Author: Frank, MSX Research Institute

Nasdaq’s 23-Hour Trading: A Stress Test for TradFi and a Prelude to Stock Tokenization

For years, trading U.S. equities meant sacrificing sleep for investors in distant time zones. But what if the market never truly closed? While the cryptocurrency market has long embraced a relentless 24/7 rhythm, Nasdaq, a cornerstone of Traditional Finance (TradFi), is finally making its move.

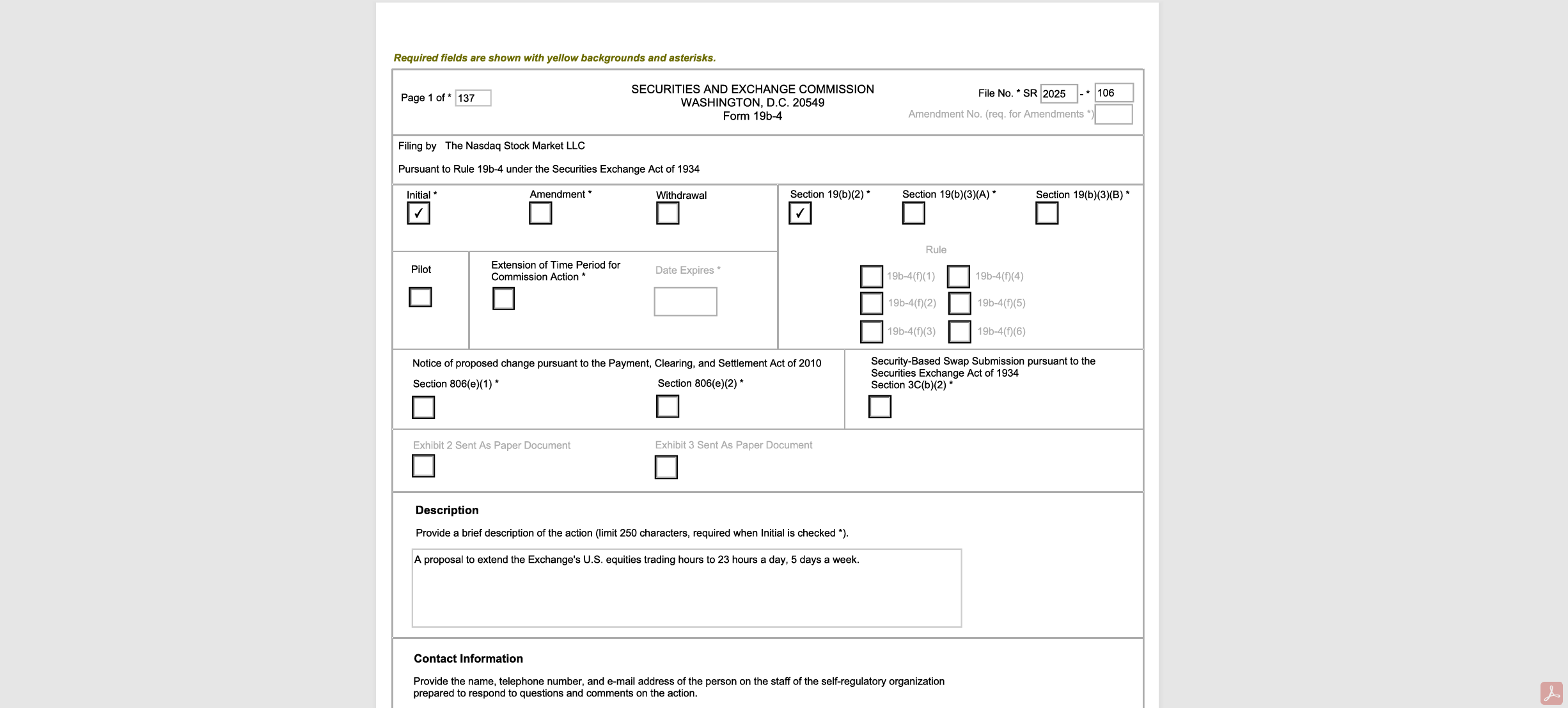

On December 15, Nasdaq officially filed a proposal with the U.S. Securities and Exchange Commission (SEC) to extend its trading hours. The plan is to expand from the current 16 hours per day, five days a week (covering pre-market, regular, and after-hours sessions) to an ambitious 23 hours per day, five days a week (encompassing both day and night sessions).

Should this proposal gain approval, U.S. stock trading would commence on Sunday evenings at 9:00 PM and conclude on Friday evenings at 8:00 PM, leaving a mere one-hour daily closure window (8:00 PM – 9:00 PM). The official rationale is to “meet the growing demand from Asian and European investors, allowing them to trade during non-traditional hours.”

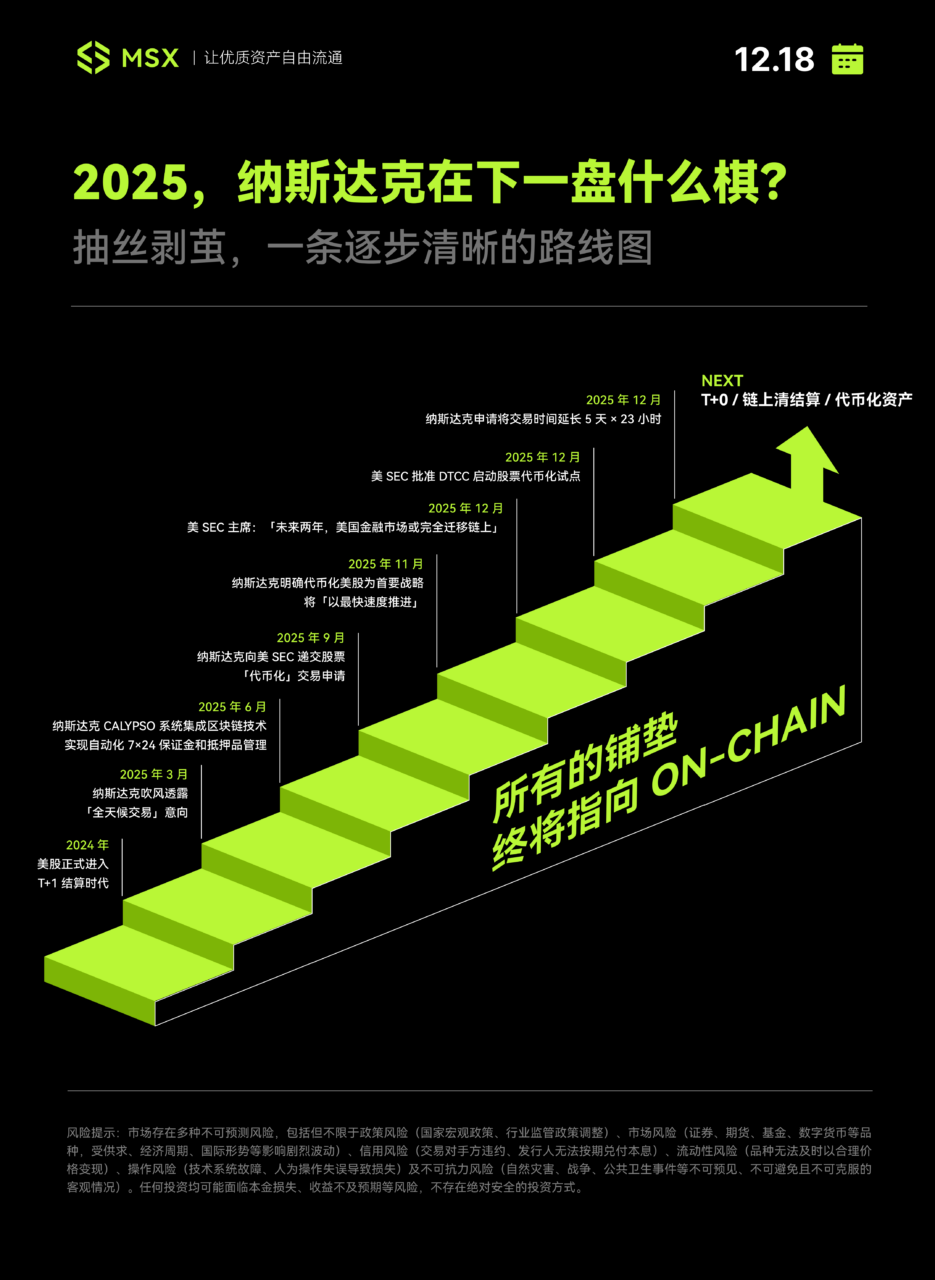

However, a closer examination reveals a far more strategic underlying logic. Nasdaq appears to be conducting an extreme stress test for the impending era of stock tokenization. A continuous timeline of events suggests a clear trajectory:

Nasdaq and the broader U.S. financial markets are meticulously preparing for a “never-closing financial system.”

The “Last Hour”: Pushing TradFi to Its Operational Limits

On the surface, this merely seems like an extension of trading hours. Yet, from the perspective of various TradFi participants, this move pushes the technical capacity and collaborative capabilities of existing financial infrastructure to its absolute physical limits.

The TradFi ecosystem for stock trading is an intricately meshed gear system. Beyond Nasdaq itself, key stakeholders include brokers, clearing institutions, regulators, and even the listed companies. To support a 23-hour trading regime, all market participants must engage in extensive communication and undertake profound overhauls across every facet of their clearing, settlement, and coordination systems:

- Brokers and Dealers will need to extend their customer service, risk control, and trade maintenance systems to operate around the clock, leading to a significant surge in operational and human resource costs.

- Clearing Institutions (like DTCC) must simultaneously upgrade their transaction coverage and clearing/settlement systems. This means extending service hours until 4:00 AM to comply with new “next-day settlement for night trading” rules (trades executed between 9:00 PM and midnight will be settled the following day).

- Listed Companies will need to re-evaluate the timing of financial reports and significant announcements. Investor relations teams and market participants must adapt to a new reality where “material information is priced instantly by the market during non-traditional hours.”

For investors in Eastern time zones, the current U.S. stock trading typically occurs late at night or early morning. The future 5-day, 23-hour model would eliminate the need for late-night sessions, allowing real-time participation without disruption – a substantial benefit. However, this raises a crucial question: If reform is underway, why not go all the way to 7×24 trading, rather than leaving this awkward one-hour gap?

According to Nasdaq’s public disclosures, this one-hour hiatus is primarily dedicated to system maintenance, testing, and trade settlement. This precisely exposes the “Achilles’ heel” of traditional financial architecture: under the existing centralized clearing and settlement systems (reliant on DTCC and broker/bank systems), a physical downtime is indispensable for batch data processing, margin settlement, and guarantees.

Much like bank branches needing to reconcile accounts after closing, this one-hour window serves as a “fault tolerance buffer” in the real world. While it demands significant labor and system maintenance costs, it provides essential breathing room for system upgrades, synchronized clearing and settlement, fault isolation, and risk management across all parties within the current financial infrastructure.

However, compared to the past, this remaining single hour will impose nearly draconian demands on the cross-role coordination capabilities of the entire TradFi industry, representing nothing short of an extreme stress test.

In stark contrast, blockchain-based cryptocurrencies and tokenized assets, leveraging distributed ledgers and atomic settlement, inherently possess a 7x24x365, always-on trading DNA. They have no closing bell, no need for market holidays, and no requirement to cram critical processes into a fixed end-of-day window.

This contrast elucidates why Nasdaq is undertaking such an arduous challenge. It’s not a sudden awakening to “accommodate” Asian users, but a strategic imperative. As the lines between the 7×24 cryptocurrency market and traditional finance increasingly blur, traditional exchanges are seeing a growing demand for incremental trading from global capital across multiple time zones, requiring broader liquidity coverage over longer periods.

Indeed, with tokenization poised to accelerate post-2025, players like Nasdaq have already been strategically positioning themselves behind the scenes. From this perspective, the 23-hour trading system is not an isolated rule change merely extending market hours. Instead, it functions as an institutional transitional state, meticulously paving the way for stock tokenization, on-chain clearing, and a truly 7×24 global asset network.

Without dismantling existing securities laws and the National Market System (NMS), the initial objective is to align trading systems, infrastructure, and participant behavior with an “approaching on-chain” rhythm. This serves as a preliminary test and groundwork for more ambitious future goals, including more continuous trading, shorter settlement cycles, and ultimately, on-chain clearing and tokenized delivery.

Consider this: once SEC approval is granted and 23-hour trading becomes the norm, the market’s patience threshold and reliance on “trade anytime, instant pricing” will undoubtedly elevate. How far then will we be from the true 7×24 end-game? At that juncture, with the formal implementation of tokenized U.S. stocks, the global financial system will smoothly transition into a truly “never-closing” future.

Profound Market Impacts: Liquidity, Pricing, and Black Swan Risks

Objectively, the “5×23” model is likely to trigger a structural shock across the entire global TradFi ecosystem.

In terms of time breadth, it significantly expands trading boundaries, offering a tangible benefit to cross-timezone investors, particularly those in Asian markets. However, from a market micro-structure perspective, it also introduces new uncertainties regarding liquidity distribution, risk transmission, and pricing power, which could easily challenge the “sustainability” of global liquidity.

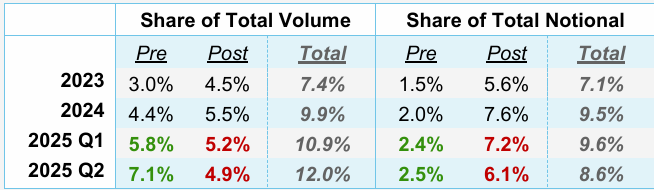

In fact, the activity during non-traditional U.S. stock trading hours (pre-market and after-hours) has seen explosive growth in recent years.

Data from the NYSE indicates that in Q2 2025, non-trading hour volumes exceeded 2 billion shares, with a turnover of $62 billion, accounting for a record 11.5% of total U.S. stock trading during that quarter. Concurrently, trading volumes on night trading platforms such as Blue Ocean and OTC Moon have also steadily climbed, demonstrating that night trading is no longer a fringe phenomenon but a critical new battleground for mainstream capital.

This trend fundamentally represents the concentrated release of genuine demand from global traders, especially Asian retail investors, to “trade U.S. stocks in their own time zone.” From this perspective, Nasdaq is not attempting to create new demand, but rather to re-centralize and bring night trading—which was previously scattered across off-exchange, low-transparency environments—back into a compliant, regulated exchange system. This is a strategic move to reclaim the pricing power that had been migrating to dark pools.

However, the “5×23” trading model does not necessarily guarantee higher quality price discovery. It is more likely to manifest as a double-edged sword with significant implications:

- Risk of Liquidity Fragmentation and Dilution: While extended trading hours theoretically attract more cross-timezone capital, in reality, it often means that finite trading demand is fragmented and diluted across a longer time axis. Particularly during the “night” sessions of the “5×23” model, U.S. stock trading volumes are typically lower than during regular hours. Extending these periods could lead to wider spreads, insufficient liquidity, increased transaction costs, and heightened volatility. It also makes the market more susceptible to manipulation (e.g., “pump and dump” schemes) during thinly traded periods.

- Potential Shift in Pricing Power Structure: As previously mentioned, Nasdaq aims to consolidate orders that were diverted to off-exchange platforms like Blue Ocean and OTC Moon through the “5×23” model. However, for institutional investors, liquidity fragmentation does not disappear; it merely shifts from “dispersed off-exchange” to “time-sliced on-exchange,” imposing higher costs on risk control and execution models.

- Amplified “Black Swan” Risks Due to “Zero Delay”: Within a 23-hour trading framework, major unforeseen events (be it an earnings surprise, a regulatory statement, or geopolitical conflict) can be instantly translated into trading指令. The market will no longer have the buffer period to “sleep on it and digest overnight.” In a relatively thin night trading environment, such immediate reactions are more prone to triggering exponential chain reactions of price gaps and severe volatility, particularly in the event of unforeseen “black swan” scenarios.

Therefore, as asserted earlier, the “5×23” trading model is far more complex than simply “opening for a few more hours.” It’s not merely a question of “less or more risk,” but rather a systemic, extreme stress test of TradFi’s price discovery mechanisms, liquidity structure, and the distribution of pricing power.

Ultimately, all these preparations are laying the groundwork for that “never-closing” tokenized future.

Nasdaq’s Grand Strategy: All Roads Lead On-Chain

When we take a broader view and connect Nasdaq’s recent flurry of activities, it becomes unequivocally clear that this is a meticulously crafted, step-by-step strategic puzzle. The core objective is to empower stocks with the ability to circulate, settle, and be priced much like digital tokens.

To achieve this, Nasdaq has opted for a gradual, yet profoundly impactful, reform pathway characteristic of traditional finance. The evolution of this roadmap is strikingly clear and progressive:

The first significant step occurred in May 2024, when the U.S. stock settlement cycle was officially shortened from T+2 to T+1. This was a seemingly conservative, yet fundamentally critical, infrastructure upgrade. Following this, in early 2025, Nasdaq began signaling its intent for “all-day trading,” with plans to introduce a continuous five-day trading service in the second half of 2026.

Subsequently, Nasdaq shifted its reform focus to a more subtle, yet crucial, backend system: integrating blockchain technology into its Calypso system to enable 7×24 automated margin and collateral management. While this step had no visible immediate impact on average investors, it sent a very clear signal to institutional players.

By the second half of 2025, Nasdaq began aggressively advancing its agenda on both the institutional and regulatory fronts.

In September, it formally submitted an application to the U.S. SEC for stock tokenization trading. Then, in November, it explicitly declared tokenized U.S. stocks as a top strategic priority, vowing to “proceed as fast as possible.”

Almost concurrently, SEC Chair Paul Atkins stated in a Fox Business interview that tokenization represents the future direction of capital markets. He emphasized that placing securities assets on-chain could achieve clearer ownership verification, predicting that “within approximately two years, all U.S. markets will migrate to on-chain operations, achieving on-chain settlement.“

It is against this backdrop that Nasdaq submitted its application for the 5×23 hour trading system in December 2025.

From this vantage point, Nasdaq’s extended “23-hour trading system” is not an isolated reform but an indispensable step in its comprehensive stock tokenization roadmap. Future tokenized assets will inherently demand 7×24 global liquidity, and the current 23-hour model represents the closest “transitional state” to that on-chain rhythm.

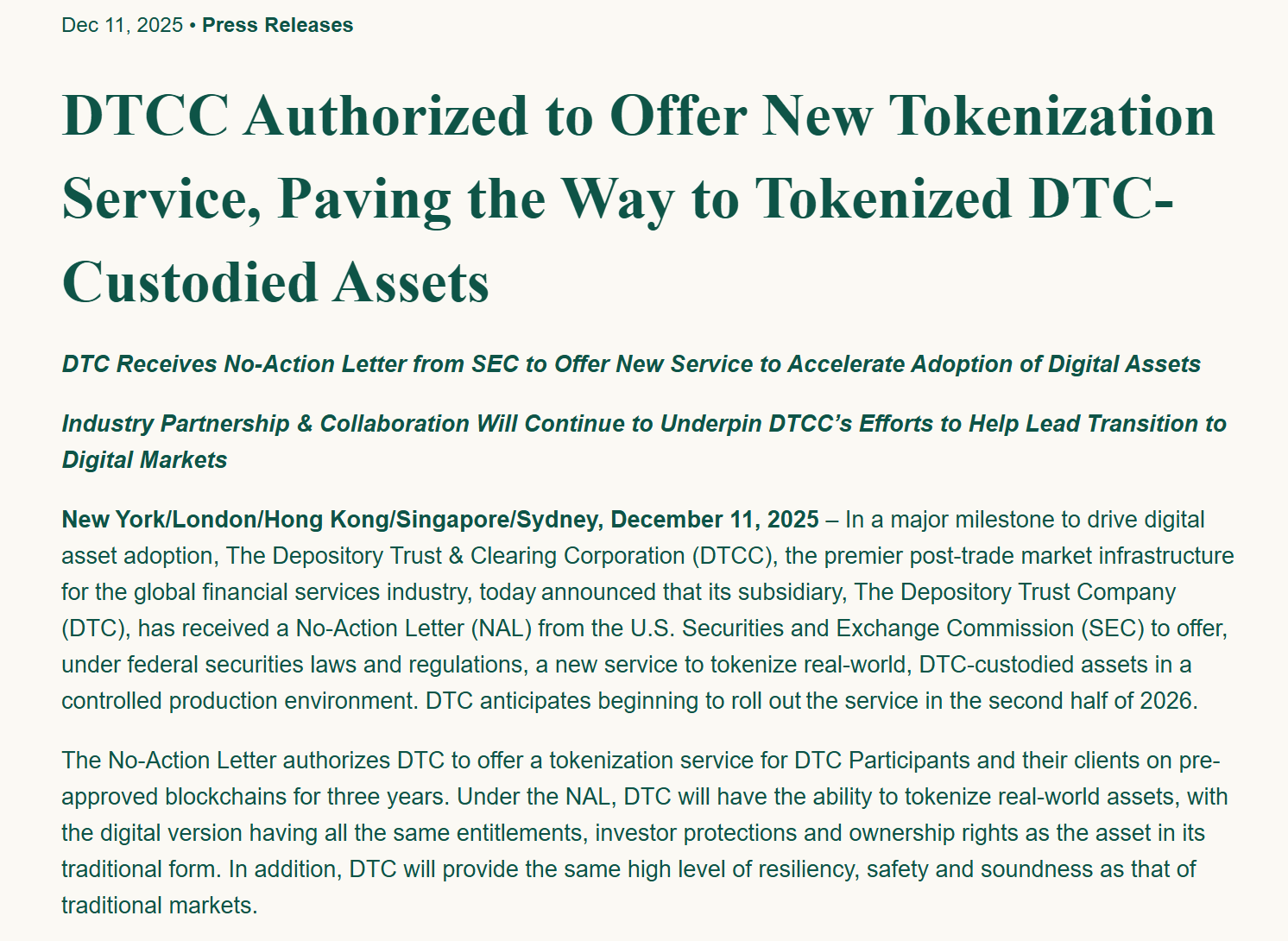

What is most intriguing is the remarkable coordination demonstrated by regulators (U.S. SEC), infrastructure providers (DTCC), and trading venues (Nasdaq) throughout 2025:

- U.S. SEC Loosens and Directs: The SEC has been progressively easing regulations while simultaneously using high-level interviews to consistently project an “all on-chain” future, injecting certainty into the market.

- DTCC Fortifies Foundation: On December 12, DTCC subsidiary Depository Trust Company (DTC) received a No-Action Letter from the U.S. SEC, approving its provision of real-world asset tokenization services within a controlled production environment. DTC plans a formal launch in the second half of 2026, directly addressing the critical issues of clearing and custody compliance for digital assets.

- Nasdaq Leads the Charge: Nasdaq has officially announced its tokenized stock initiatives, elevating them to top priority, and submitted the 23-hour trading application to attract global liquidity.

When these three distinct trajectories are overlaid on the same timeline, this profound synergy makes it difficult to draw any other conclusion:

This is neither coincidence nor a sudden whim from Nasdaq. Instead, it is a highly coordinated, continuously advancing institutional engineering effort. Nasdaq and the U.S. financial markets are making a final, decisive sprint towards a “never-closing financial system.”

The Future is 24/7: Time is Running Out for the “Old Clock”

Of course, once Pandora’s box is opened, “5×23 hours” is merely the first step.

Human demand, once unleashed, is irreversible. If U.S. stocks can now be traded late into the night, users will inevitably question: Why must I still endure that one-hour interruption? Why can’t I trade on weekends? Why can’t I settle instantly with stablecoins?

As the appetites of global investors are thoroughly whetted by “5×23 hours,” the existing, incomplete TradFi architecture will face its ultimate reckoning. Only truly 7×24 native tokenized assets can fill that final hour gap. This is precisely why, beyond Nasdaq, other formidable players like Coinbase, Ondo, Robinhood, and MSX are also racing to embrace and shape this transformative torrent.

The future is not merely arriving; it’s already here. And for the “old clock” of traditional finance, time is rapidly running out.

(The above content is an excerpt and reproduction authorized by partner PANews, original link | Source: MSX Research Institute)

Disclaimer: This article is for market information purposes only. All content and views are for reference only, do not constitute investment advice, and do not represent BlockBeats’ views or positions. Investors should make their own decisions and trades. The author and BlockBeats will not bear any responsibility for direct or indirect losses resulting from investor trades.