BOJ Rate Hike Looms: Will Bitcoin Plunge or Find Its ‘Sweet Spot’?

The cryptocurrency market stands at a critical juncture this week as global financial nerves fray ahead of the Bank of Japan’s (BOJ) highly anticipated interest rate decision, scheduled for December 18-19. All signs point to an almost certain outcome: a rate hike is virtually guaranteed, a move that could send significant ripples through risk assets, most notably Bitcoin.

Market forecasts and macro analysts are in rare agreement: Japan is on the cusp of raising its policy rate by 25 basis points (bps). While seemingly modest, the implications of this hike are far from contained to Japan’s domestic bond market. Instead, it threatens to reverberate across global capital flows, directly impacting volatile assets like Bitcoin.

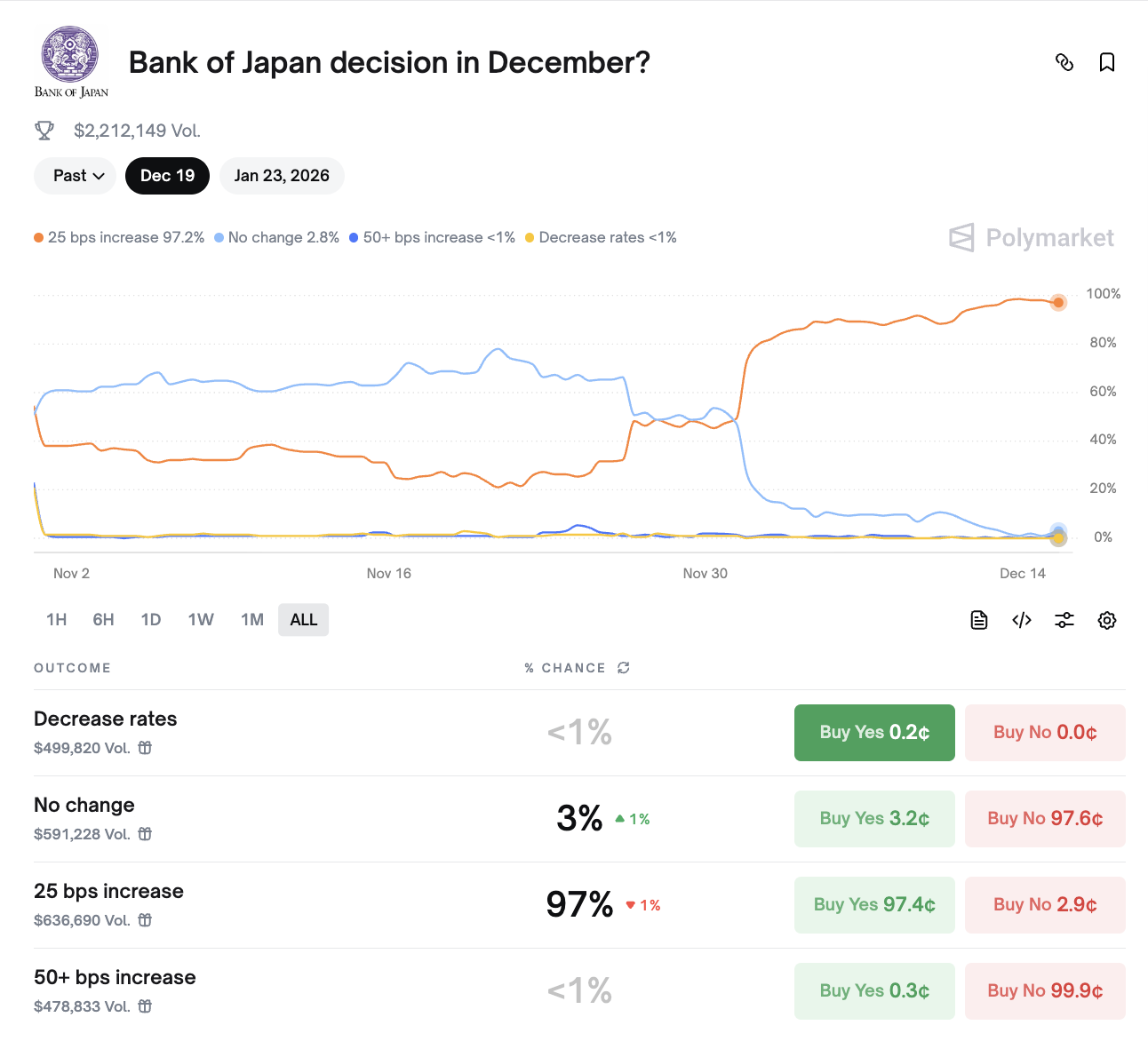

Data from prediction platform Polymarket underscores this certainty, with the market currently assigning a staggering 97% probability to a BOJ rate hike, leaving a mere 3% betting on rates remaining unchanged.

This impending shift has cast a pall of pessimism over cryptocurrency analysts, especially given Bitcoin’s recent dip below the crucial psychological threshold of $90,000, fostering a more conservative investment sentiment.

Should the hike materialize, Japan’s policy rate would climb to 0.75%, marking a two-decade high. While still low by international standards, this represents a seismic event for a global financial system that has long relied on Japan as a source of “cheap money.”

For decades, institutional investors have capitalized on the “JPY carry trade” strategy: borrowing ultra-low interest yen to invest in higher-yielding global stocks, bonds, and cryptocurrencies. This lucrative funding mechanism now faces the risk of an abrupt end.

Analyst Mister Crypto warns, “For decades, the Japanese Yen has been the preferred currency for people to borrow and convert into other assets… But as Japanese bond yields rapidly climb, this carry trade is shrinking.” Simply put, a sustained rise in borrowing costs would compel investors to unwind their JPY-leveraged positions, forcing the sale of risk assets to repay debts.

BOJ Hike: A Guaranteed Bitcoin Plunge?

The historical context surrounding BOJ tightening cycles further fuels anxiety within the crypto community. As of writing, Bitcoin is trading around $89,630, experiencing a modest 0.6% decline over the past 24 hours. However, traders are less focused on the current quote and more on the severe downturns that have historically followed BOJ policy shifts. While specific dates vary, analysts point to patterns suggesting significant drops:

- Following periods of BOJ tightening or anticipated hikes, Bitcoin has seen declines of approximately 23%, 25%, and even over 30% in various instances.

Against this backdrop, analyst 0xNobler issues a stark warning: “Every time Japan hikes rates, Bitcoin crashes by 20-25%. Next week, they are set to hike again to 75 basis points. Extrapolating this pattern, Bitcoin could plummet below the $70,000 mark by December 19th. Investors should adjust their positions proactively.”

The prevailing market sentiment suggests that the Bank of Japan’s decision will be the most significant variable suppressing Bitcoin’s price action this week, with a “retest of $70,000” increasingly factored into risk assessments.

Not All Doom and Gloom: A Systemic Shift?

However, not everyone views a BOJ rate hike as an unequivocally bearish signal. An alternative perspective posits that if Japan’s rate hike coincides with the U.S. Federal Reserve (Fed) initiating a rate-cutting cycle, it could paradoxically create a “long-term bullish” scenario for the cryptocurrency market.

Macroeconomist Quantum Ascend suggests this isn’t merely a liquidity contraction but a “systemic transition.” In his view, the Fed’s rate cuts would inject dollar liquidity and weaken the dollar’s strength, while the BOJ’s moderate hike would only serve to support the yen without fundamentally destroying global liquidity.

This scenario, he argues, would trigger a rotation of capital into risk assets possessing asymmetric upside potential – a “sweet spot” precisely where cryptocurrencies reside, offering stable returns relative to their perceived risk.

Year-End Volatility: The Liquidity Squeeze

Despite the long-term divergence in outlook, the market’s short-term fragility remains undeniable. Analyst The Great Martis cautions that the bond market is already compelling the BOJ’s hand, “potentially triggering a wave of carry trade liquidations and wreaking havoc on stock markets.”

He further notes that major stock indices are flashing “head and shoulders” top signals, coupled with globally rising yields – all indicative of accumulating pressure.

Concurrently, Bitcoin’s price action reflects this pervasive uncertainty. Since the beginning of December, the cryptocurrency has traded flat and lacked clear direction. Analyst Daan Crypto Trades highlights that low market liquidity and wavering investor confidence ahead of the year-end holidays are set to contribute to exceptionally volatile trading conditions.

With stock markets signaling potential tops, yields consistently climbing, and Bitcoin historically exhibiting extreme sensitivity to JPY-driven liquidity shifts, the BOJ’s upcoming decision is undoubtedly one of the most influential macroeconomic catalysts of the year.

Whether this decision sparks another sharp correction or lays the groundwork for a post-volatility rebound may depend not just on the rate hike itself, but critically, on how global liquidity responds to this evolving landscape in the weeks to come.

Disclaimer: This article provides market information only. All content and opinions are for reference purposes and do not constitute investment advice. They do not represent the views and positions of Blockcast. Investors should make their own decisions and trades. The author and Blockcast will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.