Following a weekend of constrained trading, the cryptocurrency market demonstrated renewed activity as U.S. stock exchanges opened. In the early evening, prices briefly surged past the $90,000 mark before settling around the $89,000 level, a trajectory that closely mirrored movements in the broader U.S. equities market. However, with the holiday season fast approaching, overall trading volumes remained notably subdued, aside from the brief push above $90,000. Liquidated short positions amounted to a mere $12 million, signaling that a significant number of investors have adopted a wait-and-see approach. This cautious sentiment is expected to persist through year-end, barring any unforeseen major market catalysts.

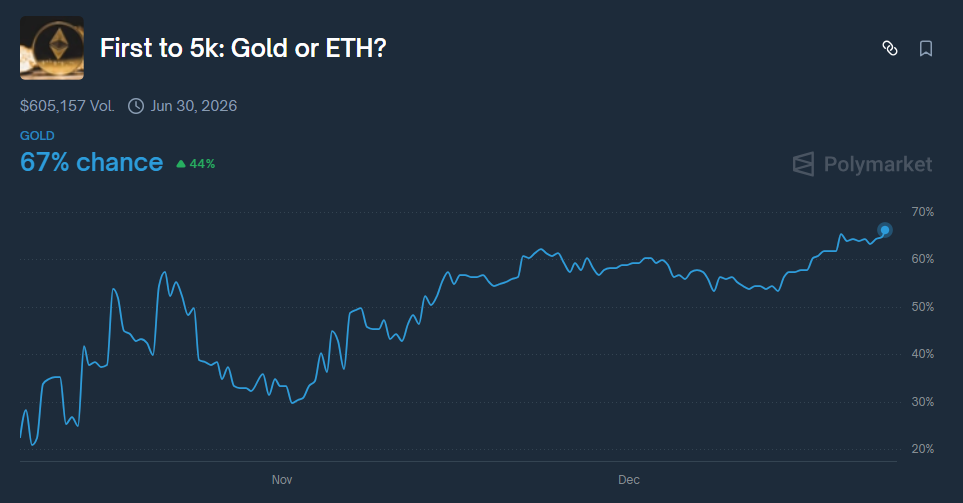

Shifting focus to a compelling market forecast, data from the prediction market Polymarket reveals a noteworthy trend: the probability of gold reaching $5,000 per ounce by June 2026 has escalated to 67%. This projection now notably surpasses the likelihood of Ethereum (ETH) achieving the same $5,000 milestone within the identical timeframe. Gold’s current price, already above $4,400, is being bolstered by escalating global geopolitical and economic uncertainties, cementing its traditional role as a safe-haven asset. In stark contrast, ETH continues to struggle to maintain its critical $3,000 support level. Amidst a pervasive bearish sentiment, a further decline for ETH appears increasingly probable, underscoring the market’s perception of cryptocurrencies as inherently risk-on assets.

This cautious outlook for Ethereum aligns with previous analyses, including Fundstrat’s forecast by Tom Lee, which projected ETH to potentially drop to $1,800 by the first half of next year. A broader examination of Polymarket’s cryptocurrency predictions further reinforces this pessimistic sentiment. For instance, the probability of Bitcoin (BTC) reaching a new all-time high by December 31st next year stands at just 50%, plummeting to a mere 12% for a new high before March. Polymarket’s predictive accuracy has garnered increasing market acknowledgment throughout the year, suggesting that investors should approach their outlook for the cryptocurrency market in the coming year with considerable prudence and strategic foresight.

Disclaimer: This article is intended solely for the provision of market information. All content and views expressed herein are for reference purposes only and do not constitute investment advice. They do not necessarily reflect the opinions or positions of Block Guest. Investors are solely responsible for their own decisions and transactions. Neither the author nor Block Guest will assume any responsibility for direct or indirect losses incurred by investors as a result of their transactions.