Is Crypto Winter Coming? Bitcoin’s Dip May Just Be a Mid-Bull Market Shakeout, Say Analysts

Recent market jitters have many investors on edge. With Bitcoin shedding over 18% in the last three months and cryptocurrency-related stocks showing weakness, the specter of an impending “crypto winter” looms large. However, leading on-chain analytics firm Glassnode, in collaboration with Fasanara Digital, offers a compelling counter-narrative. Their latest reports suggest that current market dynamics are more indicative of a healthy “mid-bull market adjustment” rather than the onset of a prolonged bear trend.

Unprecedented Capital Inflows Fueling the Market

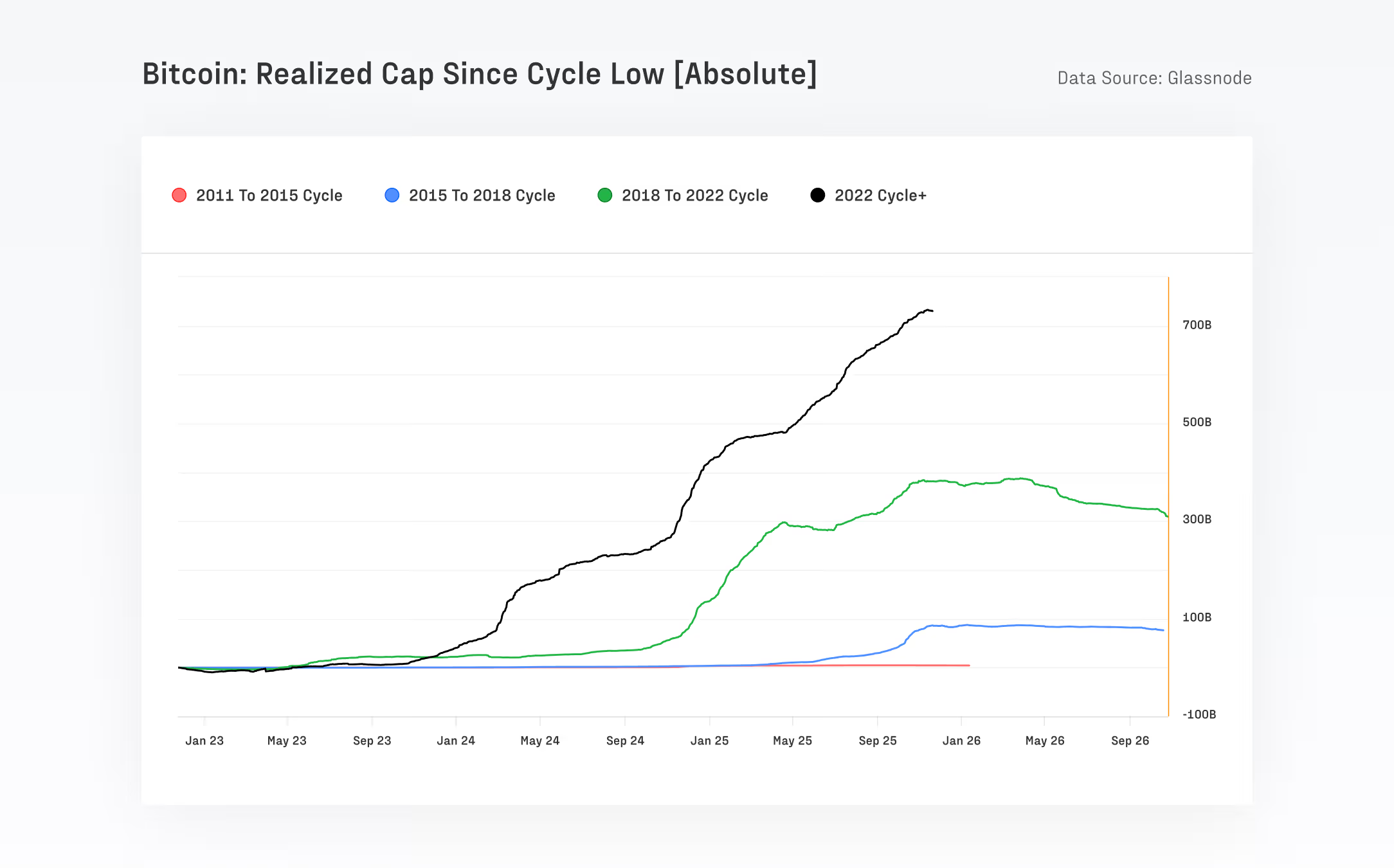

Dispelling fears of a capital exodus, Glassnode and Fasanara Digital’s latest report highlights a remarkable influx of capital into Bitcoin. Since its 2022 cycle low, Bitcoin has attracted an astounding net new capital exceeding $732 billion. This figure alone speaks volumes, surpassing the cumulative capital inflows of all previous Bitcoin cycles combined.

This massive investment has propelled Bitcoin’s “Realized Cap” — a metric reflecting the aggregate cost basis of all coins in circulation — to an impressive $1.1 trillion. Crucially, the Realized Cap typically shows signs of contraction at the outset of a “crypto winter,” yet currently, it exhibits no such weakness, suggesting robust underlying support for the asset.

Volatility Declines, Signaling Maturity and Stability

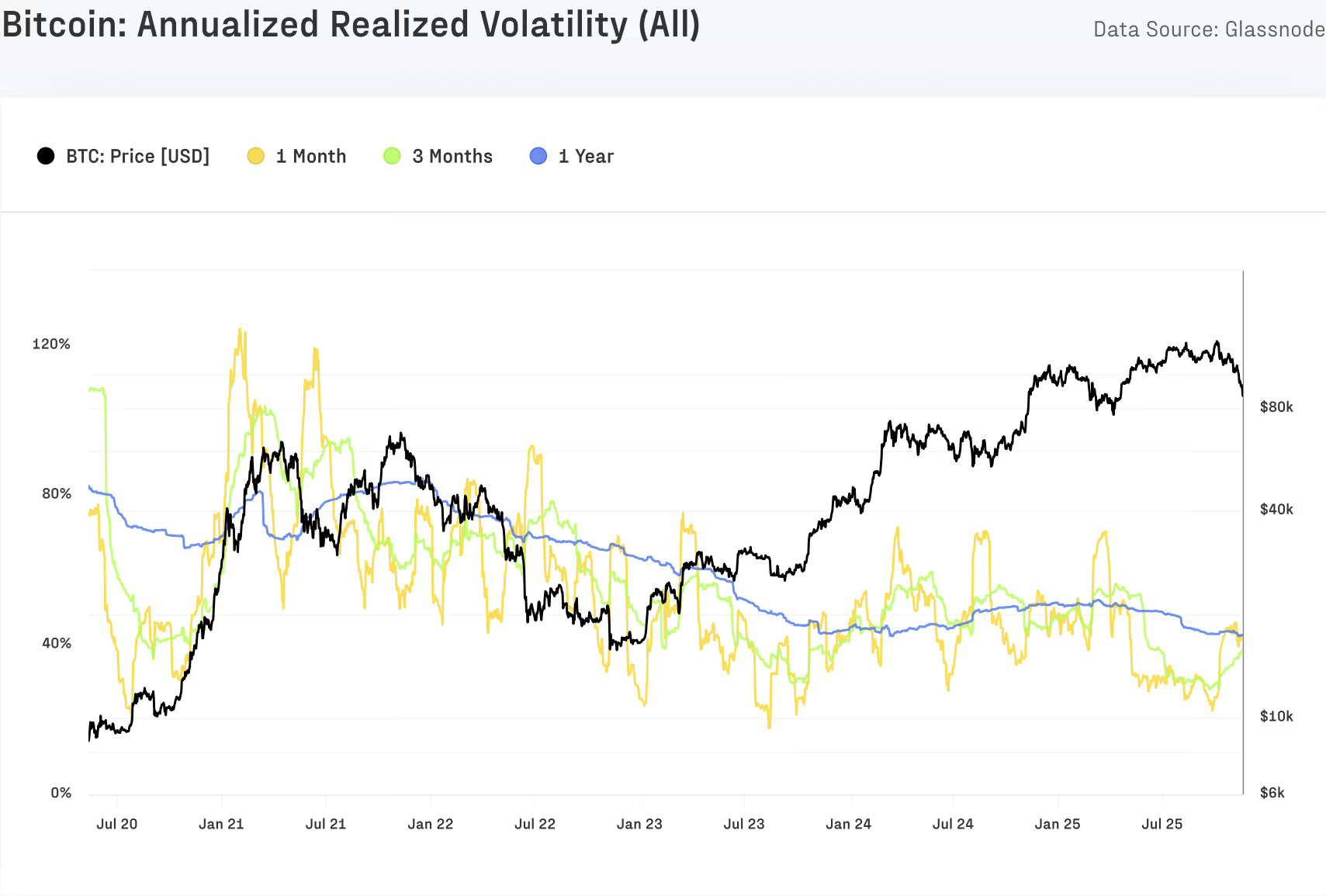

Another key indicator contradicting bear market narratives is Bitcoin’s evolving volatility profile. The report notes a significant drop in Bitcoin’s one-year “Realized Volatility,” plummeting from 84% to approximately 43%. This reduction is attributed to several factors: enhanced market liquidity, increased participation from institutional players via ETFs, and a growing number of derivative positions utilizing cash margins.

Historically, “crypto winters” are characterized by soaring volatility and dwindling liquidity. The current environment, with volatility nearly halved, presents a stark contrast. Furthermore, this cycle introduces a unique dynamic: the increasing popularity of “Call Overwriting” strategies in both Bitcoin and IBIT options markets. This strategy actively suppresses price volatility, further decoupling the traditional link between high volatility and price downturns.

Spot ETFs and Mining Stocks Defy Bearish Trends

Strong ETF Inflows Persist

ETF market activity, often a bellwether for institutional sentiment, shows no signs of a “bull market top.” Spot ETFs currently hold approximately 1.36 million Bitcoins, representing about 6.9% of the total circulating supply. Since their inception, these ETFs have contributed a net inflow of roughly 5.2%. In previous “crypto winters,” ETFs typically experienced sustained net outflows – a pattern entirely absent in the current market.

Mining Sector Resilience

The performance of mining stocks further challenges the “crypto winter” hypothesis. During Bitcoin’s recent pullback, the CoinShares Bitcoin Mining ETF (WGMI) surged by over 35%. Historically, miners are among the first to face severe pressure during a bear market, as declining mining revenues quickly erode profitability. The current resilience of the mining sector suggests a healthier market environment than a typical crypto winter.

A Mid-Cycle Shakeout, Not an End to the Bull Run

Glassnode posits that the current Bitcoin correction aligns more closely with historical “mid-cycle behavior.” This pattern involves a necessary market “shakeout” or deleveraging before the asset continues its upward trajectory. Similar pullbacks were observed in 2017, 2020, and 2023, often accompanied by derivative market deleveraging or global liquidity tightening. These events consistently served to reset market positions rather than signal the end of a cycle.

Crucially, Bitcoin currently remains closer to its recent highs than its cycle lows. In contrast, historical “crypto winters” are marked by Bitcoin hovering near the bottom, coupled with accumulating realized losses and weakening long-term holder activity. The present market exhibits none of these bearish characteristics.

In conclusion, the confluence of record-high Realized Cap, consistently declining volatility, and robust ETF buying all point towards a healthy consolidation phase after a period of strong capital inflows. This picture is distinctly different from the indicators typically seen at the dawn of a “crypto winter,” offering a more optimistic outlook for the market’s trajectory.

Disclaimer: This article is for market information purposes only. All content and opinions are for reference only and do not constitute investment advice, nor do they represent Blockcast’s views or positions. Investors should make their own decisions and trades. The author and Blockcast will not bear any responsibility for direct or indirect losses resulting from investor transactions.