By Lucida

CEX Deep Dive: Unpacking Risk Control and Listing Prowess in Crypto Exchanges

In the exhilarating pursuit of wealth within the crypto universe, investors are constantly seeking the ultimate platform – one that promises not just exponential gains, but also robust protection. Our previous analysis explored the profit potential across major exchanges, but as we know, high rewards often come tethered to significant risks. A truly superior cryptocurrency exchange (CEX) transcends being a mere “wealth-creation factory”; it must also serve as a steadfast guardian for your digital assets.

So, which platforms possess the foresight to navigate volatile markets, meticulously identifying and mitigating risks? And who demonstrates the keen intuition of a seasoned scout, consistently listing the next breakout tokens ahead of the curve?

To address these critical questions, Lucida’s latest comprehensive review delves deeper. We conducted a rigorous, data-driven “health check” on mainstream CEXs, focusing on two pivotal dimensions: Risk Control Capabilities and Token Listing Acumen. Moving beyond anecdotal reputations, we employ quantitative metrics such as “Odds Ratio,” “Listing Failure Rate,” and “Half-Value Rate” to pierce through the market fog, revealing which exchanges genuinely safeguard your investments and which might inadvertently expose you to undue peril.

Furthermore, we meticulously tracked the listing trajectories of star tokens across various trending sectors, uncovering each exchange’s unique “market rhythm.” Who consistently offers you the earliest entry points, and who arrives only as the market rally wanes? This analysis forms the second installment of our CEX Comparison series, focusing on Risk Control and Token Listing.

The First Line of Defense: Quantifying Exchange Risk Control

High returns in the crypto space are frequently accompanied by the sharp teeth of elevated risk. A top-tier exchange acts as your primary bulwark, not merely a conduit for gains. Our evaluation extends beyond potential price surges; we scrutinize an exchange’s capacity to “defuse bombs” and preserve your initial capital.

We quantitatively assessed exchange risk control across three critical dimensions:

1. Odds Ratio: Balancing Gains Against Drawdowns

The Odds Ratio provides a probabilistic measure of risk-reward, indicating how many significant downturns an investor might endure for each instance of a parabolic gain. Simply put, it quantifies the potential “crashes” you might face for a single “surge.”

The formula is defined as:

Across all three observed periods, MEXC and Bybit consistently demonstrated superior Odds Ratio performance, securing their positions in the top tier. This suggests that these platforms offer a higher probability of capturing significant upward movements with a comparatively lower “cost of trial and error.”

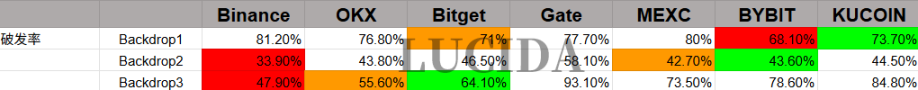

2. Listing Failure Rate: Vetting New Tokens

The fear of a newly launched token “breaking its initial price” (falling below its listing price) is a common concern for early adopters. This metric gauges an exchange’s diligence and judgment in vetting new listings.

The formula for Listing Failure Rate is:

![]()

Here, BCEX,i signifies the count of newly listed tokens on a CEX that experienced a price drop below their initial value within the i-th backdrop. NCEX,i represents the total number of new tokens listed by that CEX during the same period. For a more accurate reflection of actual investor cost, we benchmark against the opening price of the day following listing.

Key Findings:

Binance consistently demonstrates robust control over its listing failure rate, often maintaining the lowest figures, affirming its position as an industry leader. Bitget and Bybit also exhibit reliable performance in this regard. Conversely, Gate.io did not rank among the top three in any of the three evaluation periods, warranting extra caution for those considering new listings on their platform.

3. Half-Value Rate: Assessing Portfolio Health

An asset losing half its value from its peak is a devastating blow to investor confidence and portfolio health. This metric quantifies the proportion of tokens on an exchange that have experienced a 50% or greater drawdown, directly reflecting the overall health and stability of its listed asset pool.

The calculation is as follows:

Bybit and MEXC once again underscore their formidable risk control capabilities, consistently exhibiting the lowest Half-Value Rates. This significantly reduces the likelihood of substantial asset depreciation for their users. Binance also demonstrated increasingly strong performance in later periods, showcasing a powerful ability to adapt and improve.

Risk Control Summary: Top Performers

- Overall Risk Management Excellence: Bybit and MEXC lead across both Odds Ratio and Half-Value Rate, making them prime choices for investors seeking a robust balance between asset security and potential returns.

- New Listing Sanctuaries: For those keen on new token launches, Binance, Bybit, and Bitget offer a comparatively safer environment due to their consistently lower Listing Failure Rates.

Seizing Opportunity: Evaluating Token Listing Acumen

In the fast-paced world of cryptocurrency, timing is everything. An exchange’s ability to keenly identify emerging trends and list high-potential tokens early directly dictates whether investors can “board the train” before a significant price surge. To dissect this crucial aspect, we tracked the listing patterns of several representative tokens across diverse sectors.

Here’s how different exchanges performed:

- AGLD:

Gate.io, MEXC, and OKX were early movers, with Binance following. Bybit‘s late listing meant missing the primary rally. - AXS:

Users on Binance and KuCoin captured substantial gains. OKX and Bitget listed before the major surge, offering opportunities. Gate.io and MEXC users faced high-point pullback risks, while Bybit listed post-rally. - INJ:

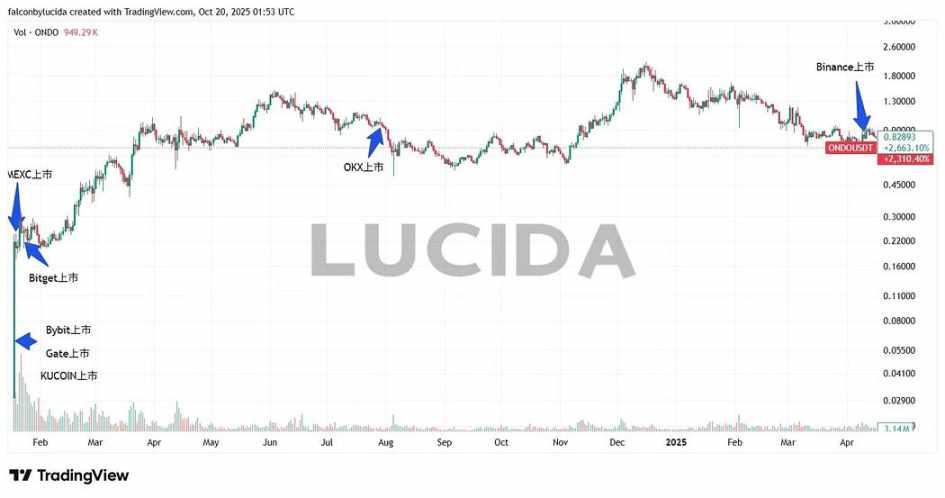

Initially launched on Binance and Gate.io. After a significant correction, Bybit, Bitget, and MEXC listed, perfectly timing the second upward wave. OKX listed near the rally’s conclusion. - ONDO:

KuCoin, Gate.io, and Bybit led the charge, with MEXC continuing the momentum. By the time OKX and Binance listed, prices had entered a retracement phase. - FET:

MEXC and Binance were first, followed by a long bull run after an initial dip. Gate.io listed at a cyclical high. Bitget listed after a low consolidation, preceding a rally. KuCoin saw a correction post-listing, while Bybit and OKX strategically listed before a new market surge. - GOAT:

MEXC was the initial launcher, with Gate.io, Bitget, Binance, and KuCoin listing during its ascent. Bybit and OKX joined when the rally was nearing its end. - NMR:

NMR saw sequential listings across MEXC, Binance, OKX, Gate.io, KuCoin, Bitget, and Bybit. - PEPE:

Gate.io and MEXC emerged as significant winners, enabling users to capture substantial early gains. OKX, though later, still offered opportunities during the main rally. Binance and KuCoin listed at the market’s emotional peak, exposing investors to high risks of chasing tops. - POPCAT:

The pattern repeated: Gate.io and MEXC seized the early advantage. Exchanges like Bitget and OKX listed later, missing a significant portion of the rally initiated after Bybit‘s listing. - FARTCOIN:

MEXC stood out, experiencing an immediate massive surge upon its initial listing. Bitget followed closely. Gate.io and KuCoin listed amidst significant price volatility, drastically increasing risk. - MOODENG:

This case further validates MEXC’s exceptional acuity in identifying and listing early trending tokens.

Overall Observations on Listing Capabilities:

While OKX and Binance tend to be more judicious and cautious in listing high-potential tokens – a strategy that might lead to missed early opportunities but also filters out lower-quality projects – MEXC and Gate.io are renowned for their speed. This agility offers investors more avenues to pursue high-reward scenarios.

However, it’s crucial to remember that speed isn’t always advantageous. When cross-referenced with our Listing Failure Rate data, Gate.io, despite its rapid listings, exhibits an exceptionally high “listing failure rate.” This positions it as a quintessential “high-risk, high-reward” platform. Therefore, listing speed must always be evaluated in conjunction with an exchange’s inherent risk control capabilities.

Sector-Specific Listing Strategies: A Deeper Look

Within the dynamic crypto landscape, project categories exhibit distinct breakout rhythms and listing rationales. Our analysis of recent market data highlights that an exchange’s sectoral sensitivity is paramount for investors aiming to gain an early strategic advantage.

1. Meme Sector: Speed is Supreme, Early Birds Catch the Worm

Tokens like PEPE, POPCAT, and FARTCOIN exemplify the Meme coin phenomenon, characterized by extremely short lifecycles where listing speed directly correlates with potential returns. MEXC and Gate.io consistently act as the primary launchpads for Meme tokens, often monopolizing the initial listings of early star projects. While OKX and Binance typically list these later, their immense user bases can still propel token prices into a significant second wave of appreciation.

Investment Insight: Meme coin enthusiasts should concentrate approximately 80% of their efforts on MEXC and Gate.io, aiming for rapid entry on listing day. Consider phased profit-taking as these tokens subsequently list on larger platforms like Binance and OKX.

2. AI & Infrastructure: Graded Listings for Sustained Value Discovery

AI and infrastructure projects typically involve higher technical barriers and longer value realization cycles. Exchanges exhibit a clear “graded listing” approach for these sectors. Binance often serves as the premier launchpad for significant AI projects (e.g., FET), with its Alpha platform and IDO channels demonstrating a discernible preference for this domain. Bitget and Bybit excel at listing these projects during their low consolidation phases, often after an initial price correction, providing excellent secondary entry opportunities for investors who missed the initial launch.

Investment Insight: The AI sector is conducive to a “left-side positioning” strategy with phased accumulation. Establish an initial observation position upon a Binance launch, then consider increasing investment after a secondary listing on platforms like Bitget, especially following a price retracement.

3. GameFi & RWA: Emerging Dark Horses and Astute Exchanges

KuCoin and Gate.io have displayed remarkable foresight in the GameFi arena (e.g., AGLD), frequently listing promising projects ahead of even Binance. In the burgeoning Real World Asset (RWA) sector (e.g., ONDO), Bybit and Bitget demonstrate keen market intuition, timing their listings precisely to capture substantial rallies.

Investment Insight: For GameFi and RWA – sectors frequently yielding “dark horse” projects – it’s essential not only to monitor leading exchanges but also to set price alerts on KuCoin, Bybit, and Bitget to capitalize on early opportunities.

Tailored Investment Strategies: Choosing Your Ideal CEX

Our multi-faceted data comparison unequivocally shows that no single exchange reigns supreme across all metrics. Each platform, shaped by its distinct listing strategies, vetting standards, and target user base, presents a unique risk-reward profile.

Personalized Recommendations:

- For the Conservative Investor: Binance and OKX are your “safe harbors.” While you might forgo some of the wildest “moonshots,” you’ll benefit from more stable returns, significantly lower listing failure rates, and a generally more secure trading environment.

- For the Aggressive Investor: MEXC and KuCoin represent your “adventure playground.” These platforms are characterized by rapid new listings, a higher density of potential “dark horses,” and considerable odds for substantial gains. They are ideal for “crypto prospectors” equipped with strong research skills and a willingness to embrace higher risk.

- For the Balanced Risk-Reward Seeker (The “Hexagonal Warrior”): Bybit stands out as a rare “all-rounder.” It achieves an exceptional equilibrium between robust risk control and impressive profitability, making it a prime choice for assertive fund managers prioritizing optimized risk-adjusted returns.

- For the Experienced “Token Prospector”: Gate.io, with its “ocean of tokens” strategy and lightning-fast listings, offers the most extensive array of choices. However, this is also where the “law of the jungle” is most pronounced, demanding top-tier independent judgment and research capabilities from its users.

Ultimately, selecting a cryptocurrency exchange is a deeply personal decision, much like crafting your investment strategy. It requires a clear understanding of your own risk appetite and financial objectives. Choose the platform that best aligns with these goals, and it will become your most effective “money-printing machine.”