Circle’s Axelar Acquisition Ignites Fierce Debate: The ‘People Over Tokens’ Conundrum

Original Source: Odaily Planet Daily

Author: Azuma

In the early hours of December 16th, stablecoin giant Circle officially announced the signing of an agreement to acquire the core talent and technology of Interop Labs, the initial development team behind the cross-chain protocol Axelar Network. This strategic move aims to advance Circle’s cross-chain infrastructure strategy, facilitating seamless and scalable interoperability for its core products like Arc and CCTP.

While initially appearing as another standard acquisition of a promising team by an industry titan, the crucial detail lies in Circle’s explicit statement: the transaction *only* encompasses Interop Labs’ team and its proprietary intellectual property. Axelar Network, the Axelar Foundation, and the AXL token are slated to continue operating independently under community governance. Common Prefix, another contributing team to the original project, will take over activities previously handled by Interop Labs.

In essence, Circle has acquired the original development force behind Axelar Network, but has overtly bypassed the Axelar Network project itself and its native AXL token.

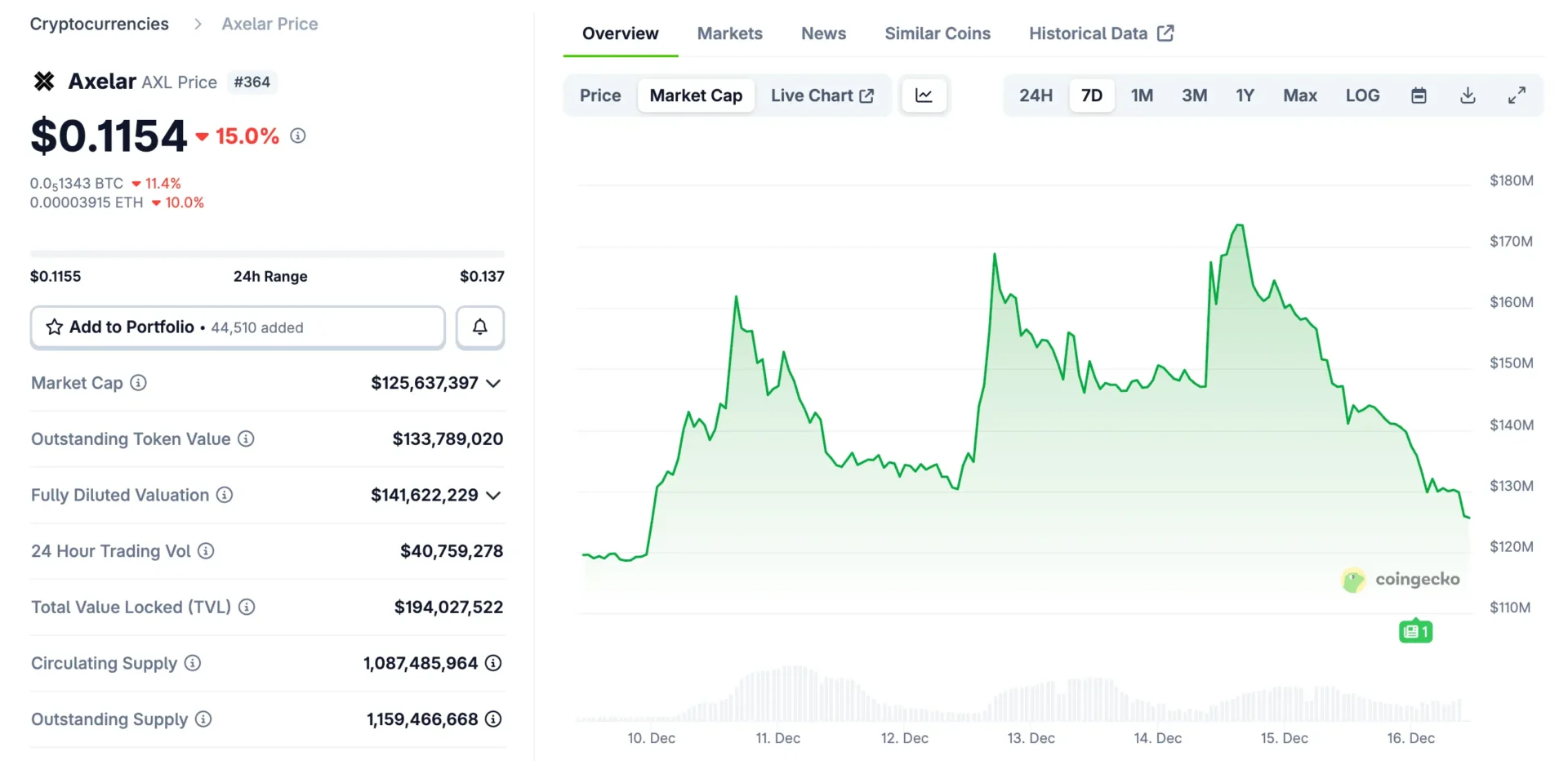

This unexpected announcement triggered a sharp decline in AXL’s price, plummeting by 15% within 24 hours to approximately $0.115 by 10 AM today.

The unique nature of this ‘people over tokens’ acquisition, and the ensuing ‘equity vs. token’ debate it has sparked, have ignited widespread discussion within the crypto community, with proponents and opponents passionately defending their respective positions.

The Outcry Against: “A Variant of RUG Pull, Circle’s Recklessness, Token Holders Bear the Brunt…”

A significant portion of the opposition comprises venture capitalists, a stance that is readily understandable: “I invested real money into the project’s token rights, holding a substantial amount of tokens. Now you’ve taken the team that built it, what good are these tokens to me?”

Simon Dedic, founder of Moonrock Capital, commented, “Another acquisition, another RUG. Circle’s acquisition of Axelar, explicitly excluding the Foundation and the AXL token, is nothing short of criminal. Even if it doesn’t violate the law, it’s morally reprehensible. If you’re a founder looking to issue a token: either treat it like equity or get out.”

Mike Dudas, co-founder of The Block and founder of 6MV, stated, “For everyone who thinks this is a token vs. equity issue, I can tell you definitively that this is entirely Circle’s doing. Rumor has it that Circle’s VP of Corporate Development told one of Axelar’s co-founders, ‘I don’t care about your investors,’ and effectively ‘bought’ the IP and team, critical for Arc’s launch, right under the investors’ noses without compensating them.”

The founder of Lombard Finance posted AXL’s price chart, predicting, “Axelar’s core team has been bought by Circle, and AXL may now be worthless. The token has been issued for over three years, and the team’s equity has long since been fully vested. But such an outcome feels deeply uncomfortable: the team and/or investors sold tokens hoping for future returns, only for the token to become an orphaned asset, its future dependent on a distant, indifferent owner.”

Zach Rynes, a prominent figure in the ChainLink community, remarked, “This again exposes the token vs. equity conflict of interest plaguing the crypto industry. The development team behind the protocol is successfully acquired, while the token holders who funded that team gain nothing. The notion of continuing independent operation under community governance is tantamount to the development team abandoning its users for personal gain. If we want to attract user capital, we must address this.”

Nicholas Wenzel, Head of SOAR Ecosystem, declared, “The Axelar token is heading to zero, thank you for participating. This is yet another acquisition where token holders receive nothing, while equity holders profit handsomely.”

The Supporting Viewpoint: “Normal Market Behavior, Tokens are at the Bottom of the Capital Structure”

While the opposition focuses on the unfair treatment of token holders, the supporting faction emphasizes the established rules of financing and mergers and acquisitions.

Jeff Dorman, CIO of Arca, believes Circle’s actions are justifiable and provided a lengthy explanation of corporate financing capital structures and the inherent disadvantageous position of tokens.

Companies raise capital through different layers of a capital structure, and these layers inherently have clear priorities, with some naturally preceding others: Secured Debt > Unsecured Senior Debt > Subordinated Debt > Preferred Stock > Common Stock > Tokens.

History offers countless examples where the interests of one class of investors are realized at the expense of another:

- In bankruptcy liquidation, creditors prevail at the expense of equity investors.

- In leveraged buyouts (LBOs), equity holders often profit at the expense of creditors.

- In take-unders (low-priced acquisitions), creditors typically take precedence over equity holders.

- In strategic acquisitions, both creditors and equity holders usually benefit (though not always).

- And tokens are often at the very bottom of the capital structure…

This doesn’t imply that tokens are worthless, nor does it mean tokens necessarily require some “protection mechanism.” However, the market needs to acknowledge a reality: when a company acquires another company of inherently low value, and the tokens issued by that company are also nearly worthless, token holders will not magically receive a “dividend out of thin air.” In such scenarios, equity gains are often realized at the cost of token losses.

Avichal Garg, co-founder of Electric Capital, also commented, “This is normal. If all future value is created by the team, no company is willing to pay investors a return.”

The Core Contradiction: What Exactly is a Token?

In the “people over tokens” acquisition controversy surrounding Axelar and Circle, both sides of the argument appear to have valid points.

The anger of the opposition is genuine: token holders bore the risk when the project was most difficult and needed liquidity and narrative support, only to be completely excluded at the critical juncture of value realization. From an outcome perspective, the core team and intellectual property achieved value monetization, while the tokens were left in the vacuum narrative of “community governance.” The market’s direct vote through price indeed profoundly frustrates all who believed in token value.

The judgment of the supporting faction also holds practical validity: from a strict capital structure standpoint, tokens are neither debt nor equity, and thus inherently lack priority in the context of mergers, acquisitions, and liquidations. Circle did not violate existing commercial rules; it simply made a pragmatic choice for the assets most valuable to itself.

The true core of the contradiction is not whether Circle’s actions were moral, but rather a long-deliberately avoided question within the industry: What exactly is a token in the legal and economic structure?

When prospects are bright, tokens are implicitly treated as “quasi-equity,” endowed with the imagined right to future success. Yet, in real-world scenarios such as acquisitions, bankruptcies, or liquidations, they are quickly relegated to their original form as “rights-less certificates.” This narrative equity-like treatment combined with their structural position at the very bottom is the root cause of recurring conflicts.

The Axelar acquisition may not be the last such controversy, but it is hoped that it will serve as an opportunity for the industry to further contemplate the positioning and significance of tokens. Tokens do not inherently possess rights; only institutionalized and structured rights will be recognized at critical junctures. The specific forms of realization still require all practitioners to jointly explore and implement.

(The above content is an authorized excerpt and reproduction from partner PANews, original link | Source: Odaily Planet Daily)

Disclaimer: This article is for market information purposes only. All content and opinions are for reference only and do not constitute investment advice, nor do they represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses resulting from investor transactions.