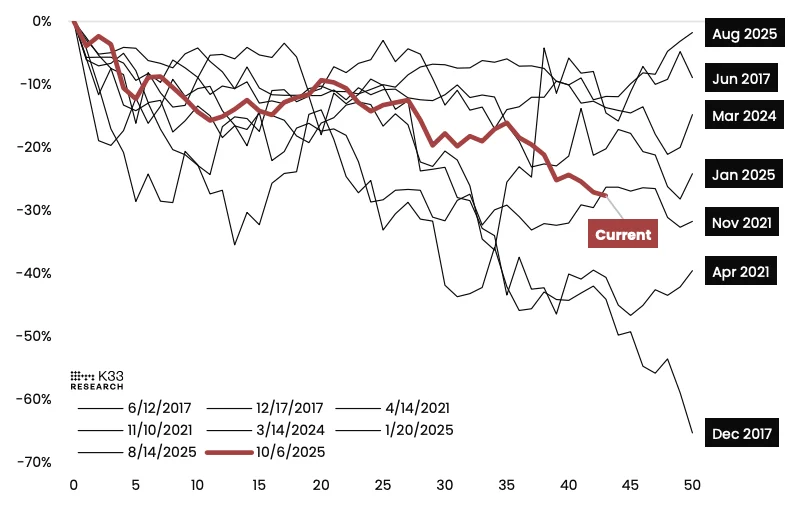

Despite K33’s long-term optimism for Bitcoin, fueled by accelerating institutional adoption and a supportive monetary environment, Lunde acknowledges that the current retracement depth already ranks among the “deepest declines” recorded at the 43-day mark of market weakness since 2017.

While K33 admits that using “day 43” as a precise benchmark has an element of randomness, the firm emphasizes that it does not foresee a repeat of the prolonged and brutal bear markets of 2018 or 2022.

K33 estimates that if Bitcoin follows the trajectory of the deepest declines observed in the past two years, its potential bottom could range between $84,000 and $86,000. Should selling pressure intensify further, the price might even retest its April lows, potentially nearing MicroStrategy’s average Bitcoin holding cost of $74,433. Vetle Lunde stressed:

“These two price levels are critical psychological thresholds closely monitored by traders. While the market often mistakenly believes MicroStrategy would be forced to sell if Bitcoin falls below its cost price, this level itself represents a psychological target area that the market might aggressively pursue.”

Disclaimer: This article is intended solely for providing market information. All content and opinions are for reference purposes only and do not constitute investment advice. They do not represent the views and positions of BlockTempo. Investors should make their own decisions and conduct their own trades. The author and BlockTempo shall not be held responsible for any direct or indirect losses incurred by investors as a result of their transactions.