Bitcoin’s Long-Term Selling Spree Nears End: A Shift Towards Buyer Dominance Predicted

The protracted selling pressure from Bitcoin’s long-term holders, a trend that has persisted for nearly two years, appears to be finally reaching its conclusion. A recent report from K33 Research indicates a structural exhaustion of sell-side pressure, suggesting that as Bitcoin supply stabilizes, the market is poised to transition towards buyer dominance in the coming year.

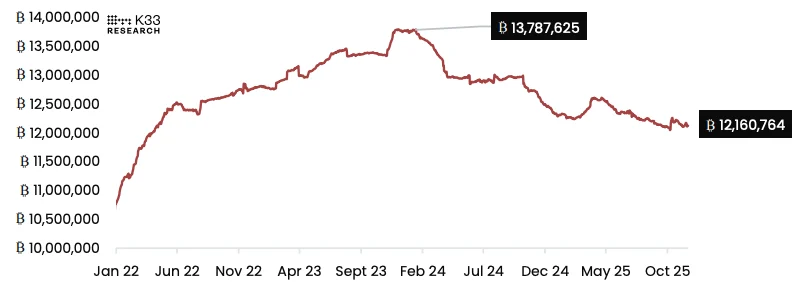

Vetle Lunde, Head of Research at K33 Research, highlights a consistent decline in Bitcoin’s “unspent transaction outputs” (UTXOs) held for over two years, a trend observed since early 2024. During this period, approximately 1.6 million BTC—an estimated $138 billion at current prices—has re-entered circulation. This substantial movement underscores a sustained, rather than fleeting, distribution by early investors.

Lunde firmly asserts that this large-scale re-entry of dormant supply transcends mere wallet upgrades or technical adjustments, representing genuine “whale” profit-taking. While acknowledging that factors such as the conversion of the Grayscale Bitcoin Trust (GBTC) into a spot ETF, wallet consolidations, or security-driven address upgrades may contribute to some early addresses becoming active again, he argues these reasons are insufficient to fully explain the massive volume of Bitcoin re-entering circulation. A more comprehensive interpretation, Lunde suggests, points to a continuous “chip distribution” phase, where large holders systematically sell their holdings into the broader market.

The Great Bitcoin Reawakening: Reshaping the Holding Structure

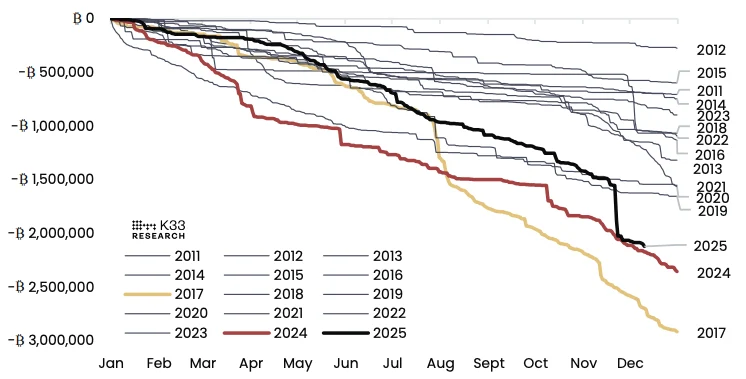

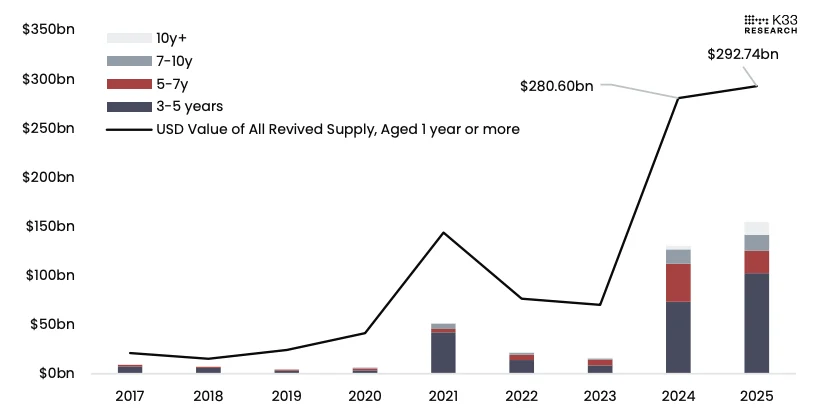

K33’s report identifies 2024 and 2025 as the second and third largest “long-term supply awakening” years in Bitcoin’s history, trailing only 2017. However, the nature of this current cycle’s distribution differs significantly. Lunde contrasts the 2017 supply shift, which was primarily fueled by the ICO boom and altcoin speculation, with the past two years’ selling. The recent activity has largely capitalized on the deep liquidity provided by U.S. spot Bitcoin ETFs and robust corporate demand, enabling long-term holders to systematically realize profits with ample market support.

K33 cites several significant transactions as evidence of this trend:

- In July of this year, Galaxy Digital completed an over-the-counter (OTC) transaction involving 80,000 Bitcoin.

- In August, a prominent “whale” exchanged 24,000 Bitcoin for Ethereum.

- Between October and November, another large holder divested approximately 11,000 Bitcoin.

The report suggests that similar behaviors are prevalent among other major holders, likely contributing to Bitcoin’s relatively subdued performance this year compared to other assets.

This year alone, an estimated $300 billion worth of Bitcoin (held for over a year) has re-entered circulation. Lunde emphasizes that the influx of institutional liquidity has empowered long-term holders to lock in profits within the “six-figure dollar price range.” This process has not only reduced supply concentration but also established new price baselines for the circulating Bitcoin supply.

Selling Pressure Easing: The Dawn of Buyer Dominance and Rebalancing Effects

Looking ahead, K33 anticipates a gradual easing of sell-side pressure. Lunde notes that roughly 20% of Bitcoin’s total supply has been “reawakened” over the past two years. As this significant wave of long-term selling pressure is progressively digested, on-chain selling power is expected to approach saturation.

He further projects that the supply of Bitcoin held for two years or more will reverse its prolonged decline, potentially recovering to levels above the current approximately 12.16 million BTC by late 2026. This pivotal shift, as early holders conclude their distribution, is expected to usher the market back into a buyer-dominated structure.

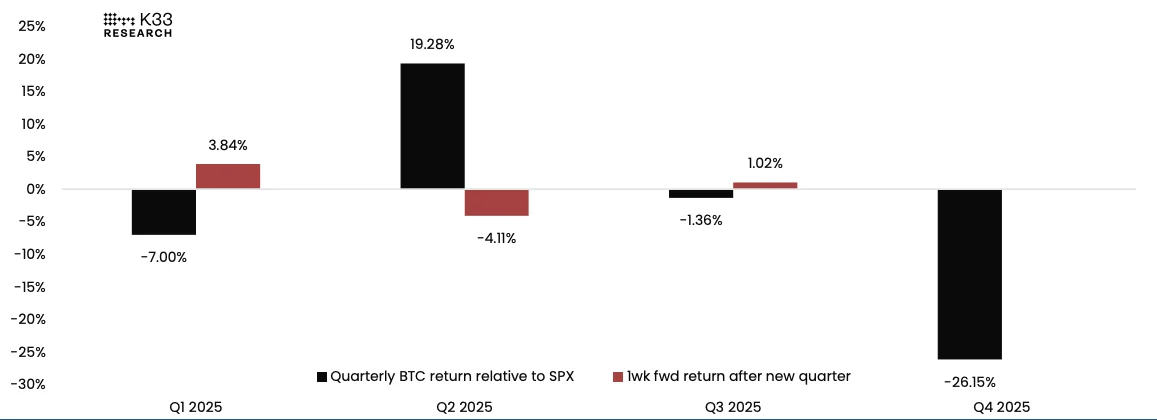

K33 also alerts investors to potential technical impacts stemming from portfolio rebalancing as the current quarter draws to a close. Lunde points to historical data indicating a tendency for Bitcoin to move inversely to the preceding quarter’s performance at the start of a new quarter. Given Bitcoin’s relative underperformance compared to other asset classes in Q4, year-end and early next-year rebalancing by asset managers adhering to fixed allocation strategies could inject additional capital into the market, echoing similar movements observed in late September to early October this year.

While historical patterns often link significant long-term supply awakenings to “market tops,” Lunde contends that Bitcoin’s increasing integration into mainstream financial systems through ETFs and advisor platforms establishes a more robust long-term demand foundation than in any previous cycle. This, he argues, holds true despite the potential for short-term volatility.

Disclaimer: This article provides market information only. All content and views are for reference purposes and do not constitute investment advice. It does not represent the views or positions of BlockTempo. Investors should make their own decisions and conduct their own trades. The author and BlockTempo shall not be held responsible for any direct or indirect losses incurred by investors as a result of their transactions.