Authored by Dyme, Compiled by TechFlow

The cryptocurrency market appears to be undergoing a significant “rule shift.” While the preceding bull run was exhilarating, the true test of investor resilience and strategy is only just beginning. Patience, it seems, is the new currency.

All current indicators suggest Bitcoin has entered a “safe-haven” mode, echoing patterns observed in 2021 where Bitcoin surged notably before a stock market peak, a peak that has since shown less-than-ideal performance in recent months.

As of this writing, Bitcoin’s price has retracted approximately 30% from its all-time high. We witnessed the anticipated market peak in early October, with some investors successfully realizing profits above $100,000. Now, the inevitable question looms: “What comes next?”

Unlike April of this year, I am not rushing to establish a long-term position, though I currently hold a tactical long position targeting a rebound to the $95,000-$100,000 range. Many readers, with Bitcoin as their core asset and perhaps some exposure to altcoins, are likely pondering: “Where is the bottom?” or “When is the right time to buy?”

The honest answer is that no one can know with absolute certainty. However, numerous time-tested strategies can help you maximize returns while ensuring you don’t miss the next major market move. My aim is to equip you with insights to develop your own informed market judgment and recognize when the market’s underlying “rules” may shift once more. As a “left-brained” trader who prioritizes market sentiment and data simplification over complex order book analysis, I offer my accumulated experience below.

This article operates on the core assumption that Bitcoin will indeed forge new all-time highs and that market cycles remain a potent force. Based on all available information and market reactions, this should be our foundational reality. Furthermore, it acknowledges Bitcoin as an unparalleled savings technology for the patient investor, yet a formidable “wealth destruction” tool for the impatient or over-leveraged.

Our discussion will center predominantly on Bitcoin. Frankly, over the past 36 months, with the exception of Solana and a few fleeting hype cycles, 90% of altcoins have delivered negligible performance. We likely have another 1 to 2 years before new altcoin narratives truly solidify, at which point you can strategically evaluate those opportunities. We will delve into:

- Investment Strategies

- Cyclical Expectations & Timing

- Where to Park Funds During the Waiting Period

- Key Indicators for Identifying a Market Bottom

Investment Strategies: Navigating the Bitcoin Landscape

When I speak of “strategy,” I refer to your overarching approach to buying, selling, and holding. This market offers myriad entry and exit points, and the ultimate decision rests squarely with you.

Your strategy fundamentally hinges on one question: “Do you possess the confidence and capability to precisely time the market?” If not, what alternative paths are available?

Several time-tested Bitcoin investment methodologies exist, with HODLing (Holding On for Dear Life) remaining one of the most popular.

The Enduring Power of HODLing

HODLing is an foundational tenet within the Bitcoin community. If you possess unwavering conviction in Bitcoin’s long-term potential and your immediate financial needs are met, this strategy can be profoundly appealing. Moreover, HODLing offers significant tax efficiency, as no taxes are incurred until an asset is sold.

Certain investors possess the fortitude to endure an 80% portfolio drawdown, tactically adding to their positions during each market dip. For those whose fiat requirements are satisfied and who can commit to a multi-year horizon, this method can, over a sufficiently long period, facilitate multi-generational wealth accumulation. It is particularly suited for individuals seeking to compound wealth through time and steadily expand their Bitcoin holdings. This approach demands immense patience – a trait some possess, and others struggle to maintain. Yet, for the patient, it is undeniably viable.

My journey into this space began with HODLing, though my strategy has naturally evolved over time.

Dollar-Cost Averaging (DCA): A Disciplined Approach

Dollar-Cost Averaging (DCA) aligns perfectly with the HODL philosophy, but its application extends beyond. Some investors purchase Bitcoin daily, irrespective of price fluctuations; others opt for weekly, monthly, or opportunistic buys during market volatility.

Goals of DCA:

- To consistently increase your Bitcoin holdings while mitigating upward pressure on your average cost.

- To reduce your average holding cost if you previously acquired Bitcoin at higher price points.

For instance, I initiated Bitcoin purchases at the 2013 peak and subsequently dollar-cost averaged all the way down to $200. This strategy ultimately proved successful.

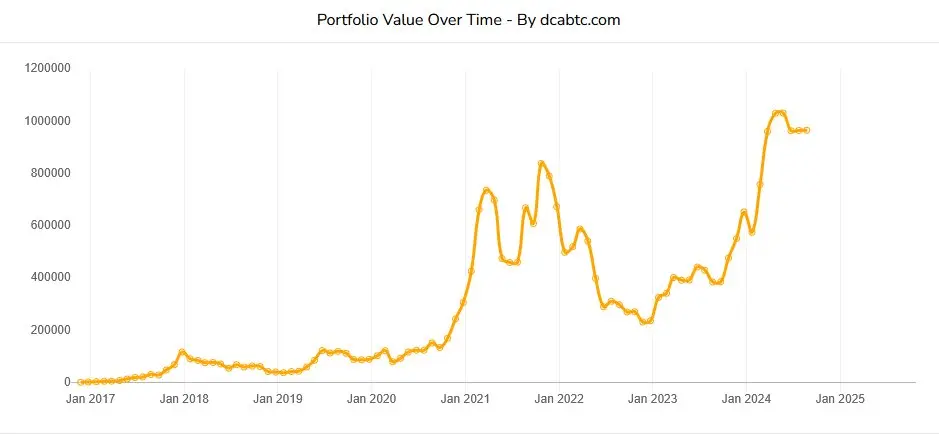

The chart above illustrates a classic DCA scenario. While these results are naturally observed in hindsight, they unequivocally demonstrate that investors who consistently purchased Bitcoin on a regular schedule, even through significant market corrections like the one this month, have realized substantial wealth growth, often without incurring capital gains taxes.

For those with a nuanced understanding of market dynamics, strategically adjusting your DCA cadence can significantly amplify your unrealized fiat gains.

Modern investors are not confined to purely mechanical approaches. For those preferring a “set it and forget it” method, straightforward tools are readily available. Platforms like Coinbase, Cash App, and Strike offer automated purchase options that can be activated or deactivated at will. However, each service comes with its own trade-offs, fees, and limitations, necessitating thorough research before implementation. Transaction fees, in particular, can accumulate substantially over months or years of automated purchases.

You might opt for a low-frequency, modest plan, or a more aggressive, larger-scale plan executed over a shorter duration. If you possess a knack for market timing and believe a bottom is imminent but lack precise certainty, I would lean towards the latter.

Alternatively, you can bypass third-party platforms and execute manual DCA. Utilize your preferred exchange to place orders when Bitcoin’s price appears “discounted,” or even set up tiered buy orders based on your personal market analysis and technical indicators. This flexibility caters entirely to individual preference.

Whether automated or manual, the ultimate outcome remains consistent, provided a degree of discipline is maintained.

The core philosophy underpinning DCA is that “time in the market” generally outperforms “attempting to time the market,” a principle consistently supported by historical data.

Both HODLing and DCA can be flexibly scaled to align with your financial capacity. The market may dip deeper or bottom out faster than anticipated, making it crucial to discover your personal equilibrium.

The Hybrid Strategy: Blending Patience with Opportunity

Not every investor fits neatly into the HODL or DCA paradigms. Many gravitate towards a hybrid strategy, occupying the space between these two extremes:

- You don’t attempt perfect market timing, but neither do you buy indiscriminately.

- Your buying decisions are informed by liquidity conditions, spikes in volatility, or moments of profound market sentiment collapse.

This approach often proves more effective than either extreme, as it judiciously balances patience with opportunistic action. Consider it rules-based accumulation, rather than mere speculative guesswork.

Lump Sum vs. Staggered Entry: A Matter of Psychology and Risk

Another often-overlooked aspect is the choice between a lump sum investment and staggered entry. From a purely expected return perspective, in markets with a long-term upward trajectory, a lump sum investment frequently yields superior results. However, most individuals are ill-equipped to handle the emotional toll of an “all-in” lump sum investment.

Staggered entry can mitigate regret and enhance adherence to the investment process. If you possess a substantial cash reserve, deploying a portion for an initial purchase and gradually allocating the remainder in phases presents a more realistic and sustainable option for the average investor.

The Discipline of Liquidity Management

It is paramount to exercise stringent liquidity discipline. A primary driver of forced selling stems from investors commingling daily operational funds, emergency savings, and Bitcoin investments within the same “mental account.” When life inevitably presents financial exigencies, Bitcoin can transform into an unintended “ATM.” To circumvent this, compartmentalize your cash for distinct purposes, ensuring you are never compelled to liquidate assets during vulnerable or desperate periods. This practice, in itself, constitutes a significant competitive advantage.

Furthermore, your investment strategy must embody a sense of proportion. Investors typically don’t get “rekt” simply because Bitcoin declines; rather, it’s often due to:

- Emotionally increasing position sizes.

- Chasing fleeting thrills in altcoins.

- Employing leverage in an attempt to “make back losses.”

The harshest penalties in a bear market are frequently reserved for overconfident investors. Maintain rational position sizing, remain vigilant against “too good to be true” narratives, and always stay grounded in reality.

Bitcoin Cycles & Timing: Will the Rhythm Accelerate?

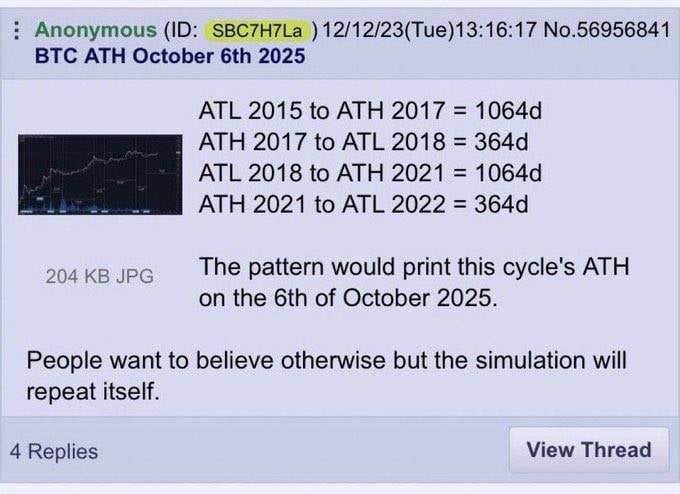

I have frequently discussed Bitcoin’s inherent “cyclicality,” yet a mild concern arises from the widespread awareness of these cycles. The question then becomes: Will this cycle be shorter? It’s uncertain.

For those unfamiliar, a brief overview:

Bitcoin, for better or worse, is a time-based cyclical asset whose price movements are intricately linked to its halving cycles. To date, Bitcoin’s price action has largely adhered to these cyclical principles. As previously noted, we should, for now, assume this regularity will persist. If the cycles continue to unfold as expected, we might anticipate a macro bottom emerging in early Q4 2026.

This projection, however, is not an instruction to delay all purchases until the first day of Q4 2026. Instead, it serves as a contextual reference, suggesting that it might still be too early for aggressive long-term accumulation. Naturally, the cycle could conclude earlier, with a bottom potentially materializing this summer, which would necessitate integrating other technical analysis (TA) and signals into our considerations.

Broadly, I do not foresee Bitcoin re-entering a sustained long-term bull market before late 2026 or 2027. Should I be mistaken, I would, of course, be delighted.

Strategic Capital Deployment: Where to Park Funds While Awaiting Opportunity

As interest rates trend downwards, the allure of “safe but unexciting” yields diminishes. Nevertheless, we still have several months to capitalize on yields exceeding 3% before Federal Reserve Chair Jerome Powell potentially intervenes. For those who have strategically de-risked and are awaiting optimal market entry, here are some options to consider. Always conduct your own thorough due diligence.

For straightforward monthly and weekly income, SGOV and WEEK offer exposure to stable, albeit unexciting, Treasury bills. Other alternatives include ultra-short-term Treasury ETFs like SHV and pure short-term Treasury funds, or slightly longer-duration bond ETFs such as ICSH or ULST. SHV provides nearly identical exposure to SGOV, holding very short-term Treasuries and acting as a cash surrogate with a minor yield enhancement.

WEEK operates similarly but is structured for weekly distributions, catering to investors requiring more frequent cash flow. The trade-off, however, is that weekly payouts can fluctuate with interest rate movements.

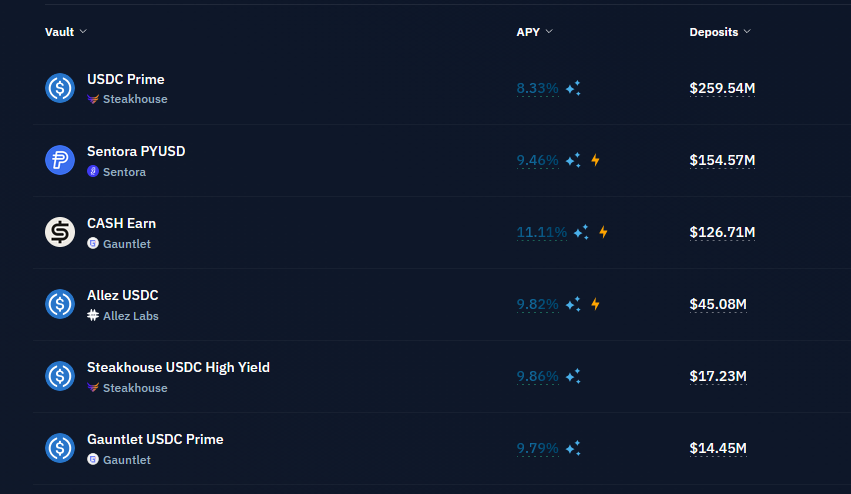

For those comfortable with on-chain operations, despite a general decline in DeFi yields, some options persist:

- AAVE: Currently offers approximately 3.2% yield on USDT.

- Kamino: Presents higher-risk, higher-reward opportunities, with yields typically surpassing “risk-free” rates, but inherently accompanied by additional risk factors.

It is crucial to note that while these on-chain platforms are viable, they are not suitable for full capital deployment. If pursuing the DeFi route, diversification is highly recommended to mitigate risk.

Many centralized exchanges, such as Coinbase, offer rewards for holding USDC on their platforms. Robinhood, for its Gold members, also provides yields in the 3%-4% range.

In a decelerating economic environment, the objective is remarkably clear and requires minimal overthinking: **safeguard purchasing power while combating inflation.**

Identifying the Market Bottom: A Confluence of Signals

Imagine it’s nine months from now. The market has endured multiple headwinds, and Bitcoin’s price perhaps hovers around $50,000. How do you discern if we are nearing a bottom?

It’s vital to understand that a market bottom is never dictated by a singular signal. By integrating the following indicators to form a robust “thesis with confluence,” you can enter the market with greater conviction and anticipate favorable returns.

1. Time

How long has it been since Bitcoin’s All-Time High (ATH)? If more than nine months have elapsed, it might be an opportune time to begin contemplating accumulation.

2. Momentum

Bitcoin typically peaks when momentum is exhausted, and conversely, bottoms when momentum wanes. Historically, purchasing Bitcoin when the weekly Relative Strength Index (RSI) dips below 40 has often proven to be a prudent decision. Expand your perspective, integrate your preferred momentum indicator scripts, and develop an analytical framework that resonates with you.

3. Market Sentiment

Market cycles frequently coincide with catastrophic events that induce extreme levels of unease and fear. Consider events like the FTX collapse, the COVID-19 pandemic, or the Terra Luna implosion. When the market is shrouded in despair, and no one dares to buy Bitcoin, that is precisely your window to act boldly, especially when corroborated by multiple confirming signals.

For instance, at the bottom of the previous cycle, an obscure influencer was famously promoting mattresses. Those who accumulated Bitcoin during that period are likely very content today.

4. Embrace Imperfection: You Don’t Need to Catch the Absolute Bottom

There’s no necessity to pinpoint the market’s absolute lowest point. For a more conservative approach, consider waiting for Bitcoin to convincingly reclaim its 50-week Exponential Moving Average (50W EMA) or the 365-day Volume-Weighted Average Price (VWAP). These serve as robust confirmation signals.

5. Bitcoin Beta: MicroStrategy (MSTR) as a Bellwether

If Bitcoin-related stocks, such as MicroStrategy (MSTR), manage to reclaim their 200-day Simple Moving Average (SMA), this could signal a resurgence of market interest and premium for Bitcoin, indicating a broader return of risk appetite.

My previous objective was to assist some in locking in profits at the market top. I sincerely hope this article empowers you to navigate and prepare for the opportunities that lie ahead.

Disclaimer: This article is intended solely for informational and educational purposes and does not constitute financial, investment, or legal advice. Before making any financial decisions, it is imperative to conduct your own research and consult with a licensed professional. All investments involve risk, and caution should always be exercised. Remember the old adage: “There are no tears in the casino.”

(This content is an authorized excerpt and reproduction from our partner PANews. Original Link | Source: TechFlow)

Disclaimer: This article provides market information only. All content and views are for reference purposes and do not constitute investment advice. They do not represent the views and positions of BlockBeats. Investors should make their own decisions and trades. The author and BlockBeats will not assume any responsibility for direct or indirect losses resulting from investor transactions.