Author: JAE, PANews

Ethena’s Strategic Pivot: Navigating Challenges and Forging a New Path in Stablecoin Infrastructure

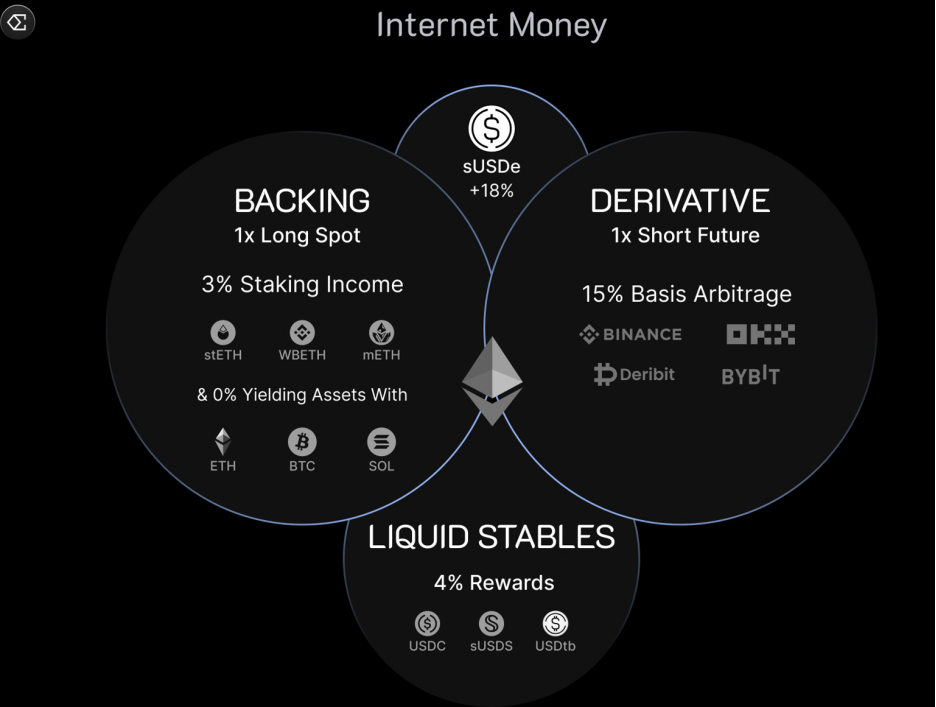

Ethena, with its innovative Delta-neutral hedging strategy, rapidly rose to prominence as the issuer of USDe – a censorship-resistant, scalable synthetic dollar designed to capture perpetual futures funding rate yields. This unique approach propelled Ethena’s Total Value Locked (TVL) to nearly $15 billion, positioning it as a potential disruptor to the entrenched duopoly of centralized stablecoins like USDT and USDC.

However, by October 2025, Ethena faced an abrupt reversal of fortune, encountering severe structural challenges. Within a mere two months, the protocol endured a series of setbacks, including a halving of USDe’s TVL and the unexpected termination of a key incubated ecosystem project. These events prompted the market to critically re-evaluate: Is Ethena’s core mechanism inherently susceptible to external pressures? Is its early high-growth model sustainable? And where lies its next curve of growth?

USDe TVL Plummets Amidst Arbitrage Retreat and Project Setbacks

The significant challenges recently confronted by Ethena were not coincidental; they unveiled the protocol’s over-reliance on external liquidity during its rapid expansion phase and a strategic misstep in its ecosystem development.

According to the latest data from DeFiLlama, as of December 2, 2025, USDe’s TVL had fallen to approximately $7 billion, representing a precipitous decline of over 50% from its October peak of more than $14.8 billion.

The sharp decline in USDe’s TVL was not due to a failure of the protocol’s hedging mechanism itself. Instead, it was primarily catalyzed by the “1011” USDe de-pegging event on Binance, which triggered widespread market panic and led to a systematic unwinding of high-leverage arbitrage strategies across DeFi. During Ethena’s rapid growth, many users employed USDe as collateral on platforms like Aave, borrowing USDC through recursive lending operations to achieve leverage exceeding 10x, thereby amplifying potential yields.

This model’s viability hinged on favorable interest rate spreads. As market lending rates fluctuated, USDe’s APY (Annual Percentage Yield) dropped to around 5.1%, while the cost of borrowing USDC on Aave remained at 5.4%. Once USDe’s yield fell below borrowing costs, arbitrage trades relying on a positive spread became unprofitable. Consequently, the leveraged positions that had inflated TVL began to close out and redeem en masse, causing a massive outflow of liquidity and a substantial contraction in TVL.

This phenomenon also underscored the reflexivity inherent in USDe’s yield model: the protocol’s yield and TVL growth formed a self-reinforcing cycle, yet also introduced structural fragility. When deposit rates were high, attractive yields drew in significant leveraged capital, driving TVL upwards. However, once deposit rates declined or borrowing costs increased, pushing yields below a critical threshold, a collective withdrawal of leveraged positions accelerated the protocol’s contraction.

USDe’s growth, therefore, proved to be deeply influenced not only by its Delta-neutral hedging mechanism but also by market sentiment and panic. Despite Ethena maintaining a collateralization ratio above 100%, the spread of de-risking sentiment and the brief de-pegging crisis of USDe to $0.65 on Binance further exacerbated the liquidity retreat.

Concurrently with the TVL plunge, Terminal Finance, a decentralized exchange (DEX) incubated by Ethena, announced the termination of its launch plans, casting a shadow over the protocol’s strategic direction. Terminal had previously garnered significant market attention, attracting over $280 million in deposits during its pre-launch phase.

The fundamental reason for Terminal’s termination was the failure of its underlying public chain, Converge, to launch as scheduled. In March of this year, Ethena Labs and Securitize had announced a collaboration to build Converge, an Ethereum-compatible institutional-grade public chain, with Terminal positioned as the liquidity hub on the Converge chain.

However, without Converge mainnet launching as promised and no definite launch plans in sight, Terminal lost its indispensable infrastructure. Terminal’s official statement on X candidly admitted that the team explored various transformation options but concluded that these paths faced “limited ecosystem support, scarce asset integration potential, and bleak long-term development prospects,” ultimately leading to the project’s termination.

Terminal’s failure marked a significant setback for Ethena’s attempt to build its own public chain ecosystem. In the fiercely competitive public chain landscape, dispersing resources and effort often proves costly. This event signaled to Ethena the necessity of shifting its focus towards a more efficient and scalable horizontal expansion model: becoming a premier stablecoin infrastructure provider for other public chains.

Building a White-Label Platform: Ethena’s Second Growth Engine and Enhanced USDe Utility

Despite the recent pains in liquidity and ecosystem projects, Ethena is strategically deploying a series of initiatives, redirecting its growth focus towards infrastructure services and product diversification. This pivot has already demonstrated strong resilience in its profitability.

Currently, the White-Label platform stands as Ethena’s most critical second growth engine. This “Stablecoin as a Service” (SaaS) product transforms the protocol’s role from merely an asset issuer to a fundamental infrastructure provider. The white-label platform enables high-performance public chains, consumer applications, and wallets to leverage Ethena’s underlying infrastructure to efficiently issue their own customized dollar-denominated assets. Ethena has already forged partnerships with various DeFi projects, exchanges, and public chains.

For instance, on October 2, Ethena announced a significant white-label partnership with Sui and its NASDAQ-listed DAT company, SUI Group Holdings (NASDAQ: SUIG). The Sui ecosystem is set to launch two types of native dollar assets:

-

suiUSDe: A yield-bearing stablecoin based on Ethena’s synthetic dollar model.

-

USDi: A stablecoin backed by BlackRock’s BUIDL tokenized fund.

This collaboration with Sui marks the first adoption of Ethena’s white-label platform by a non-EVM public chain, underscoring its cross-chain scalability. Furthermore, SUI Group will utilize the net revenue generated from suiUSDe and USDi to purchase more SUI tokens on the open market, directly linking stablecoin issuance to ecosystem growth.

On October 8, Ethena announced another pivotal partnership with Jupiter, a leading DEX aggregator in the Solana ecosystem, to launch JupUSD. This move secures another critical bridgehead within the non-EVM public chain landscape.

Jupiter plans to gradually replace $750 million worth of USDC in its core liquidity pools with JupUSD. Initially, JupUSD will be backed by USDtb, supported by BlackRock’s BUIDL fund, with future integration of USDe. This large-scale asset transition will introduce Ethena’s assets into mainstream Solana DeFi applications such as Jupiter Perps and Jupiter Lend, further solidifying the white-label platform’s utility within non-EVM ecosystems.

The implementation of this white-label strategy is not merely about expanding Ethena’s market share; it’s crucially about mitigating the protocol’s structural risks. Through the white-label platform, Ethena can assist various market participants in integrating and issuing Real World Asset (RWA)-backed stablecoins (such as USDtb/USDi). This signifies a diversification of Ethena’s revenue streams, reducing its heavy reliance on the highly volatile perpetual futures funding rates.

During periods of low or negative funding rates, the institutional-grade stable yields provided by RWAs can balance the protocol’s overall returns, potentially alleviating the reflexivity observed in USDe’s early growth model.

Notably, Ethena is also deepening USDe’s utility as a functional asset within DeFi, thereby reducing its dependence on leverage arbitrageurs. Ethena Labs has established a strategic partnership with Nunchi, the deployment entity for Hyperliquid HIP-3.

Nunchi is developing yield perpetuals, financial products that allow users to trade or hedge various yield rates (e.g., RWA interest rates, dividends, or ETH staking returns).

In this collaboration, USDe has been designated as the base collateral and settlement asset for yield perpetuals. More importantly, users utilizing USDe as margin will benefit from a “Margin Yield” mechanism, allowing the passive yield earned from holding USDe to offset trading fees and funding costs. This will not only enhance market liquidity but also reduce users’ effective trading expenses.

This mechanism contributes to USDe’s evolution from a mere savings tool to a functional asset within the DeFi derivatives market. A portion of the revenue generated on Nunchi will also flow back to Ethena, creating a new revenue flywheel and further diversifying the protocol’s income sources.

Over $600 Million in Protocol Revenue Captured, Multicoin Capital Endorses with Investment

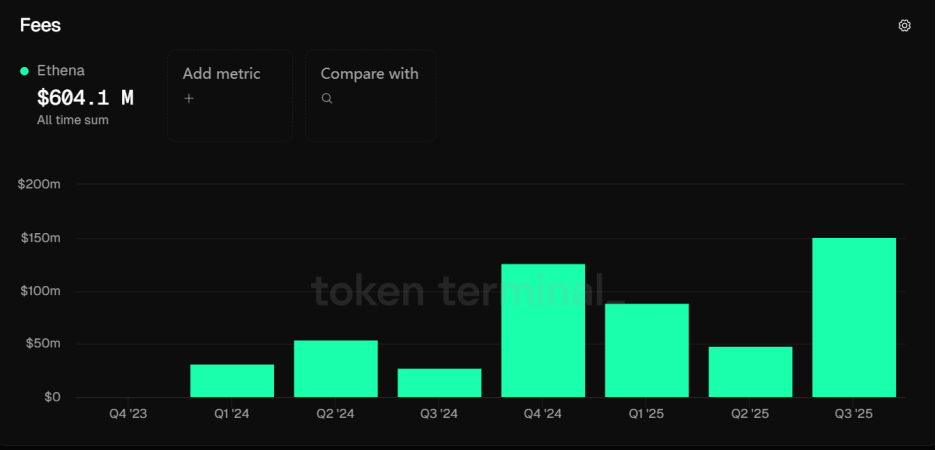

Indeed, even before Ethena experienced its recent turbulence, the protocol’s underlying profitability had already been validated, and its fundamentals remained robust. Data from Token Terminal shows that Ethena captured $151 million in fees during Q3 of this year, setting a new historical high for the platform, with total cumulative protocol revenue surpassing $600 million.

These revenue figures underscore Ethena’s highly efficient profitability when market conditions are favorable. Ethena protocol’s income streams are primarily composed of three components: 1) funding rates and basis yields earned from perpetual futures hedging positions; 2) ETH staking incentives; and 3) fixed rewards from liquid stablecoins.

This diversified revenue structure, coupled with the decentralized hedging of protocol positions across BTC and ETH, and a robust reserve fund of $62 million, collectively provides strong support for Ethena’s fundamental stability.

Amidst fluctuating market sentiment, the endorsement from a top-tier institution has injected significant confidence into Ethena’s long-term prospects. On November 15, Multicoin Capital announced its investment in ENA, the protocol’s governance token, through its liquidity fund.

Multicoin Capital’s investment thesis centers on the immense potential of the stablecoin sector, which it projects to grow into a multi-trillion-dollar market. They believe that “yield is the ultimate competitive advantage.” Multicoin views Ethena’s synthetic dollar model as uniquely capable of transforming the global market’s demand for crypto asset leverage into substantial yield, a capability that distinguishes Ethena from traditional centralized stablecoins.

From a capital perspective, Multicoin Capital’s investment primarily highlights Ethena’s platform potential as a yield-bearing stablecoin issuer. Ethena’s scale, brand recognition, and revenue-generating capacity equip it with the ability to expand into new product lines, providing strategic and financial support for the protocol’s future infrastructure business expansion.

Despite facing a halving of its TVL and the termination of an ecosystem project, Ethena has achieved record-breaking revenue and secured counter-cyclical investment from top-tier capital. It is now actively striving to mitigate the impact of liquidity withdrawal and seek new avenues for business growth through its “Stablecoin as a Service” white-label strategy and by further broadening USDe’s application scenarios.

For Ethena, the crucial determinant of whether it can successfully transition from a 2C high-yield savings vehicle to a 2B stablecoin infrastructure provider will be key to reaching new heights in the next market cycle.

(The above content is an excerpt and reproduction authorized by our partner PANews. Original Link)

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of Blockcast. Investors should make their own decisions and trades. The author and Blockcast will not bear any responsibility for direct or indirect losses incurred by investor transactions.