Navigating Volatility: Central Bank Decisions Set to Define Market Trajectory

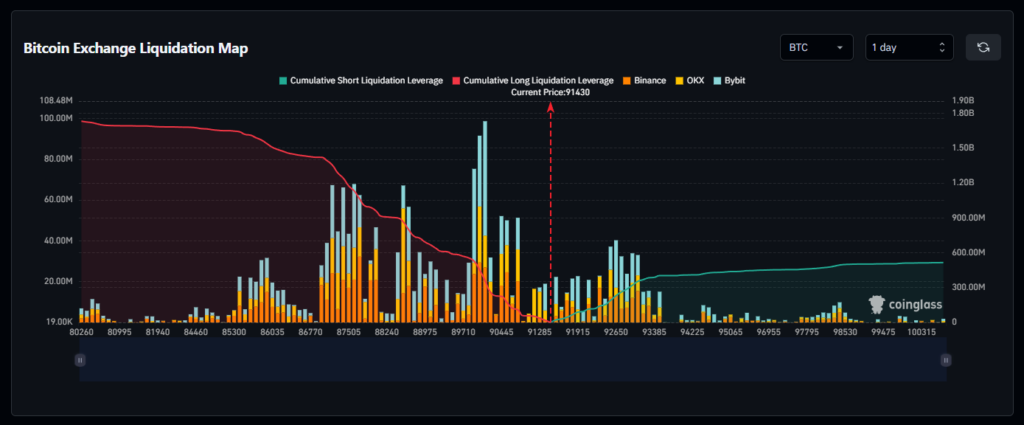

The past week witnessed a significant turnaround in global financial markets, with U.S. equities and the cryptocurrency sector experiencing a robust rebound. This resurgence followed the Federal Reserve’s official conclusion of its Quantitative Tightening (QT) policy, coupled with mounting market expectations for imminent interest rate cuts. Bitcoin (BTC) impressively reclaimed the $90,000 mark, while Ethereum (ETH) surged back above $3,000, shaking off the early-week doldrums. However, Sunday brought a bout of characteristic crypto volatility, as Bitcoin sharply dipped to $87,000 before swiftly rebounding to $91,000, triggering a ‘long-short squeeze’ that liquidated positions on both sides. Despite this turbulent episode, a short-term (1-day) liquidation map suggests a prevailing bullish bias, indicating that investors remain largely optimistic about future market movements, primarily driven by this week’s anticipated rate cut.

Crucial Week Ahead: BoJ and Fed in the Spotlight

This week, however, presents two pivotal events that could significantly sway market dynamics. The first is the highly anticipated speech by Bank of Japan (BoJ) Governor Kazuo Ueda on Tuesday afternoon. Following closely on Wednesday evening is the Federal Reserve’s crucial interest rate decision. As highlighted last week, a potential interest rate hike by the Bank of Japan could effectively neutralize the positive impact of the Fed’s recent QT cessation. More critically, such a move would siphon global liquidity, rendering the long-standing ‘carry trade’ — a strategy widely employed by international investors — ineffective. The ripple effect could be profound, potentially overwhelming even the positive sentiment generated by a U.S. rate cut, plunging market sentiment into pessimism due to a severe liquidity crunch and delivering a significant blow to the cryptocurrency market.

Fed’s Rate Cut Dilemma: Expectations vs. Reality

While the market has largely priced in an impending Fed rate cut, the upside potential from this alone is likely limited. Significant further gains would primarily hinge on a more aggressive rate cut trajectory outlined in the 2026 dot plot or overtly dovish remarks from Chairman Powell. Adding to the complexity, reports suggest considerable internal disagreement within the Federal Reserve regarding the timing and necessity of a rate cut. Should the U.S. fail to deliver a rate cut this week, the repercussions for the market could be catastrophic. Given this elevated level of uncertainty, investors are strongly advised to exercise caution in their position deployment early this week. The potential for unexpected market turbulence is high, and the cryptocurrency market, already navigating a delicate sentiment, could experience unforeseen and sharp movements.

Disclaimer: This article is intended solely to provide market information. All content and views expressed are for reference only and do not constitute investment advice. They do not represent the views or positions of the author or BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo shall not bear any responsibility for direct or indirect losses incurred by investors’ trading activities.