Author: Jae, PANews

As decentralized perpetual contract exchanges (Perp DEXs) strive to emulate Wall Street’s sophisticated strategies, the introduction of a more efficient margin system could simultaneously unleash both unprecedented profits and amplified risks.

The Perp DEX landscape has evolved into a fiercely competitive arena. While many platforms are still focused on optimizing fees and user interfaces, Hyperliquid, a leading protocol, is strategically elevating its game, setting its sights on attracting more professional institutional clients.

On December 15th, Hyperliquid announced the launch of its innovative portfolio margin system, now live on its testnet. This is far more than a simple feature update; it represents a fundamental re-engineering of capital efficiency and risk logic for on-chain derivatives trading. The move is designed to capture market makers and high-frequency trading firms, groups often “spoiled” by the advanced offerings of centralized exchanges (CEXs).

However, in the DeFi market, which inherently lacks a lender of last resort, greater efficiency often comes hand-in-hand with magnified risk. The potential for a single, unified account to be liquidated during extreme market conditions could trigger a cascading on-chain liquidation tsunami across multiple markets.

Unlocking Capital Efficiency: Hyperliquid’s Institutional Pivot

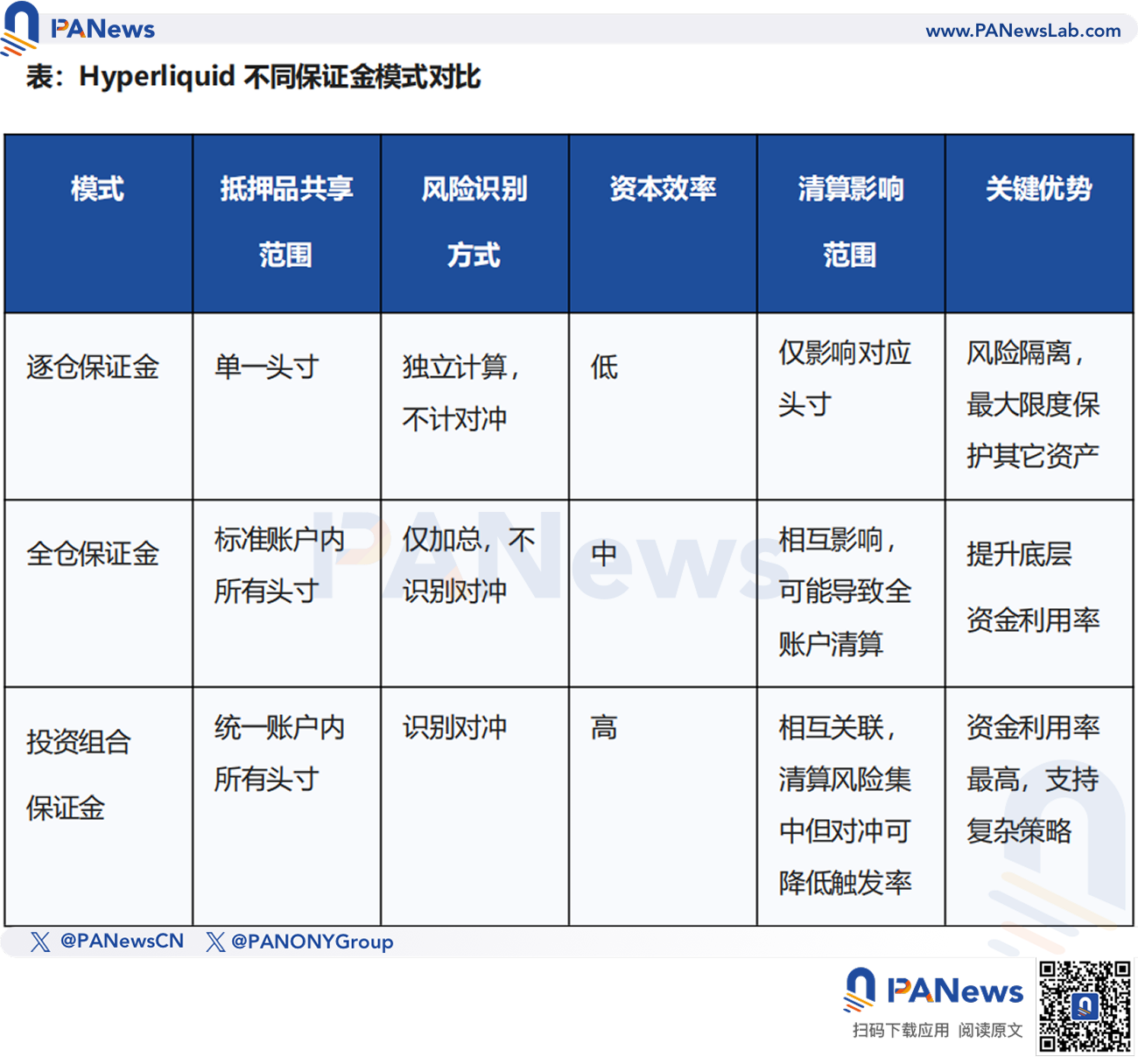

The portfolio margin system, a staple in CEXs for years, fundamentally differs from traditional cross-margin or isolated-margin modes. In a conventional cross-margin setup, the overall margin requirement for a portfolio is typically a simple sum of the individual margin requirements for each position, failing to acknowledge any risk-offsetting effects between them.

In stark contrast, Hyperliquid’s portfolio margin system unifies a user’s spot and perpetual contract accounts. It employs a net risk-based settlement mechanism, calculating margin requirements based on the overall net risk exposure of the entire portfolio. This approach inherently rewards risk hedgers by liberating capital from redundant collateral. For portfolios holding both long and short positions in the same underlying asset, the risk-offsetting effects between these positions mean the overall portfolio margin requirement will be significantly lower than if calculated by summing individual positions. CEX data has long confirmed that portfolio margin systems can boost capital efficiency by over 30%. Industry insiders even recall a derivatives-focused CEX that saw its trading volume double after implementing a portfolio margin system.

For Hyperliquid, the introduction of this mechanism signals a clear strategic pivot: shifting from a battle for retail traffic to targeting the institutional market, which is acutely sensitive to capital efficiency. The portfolio margin system is a crucial competitive advantage for Hyperliquid in the intense Perp DEX race, designed to attract market makers and high-frequency trading institutions by maximizing fund utilization.

However, Hyperliquid is approaching the development of its portfolio margin system with considerable prudence. It will be rolled out in a Pre-Alpha stage on the testnet to ensure the robustness and stability of this new functionality. Initially, users can only borrow USDC, with the HYPE token designated as the sole collateral asset.

This phased approach represents a risk-minimized launch strategy. The protocol validates its model with a single asset while strategically enhancing the utility of the HYPE token, providing early liquidity bootstrapping and economic incentives for its native L1 ecosystem.

Hyperliquid officially states that as the system matures, it will progressively expand support for additional assets, including USDH and BTC as collateral. In the long term, Hyperliquid’s portfolio margin system is designed for high scalability. It can not only extend to new asset classes via HyperCore but also facilitate the creation of complex on-chain strategies. This positions the portfolio margin system as a potential cornerstone for sophisticated arbitrage and yield strategies within the HyperEVM ecosystem, injecting significant vitality into the on-chain derivatives trading landscape.

3.35x Leverage Potential: Empowering Institutional Strategy Matrices

The appeal of Hyperliquid’s portfolio margin system will manifest across three key dimensions, forming a comprehensive product ecosystem tailored for institutions:

- Seamless Trading with Unified Accounts: Institutions will no longer need to manually allocate funds across disparate sub-accounts for spot, perpetual futures, and other instruments. All assets are managed synchronously within a single, unified account, drastically simplifying operational workflows, eliminating friction and time loss associated with fund transfers, thereby reducing operational costs, and enhancing the execution efficiency of high-frequency trading strategies.

- Automated Yield Generation on Idle Assets: The portfolio margin system will also optimize yield structures. Idle collateral will automatically generate interest within the system and can even serve as collateral to support perpetual contract short positions or execute arbitrage strategies, further optimizing asset yield potential and realizing “one asset, multiple utilities” capital stacking.

- A Paradigm Shift in Leverage Capability: Drawing parallels with similar systems in the U.S. stock market, qualified investors could theoretically see their leverage ratio increase by up to 3.35 times. This offers a richer selection of tools for institutions seeking greater nominal exposure and higher capital turnover.

In essence, Hyperliquid aims to support not just individual strategies but an entire matrix of institutional-grade strategies. Complex trading approaches like long/short hedging, spot-futures arbitrage, and options combinations all require an optimized margin system as their foundation. Currently, executing such strategies on-chain incurs substantial costs.

By attracting large institutions, Hyperliquid’s on-chain order book is also expected to gain significantly more trading depth, narrowing bid-ask spreads and further enhancing its competitiveness as an institutional-grade trading venue, creating a positive flywheel effect.

The Perils of Efficiency: When Hedging Fails and Liquidations Spiral

However, heightened efficiency is inextricably linked with elevated risk. Particularly within the DeFi market, which lacks a central guarantor, portfolio margin could become a potent amplifier of systemic risk.

The primary risk lies in the magnification of losses and the acceleration of liquidations. While the portfolio margin system reduces initial requirements, it also means that losses can be equally amplified. Although margin requirements are lowered due to the offsetting effects of hedged positions, if the market shifts unfavorably for the entire portfolio, user losses could rapidly exceed expectations.

A core characteristic of the portfolio margin system is the concentration of all risk into a unified account for net settlement. However, should an irrational, broad market downturn occur, causing even seemingly uncorrelated assets to decline in tandem, hedging strategies could instantaneously fail, leading to a dramatic expansion of risk exposure. Compared to standard margin models, unified account margin call mechanisms typically demand that traders top up their collateral within a shorter timeframe. In the highly volatile crypto market, this significantly compressed margin call window substantially increases the risk of users being unable to deposit funds on-chain promptly, thus triggering forced liquidations.

A deeper systemic risk is that the portfolio margin system could weave a network of cascading liquidations. Unified account liquidation events often have multi-market implications. When a highly leveraged unified account is liquidated, the system must simultaneously close all its associated spot and derivatives positions. Such large-scale, multi-asset automated selling can, in a short period, exert immense pressure on several related markets, driving down underlying asset prices. This, in turn, causes more accounts’ margin levels to fall below maintenance requirements, triggering a chain reaction of forced liquidations—thus forming an algorithmically driven liquidation spiral.

Equally critical is the deep integration of Hyperliquid’s portfolio margin system with lending protocols within its HyperEVM ecosystem. The inherent interconnectedness of DeFi “Legos” often leads to extremely strong risk transmission effects. This implies that a sharp drop in the price of underlying collateral could not only ignite liquidations at the trading layer on Hyperliquid but also propagate through the collateral chain to the lending markets, potentially triggering widespread liquidity crises or credit freezes.

Portfolio margin, a path Wall Street has navigated for decades, is now being re-engineered by Hyperliquid using blockchain code. It represents a bold gamble by Hyperliquid to penetrate the institutional market and will serve as an ultimate stress test for the resilience of the entire DeFi system.

(The above content is an authorized excerpt and reprint from our partner PANews. Original link)

Disclaimer: This article provides market information only. All content and opinions are for reference purposes and do not constitute investment advice. They do not represent the views or positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo shall not be held responsible for any direct or indirect losses incurred by investors as a result of their trading activities.