By Nancy, PANews

The cryptocurrency market is currently navigating treacherous waters. Bitcoin’s prolonged weakness has cast a pall over the entire sector, accelerating a “bubble cleansing” and leaving investors wary. As a prominent bellwether, MicroStrategy (MSTR), a leading digital asset treasury (DAT) company, finds itself under intense scrutiny, facing a confluence of pressures: a significant contraction in its market net asset value (mNAV) premium, a deceleration in Bitcoin accumulation, executive stock sales, and potential risks of index exclusion. These factors are severely testing market confidence.

MicroStrategy: On the Brink of Index Exclusion?

The DAT sector appears to be enduring its darkest hour. As Bitcoin prices continue their downward trajectory, the premiums of numerous DAT companies have plummeted, stock prices remain under pressure, and accumulation efforts have slowed or even stalled. This challenging environment is putting their fundamental business models to the ultimate test, and MicroStrategy is no exception, now grappling with a crisis of trust.

The mNAV multiple serves as a crucial indicator of market sentiment. Recently, MicroStrategy’s mNAV premium has rapidly dwindled, at one point nearing critical levels. Data from StrategyTracker indicates that as of November 21, MicroStrategy’s mNAV stood at 1.2, having previously dipped below 1. This represents a substantial decline of approximately 54.9% from its historical peak of 2.66. The perceived failure of MicroStrategy’s treasury premium, as the largest and most influential DAT company, has triggered market unease. The underlying concern is that a falling mNAV weakens the company’s financing capabilities, potentially forcing it to issue new shares, dilute existing shareholder equity, and exert further downward pressure on its stock price, thereby perpetuating a detrimental cycle.

However, Greg Cipolaro, Global Head of Research at NYDIG, argues that mNAV has limitations as an evaluation metric for DAT companies and should even be removed from industry reports. He contends that mNAV can be misleading because its calculation often overlooks the company’s operating business, other potential assets and liabilities, and typically relies on assumed outstanding shares without fully accounting for unconverted convertible debt.

Underperforming stock prices have also fueled market apprehension. StrategyTracker data shows that as of November 21, MicroStrategy’s total market capitalization (MSTR stock) was approximately $5.09 billion. This figure has fallen below the total market value of its nearly 650,000 Bitcoins, which, with an average acquisition cost of $74,433, amounted to $6.687 billion. This discrepancy signifies a “negative premium” on the company’s stock. Year-to-date, MSTR’s stock price has declined by 40.9%.

This situation has sparked concerns in the market regarding its potential exclusion from indices such as the Nasdaq 100 and MSCI US. JPMorgan has projected that if global financial index provider MSCI removes MicroStrategy from its equity indices, related outflows could reach as high as $2.8 billion. Should other exchanges and index compilers follow suit, the total outflow could escalate to $11.6 billion. MSCI is currently evaluating a proposal to exclude companies whose primary business is holding Bitcoin or other crypto assets, particularly if such assets constitute over 50% of their balance sheet. A final decision is anticipated by January 15, 2026.

Nevertheless, the immediate risk of MicroStrategy’s exclusion appears relatively low. For instance, the Nasdaq 100 Index conducts annual market capitalization adjustments on the second Friday of December. The top 100 companies are retained, while those ranked 101–125 must have been within the top 100 in the preceding year to remain. Companies beyond rank 125 are unconditionally removed. MicroStrategy currently remains within a safe zone, ranking among the top 100 by market capitalization, and recent financial reports indicate solid fundamentals. Furthermore, several institutional investors, including the Arizona State Retirement System, Renaissance Technologies, the Florida State Board of Administration, the Canada Pension Plan Investment Board, Swedbank, and the Swiss National Bank, disclosed holdings in MSTR stock in their Q3 reports, providing a degree of market confidence.

MicroStrategy’s recent slowdown in Bitcoin accumulation has been interpreted by the market as a sign of dwindling “ammunition,” especially given its Q3 financial report showing only $54.3 million in cash and cash equivalents. Since the beginning of November, MicroStrategy has acquired a total of 9,062 Bitcoins, significantly lower than the 79,000 Bitcoins accumulated during the same period last year, although this is partly influenced by the rising price of Bitcoin itself. The majority of this month’s accumulation came from a single recent purchase of 8,178 BTC, with other transactions typically involving only hundreds of Bitcoins.

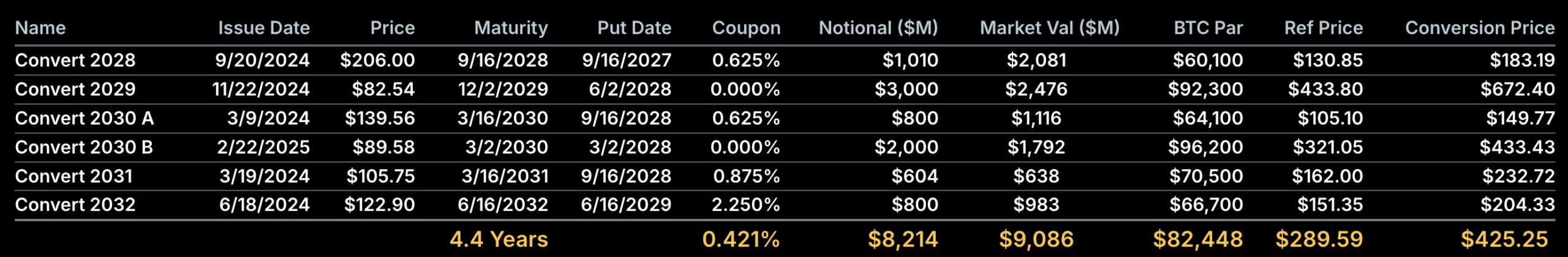

To bolster its capital, MicroStrategy has begun seeking international financing and has introduced new funding instruments, such as perpetual preferred stock (which carries high dividend payments of 8-10%). Recently, the company raised approximately $710 million through the issuance of its first euro-denominated perpetual preferred stock (STRE) to support its strategic objectives and Bitcoin reserve plans. It’s worth noting that the company currently has six outstanding convertible bonds, with maturity dates ranging from September 2027 to June 2032.

Moreover, the movements of internal executives have also drawn market attention. MicroStrategy’s financial report disclosed that Shao Weiming, Executive Vice President, will depart on December 31, 2025. Concurrently, he has sold MSTR stock worth $19.69 million through five transactions since September of this year. However, these sales were conducted under pre-arranged 10b5-1 trading plans. According to US SEC rules, a 10b5-1 trading plan allows company insiders to trade stocks under predefined rules (specifying quantity, price, or timetable), thereby mitigating the legal risks associated with insider trading.

Debt Risk Overstated: High-Premium Investors Face Significant Pressure

In response to the prevailing bearish sentiment in the crypto market and multiple concerns surrounding the DAT business model, MicroStrategy founder Michael Saylor reiterated his “HODL” philosophy. He expressed continued optimism regarding the recent decline in Bitcoin prices, maintaining a bullish outlook for the future, and even emphasized that MicroStrategy’s holdings would not be sold unless Bitcoin fell below $10,000, aiming to bolster market confidence.

Concurrently, market analysts have provided diverse perspectives on MicroStrategy. Matrixport notes that MicroStrategy remains one of the most representative beneficiaries of the current Bitcoin bull run. Previous market anxieties centered on whether the company would be forced to sell its Bitcoin holdings to repay future debts. However, based on the current balance sheet structure and debt maturity distribution, Matrixport assesses that the probability of “forced Bitcoin sales for debt repayment” in the short term is low and not the primary source of current risk. The most significant pressure, they argue, is currently borne by investors who bought in during periods of high premiums. A substantial portion of MicroStrategy’s financing occurred when its stock price was near its historical high of $474, and its net asset value (NAV) per share was at its peak. As NAV gradually receded and premiums compressed, the stock price corrected from $474 to $207, resulting in considerable unrealized losses for investors who entered at high premium valuations. Relative to the current Bitcoin price rally, MicroStrategy’s stock has significantly corrected from its previous highs, making its valuation comparatively more attractive, and the expectation of its inclusion in the S&P 500 Index in December still persists.

Crypto analyst Willy Woo further dissected MicroStrategy’s debt risk, stating he is “highly skeptical” of the company facing liquidation during a bear market. In a tweet, he explained that MicroStrategy’s debt primarily consists of convertible senior notes, which can be repaid at maturity in cash, common stock, or a combination of both. Approximately $1.01 billion of MicroStrategy’s debt is due on September 15, 2027. Woo estimated that to avoid needing to sell Bitcoin to repay this debt, MicroStrategy’s stock would need to trade above $183.19 at that time, roughly equivalent to a Bitcoin price of approximately $91,502.

Ki Young Ju, founder and CEO of CryptoQuant, likewise believes the probability of MicroStrategy’s bankruptcy is extremely low. He bluntly stated, “MSTR could only go bankrupt if an asteroid hit Earth. Saylor would never sell Bitcoin unless shareholders demanded it; he has publicly emphasized this point multiple times.”

Ki Young Ju highlighted that even if Saylor were to sell a single Bitcoin, it would fundamentally undermine MSTR’s core identity as a “Bitcoin treasury company,” potentially triggering a “double death spiral” for both Bitcoin and MSTR’s stock price. Therefore, MSTR’s shareholders not only desire Bitcoin’s value to remain robust but also expect Saylor to continuously leverage various liquidity strategies to ensure MSTR and Bitcoin prices appreciate in tandem.

Addressing market concerns about debt risk, he further clarified that the majority of MicroStrategy’s debt comprises convertible bonds, and failing to reach the conversion price does not imply a liquidation risk. It simply means the bonds would need to be repaid in cash, which MSTR has multiple avenues to address for upcoming maturities, including refinancing, issuing new bonds, securing collateralized loans, or utilizing operating cash flow. Failure to convert does not trigger bankruptcy; it is merely a normal scenario of debt maturity, unrelated to liquidation. While this doesn’t guarantee MSTR’s stock price will remain perpetually high, the notion that they would sell Bitcoin to boost the stock price or face bankruptcy as a result is utterly absurd. Even if Bitcoin were to fall to $10,000, MicroStrategy would not go bankrupt; the worst-case scenario would merely involve a debt restructuring. Additionally, MSTR could opt to raise cash by collateralizing its Bitcoin, though this would introduce potential liquidation risks, making it a last resort.

(The above content is an authorized excerpt and reproduction from our partner PANews. Original link)

Disclaimer: This article is for market information purposes only. All content and opinions are for reference only, do not constitute investment advice, and do not represent the views and positions of the author or Blockcast. Investors should make their own decisions and trades. The author and Blockcast will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.