The cryptocurrency market is currently navigating a turbulent period, grappling with a confluence of macroeconomic factors. Last week’s anticipated interest rate cut by the US Federal Reserve initially sparked a minor rally, but this optimism quickly faded as deeper market insights emerged, pointing towards a more cautious outlook.

The Fed’s Mixed Signals and Crypto’s Retreat

While the Fed’s rate reduction was a long-awaited positive, its impact was short-lived. The market had largely priced in this move, and subsequent revelations from the meeting minutes and the ‘dot plot’ painted a more cautious picture. These documents hinted at a potential pause in further rate cuts, with projections indicating only a single reduction in 2026. This revised outlook triggered a significant market downturn, with Bitcoin (BTC) sliding back below the $90,000 mark. Ethereum (ETH) managed to cling to the $3,000 level, but the broader crypto market experienced a notable loss of momentum and a clear downward trend over the weekend.

The Looming Shadow of the Bank of Japan

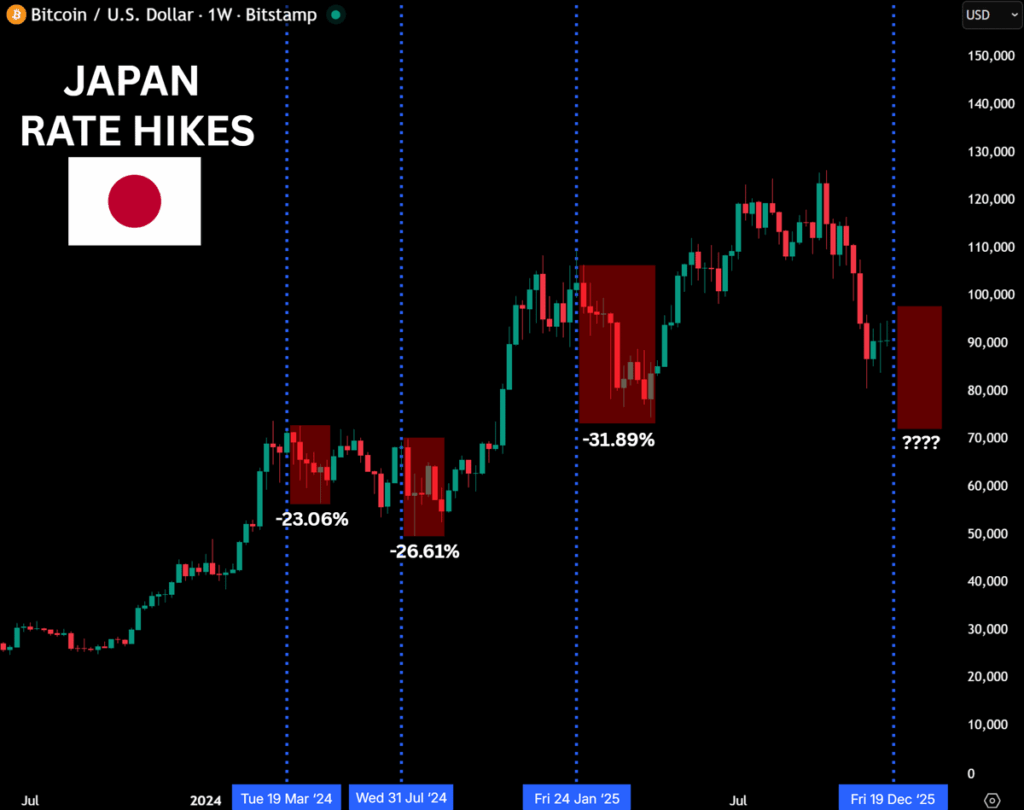

Adding to the market’s apprehension, a major catalyst for concern this week is the potential interest rate hike by the Bank of Japan (BoJ) on Friday. Online discussions and analyses highlight a compelling historical correlation: previous BoJ rate increases have often preceded a substantial 20-30% decline in Bitcoin’s value within the subsequent one to two months. Should history repeat itself, such a drop could potentially see BTC plummeting towards the $70,000 threshold. This prospect understandably fueled a wave of panic selling over the weekend, contributing significantly to the sharp declines observed.

US Economic Data Deluge: A Recipe for Volatility?

Further intensifying the market’s uncertainty is the impending release of a trove of critical US economic data this week. Several key reports, previously delayed due to government shutdowns, are now slated for publication. These include Tuesday’s crucial non-farm payrolls, unemployment rate, and retail sales figures, followed by Thursday’s Consumer Price Index (CPI) and additional unemployment data. Each of these metrics holds significant sway over the Federal Reserve’s future monetary policy decisions. The timing of these releases – after the Fed’s recent interest rate meeting – is particularly unsettling for investors. There’s a palpable fear that the incoming data might contradict the Fed’s recent assessment and projections, effectively signaling an error in the central bank’s forecast. With the next Fed meeting not scheduled until next year, any perceived misstep could introduce extreme volatility and unpredictability into the market through the end of the year.

Outlook: Navigating a High-Stakes Environment

In summary, the crypto market finds itself at a precarious juncture, caught between the nuanced signals from the US Federal Reserve, the specter of a Bank of Japan rate hike, and a heavy slate of impactful US economic data. These intertwined factors are creating a high-stakes environment, suggesting that investors should brace for continued choppiness and heightened sensitivity to macroeconomic developments in the weeks ahead.

Disclaimer: This article is provided for market information purposes only. All content and views are for reference only and do not constitute investment advice, nor do they represent the views and positions of Blockcast. Investors should make their own decisions and trades. The author and Blockcast will not bear any responsibility for direct or indirect losses resulting from investor transactions.