Author: Ryan Yoon, Analyst at Tiger Research

Translated by: Tim, PANews

Just two weeks ago, I highlighted the unlikelihood of Bitcoin breaching the $100,000 mark. Indeed, after a fleeting touch of $99,000, Bitcoin retreated and is now consolidating around the $90,000 level. This naturally leads to the pressing question: Is it time to ‘buy the dip’?

Our analysis suggests a cautious ‘yes’ – strategic accumulation is advisable, provided you implement a rigorous stop-loss strategy.

Bitcoin Enters Consolidation: Critical Choices Ahead

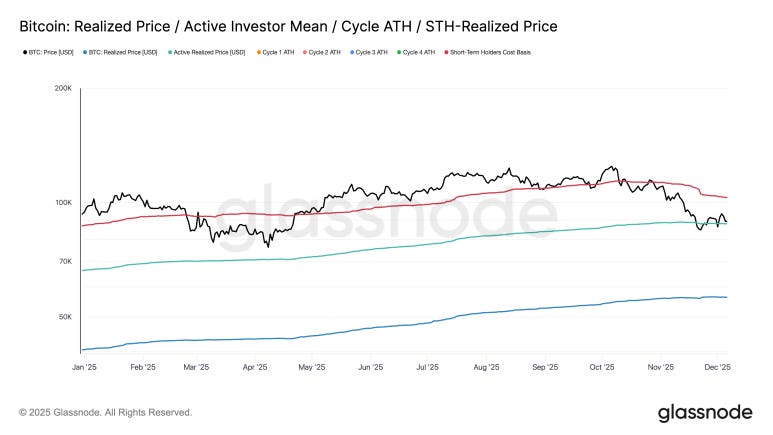

The price of Bitcoin has stabilized above $87,900, a crucial level representing the average cost for active market participants.

This ‘active realized price’ acts as the market’s collective breakeven point. Following the dramatic market downturn in 2022, it took a painstaking year and a half for Bitcoin to reclaim and hold this level. The market can finally breathe a sigh of relief as prices have successfully bottomed out and recovered.

Investors should closely monitor this specific price point, considering it a foundational baseline for current market health.

Furthermore, observe the dynamic relationship between the short-term holder cost line and the active realized price line. A downward cross of the short-term line below the active line would signal a rapid escalation of risk. Crucially, this unfavorable crossover has not yet materialized.

2. On-Chain Signals Nuanced, But Potential Returns Are Compelling

While some key on-chain indicators currently suggest a weaker trend, the potential for significant profit remains high, positioning us near the bottom of a potential value zone.

The MVRV Z-Score currently sits at 1.17. While it has moved beyond the historically ‘cheap’ price range, it has not yet climbed substantially. The interplay between buying and selling pressures is causing growth to decelerate, resulting in a somewhat weak and directionless trend.

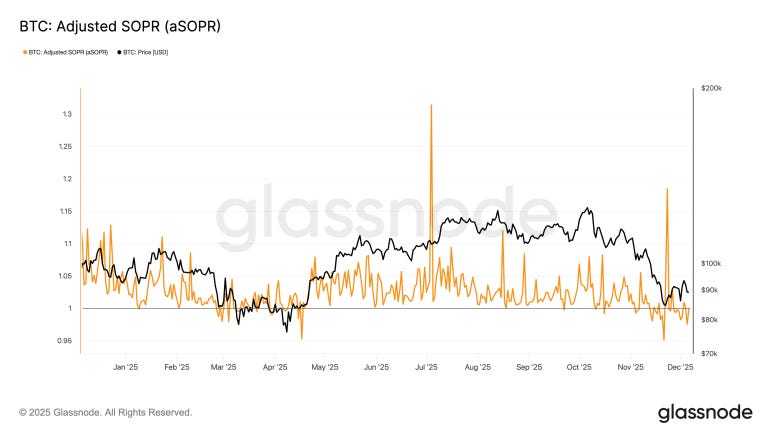

The aSOPR (Adjusted Spent Output Profit Ratio) is flat at 1.0. This indicates that sellers are transacting at their cost basis, opting to liquidate positions even for marginal or zero profit.

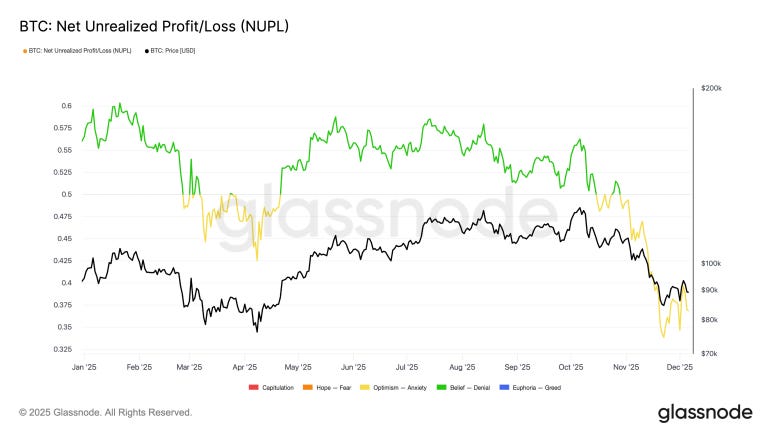

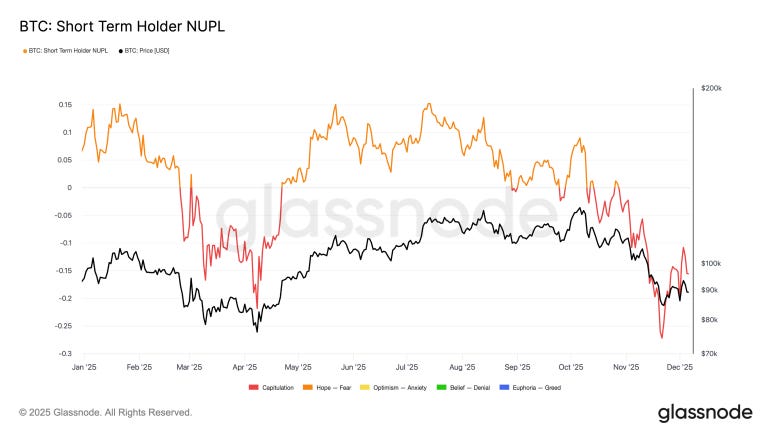

The NUPL (Net Unrealized Profit/Loss) stands at 0.36, having just entered the equilibrium zone. More notably, the Short-Term Holder NUPL is at -0.155, signifying that recent buyers are currently holding losses. This group is likely to sell once the price reaches their cost basis, further confirming a prevailing weak market sentiment.

Generally, holders tend to sell when they achieve even slight profitability. However, a critical insight for long-term investors: when the MVRV (Market Value to Realized Value ratio) approaches 1.10, it historically presents an exceptional buying opportunity. At this juncture, risk is comparatively low, and historical data indicates an average return of 40% over the subsequent year from this specific entry point.

3. Bitcoin’s Lifeline: $84,000

A decisive break below the $84,000 mark would introduce significant risk and could potentially trigger a prolonged and severe sell-off.

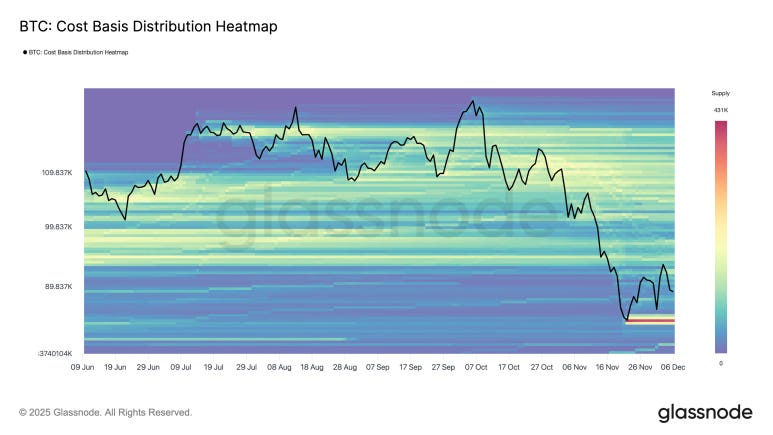

The cost distribution chart reveals a dense ‘buy wall’ concentrated around $84,000 (specifically within the $83,000-$85,000 range). This area represents the average cost basis for a substantial cohort of recent buyers. Should the price fail to hold this critical support, short-term holders would face considerable losses, likely sparking widespread panic selling.

A significant breach of $84,000 would fundamentally disrupt the current market structure. We observed a sharp increase in market panic on December 1st when the price briefly touched $83,000. Thus, $84,000 is more than just a technical level on the chart; it represents the ultimate defense line for maintaining the breakeven point for a large segment of current holders.

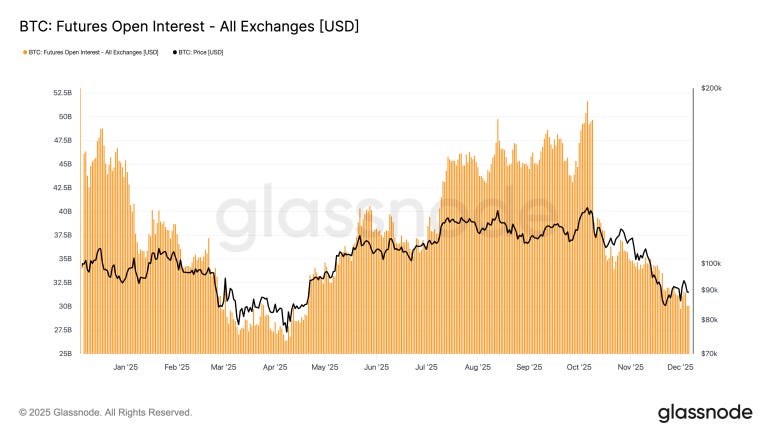

4. Open Interest: Deleveraging to Lows

Open interest in the futures market has receded to levels last seen in April. This significant decline is a clear indication that excessive leveraged positions have been effectively flushed out of the system.

This substantial deleveraging is a positive development. Lower leverage reduces the overall risk of sudden market crashes or cascading liquidations. The market has successfully purged its speculative froth, establishing a more robust foundation for future growth. We can now anticipate a fresh market rally originating from this more stable price range.

5. Strategic Accumulation is Prudent, But Strict Stop-Loss is Imperative

Based on our comprehensive on-chain analysis, the current market conditions present an opportune moment for strategic accumulation. The market’s speculative excesses have largely dissipated, suggesting that the potential for reward now significantly outweighs the inherent risks. Initiating positions at this juncture appears to be a judicious choice.

However, for risk-conscious investors, a disciplined approach is paramount. Avoid indiscriminate buying and instead, implement clear, predefined stop-loss levels. The market’s immediate trajectory, while showing signs of stabilization, remains subject to uncertainty.

A drop below the active realized price would push a majority of active traders into a loss-making position. Such an event would undoubtedly trigger market-wide panic, potentially cascading into a broader market collapse.

Therefore, we recommend setting your stop-loss order at $87,900. This strategy allows you to capitalize on potential dips while effectively mitigating downside risk should a critical support level fail. In the event of such a breakdown, preserving capital by moving to cash becomes the priority.

(The above content is an authorized excerpt and reprint from our partner PANews. Original Link)

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses resulting from investor transactions.