Author: Jae, PANews

1inch Unveils Aqua: Revolutionizing DeFi Liquidity with Self-Custody and Capital Efficiency

For years, the decentralized finance (DeFi) landscape has grappled with two formidable challenges: pervasive liquidity fragmentation and vast sums of idle capital. With tens of thousands of liquidity pools holding billions in dormant funds, the ecosystem has struggled to channel this potential into a vibrant, active flow.

On November 17, industry leader 1inch, renowned for its DEX aggregation prowess, announced the launch of its groundbreaking liquidity protocol, Aqua. Positioned as an “awakener,” Aqua is set to redefine DeFi’s approach to liquidity management, ushering in an era of enhanced capital efficiency.

1inch’s Strategic Pivot: From Aggregator to Foundational Infrastructure

The introduction of Aqua marks a significant turning point in 1inch’s strategic evolution. While initially celebrated for its ability to aggregate optimal trading paths and prices across various DEXs for retail users, 1inch has steadily shifted its focus towards becoming a crucial B2B infrastructure provider.

Aqua’s initial release underscores this strategic pivot. Rather than directly targeting general retail users, the protocol first opened its doors to developers, offering comprehensive SDKs, libraries, and technical documentation. This developer-centric approach firmly establishes Aqua as a foundational layer within the DeFi stack.

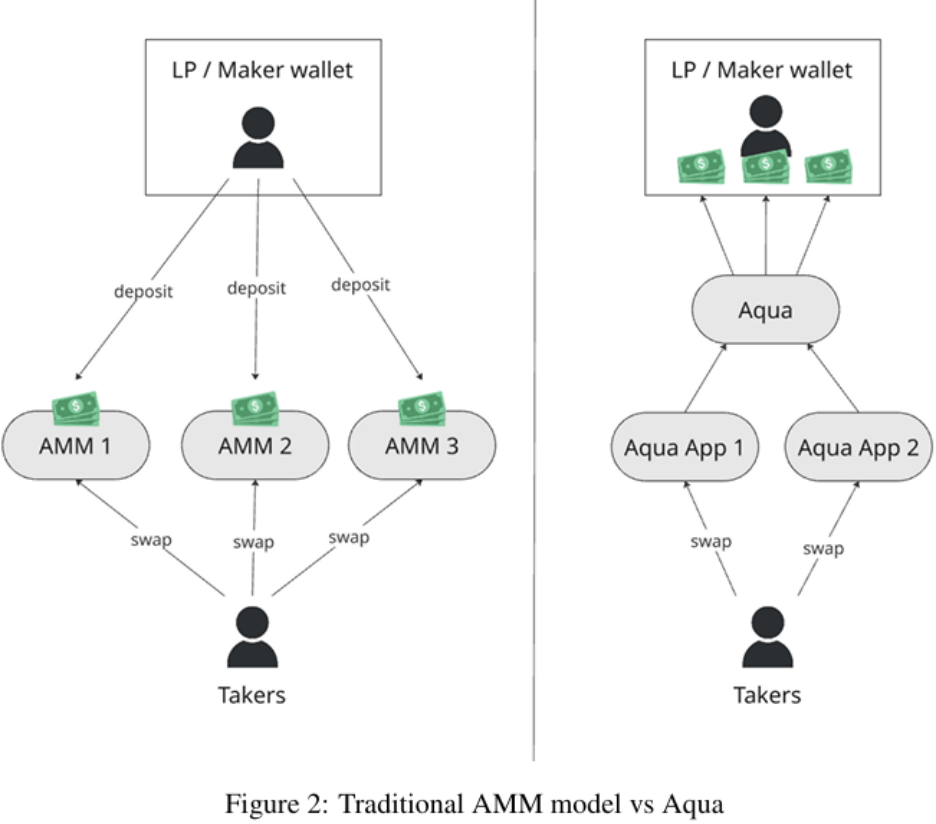

At its heart, Aqua introduces a revolutionary shared liquidity model. This innovative design enables assets to be accessed and utilized concurrently and dynamically across multiple DeFi protocols, a stark contrast to traditional models where funds remain locked in isolated pools.

Anton Bukov, co-founder of 1inch, highlighted Aqua’s profound impact on market makers: “Aqua addresses the pervasive issue of liquidity fragmentation by unleashing a multiplier effect on effective capital. Moving forward, the only constraint on capital efficiency will be the strategy itself.”

Sergej Kunz, another 1inch co-founder, further articulated Aqua’s vision, describing it as “the underlying architecture for scalable, capital-efficient DeFi.” While conventional DeFi measures capital efficiency by concentrating assets within a single pool, Aqua aims to elevate this to an unprecedented level: facilitating concurrent capital calls across diverse protocols and strategies.

Unlocking Capital: The Power of Self-Custody AMM

Prior to Aqua, mainstream Automated Market Maker (AMM) models relied heavily on a “pooled custody” design. This required Liquidity Providers (LPs) to deposit and lock their assets within a protocol, leading to two fundamental inefficiencies:

- Idle Capital: Locked user funds could only execute a single strategy. The Aqua whitepaper reveals a staggering statistic: up to 85% of LP capital often lies dormant, passively awaiting transactions or price fluctuations.

- Utility Loss: Once assets were locked, they became unavailable for simultaneous participation in other DeFi activities, resulting in significant opportunity costs. LPs were forced to choose between different DeFi engagements, diminishing overall capital utility.

Aqua addresses these inefficiencies head-on by introducing a new metric: TVU (Total Value Unlocked). This concept signifies that user funds are no longer physically confined within DeFi protocols. Instead, they enable dynamic, parallel strategy execution through a robust authorization mechanism.

Unlike traditional pooled custody systems, Aqua ensures that user funds remain securely in their own wallets. Assets are only transferred or utilized based on pre-set permissions during actual transactions or strategy executions.

Aqua’s self-custody model is designed to unleash a powerful capital multiplier effect. By maintaining self-custody, users can authorize their funds to participate in multiple DeFi activities simultaneously. Imagine a single asset providing liquidity to an AMM, participating in DAO governance voting, and serving as collateral in a lending protocol—all at once. This multi-faceted engagement dramatically boosts capital efficiency and expands application scenarios, creating synergistic value.

The cornerstone of Aqua’s technical innovation is its registry authorization system. This ingenious design decouples asset ownership from usage rights. Aqua itself does not directly hold assets; instead, it assigns virtual balances to LPs within its internal registry, corresponding to their participation in various DeFi strategies. These virtual balances dictate the share of underlying assets each strategy can access. This groundbreaking approach allows diverse DeFi applications—such as AMMs, lending platforms, or stablecoin liquidity pools—to concurrently draw upon the same underlying capital, achieving true shared liquidity without requiring LPs to split or transfer funds across pools.

For LPs, this mechanism offers unparalleled granular permissions and sophisticated risk control. They can define precise authorizations and capital ceilings for each strategy, thereby strictly limiting how their funds are used. Once set, strategy parameters become immutable, enhancing code security and integration reliability by confining risk within specific, pre-authorized strategy scopes.

It’s crucial to distinguish Aqua from leading DEX protocols like Uniswap V3. While Uniswap V3’s concentrated liquidity model allows LPs to optimize capital efficiency within a single pool by deploying liquidity within specific price ranges (leading to lower slippage), it still requires funds to be locked in an NFT-represented position. This means liquidity, though concentrated, remains fragmented and locked from a broader ecosystem perspective.

If Uniswap V3 solved “how to use capital more efficiently within one pool,” then Aqua addresses the fundamentally different challenge of “how to enable the same capital to provide liquidity for multiple pools simultaneously.” These represent distinct technological philosophies aimed at different facets of DeFi’s liquidity puzzle.

Navigating the Horizon: Challenges and Future Considerations

While Aqua represents a significant leap in DeFi innovation, its sophisticated architecture also introduces new complexities and potential risks that warrant careful consideration:

- Transaction Complexity and Latency: Unlike traditional AMMs with single-strategy interactions, Aqua’s shared liquidity model involves intricate interactions across multiple strategies. This increased complexity could lead to transaction delays, particularly during high-volume or high-frequency trading, potentially impacting user experience.

- Path-Dependent Losses: A critical challenge arises when multiple strategies simultaneously call upon the same underlying asset, but the actual wallet balance falls short of the total virtual balances committed across all strategies. In such cases, transactions will revert. Crucially, Aqua does not automatically pause strategy quotes, which could expose LPs to unfavorable positions during price fluctuations—akin to an amplified form of impermanent loss. This necessitates real-time monitoring and manual intervention by LPs to revoke strategies.

- Security Vector Risks:

- The registry’s reliance on immutable ERC-20 authorizations means that strategy parameters, once deployed, cannot be altered. Any initial configuration errors would be irreversible, demanding 100% correct auditing prior to launch to prevent permanent vulnerabilities.

- While self-custody mitigates single-point-of-failure risks associated with smart contract vulnerabilities, malicious or poorly configured authorized strategies could still potentially drain funds within the user’s defined scope.

- Token Value Capture: The whitepaper states that Aqua will bolster 1inch products and deepen ecosystem liquidity. As a pivotal component of 1inch’s infrastructure transformation, Aqua may indirectly enhance 1inch’s overall usage by increasing aggregator call volumes, thereby supporting demand for the 1INCH token. However, the whitepaper currently lacks explicit details on direct 1INCH token utility, such as fee burning or direct revenue sharing, which could limit its immediate value appreciation potential.

Aqua charts a bold new course for DeFi liquidity management, shifting the paradigm from “how much is locked” to “how much is utilized.” However, venturing into uncharted territory inherently presents implementation challenges. With the frontend slated for launch in Q1 2026, the market eagerly awaits real-world data to validate Aqua’s promise. Will it usher in a new era of capital efficiency, or will its inherent complexities prove to be its undoing? Until the answers emerge, a balanced approach of rational assessment and bold experimentation remains the most prudent path forward.

(The above content is an authorized excerpt and reprint from our partner PANews. Original Article Link)

Disclaimer: This article is provided for market information purposes only. All content and views are for reference only, do not constitute investment advice, and do not represent the views and positions of BlockBeats. Investors should make their own decisions and transactions. The author and BlockBeats will not bear any responsibility for direct or indirect losses incurred by investor transactions.