Bitcoin Nears Critical Juncture: Glassnode Warns of $88,000 Fall Amid Weakening Confidence

Bitcoin’s recent price trajectory has been marked by persistent weakness, prompting a stern warning from on-chain analytics firm Glassnode. With short-term speculators capitulating and long-term holders initiating significant sell-offs, the cryptocurrency faces a crucial test. Failure to reclaim the pivotal $113,000 cost basis could trigger a deeper market correction, potentially driving prices down to $88,000 as investor confidence wanes.

Bitcoin’s Precarious Position: Key Support Levels Under Scrutiny

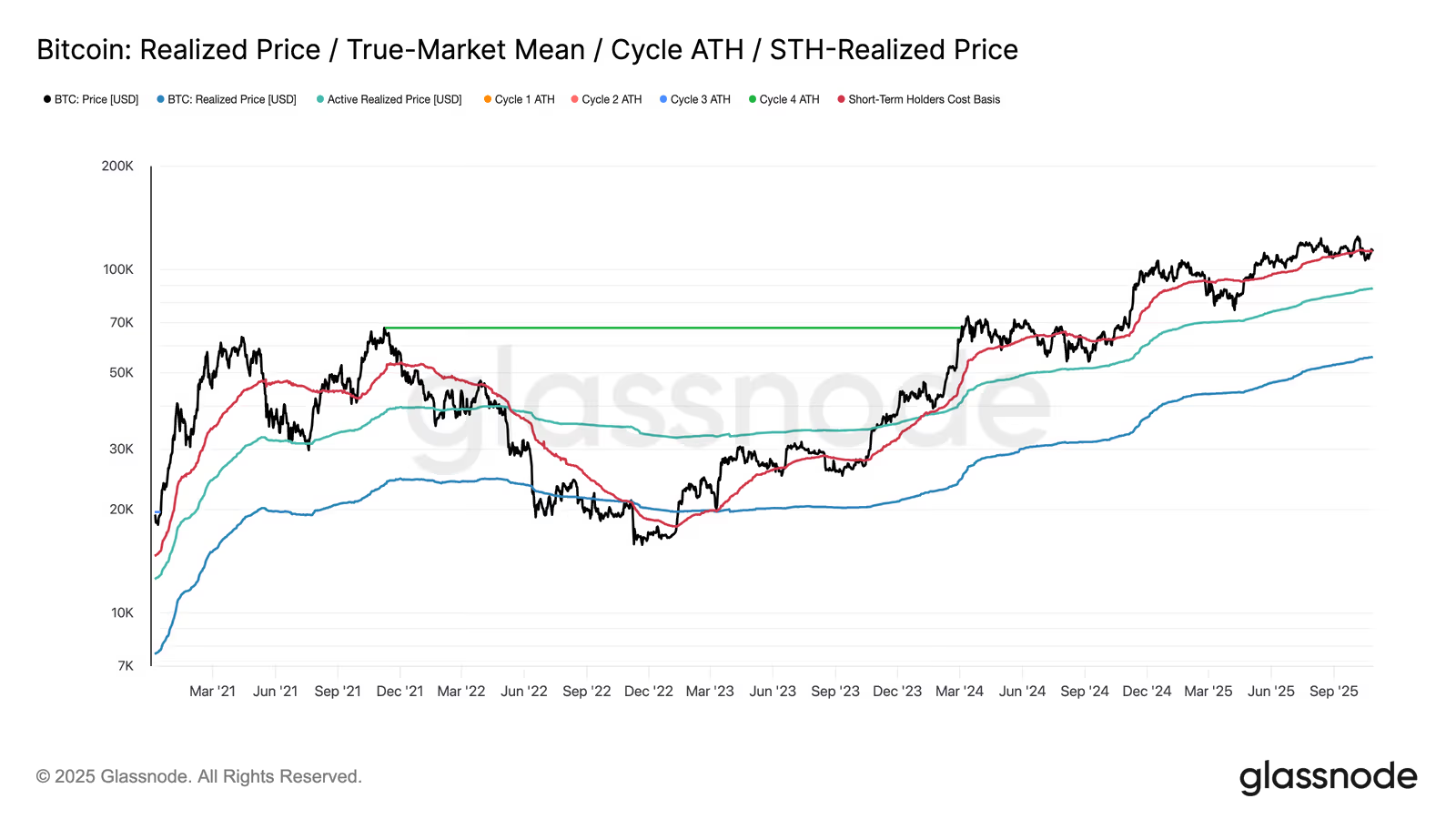

Glassnode’s latest report highlights Bitcoin’s repeated, yet unsuccessful, attempts to breach the “Short-Term Holder Cost Basis” at $113,000. This key metric represents the average purchase price for Bitcoin buyers over the past 155 days. The consistent failure to hold above this level underscores a clear exhaustion of upward momentum, raising concerns about the asset’s immediate future.

The $113,000 mark is not merely a resistance level; Glassnode characterizes it as a “lifeline” essential for sustaining any bullish sentiment. Should Bitcoin fail to firmly establish support above this threshold, a profound correction could ensue, pushing prices towards the next significant support zone at $88,000. This $88,000 level, according to Glassnode, corresponds to the “Realized Price for Active Investors” – essentially, the average cost basis of all circulating Bitcoin. Historically, this metric has served as a critical test during periods of deep market downturns, most recently approached during the “tariff panic” in April.

Investor Sentiment Fades: Short-Term Holders Capitulate, Long-Term Holders Distribute

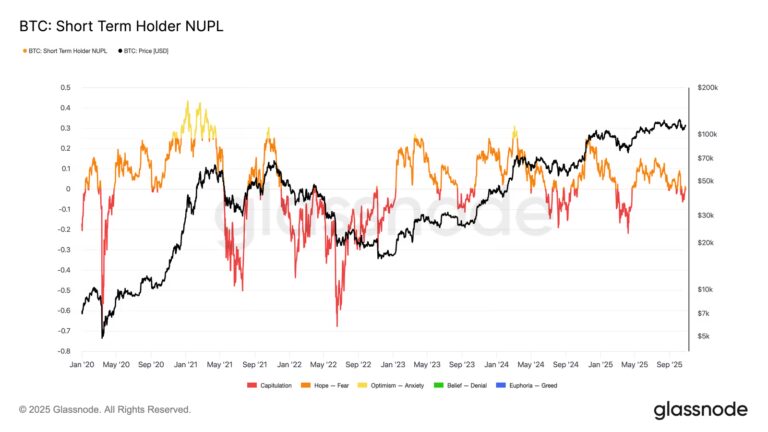

The report paints a concerning picture of investor sentiment, which is described as “showing signs of fatigue.” Short-term holders, in particular, are actively “cutting losses.” The “Short-Term Holder Net Unrealized Profit/Loss” (STH-NUPL) indicator has dipped to -0.05, signaling that this cohort is currently experiencing minor losses. While not yet at the “full capitulation” threshold of approximately -0.2, this decline clearly reflects a rapid erosion of market confidence.

Adding to the bearish pressure, even long-term holders are now participating in the sell-off. Glassnode data reveals a substantial decrease of 104,000 Bitcoins in the Net Position Change for long-term holders this month – marking the largest “distribution wave” since July. This shift in behavior from typically resilient investors is a significant red flag.

Glassnode cautions that unless long-term holders reverse course and transition from selling to accumulation, Bitcoin’s potential for a meaningful rebound will likely remain severely constrained.

A Glimmer of Hope: Derivatives Market Stabilizes

Amidst these headwinds, a flicker of optimism emerges from the derivatives market. Following October’s “liquidation crisis,” market sentiment appears to have stabilized. Realized volatility has retreated to 43%, and traders have noticeably scaled back their downside hedging positions. Furthermore, the “one-week option skew” has returned to a neutral stance, suggesting a reduction in immediate bearish expectations.

The Road Ahead: Consolidation Amidst Fragile Confidence

In summary, Glassnode concludes that the Bitcoin market, after a tumultuous October, is now entering a consolidation phase. However, underlying market confidence and structural demand remain precariously fragile. This implies that while the most acute phase of panic may have subsided, Bitcoin’s path to renewed upward momentum is contingent upon a decisive stabilization of investor confidence and a significant return of long-term capital inflows.

Disclaimer

This article is provided solely for market information purposes. All content and views presented are for reference only and do not constitute investment advice. They do not represent the opinions or positions of BlockTempo. Investors are solely responsible for their own investment decisions and transactions. The author and BlockTempo shall not be held liable for any direct or indirect losses incurred by investors as a result of their transactions.