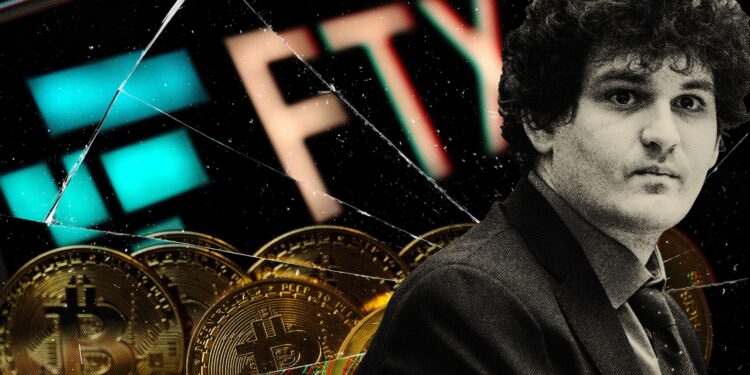

Sam Bankman-Fried: FTX Was Solvent, Bankruptcy Team ‘Destroyed’ the Company and Hindered Customer Repayment

Sam Bankman-Fried (SBF), the disgraced founder of the now-defunct cryptocurrency exchange FTX, has once again emerged to vehemently dispute the narrative surrounding his company’s collapse. In a newly unveiled 15-page statement, the former “crypto wunderkind” asserts that FTX and its sister firm, Alameda Research, were never truly insolvent. He contends that even after facing a severe liquidity crisis in November 2022, the entities possessed ample funds to fully repay all customers, only to be allegedly driven to ruin by the “misguidance, power grab, and manipulation” of bankruptcy lawyers and the appointed CEO.

According to the statement released by SBF’s team today, July 31st, at the peak of the November 2022 crisis, FTX allegedly held $25 billion in assets and $16 billion in equity value. This, SBF claims, was more than sufficient to cover the $8 billion in customer withdrawal requests that triggered the panic.

SBF had previously attempted to introduce this solvency argument during his trial, but was reportedly barred by the judge from presenting evidence to support his claims. The statement elaborates:

FTX in November 2022 faced a “liquidity crisis” – a sudden, acute shortage of readily available cash.

This crisis was on track for resolution by the end of the month, a trajectory that was allegedly derailed when FTX’s external legal counsel forcibly seized control of the company.

Accusations of Corporate Sabotage: Blaming the Bankruptcy Team

SBF directly points fingers at John J. Ray III, the new FTX CEO, and the bankruptcy attorneys, accusing them of orchestrating a “power grab” that intentionally steered FTX into an unnecessary bankruptcy process. He claims this intervention led to significant delays in customer repayment and drastically diminished the total amount ultimately recoverable.

The statement alleges that the bankruptcy lawyers were driven by “strong motives” to file for bankruptcy, subsequently portraying FTX to the public as a “completely bankrupt, irredeemable mess.” This narrative, SBF contends, was constructed while deliberately ignoring company records and systematically undervaluing assets.

Further intensifying his allegations, SBF claims the FTX debtors (the bankruptcy team) have paid nearly $1 billion in advisory fees, dismissed $7 billion worth of FTT tokens as “worthless paper,” and “dumped” valuable assets at prices significantly below their market value. The SBF team concludes with a staggering assertion:

Had the debtors not “destroyed” the company, these assets, combined with Alameda’s equity in FTX, would now be valued at approximately $136 billion.

The Road to Ruin: A Brief Recap of FTX’s Collapse

The spectacular collapse of FTX in 2022 remains one of the most significant scandals in cryptocurrency history. Court documents revealed that Alameda Research utilized a “secret backdoor” within FTX, enabling it to “borrow” vast sums of customer funds without collateral. These funds were allegedly leveraged for speculative trading and to purchase FTT tokens, artificially inflating Alameda’s balance sheet.

The exposure of this “backdoor mechanism” triggered widespread panic and a catastrophic bank run, forcing FTX to freeze withdrawals and ultimately revealing an $8 billion funding gap. This chain of events led to the simultaneous bankruptcies of FTX and Alameda Research, sending shockwaves across the crypto market and wiping out an estimated $200 billion in market capitalization.

SBF was subsequently arrested in the Bahamas in December 2022 and, in March 2024, was sentenced by a U.S. court to 25 years in prison on multiple counts of fraud and conspiracy. He is currently serving his sentence and has filed an appeal.

Seeking Clemency: SBF Alleges Political Retaliation

Sam Bankman-Fried steadfastly maintains his innocence, asserting he was “wrongly convicted.” He is now actively seeking a presidential pardon from Donald Trump, who has previously granted clemency to figures like Ross Ulbricht, founder of Silk Road, and Changpeng Zhao (CZ), co-founder of Binance.

Earlier this month, SBF took to the conservative social media platform GETTR, claiming his arrest and conviction were direct consequences of “political retaliation” by the Biden administration. He attributes this alleged retribution to his decision to shift election donations from the Democratic Party to the Republican Party.

Disclaimer: This article provides market information only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not be liable for any direct or indirect losses incurred by investors’ transactions.