The Tokyo Effect: Unraveling Bitcoin’s Recent Price Plunge and Its Evolving Identity

On December 15th, Bitcoin experienced a notable downturn, dropping over 5% from $90,000 to $85,616 in a single day. Intriguingly, this significant price movement occurred without any major negative news within the crypto space or unusual selling pressure evident in on-chain data. For those exclusively following cryptocurrency news, pinpointing a plausible cause for the sudden decline proved challenging.

In stark contrast, gold, often hailed as a traditional safe haven, saw its price hold steady at $4,323 per ounce on the same day, barely moving from the previous day’s close. This divergence highlights a critical question: If Bitcoin truly embodies the “digital gold” narrative, acting as a hedge against inflation and fiat currency depreciation, why did its performance so closely mirror high-beta tech stocks on the Nasdaq rather than the stability of gold during a period of market uncertainty?

The answer, surprisingly, may lie far from the crypto exchanges and deep within the boardrooms of Tokyo.

The Butterfly Effect Originating in Tokyo

The spotlight now turns to the Bank of Japan (BOJ), which is slated to hold its monetary policy meeting on December 19th. Market consensus heavily anticipates a 25 basis point interest rate hike, elevating the policy rate from 0.5% to 0.75%. While 0.75% might seem modest, this represents Japan’s highest interest rate in nearly three decades. Prediction markets like Polymarket reflect this strong expectation, with traders pricing in a 98% probability of the hike.

But how can a decision by a central bank in distant Tokyo trigger a 5% drop in Bitcoin within 48 hours? The explanation lies in a sophisticated, decades-old financial strategy known as the “Yen carry trade.”

Unpacking the Yen Carry Trade

The mechanics are deceptively simple: For years, Japan has maintained near-zero or even negative interest rates, making it exceptionally cheap to borrow Japanese Yen. Global hedge funds, asset managers, and proprietary trading desks have capitalized on this by borrowing vast sums of JPY, converting them into higher-yielding currencies like the US dollar, and then investing in assets with better returns—ranging from US Treasuries and stocks to, more recently, cryptocurrencies. The spread between the low JPY borrowing cost and the higher returns on invested assets constitutes the profit.

The scale of this strategy is enormous, conservatively estimated at hundreds of billions of dollars, and potentially trillions when considering derivative exposures. Furthermore, Japan holds a unique position as the largest overseas holder of US Treasury bonds, with a staggering $1.18 trillion in US debt. This means any shift in Japanese capital flows has direct implications for the global bond market, consequently influencing the pricing of virtually all risk assets worldwide.

The anticipated BOJ rate hike fundamentally disrupts this established game. Firstly, the cost of borrowing JPY rises, narrowing the profitable arbitrage window. More critically, expectations of a rate hike tend to strengthen the Yen. Institutions that initially borrowed JPY, converted to USD, and invested must eventually repay their JPY loans. A stronger Yen means they need to sell more of their USD-denominated assets to convert back to JPY, creating a “forced selling” scenario.

Bitcoin: The First to Feel the Pinch

This forced selling is indiscriminate, targeting assets with the highest liquidity and ease of conversion. Given Bitcoin’s 24/7 trading, absence of daily price limits, and relatively shallower market depth compared to traditional equities, it often becomes the prime candidate for rapid liquidation.

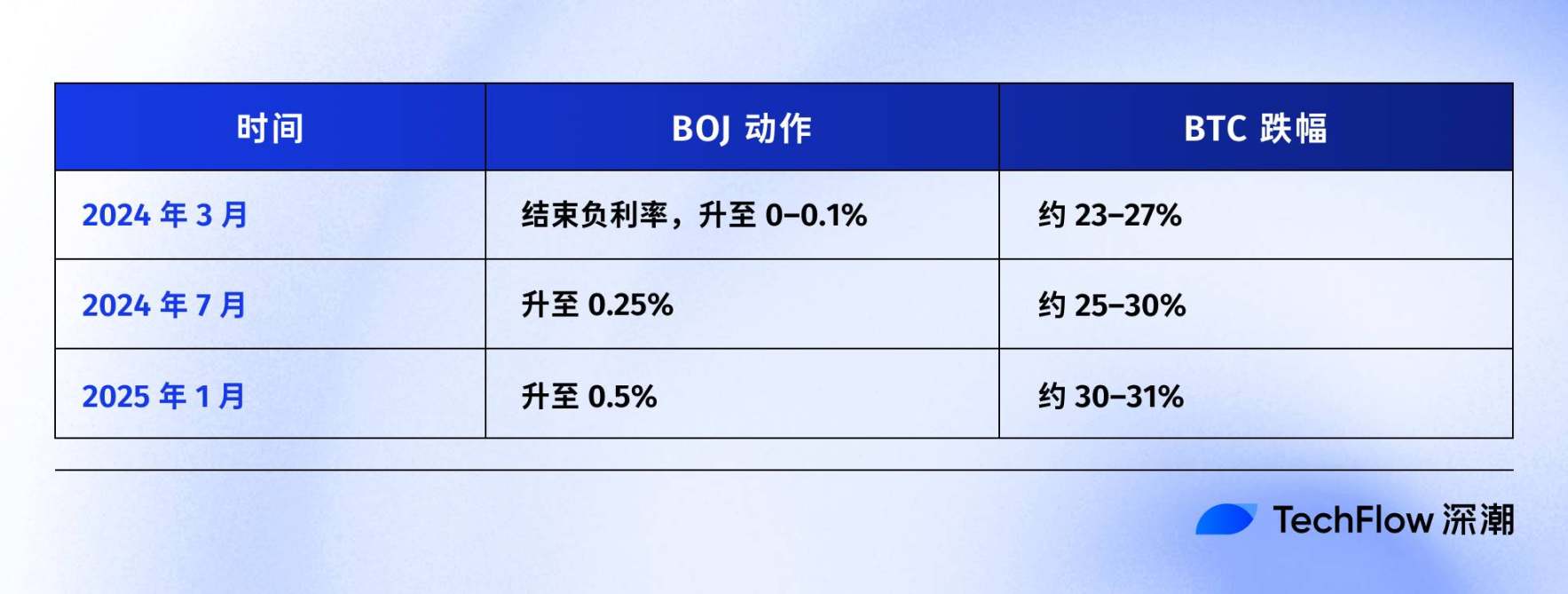

Historical data lends credence to this theory. A review of past BOJ rate hikes reveals a pattern:

For instance, after the BOJ raised rates to 0.25% on July 31, 2024, the Yen appreciated significantly against the US dollar. In the subsequent week, BTC plummeted from $65,000 to $50,000—a roughly 23% decline—wiping out $60 billion from the total crypto market capitalization. On-chain analysts have observed that the past three BOJ rate hikes have each been followed by Bitcoin corrections exceeding 20%. While the exact timings and magnitudes vary, the consistent direction is clear: tightening monetary policy in Japan often spells trouble for Bitcoin.

The December 15th Bitcoin dip, therefore, appears to be the market “front-running” the BOJ’s official announcement. Funds began withdrawing preemptively, evidenced by a $357 million net outflow from US spot Bitcoin ETFs that day—the largest in two weeks—and over $600 million in leveraged long liquidations across the crypto market within 24 hours. This suggests a coordinated unwinding of carry trades by institutional players, rather than panic selling by retail investors.

Challenging the “Digital Gold” Narrative

While the Yen carry trade explains the mechanism of selling, it doesn’t fully answer why Bitcoin is consistently among the first and hardest-hit assets. The common refrain of “good liquidity and 24-hour trading” is true but incomplete.

The fundamental reason is Bitcoin’s re-pricing over the past two years. It’s no longer an isolated “alternative asset” but has been firmly integrated into Wall Street’s broader risk exposure framework. The approval of spot Bitcoin ETFs in early 2024 was a monumental milestone, enabling financial giants like BlackRock and Fidelity to incorporate BTC into client portfolios. This influx of institutional capital, while boosting Bitcoin’s market cap to $1.7 trillion, also transformed its identity.

The profile of a typical BTC holder has shifted from crypto-native enthusiasts and aggressive family offices to pension funds, hedge funds, and sophisticated asset allocators. These institutions manage diversified portfolios including US stocks, bonds, and gold, operating under a strict “risk budget” management. When overall portfolio risk needs to be reduced, they don’t selectively sell only BTC or only stocks; they reduce exposure proportionally across all risk assets.

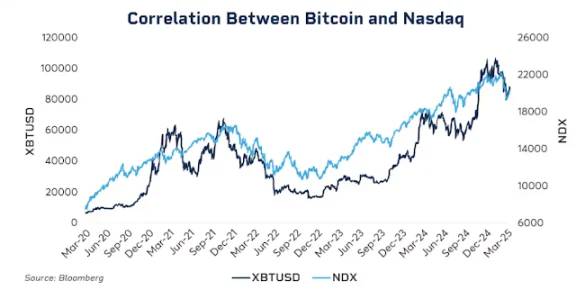

This deep integration is reflected in the data. Recently, the 30-day rolling correlation between BTC and the Nasdaq 100 index surged to 0.80, a level not seen since 2022. For context, prior to 2020, this correlation typically hovered between -0.2 and 0.2, indicating a largely uncorrelated relationship.

Crucially, this correlation intensifies during periods of market stress—be it the March 2020 pandemic crash, the aggressive Fed rate hikes of 2022, or recent geopolitical tensions. In times of heightened risk aversion, institutions categorize assets by their risk profile, not their asset class. Bitcoin, now a high-volatility, high-beta asset within institutional portfolios, becomes part of the broader risk reduction strategy.

This brings us to an uncomfortable truth: Does the “digital gold” narrative still hold? This year, gold has surged over 60%, marking its best performance since 1979. In the same period, Bitcoin has pulled back significantly from its highs. Two assets, both championed as inflation hedges and fiat depreciation antidotes, have charted diametrically opposed courses in the same macroeconomic climate. While Bitcoin’s long-term value remains compelling (its five-year compounded annual return still vastly outperforms the S&P 500 and Nasdaq), its short-term pricing logic has clearly evolved: it is currently priced as a high-volatility risk asset, not a safe haven.

Understanding this shift is key to comprehending how a seemingly minor 25 basis point rate hike from the Bank of Japan can trigger a multi-thousand-dollar drop in Bitcoin within 48 hours. It’s not about Japanese investors specifically selling BTC; it’s about global liquidity tightening, prompting institutions to de-risk across all their exposures, with Bitcoin, being highly volatile and liquid, often taking the brunt.

What to Expect from the BOJ on December 19th

As the BOJ’s monetary policy meeting approaches, the market has largely priced in the anticipated rate hike. Japan’s ten-year government bond yield, for instance, has already climbed to 1.95%, its highest in 18 years, signaling that bond markets have factored in the tightening expectations.

If the hike is already priced in, will there still be significant market impact on December 19th? History suggests yes, but the intensity will largely depend on the BOJ’s forward guidance and rhetoric. Central bank decisions are not just about the numbers; they’re about the signals. A 25 basis point hike accompanied by dovish language from Governor Kazuo Ueda, such as “future assessments will be data-dependent and cautious,” could ease market anxiety. Conversely, hawkish remarks like “inflationary pressures persist, further tightening not ruled out” could trigger another wave of selling.

With Japan’s inflation currently around 3%, exceeding the BOJ’s 2% target, the market’s primary concern isn’t just this single hike, but whether Japan is embarking on a sustained tightening cycle. If so, the unwinding of the Yen carry trade could become a multi-month process, not a one-off event.

However, some analysts suggest this time might be different. Speculative positioning in the Yen has shifted from net short to net long, potentially limiting the scope for unexpected appreciation. Furthermore, Japanese government bond yields have been rising for months, implying the market has already “self-tightened” to some extent, with the BOJ merely formalizing existing conditions. Lastly, with the Federal Reserve recently cutting interest rates, the broader global liquidity trend is easing. Japan’s counter-cyclical tightening might be partially offset by abundant US dollar liquidity.

These mitigating factors don’t guarantee Bitcoin won’t fall, but they could imply a less extreme decline compared to previous BOJ tightening cycles. Historically, Bitcoin tends to bottom out within one to two weeks following a BOJ decision before consolidating or rebounding. Should this pattern hold, late December to early January could present both heightened volatility and potential strategic entry points for investors.

The Cost of Mainstream Acceptance

The logical chain is clear: BOJ rate hike → Yen carry trade unwinding → Global liquidity tightening → Institutions reducing risk exposure → Bitcoin, as a high-beta asset, being sold first. In this sequence, Bitcoin isn’t “doing anything wrong.” It’s merely positioned at the tail end of a global macroeconomic liquidity transmission chain, a position it cannot control.

This is the new normal in the ETF era. Before 2024, Bitcoin’s price dynamics were primarily driven by crypto-native factors: halving cycles, on-chain metrics, exchange activity, and regulatory news. Its correlation with traditional assets like US stocks and bonds was minimal, lending credence to its status as an “independent asset class.”

Post-2024, with Wall Street’s embrace, Bitcoin has been integrated into the same risk management frameworks as stocks and bonds. Its holder base has diversified, and consequently, its pricing logic has evolved. While this institutionalization has propelled Bitcoin’s market capitalization to unprecedented levels, it has come with a significant side effect: Bitcoin’s immunity to macro events has diminished. A single statement from the Fed or a decision from the Bank of Japan can now trigger 5% swings within hours.

If your investment thesis hinges on Bitcoin as “digital gold”—a sanctuary in tumultuous times—its recent performance, particularly when contrasted with actual gold, might be disappointing. At least for now, the market is not pricing it as a safe-haven asset. This could be a temporary misalignment, an early stage of institutionalization where allocation ratios are yet to stabilize, or perhaps the next halving cycle will reassert the dominance of crypto-native factors.

However, until then, if you hold Bitcoin, you must acknowledge a crucial reality: you are also holding exposure to global liquidity. What transpires in a Tokyo boardroom could exert more influence over your account balance next week than any on-chain metric. This is the inherent cost of mainstream acceptance. Whether that cost is ultimately worthwhile remains a question each investor must answer for themselves.