Navigating the Crypto Downturn: Bitcoin and Ethereum Enter a Consolidation Phase

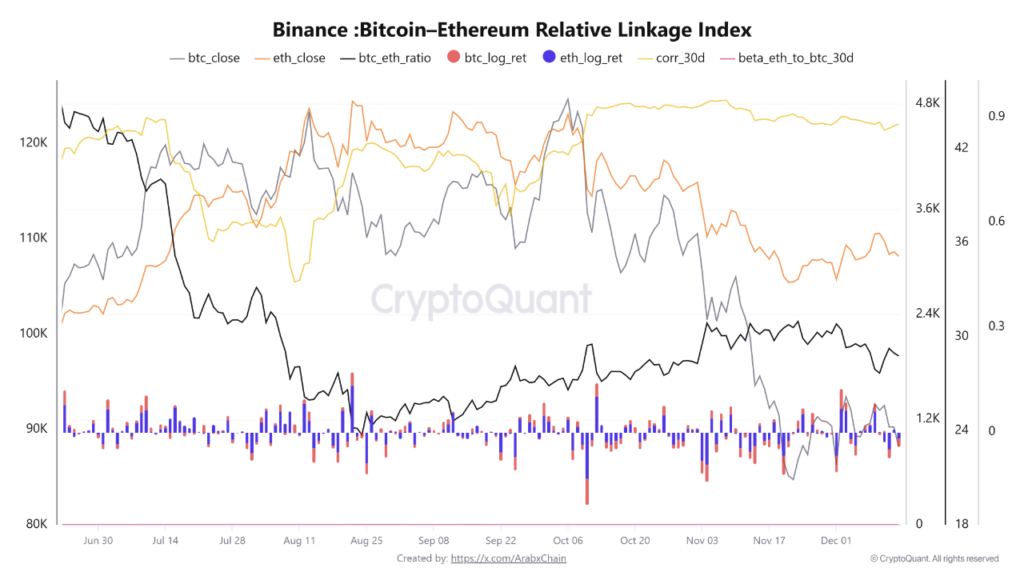

Recent analysis from Arab Chain, drawing on Binance data, indicates a period of negative daily logarithmic returns for both Bitcoin (BTC) and Ethereum (ETH). While Bitcoin is currently trading near the $87,000 mark and Ethereum hovers around $3,000, BTC has experienced a more pronounced decline than ETH. This has led to a noticeable dip in short-term momentum across the market.

This trend is widely interpreted as a natural consolidation phase following a period of robust gains, rather than an immediate signal of a prolonged downtrend. Market participants often anticipate such corrections after significant upward movements, allowing assets to re-evaluate their positions before potentially resuming their trajectory.

Key Market Indicators: Correlation and Divergence

A crucial metric to observe is the 30-day moving average correlation between Bitcoin and Ethereum, which remains notably high, currently exceeding 0.85. This strong correlation underscores that both assets are still operating within the same overarching market structure, meaning significant price swings in one typically exert a corresponding influence on the other.

However, while this correlation has stabilized, it has not reached new highs. This subtle shift suggests that the performance of BTC and ETH might be entering an early phase of gradual divergence, where their price actions, though still linked, could begin to show more independent characteristics.

Ethereum’s Volatility: The Beta Factor

Ethereum’s Beta value against Bitcoin remains close to 1.3. This figure is significant as it indicates that Ethereum is more sensitive to Bitcoin’s price volatility, often amplifying both upward and downward movements. In practical terms, if Bitcoin were to experience a strong recovery in momentum, Ethereum could potentially see an even more dramatic rally.

Conversely, during periods of market weakness or sustained downtrends, Ethereum may face larger pullbacks compared to Bitcoin. The current scenario—where correlation is maintained but relative returns are declining—points towards the market potentially entering a deeper consolidation period or a temporary cooling-off phase, where both assets might trade sideways or experience moderate declines as they seek new equilibrium points.

Disclaimer: This article is intended solely for market information purposes. All content and opinions provided are for reference only and do not constitute investment advice. They do not represent the views or positions of BlockTempo. Investors are advised to make their own independent decisions and trades. The author and BlockTempo will not be held responsible for any direct or indirect losses incurred by investors as a result of their trading activities.