Author: Tanay Ved, Coin Metrics

Compiled by: GaryMa, Wu Blockchain

Key Insights

- Demand from pivotal absorption channels, including ETFs and Digital Asset Trusts (DATs), has recently diminished. This, coupled with October’s significant deleveraging event and a broader macroeconomic shift towards reduced risk appetite, continues to exert downward pressure on the crypto asset market.

- Leverage across both futures and DeFi lending markets has undergone a substantial reset, resulting in lighter and cleaner positions that inherently mitigate systemic risk.

- Spot market liquidity remains stubbornly low for both major assets and altcoins. This persistent weakness renders the market exceptionally fragile and highly susceptible to amplified price volatility from unexpected movements.

Introduction: A Market at a Crossroads

The month of “Uptober” began with considerable optimism, propelled by Bitcoin’s ascent to new all-time highs. However, this bullish sentiment was abruptly interrupted by a sharp flash crash in October. Since that event, Bitcoin (BTC) has retracted by approximately $40,000—a decline exceeding 33%—while altcoins have experienced even more severe impacts, collectively bringing the total market capitalization closer to the $3 trillion mark. Despite a year marked by positive fundamental advancements, there is a clear divergence between price performance and overall market sentiment.

The digital asset landscape currently finds itself at the confluence of various external and internal pressures. From a macroeconomic perspective, uncertainties surrounding potential interest rate cuts in December, alongside the recent weakening of technology stocks, have exacerbated a global decline in risk appetite. Internally, the crypto market has witnessed outflows and increased cost pressures within key absorption channels such as Exchange-Traded Funds (ETFs) and Digital Asset Trusts (DATs). Concurrently, a widespread liquidation event on October 10 triggered one of the most intense deleveraging cycles in recent memory, with its aftershocks still reverberating due to persistently shallow market liquidity.

This report aims to meticulously dissect the underlying forces contributing to the recent downturn in the crypto asset market. We will provide an in-depth analysis of ETF flows, the state of perpetual futures and DeFi leverage, and order book liquidity, examining how these critical indicators reflect the current market dynamics.

Macroeconomic Headwinds: A Shift Towards Risk Aversion

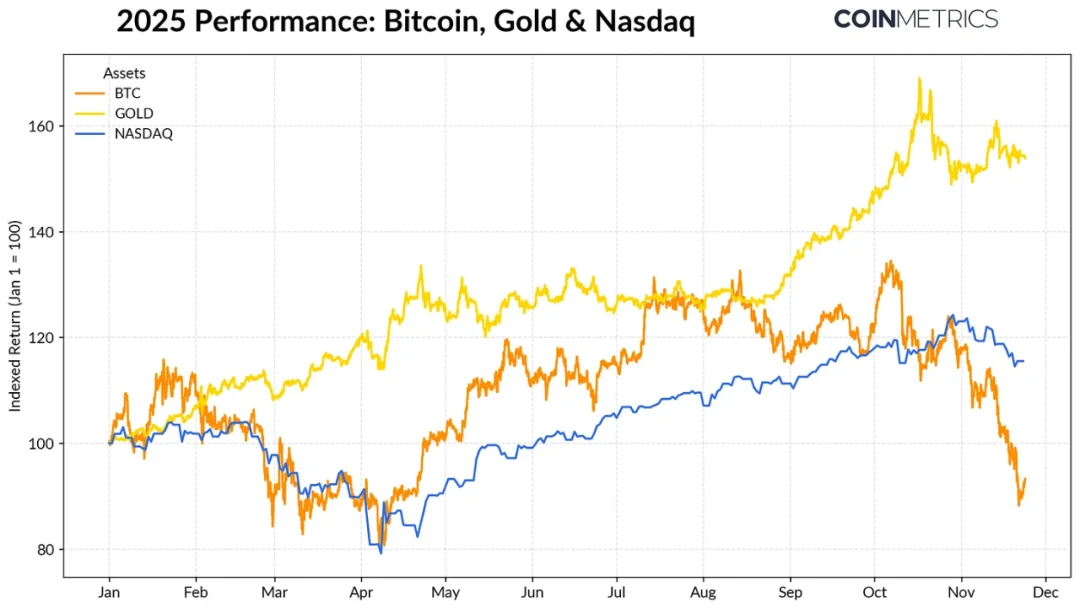

The performance disparity between Bitcoin and traditional asset classes is notably widening. Gold, for instance, has surged over 50% year-to-date, buoyed by record central bank purchases and ongoing geopolitical trade tensions. In contrast, technology stocks, represented by the NASDAQ, lost significant momentum in the fourth quarter as markets reassessed the likelihood of Federal Reserve rate cuts and the long-term sustainability of AI-driven valuations.

As highlighted in our previous research, Bitcoin’s relationship with both “risk assets” like tech stocks and “safe-haven assets” like gold demonstrates a cyclical dependency on the broader macroeconomic environment. This inherent sensitivity makes BTC particularly vulnerable to sudden market shocks or unexpected events, a pattern clearly observed during the October flash crash and the subsequent decline in overall risk appetite.

As the primary anchor for the entire crypto ecosystem, Bitcoin’s pullback has inevitably cascaded across other digital assets. While certain thematic categories, such as privacy coins, have shown occasional brief resilience, the market generally continues to move in lockstep with BTC’s trajectory.

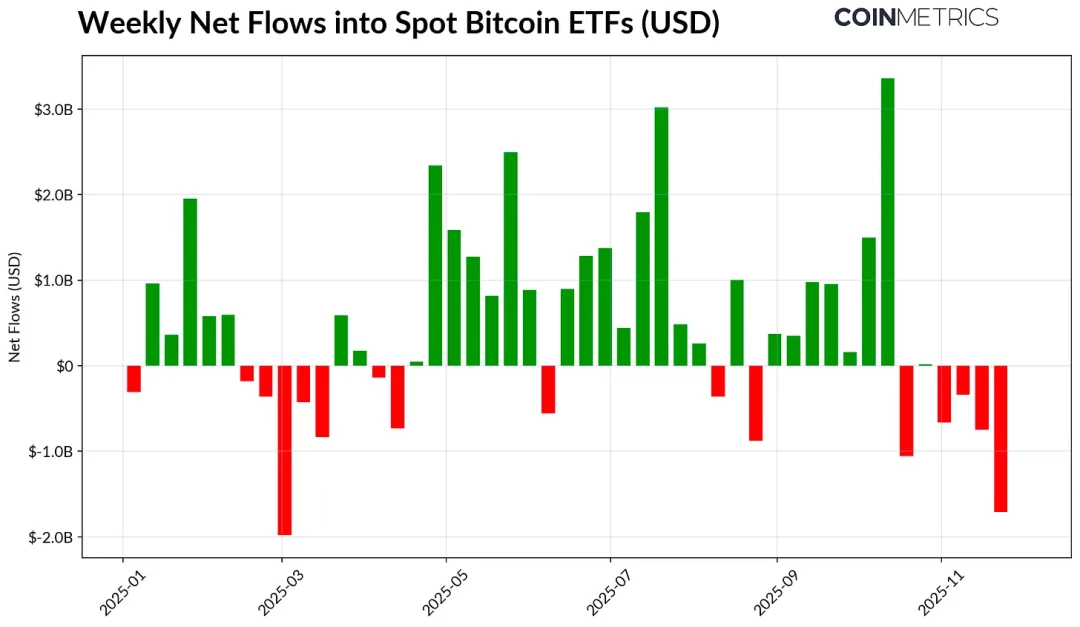

ETFs and DATs: Diminishing Demand Absorption

A significant contributor to Bitcoin’s recent weakness stems from a softening of the funding absorption channels that provided substantial support throughout much of 2024–2025. Since mid-October, ETFs have experienced several consecutive weeks of net outflows, totaling an estimated $4.9 billion. This marks the most substantial wave of redemptions since April 2025, when Bitcoin’s price dipped to approximately $75,000 amidst tariff expectations. Despite these notable short-term outflows, on-chain holdings maintain an upward trend, with BlackRock’s IBIT ETF alone holding 780,000 BTC, accounting for roughly 60% of the total spot Bitcoin ETF supply.

A sustained return to net inflows would signal a crucial stabilization of this channel. Historically, robust ETF demand has served as a key absorber of supply whenever broader risk appetite improved.

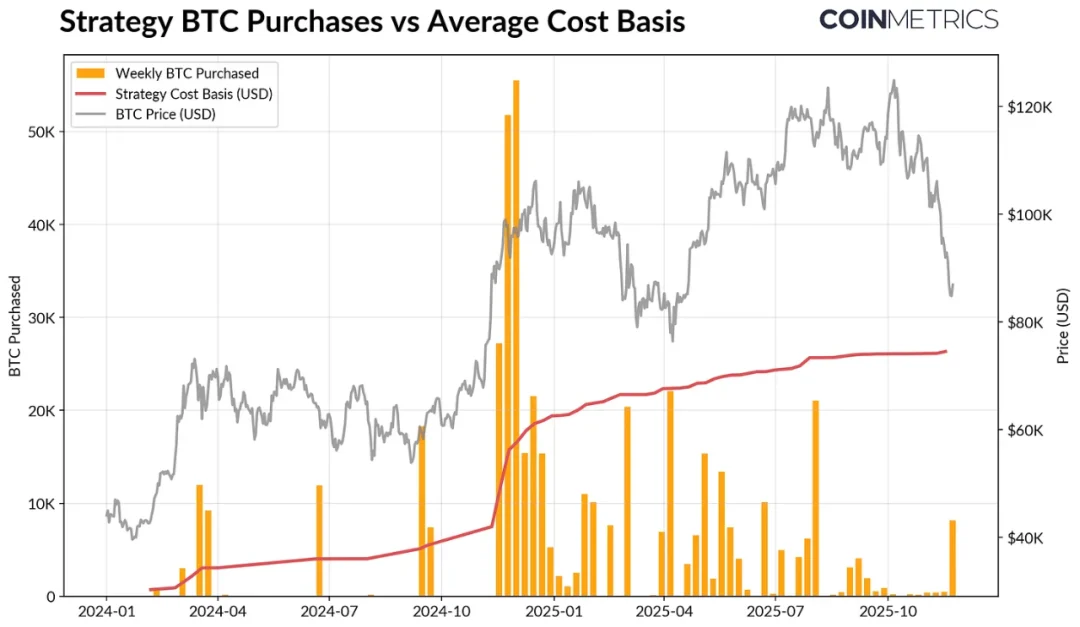

Digital Asset Trusts (DATs) are similarly under pressure. As market values decline, the valuation of their stock and crypto holdings contracts, consequently straining the net asset value premium that underpins their growth mechanisms. This contraction curtails their capacity to raise fresh capital through equity issuance or debt, thereby limiting their ability to enhance “crypto per share” allocations. Smaller or newer DATs are particularly vulnerable to these shifts, adopting a more cautious stance when their cost bases and equity valuations become unfavorable.

Strategy, currently the largest DAT, holds 649,870 BTC (approximately 3.2% of the total supply) at an average cost of $74,333. As illustrated in the chart below, Strategy’s accumulation accelerated significantly during periods of BTC price appreciation and strong stock performance. While recent accumulation has slowed considerably, it has not transitioned into active selling. Despite the slowdown, Strategy currently maintains a floating profit, with its cost basis below current market prices.

Should BTC experience further declines, or if Strategy faces index removal risks, it could come under renewed pressure. Conversely, a market reversal leading to improvements in its balance sheet and valuation could pave the way for a return to a more robust accumulation pace.

On-chain profitability metrics corroborate this market sentiment. The Short-Term Holder (STH) SOPR (for holders with assets less than 155 days old) has fallen into a ~23% loss zone. This typically indicates “capitulation” selling from the most price-sensitive cohort of holders. While Long-Term Holders (LTHs) generally remain profitable, their SOPR also suggests a mild propensity for selling. A return of STH SOPR above 1.0, coupled with a deceleration in LTH selling pressure, would be a strong indicator of potential market re-stabilization.

Crypto Market Deleveraging: Futures, DeFi, and Liquidity Reset

The widespread liquidation event on October 10 initiated a multi-faceted deleveraging cycle spanning futures, DeFi, and stablecoin-backed leverage. Its profound effects continue to be felt across the ecosystem.

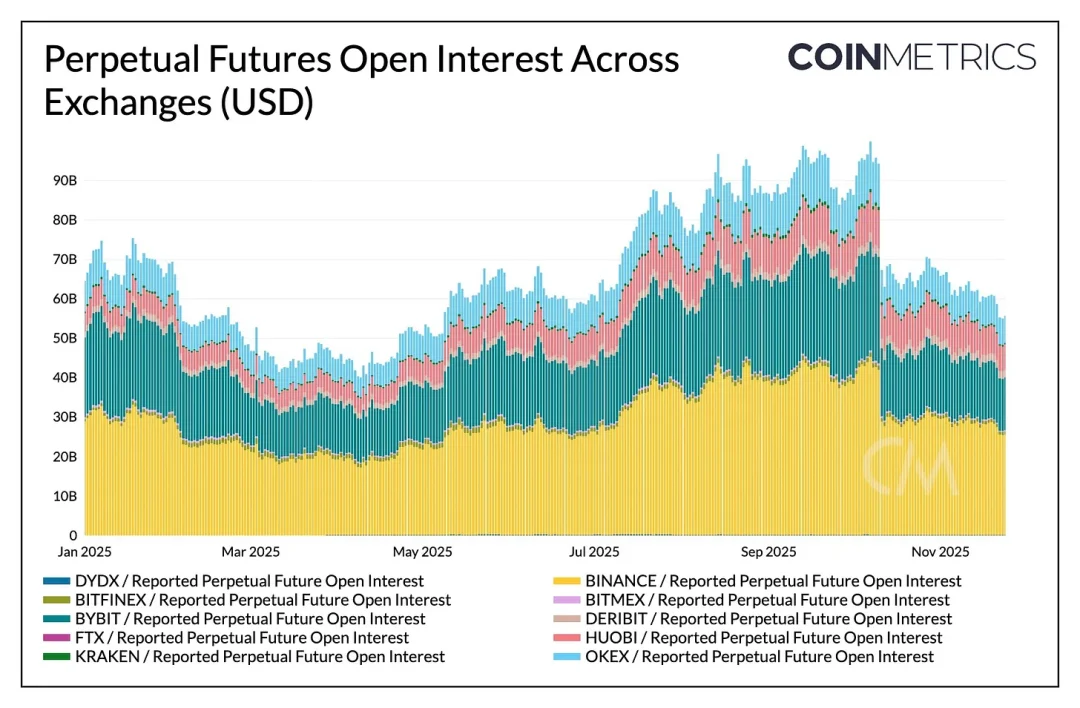

Perpetual Futures: A Comprehensive Leverage Washout

Within a mere few hours, perpetual futures markets experienced the largest forced deleveraging in their history, erasing over 30% of accumulated open interest built up over several months. Altcoins and platforms with a higher concentration of retail participation, such as Hyperliquid, Binance, and Bybit, bore the brunt of these declines, consistent with the aggressive leverage previously accumulated in these segments. As depicted in the chart below, current open interest remains significantly below its pre-flash crash peak of over $90 billion and has subsequently contracted further. This clearly indicates a substantial cleansing of systemic leverage, ushering the market into a phase of stabilization and repricing.

Funding rates have mirrored this trend, declining in parallel and reflecting a reset in long-position risk appetite. BTC funding rates have recently hovered around neutral or slightly negative territory, underscoring a market that has yet to regain clear directional conviction.

DeFi Deleveraging: A Contraction in Credit Markets

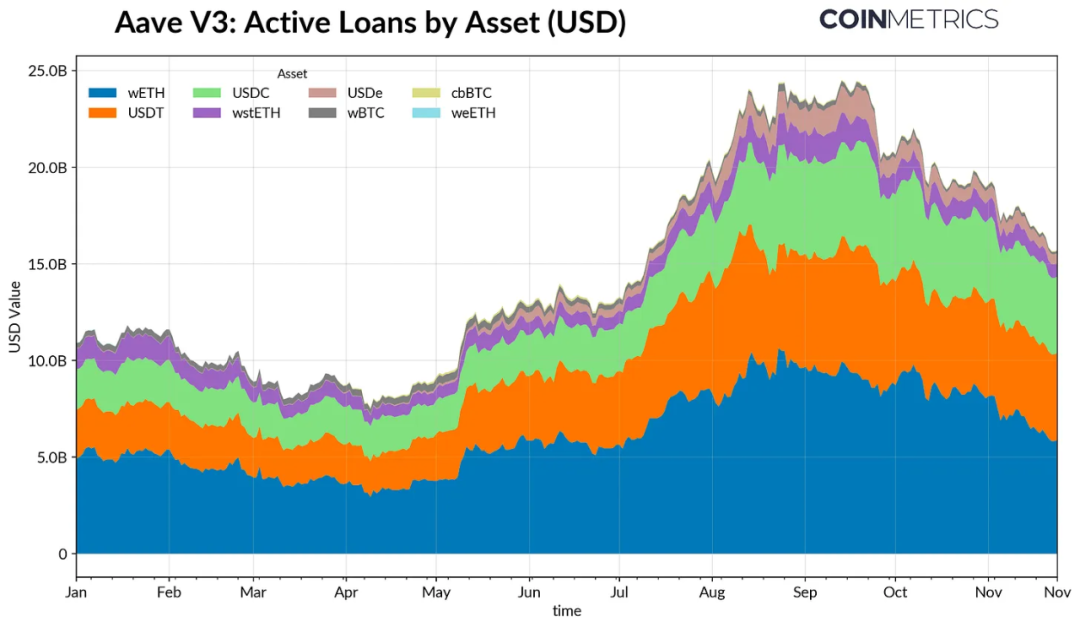

Decentralized Finance (DeFi) credit markets have also undergone a phased deleveraging process. Active loans on Aave V3 have steadily declined from their late September highs as borrowers actively reduced their leverage and repaid outstanding debts. The contraction in stablecoin lending has been particularly acute, with the de-pegging of USDe leading to a dramatic 65% reduction in USDe lending volume, subsequently triggering a cascading liquidation of synthetic dollar leverage.

Ethereum (ETH)-related lending has similarly contracted, with WETH and Liquid Staking Token (LST)-related loans decreasing by 35–40%. This signifies a significant unwinding of recursive leverage and yield-farming strategies that had previously dominated these segments.

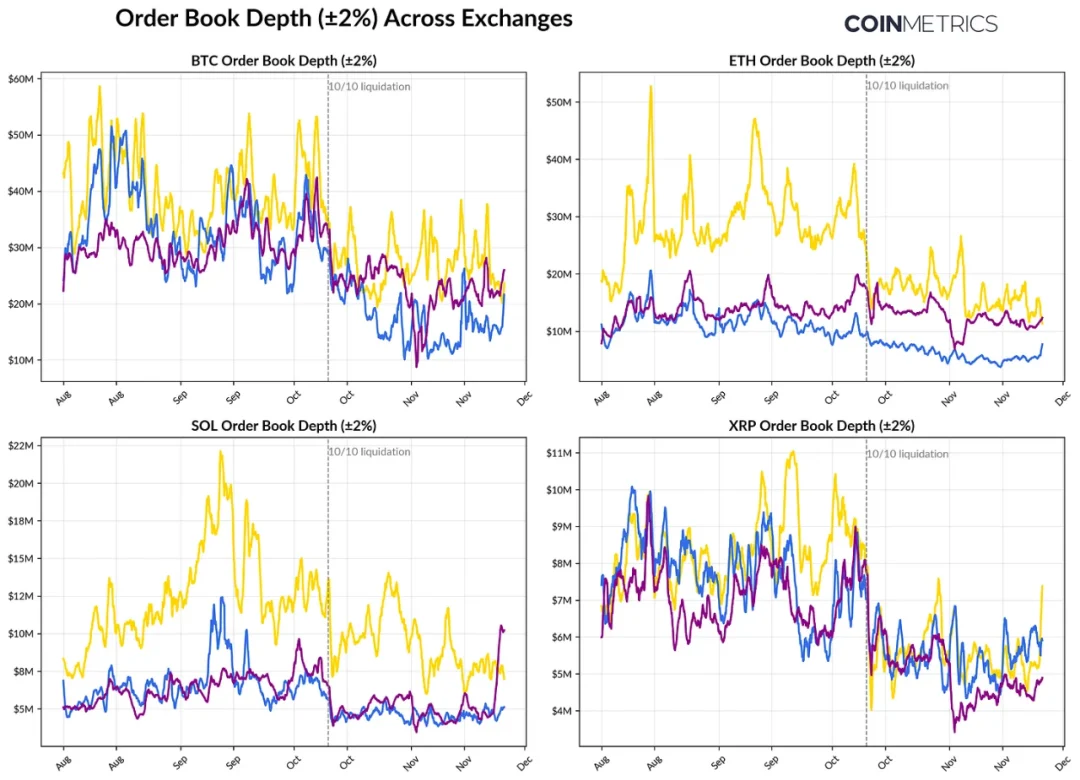

Spot Liquidity: Persistently Shallow Conditions

Critically, spot market liquidity has failed to recover in the aftermath of the October 10 liquidation event. Order book depth (within ±2% of the mid-price) on major exchanges remains 30–40% lower than in early October, even as prices have stabilized. This indicates that underlying liquidity conditions have not yet repaired. With fewer outstanding orders, the market becomes inherently more fragile; even minor trades can trigger disproportionately large price impacts, exacerbating volatility and amplifying the effects of forced liquidations.

The situation for altcoin liquidity is even more precarious. Order book depth outside of mainstream assets has experienced a more pronounced and prolonged decline, signaling sustained risk aversion among market participants and reduced activity from market makers. While a comprehensive improvement in spot liquidity would be crucial for mitigating price impact and fostering stability, the current shallow depth remains the most unambiguous indicator that systemic pressures have yet to fully dissipate.

Conclusion: Towards a Healthier, Yet Challenged, Market

The digital asset market is currently undergoing a profound recalibration, characterized by a confluence of weakening demand from ETFs and DATs, a significant reset in futures and DeFi leverage, and persistently shallow spot liquidity. While these factors have undoubtedly suppressed prices, they have simultaneously contributed to a healthier systemic foundation, marked by lower leverage, more neutral positioning, and a renewed emphasis on fundamental value.

However, the macroeconomic environment continues to present formidable headwinds. Factors such as the weakness in AI tech stocks, volatile expectations for interest rate cuts, and a general decline in risk appetite persistently dampen overall market sentiment. A sustained recovery hinges on the re-establishment of robust demand channels—including renewed ETF inflows, consistent DAT accumulation, and growth in stablecoin supply—coupled with a significant rebound in spot liquidity. Until these conditions materialize, the market will likely remain in a delicate balance, caught between the overarching “macroeconomic environment of declining risk appetite” and the ongoing “internal structural adjustments within the crypto market.”

(The above content is an excerpt and reproduction authorized by partner PANews, original link | Source: Wu Blockchain)

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice, nor do they represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses resulting from investor transactions.