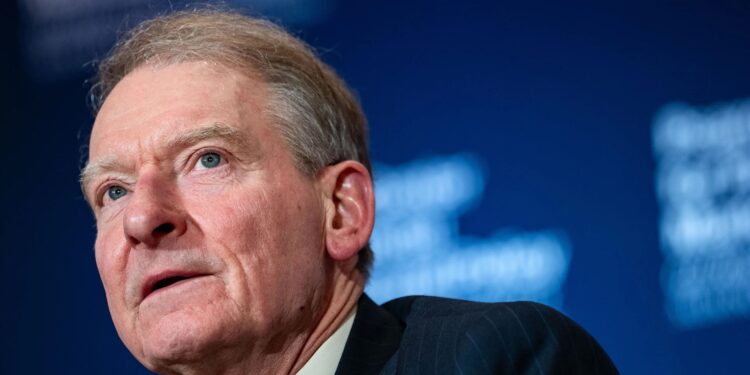

SEC Commissioner Paul Atkins Warns: Unchecked Crypto Regulation Risks ‘Financial Panopticon’

The burgeoning cryptocurrency industry presents a profound paradox: a powerful engine for financial innovation and freedom, yet also a potential tool for unprecedented state surveillance. This stark warning comes from Paul Atkins, a former Commissioner of the U.S. Securities and Exchange Commission (SEC), who cautions that without explicit, written policy constraints, the federal government could leverage crypto’s technological prowess to construct a “Financial Panopticon” – a pervasive system of financial monitoring unlike any seen before.

Atkins articulated these concerns during a recent SEC roundtable on “Financial Surveillance and Privacy,” the sixth such event focused on digital assets this year. “It’s not hard to imagine a future where the government, through a series of intermediaries, peeks into everyone’s financial activities at every level. This will be a steadily developing trend,” he stated, painting a grim picture of eroded financial autonomy.

The Double-Edged Sword of Blockchain: Efficiency vs. Surveillance

Atkins emphasized that while blockchain technology offers unparalleled transparency and efficiency, particularly in transaction traceability, this very strength could be weaponized if regulatory direction veers off course. He warned that cryptocurrency could evolve into “the most powerful financial surveillance architecture in human history” if government intervention becomes imbalanced.

“If the government’s knee-jerk reaction is to treat every wallet as a brokerage, every piece of software as an exchange, every transaction as a reporting item, and even every protocol as a surveillance node, then the government is undoubtedly personally transforming this ecosystem into a ‘Financial Panopticon’.”

For context, a “panopticon” is a theoretical prison design (also known as a circular prison) where a central observer can monitor all inmates simultaneously, yet the inmates, due to clever design, cannot see the observer and thus never know when they are being watched. This creates a pervasive, self-enforced sense of constant surveillance.

Balancing Innovation with Individual Liberty

Despite his stern admonition, Atkins also highlighted the industry’s dual potential: the ability to design robust mechanisms for preventing illicit financial flows *without* sacrificing user privacy. He believes a crucial balance can be struck between national security imperatives and the protection of individual liberties, affirming that innovation and privacy are not mutually exclusive, provided the right regulatory direction is pursued.

“I am confident that if we work together, we can collectively shape a framework that ensures technological and financial progress will never come at the expense of individual liberty,” Atkins affirmed, expressing optimism for a privacy-preserving future for digital finance.

Hester Peirce: A Champion for Financial Privacy

This call for safeguarding financial privacy resonates deeply within the SEC itself. Commissioner Hester Peirce, widely known as “Crypto Mom” for her pro-innovation stance, has consistently championed privacy rights. In an August speech, Peirce underscored the fundamental importance of financial privacy, urging the government to “strive to defend people’s privacy rights.” She frequently invokes the Fourth Amendment of the U.S. Constitution, which protects citizens from unreasonable searches, as a cornerstone for individual privacy in the digital age.

At the recent roundtable, Peirce reiterated her unwavering position: “Protecting individual privacy should be the norm, not an indicator of criminal intent.” This statement reinforces the idea that the mere act of seeking privacy in financial transactions should not be automatically equated with illicit activity, advocating for a presumption of innocence in digital financial interactions.

Disclaimer: This article is for market information purposes only. All content and views are for reference only, do not constitute investment advice, and do not represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not be responsible for any direct or indirect losses incurred by investors’ transactions.