Author: BitpushNews

As 2025 draws to a close, the crypto market, while experiencing a chill, is also buzzing with promising projects signaling upcoming airdrops and Token Generation Events (TGEs). These opportunities often require minimal capital investment and feature relatively low entry barriers, making them ideal for investors looking to stay engaged during a bear market without significant risk. This article meticulously curates the most high-potential projects, offering a strategic pathway to capitalize on future possibilities with reduced exposure to market volatility.

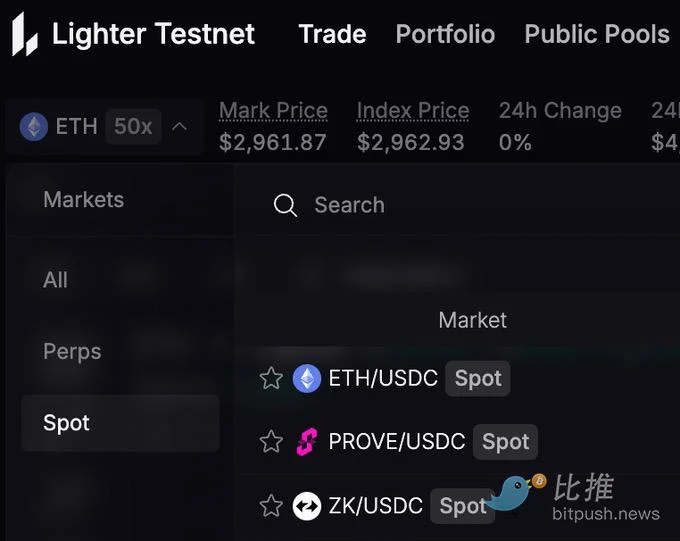

1. Lighter (LITER)

Lighter stands out as a high-frequency perpetual DEX built on Starknet L2, championing zero-fee trading, ZK-proof matching, and instant execution. Designed for professional traders, it’s often dubbed the “on-chain Citadel.” Launched on the mainnet in October 2025, Lighter is currently in its Season 2 points farming phase. Its TGE is anticipated by late December or Q1 2026, with Polymarket odds indicating a 98% chance of it being the largest airdrop of 2025.

Funding Status

Lighter has successfully raised approximately $25 million from a formidable lineup of Tier-1 VCs, including YZi Labs (lead investor), BinanceCZ Family Office, a16z Crypto, and Paradigm. These funds are primarily allocated to mainnet development and the points reward pool. Founder Vladimir Novakovski brings a strong background from the Citadel trading team.

Key Metrics

- Mainnet TVL: $1.1 billion (up 150% in the last 30 days)

- Daily Active Users: 56,000+

- Daily Trading Volume: Peak at $18.9 billion (frequently surpassing Hyperliquid)

- Total Points: 250,000 points distributed weekly (Season 2 concludes December 31)

- Estimated FDV: Approximately $500 million – $1 billion (total supply undisclosed, 50% allocated to community)

- Points OTC Price: $5-$11 per point (potential ROI 25-100x)

How to Participate

- Trade perpetual contracts on the mainnet (ETH/USDC, etc., leverage up to 50x to earn points).

- Provide LLP liquidity (share trading fees + point bonuses).

- Invite sub-accounts for farming (main account earns a 25% rebate, requires 100 points to unlock the code).

- Bridge funds and engage in high-frequency trading (beware of “death zone” risks; official snapshot before December 31).

As a dark horse in the Perps DEX arena, Lighter’s zero-fee model and high ZK technology barrier, coupled with a 50% community allocation, present immense airdrop potential. However, the sustainability of trading volume post-TGE will be crucial. This opportunity is particularly well-suited for high-capital traders aiming to maximize end-of-season points.

2. Aster (ASTER)

Aster represents a new generation of multi-chain decentralized exchanges (DEXs), specializing in perpetual contracts and spot trading. Supporting BNB Chain, Ethereum, Solana, and Arbitrum, it offers MEV resistance, one-click execution, hidden orders, and high leverage (up to 1001x). A key innovation is allowing asBNB (liquid staked BNB) or USDF (yield-bearing stablecoin) as collateral for enhanced capital efficiency. The project emerged from the late 2024 merger of Astherus and APX Finance, completing its TGE on September 17, 2025. Post-mainnet launch, its trading volume quickly surpassed Hyperliquid, establishing Aster as a significant player in the Perp DEX sector.

Funding Status

Aster has secured approximately $25 million in funding, with prominent investors including YZi Labs (Binance founder’s family office, lead investor), Binance Labs (incubation support), a16z Crypto, and Paradigm. CZ personally invested over $2.5 million and serves as an advisor, championing the development of privacy-focused trading infrastructure.

Key Metrics

- Mainnet TVL: Approximately $1.5 billion (up 120% in the last 30 days)

- Daily Active Users: 80,000+

- Daily Trading Volume: Peak over $2 billion

- Token Price: Approximately $1.16 (24h range $1.04-$1.08)

- Circulating Market Cap: Approximately $2.07 billion (1.65 billion tokens in circulation)

- FDV: Approximately $8.2 billion (total supply 8 billion tokens)

- Major Trading Platforms: Spot listings on Bybit, Bitget, Binance, and other CEXs.

Participation Pathways

- Stage 4 points farming (trade Perps, provide liquidity, hold asBNB/USDF to earn Rh points, until December 21).

- Check S3 airdrop eligibility (checker opened December 1, claim window December 15 – January 15, 2026, 200M ASTER rewards).

- Rocket Launch activities (trading volume rewards ASTER + project tokens, no lock-up period).

- Invite sub-accounts for volume generation (be aware of anti-Sybil filtering).

With CZ’s endorsement, multi-chain aggregation, and a tokenomics model allocating over 53% to the community, Aster stands out in the Perp DEX space. The Q1 2026 launch of the Aster Chain L1 mainnet is set to further amplify its potential, though investors should remain vigilant about unlocking pressures and market volatility.

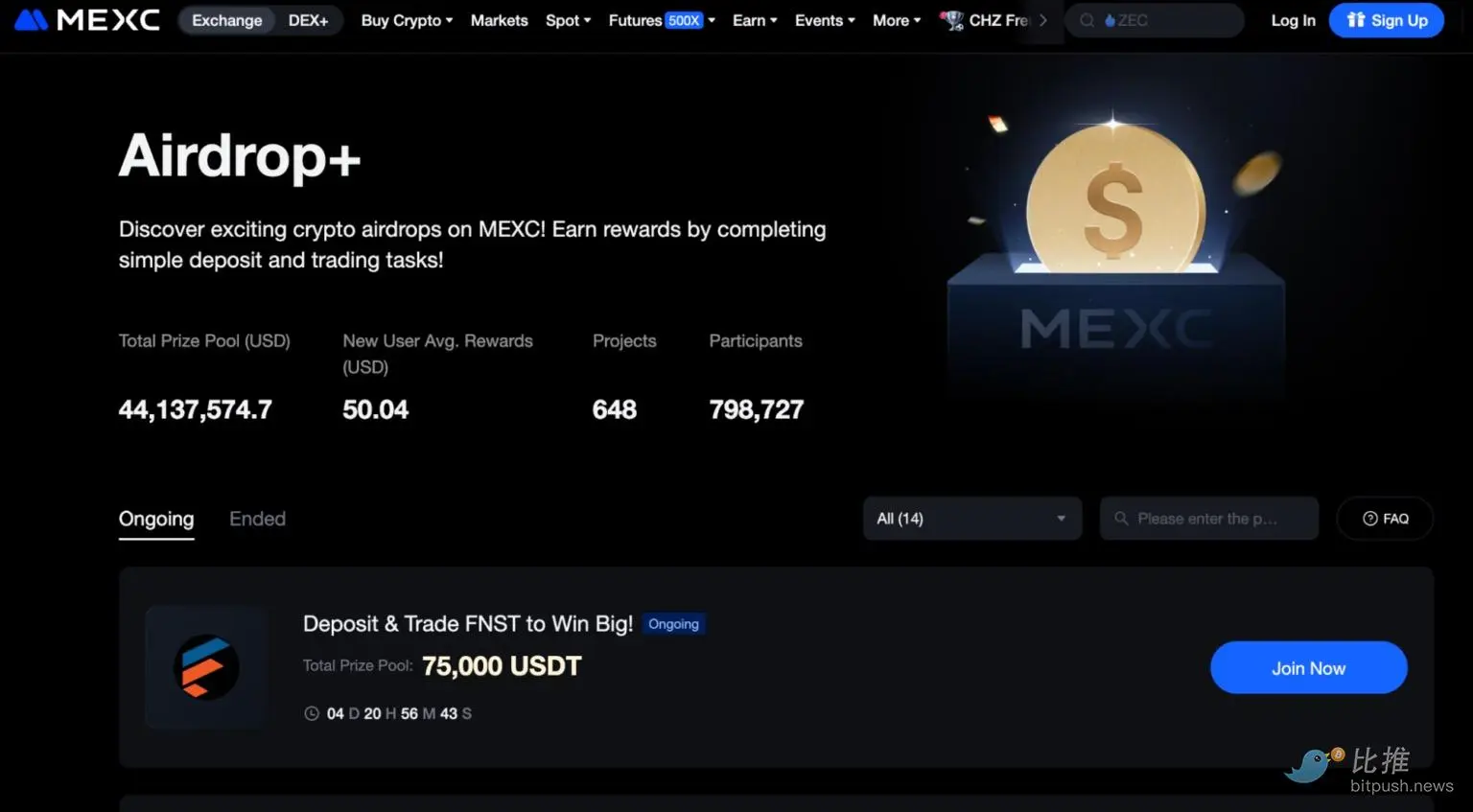

3. MEXC

As a leading non-Tier-1 centralized exchange boasting 40 million users, MEXC is currently running various micro-airdrop campaigns, offering trading rewards and task-based incentives.

Eligibility Pathways

- Complete fiat deposits and participate in lucky wheel events.

- Execute specific trading pair operations and asset deposit tasks.

Key Metrics

- Estimated Rewards: $1 – $5,000 in trading bonuses.

- Reward Pool Size: $44,137,574.

- Airdrop Status: Ongoing.

- Distribution Method: Via MEXC’s internal platform system.

MEXC serves as an ideal entry platform for newcomers, with its vast user base presenting both an advantage and a challenge due to increased competition for prize pools. It’s important to note that eligible trading pairs often involve emerging cryptocurrencies, making related tasks more suitable for users with a medium-to-high risk tolerance who are comfortable with market volatility.

4. Cysic Network (CYSIC)

Cysic Network is a Layer-1 computational network dedicated to zero-knowledge proof (ZK) hardware acceleration. Through self-developed ASIC chips and GPU clusters, it aims to boost ZK proof generation speed by 10-100 times and reduce costs by 91%, focusing on real-time ZK applications and a ComputeFi model. The project’s mainnet launched on September 24, 2025, and is currently in its early production phase.

Funding Status

Cysic has raised a total of $21.85 million from 13 institutional investors, including Polychain Capital, HashKey Capital, OKX Ventures, Binance Labs, and Multicoin Capital. Its valuation path is clear, and the node sales phase has concluded.

Key Metrics

- Mainnet TVL: $80 million (up 60% in the last 30 days)

- Active Users: 1.35 million

- Online Nodes: 260,000+ (Prover + Verifier)

- Token Price: $0.04

- Circulating Market Cap: Approximately $40 million

- FDV: Approximately $400-$500 million (total supply not fully disclosed)

- Major Trading Platforms: Spot trading pairs listed on OKX, Binance, Gate.io, etc.

Current Participation Pathways

- Run a Prover/Verifier node (consumer-grade RTX 4090 is sufficient).

- Stake $CYS to earn governance points $CGT.

- Participate in the ongoing official 4-week Onboarding Campaign in December (daily check-ins + simple tasks still qualify for future rewards).

Overall, Cysic is one of the most institutionally backed ZK infrastructure projects with a live mainnet and clear hardware implementation progress. It combines a low circulating market cap with high technical barriers, offering significant flexibility during the year-end capital rotation window. However, investors should be mindful of hardware project iteration risks and market volatility.

5. LayerZero Season 2

This cross-chain interoperability protocol has connected over 130 blockchains, forged partnerships with institutions like Tether and PayPal, and reserved 15.3% of its total token supply for community distribution.

Eligibility Pathways

- Perform cross-chain asset transfers via Stargate/Jumper.

- Utilize decentralized applications within the LayerZero ecosystem.

- Hold and stake ZRO tokens.

- Participate in governance voting.

Key Metrics

- Estimated Rewards: $2,000 – $15,000 (referencing Season 1 standards).

- Reward Pool Size: 15.3% of the 1 billion ZRO total supply.

- Airdrop Window: Expected Q4 2025 (subject to uncertainty).

- Participation Difficulty: Moderate (requires cross-chain operations and multi-chain engagement).

- Distribution Method: Anticipated via official snapshot and claim interface.

The protocol addresses a critical pain point in blockchain interoperability, making its technological prospects highly noteworthy. However, previous delays in the team’s airdrop timeline commitments introduce an element of speculation, making this opportunity more suited for users with long-term conviction in its technical roadmap.

6. Abstract Chain

As a Layer 2 solution expanding upon the Pudgy Penguins NFT project, Abstract Chain focuses on driving mainstream adoption through a minimalist user experience. It has established partnerships with platforms like Gate.io.

Eligibility Pathways

- Collect platform badges.

- Bridge assets to the Abstract network.

- Execute trades on the Vertex platform.

- Experience on-chain games like Multiplier and Duper.

Key Metrics

- Estimated Rewards: $1,000 – $8,000 (including PENGU holder bonuses).

- Reward Pool Size: To be determined (utilizes an engagement points system).

- Airdrop Status: Not yet confirmed.

- Distribution Method: Through point conversion and badge verification system.

This project has generated significant community buzz, largely fueled by the Pudgy Penguins’ marketing and initial PENGU airdrop expectations. As the official airdrop plan remains unconfirmed, it is currently best viewed as a speculative watch or a low-barrier entry for gaming enthusiasts. Participants should exercise caution until concrete details emerge.

7. Stable (STABLE)

Stable is a next-generation Layer-1 blockchain incubated by Bitfinex, specifically designed for stablecoins. It aims to facilitate instant payments, low-cost transfers, and global distribution within the USDT ecosystem. Essentially, it’s a public chain built to serve as an “on-chain PayPal + high-speed USDT channel.” With its testnet operational for several months, the mainnet launch is projected for Q4 2025 (potentially as early as late December).

Funding Status

Stable has raised a total of $28 million from an impressive roster of investors. Bitfinex and Hack VC co-led the round, with participation from traditional and crypto heavyweights including Franklin Templeton, Susquehanna, Castle Island Ventures, Nascent, and eGirl Capital. This project is a quintessential “institutional play.”

Key Metrics

- Testnet TVL: Approximately $120 million (40% growth in the last 30 days)

- Daily Active Addresses: 50,000+

- Testnet Daily Transaction Volume: Around $5 million

- Current Token Presale Price: Approximately $0.15

- Estimated FDV: Around $1.5 billion (total supply 100 billion tokens, 53% allocated to community)

- Post-TGE Listing: Expected direct listings on major spot exchanges like Binance, OKX.

How to Participate

- Perform bridging, transfer, and payment scenario tasks on the testnet (most direct source of points).

- Participate in the official Pre-deposit activities (via ConcreteXYZ partnership channel, deposits count for points).

- Engage in daily trading volume + holding farming (high probability of December snapshot).

- Pre-register and complete KYC on the official website, linking your wallet (may earn additional role bonuses).

Stable stands as one of the most institutionally backed projects with a clear roadmap in the stablecoin sector. Leveraging the vast traffic of Tether and Bitfinex, it is highly likely to experience a strong narrative-driven rally from year-end into early next year. It’s an attractive opportunity for those seeking a relatively certain airdrop or early-stage benefits, but closely monitor official announcements for mainnet launch timing.

8. Zama (ZAMA)

Zama is an open-source cryptography company dedicated to Fully Homomorphic Encryption (FHE) technology. It is building the Zama Protocol, a confidential blockchain protocol that enables processing encrypted data on public chains like Ethereum without decryption, supporting privacy-preserving DeFi, RWA, and stablecoin applications. The testnet is live, with the mainnet and TGE (Token Generation Event) anticipated in Q4 2025. On December 1, Zama announced its inaugural $ZAMA token public auction: 10% of the supply will be sold via a sealed-bid Dutch auction on Ethereum, utilizing FHE to ensure bid confidentiality and prevent bot front-running and gas wars.

Funding Status

Zama has raised an impressive total of $73 million from top-tier investors:

- Series B (June 2025): $57 million, led by Pantera Capital and Blockchange, valuing the company at over $1 billion (making it the first FHE unicorn).

- Previous Rounds: Seed and Series A rounds totaled approximately $16 million, with investors including Multicoin Capital.

- Funds are primarily allocated to FHE hardware optimization and mainnet development.

Key Metrics

- Testnet TVL: Approximately $50 million (25% growth in the last 30 days)

- Daily Active Addresses: 20,000+

- Testnet Daily Transaction Volume: Around $3 million

- Token Status: Not yet listed (TGE by year-end).

- Estimated FDV: Approximately $1 billion (total supply undisclosed, 10% sold via auction).

- Auction Details: January 12-15, 2026, with claims starting January 20; conducted on Ethereum mainnet using Zama Protocol FHE for encrypted bidding.

How to Participate

- Engage in testnet FHE computation tasks (encryption/decryption simulations to accumulate points).

- Join Creator Program Season 5 (launched September, monthly rewards + referral fees, post-mainnet share of $ZAMA sales).

- Community engagement (active participation in Discord/Guild for potential airdrop eligibility).

- Prepare for the public auction (details announced early January, requires ETH wallet + KYC pre-registration).

Zama is a leading project in FHE privacy computing, backed by a unicorn valuation and an Ethereum mainnet implementation. The January auction will initiate fair distribution and genuine price discovery, positioning it for significant potential under the year-end privacy narrative.

9. MetaMask

As the world’s most widely used Web3 wallet, its parent company Consensys has repeatedly hinted at a token distribution. Currently, MetaMask is conducting Season 1 of its LINEA rewards program.

Eligibility Pathways

- Download and use the mobile application.

- Hold LINEA rewards obtained through activities (influences future eligibility).

- Execute on-chain operations such as token swaps and cross-chain transfers.

- Connect historical wallets to accrue points retroactively.

Key Metrics

- Current Rewards: LINEA valued at $50-$10,000 (based on trading volume).

- Reward Pool Size: 30 million LINEA (MASK allocation not yet announced).

- Activity Period: LINEA Season 1 until end of February.

- Participation Difficulty: Moderate.

- Distribution Method: Via official claim page.

Market anticipation for a MetaMask airdrop has been high for a long time. However, certain design choices in the earlier LINEA airdrop sparked community dissatisfaction, casting some uncertainty over the eventual MASK distribution. Users are advised to participate naturally through regular use and avoid unnecessary transactions solely for airdrop farming.

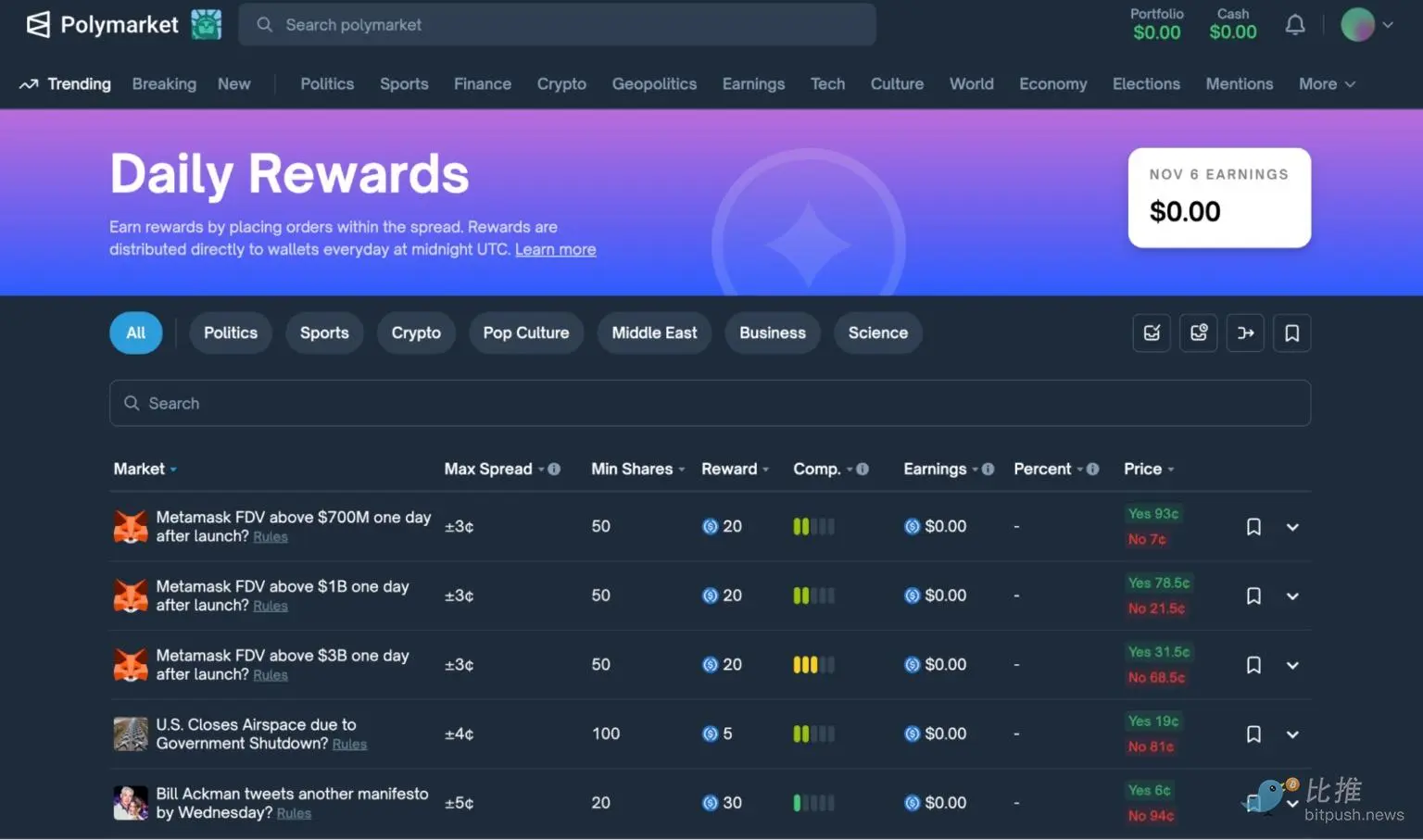

10. Polymarket

This decentralized prediction market platform has achieved a monthly trading volume of $3 billion. Following a $2 billion investment from ICE Group, Polymarket has explicitly confirmed plans for a token distribution.

Eligibility Pathways

- Download the official application.

- Participate in the “Daily Rewards” task system.

- Trading volume is likely to be a core consideration (specific rules to be announced).

The prediction market sector continues to gain traction, and Polymarket’s success in securing crucial regulatory approval to re-enter the US market has undoubtedly ignited significant market interest. Its gameplay design is remarkably clever: users don’t need to place actual bets, but can earn potential rewards by completing tasks, thereby lowering the barrier to entry. However, it’s crucial to note that the core of this model remains the prediction market mechanism; participants involved in providing liquidity should fully understand the inherent market risks and game theory involved.

(The above content is an authorized excerpt and reprint from our partner PANews. Original Link | Source: BitPush)

Disclaimer: This article is for market information purposes only. All content and opinions are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockBeats. Investors should make their own decisions and trades. The author and BlockBeats will not bear any responsibility for direct or indirect losses resulting from investor transactions.