2025: The Year Global Compliance Reshaped the Crypto Landscape and Unlocked Trillions

Time, much like market movements, often arrives with unexpected force. This sentiment perfectly encapsulates 2025, a year we now reflect upon as we stand on its precipice, looking back at what has passed and forward to what lies ahead.

The year 2025, now drawing to a close, may not have been a period of dramatic upheaval for the cryptocurrency industry, yet it was far from uneventful. From the early-year euphoria ignited by “Trump coins” to Ethereum’s mid-summer resurgence, culminating in the deep-autumn “1011” market correction, the crypto market experienced its characteristic ebbs and flows. However, beyond these immediate price fluctuations, the industry undeniably entered a new era of growth and maturity.

A series of pivotal events in 2025 underscored this transformation:

- January: The White House issued an executive order, definitively abandoning previous “restrictive regulatory” approaches.

- March: President Trump unveiled a strategic Bitcoin reserve plan, incorporating 200,000 seized Bitcoins into national strategic reserves.

- April: The U.S. Department of Justice disbanded its specialized crypto enforcement task force, creating more room for compliant platforms to innovate.

- July: The U.S. Stablecoin Act (GENIUS) officially came into effect.

- August: Hong Kong’s “Stablecoin Ordinance” was formally implemented.

These developments were not isolated; they formed a clear, interconnected chain centered on “compliance.” U.S. legislation addressed core concerns for institutional entry, while Hong Kong’s ordinance opened vital compliant pathways into Asia. Reflecting on over a decade of cryptocurrency history, its relationship with regulation has always been a dynamic interplay. The dense rollout of global compliance policies in 2025 signals the industry’s formal departure from its “wild west” phase, ushering in a new era of structured development.

Thus, if one word were to summarize the cryptocurrency industry’s journey in 2025, it would undoubtedly be “Compliance.”

But where will the industry head after achieving this significant compliance milestone? And will the dividends of this development continue to flow? These are the crucial questions that demand our attention.

A Decade of Regulatory Evolution: From Prohibition to Standardization

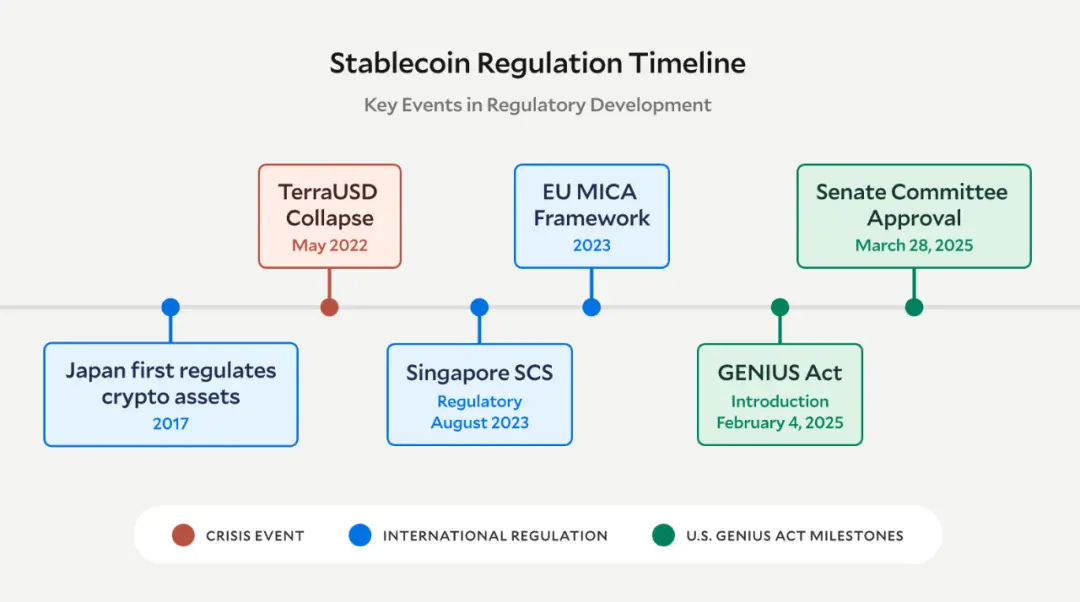

Over the past ten years, global crypto regulation has broadly progressed through three distinct phases: “Rejection and Prohibition,” “Cautious Exploration,” and “Standardized Development.” This shift in regulatory stance has directly mirrored the industry’s exponential growth.

Early Days (Pre-2015): Rejection and Prohibition

When Bitcoin emerged in 2009, its decentralized nature placed it outside traditional financial regulatory frameworks. Most global regions initially remained silent, while a few dismissed it as a “speculative tool” or a “vehicle for crime.” Before 2015, with the crypto market capitalization below a mere $10 billion, global regulation was primarily characterized by prohibitions and warnings. China’s central bank, for instance, issued a notice in 2013 on preventing Bitcoin risks, clarifying its non-currency status. Russia categorized crypto transactions as illegal in 2014, and the U.S. SEC merely labeled it an “investment tool to be wary of.” During this period, the industry operated in a near-total regulatory vacuum, with transactions often occurring on unregulated third-party platforms, leading to frequent hacking incidents and scams.

Mid-Stage (2017-2022): Cautious Exploration

The rise of the Ethereum ecosystem and the explosion of the DeFi wave between 2017 and 2022 propelled crypto market capitalization past $2 trillion, prompting regulators to enter a phase of cautious exploration.

Japan led the way, becoming the first nation to attempt regulating crypto transactions by amending its Payment Services Act in 2017 to license crypto exchanges. Switzerland, through its “Crypto Valley” strategy, built an inclusive regulatory framework that allowed banks to offer crypto custody services. The U.S. SEC began to clarify its regulatory stance, classifying some tokens as “securities” and cracking down on ICO irregularities, though federal and state-level regulatory standards remained inconsistent. Despite some Asian regions imposing bans during this period, a global consensus began to emerge: outright prohibition could not stifle technological innovation; establishing adaptive regulatory systems was key.

Modern Era (2023-Present): Standardized Development

Since 2023, regulation has entered a standardization phase. Following high-profile risk events like the FTX collapse, the industry’s demand for compliance became unprecedentedly urgent. The European Union spearheaded this effort, with the MiCA (Markets in Crypto-Assets) regulation fully coming into effect by the end of 2024, establishing the world’s first unified crypto regulatory framework. The U.S. SEC adjusted its strategy, shifting from broad “securitization” to classified regulation. Countries like Singapore and the UAE established specialized regulatory bodies and compliance sandboxes. This systematic standardization laid the groundwork for the explosive compliance trends observed in 2025.

Why 2025 Was the Year of Compliance Breakthroughs

In 2025, global crypto compliance achieved a qualitative leap. Western markets, led by the U.S. and the EU, established clear legal frameworks, while Hong Kong’s stablecoin ordinance accelerated compliance in Asia, forming a comprehensive regulatory network across major economies.

The United States: A Core of Policy Transformation

The U.S. completed a comprehensive restructuring of its crypto regulatory system in 2025, becoming a global epicenter for policy change. On January 23, the Trump administration issued an executive order, “Strengthening U.S. Leadership in Digital Fintech,” which revoked restrictive policies from the Biden era and established a regulatory tone of “promoting innovation.”

This executive order directly paved the way for subsequent legislative milestones: On July 18, the GENIUS Act was signed into law, establishing a robust regulatory framework for stablecoins. It mandated federal oversight for systemically important stablecoin issuers with market caps exceeding $10 billion and required 100% USD-backed reserve assets.

Concurrently, the House of Representatives passed the “Digital Asset Market Clarity Act,” which clarified classification standards for crypto assets. It explicitly excluded decentralized tokens like Bitcoin and Ethereum from securities classification and implemented differentiated regulation for centralized stablecoins and security tokens.

Furthermore, U.S. compliance breakthroughs were evident in strategic innovations. On March 6, President Trump signed an executive order establishing a “Strategic Bitcoin Reserve,” integrating 200,000 Bitcoins seized by the Department of Justice into national reserves with a permanent ban on their sale. This institutional lock-up reinforced Bitcoin’s scarcity and marked a pioneering move for a sovereign nation to allocate crypto assets. Regulatory enforcement also adjusted, with the DOJ disbanding its national cryptocurrency enforcement team in April, clarifying its focus solely on severe illicit activities and ceasing criminal prosecution against compliant trading platforms, fostering a more conducive environment for industry development.

The European Union: Setting the Strictest Compliance Standards

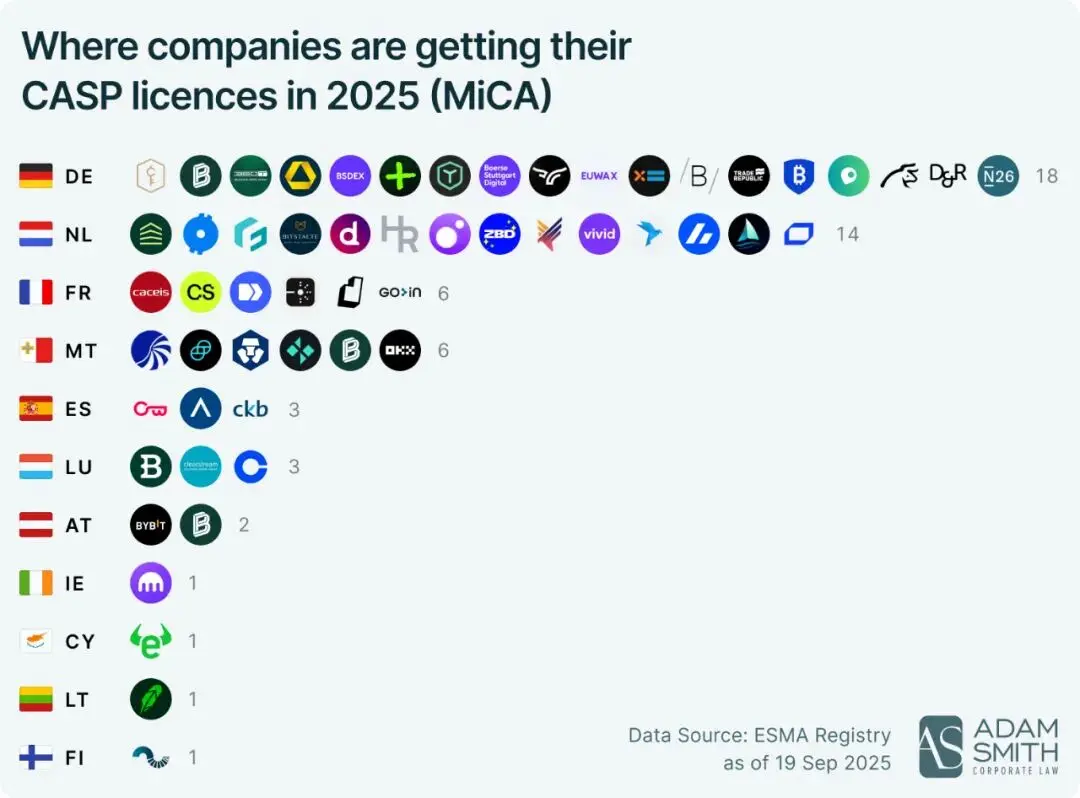

The EU, through the deepened implementation of its MiCA regulation, established the world’s most stringent compliance system. By November 2025, 57 institutions had obtained MiCA licenses, achieving full-chain regulation from issuance to custody. A key feature of MiCA is its “passporting” mechanism: a single crypto-asset service provider license obtained in one EU member state allows compliant operation across all 27 member states.

This classified regulatory model demonstrated immediate effectiveness: Tether (USDT) was delisted from EU exchanges due to unmet audit standards, while Circle’s compliant stablecoin, with its transparent reserves, captured a significant share of the EU stablecoin market. Even more groundbreaking, in November, the decentralized lending protocol Aave passed scrutiny by the Central Bank of Ireland, becoming the first DeFi project to receive MiCA authorization, signaling that regulation has begun to encompass the decentralized ecosystem.

The Eastern Market: Hong Kong’s Milestone

Similarly, the Eastern market witnessed critical compliance breakthroughs in 2025, with the enactment of Hong Kong’s Stablecoin Ordinance serving as a significant milestone. On August 1, the “Stablecoin Ordinance” officially came into force, requiring stablecoin issuers to obtain a license from the Hong Kong Monetary Authority (HKMA) and mandating that fiat-pegged stablecoins maintain 1:1 low-risk reserve assets.

This ordinance not only regulated stablecoin issuance but also laid the foundation for Hong Kong to become a leading Asian crypto financial hub. By the end of September, 36 institutions had already submitted license applications.

Globally, the compliance trends of 2025 exhibited two new defining characteristics: Firstly, regulatory frameworks shifted from “fragmented” to “unified,” with U.S. federal acts and the EU’s MiCA establishing cross-regional standards. Secondly, the scope of regulation expanded from “centralized institutions” to the “decentralized ecosystem,” with DeFi and NFTs beginning to fall under regulatory purview.

As 2025 concludes, compliance is no longer a restrictive “shackle” on industry development but rather a “passport” attracting trillions in capital, becoming the core driver pushing the industry towards maturity.

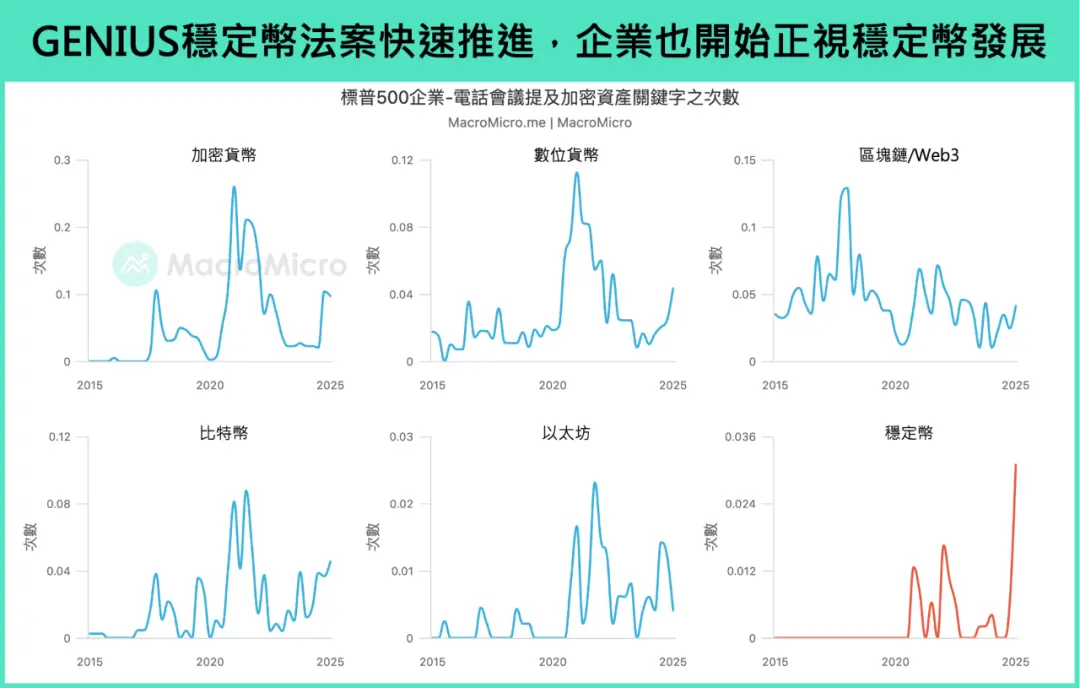

Industry Self-Regulation: Institutions Accelerate Compliance Adoption

Of course, the successful implementation of regulatory frameworks relies heavily on the proactive engagement of industry players; without cooperation, regulations are merely words on paper. In 2025, leading platforms like Coinbase and OKX, alongside investment giants such as a16z and Fidelity, became crucial bridges connecting regulators and the market through their strategic compliance initiatives and policy advocacy, significantly accelerating the industry’s move towards full compliance.

Coinbase, as one of the earliest U.S.-based compliant institutions, secured one of the first Bitcoin trading licenses (BitLicense) from New York State back in 2014. It subsequently obtained money transmitter licenses in 46 states/territories, allowing it to operate legally across all 50 U.S. states. In 2025, to align with the MiCA regulation, Coinbase relocated its new headquarters to Luxembourg, using its MiCA license to achieve full market coverage across all 27 European countries. This year, Coinbase also made multi-million dollar acquisitions of Liquifi and Echo to build out its asset issuance and public sales capabilities, positioning itself as a compliant platform for future token offerings and meeting institutional clients’ demands for compliant, efficient digital asset management tools.

Similarly, another established exchange, OKX, set an industry benchmark through its “global licensing strategy + technical compliance.” As one of the first exchanges to initiate compliance transformation, it became the world’s first trading platform to receive a full operating license in the UAE in 2024, the same year it obtained a Major Payment Institution license in Singapore. Following the official enactment of the European MiCA regulation, OKX was among the first global exchanges to acquire a MiCA license and commence operations in Europe. OKX rigorously implements KYC/AML procedures and offers diverse compliant products to adapt to varying national regulatory requirements, building a global compliant operating system with a global compliance and risk control team exceeding 600 personnel.

Additionally, OKX significantly expanded its presence in the U.S. market this year, currently holding operating licenses in approximately 47 states and territories. It also strategically recruited senior professionals with U.S. regulatory and traditional finance backgrounds, such as Linda Lacewell, former Superintendent of the New York State Department of Financial Services, who joined as Chief Legal Officer and subsequently reorganized OKX’s legal and compliance departments.

Binance, which previously faced compliance challenges, actively repaired its regulatory image by securing additional licenses. After past regulatory controversies, Binance accelerated its license applications in 2025, now holding compliant licenses in 30 countries globally. Most recently, Binance officially obtained a global license from Abu Dhabi’s ADGM/FSRA, becoming the first exchange to secure comprehensive approval under this regulatory framework, further accelerating its compliance strategy.

As Star, founder and CEO of OKX, aptly stated, “We are seeing more and more crypto companies learning how to develop healthily under regulatory systems.” Binance founder CZ also emphasized that mainstream adoption of cryptocurrencies will be a gradual process, with a clear regulatory framework being the primary prerequisite.

Beyond exchanges, several investment firms actively influenced the improvement of compliance frameworks through policy lobbying and ecosystem development. In 2025, a16z invested tens of millions of dollars to advance crypto compliance, participating in discussions for revisions to the GENIUS Act and the Digital Asset Market Clarity Act. They advocated for the inclusion of “innovation protection” clauses, exempting certain decentralized protocols from some compliance obligations.

Financial behemoths like Fidelity and BlackRock aligned with compliance developments by launching Bitcoin spot ETFs and managing crypto asset trusts. They actively participated in discussions with government and regulatory bodies (such as the SEC and CFTC) to promote clear and actionable regulatory frameworks. It is precisely because of the efforts and cooperation of these industry institutions that Bitcoin, from its birth in a regulatory vacuum in 2009, through the global warnings following the 2017 ICO frenzy, to the formation of a globally coordinated compliance network in 2025, finally shed its “grey area” label.

Compliance: Making the $10 Trillion Vision a Reality?

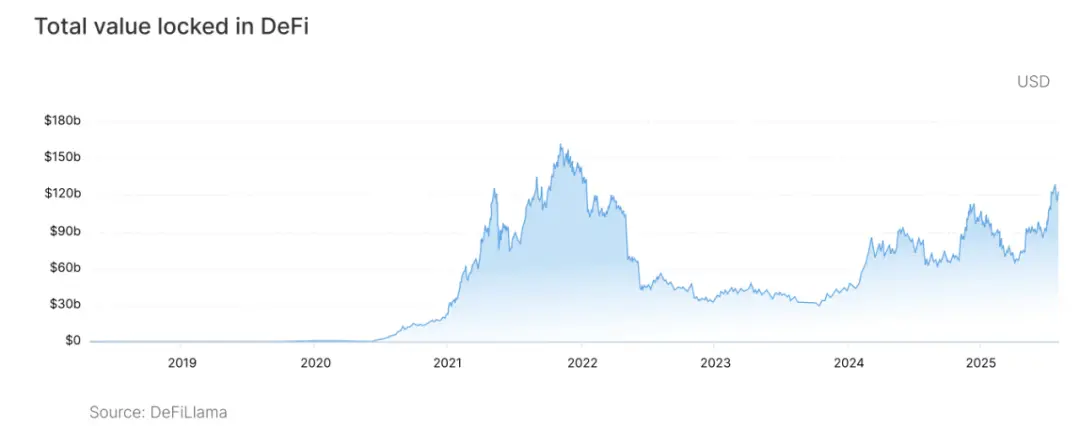

Unregulated growth was once the biggest bottleneck limiting the crypto industry’s potential. The FTX collapse, for instance, led to a 70% market contraction in 2022, and regulatory ambiguity deterred traditional institutions from engaging. However, the refinement of compliance frameworks in 2025 is now unlocking new avenues for market growth.

Compliance has ignited enterprise-level asset allocation demand. Previously, due to regulatory uncertainties, most corporations adopted a wait-and-see approach towards crypto assets. The clarity provided by global compliance frameworks in 2025 has accelerated the inflow of corporate capital. According to CoinGecko statistics, in the first three quarters of 2025, global enterprise-level crypto asset allocation surpassed $120 billion, representing a 450% increase compared to the entirety of 2024. The entry of corporations not only brings incremental capital but also enhances the liquidity and stability of crypto assets.

The explosive growth of crypto ETFs has become a critical conduit for capital inflow. Following the enactment of the GENIUS Act, the SEC eased its approval standards for crypto ETFs, resulting in dozens of new crypto ETFs being approved for listing in 2025.

By November, the total assets under management (AUM) for U.S. crypto ETFs had exceeded $140 billion, with BlackRock’s Bitcoin ETF alone reaching $70 billion, making it one of the most popular and fastest-growing products. The widespread adoption of ETFs also significantly lowers the barrier to entry for retail investors, allowing them to participate in the crypto market through traditional brokerage accounts without directly interacting with crypto trading platforms.

Compliance brings not just financial growth but also a fundamental reconstruction of ecosystem value. Under robust regulatory frameworks, the application scenarios for crypto assets are extending beyond speculative trading into the real economy. For example, Walmart and Amazon are exploring the use of stablecoins for cross-border supply chain settlements, with projections indicating a potential 60% reduction in settlement costs. The successful implementation of these real-world applications truly integrates crypto assets into traditional finance and the broader economy, providing solid support for the ambitious $10 trillion market target.

From unregulated, wild growth to the comprehensive implementation of compliance frameworks in 2025, the cryptocurrency industry has, over more than a decade, successfully transitioned into mainstream finance. However, regulatory maturation is not the end of industry development; it is merely the starting point of a “golden decade.” As a global compliance network takes shape, and traditional capital and real-world economies accelerate their integration, the crypto market is shifting from the periphery to the center. Compliance will continue to serve as the core driving force, propelling the industry to achieve a monumental leap from a $3 trillion to a $10 trillion valuation, fundamentally rebuilding the global financial value system.

Despite the current market still navigating the lingering anxieties of the “1011” event, as we stand at the dawn of 2026, those of us building within the industry must not only embrace hope but also diligently focus on every task at hand. For “life is always, and only, the moment we are experiencing now,” just as Satoshi Nakamoto merely wrote a whitepaper 17 years ago, yet birthed an entirely new industry.