Public Blockchains in 2025: The Great Reckoning – From Hype to Hard Data

For the public blockchain sector, 2025 emerged as a year of dramatic shifts and a definitive watershed. If 2024 was a “carnival night” where new public chains vied for attention with promises of massive airdrops and grand narratives, then 2025 was the “morning after” – a sobering reality check following the festivities.

As the tide receded and liquidity tightened, the true data, once obscured by superficial prosperity, began to surface. We witnessed a stark contrast, a “tale of two markets”: on one side, a widespread halving of secondary market prices and a significant deceleration in Total Value Locked (TVL) growth; on the other, a counter-intuitive surge in on-chain fee revenue and DEX trading volumes.

This sharp divergence revealed a harsh truth: the market no longer pays solely for “narratives.” Capital is now consolidating around leading protocols that demonstrate genuine revenue-generating capabilities and cater to essential, indispensable use cases.

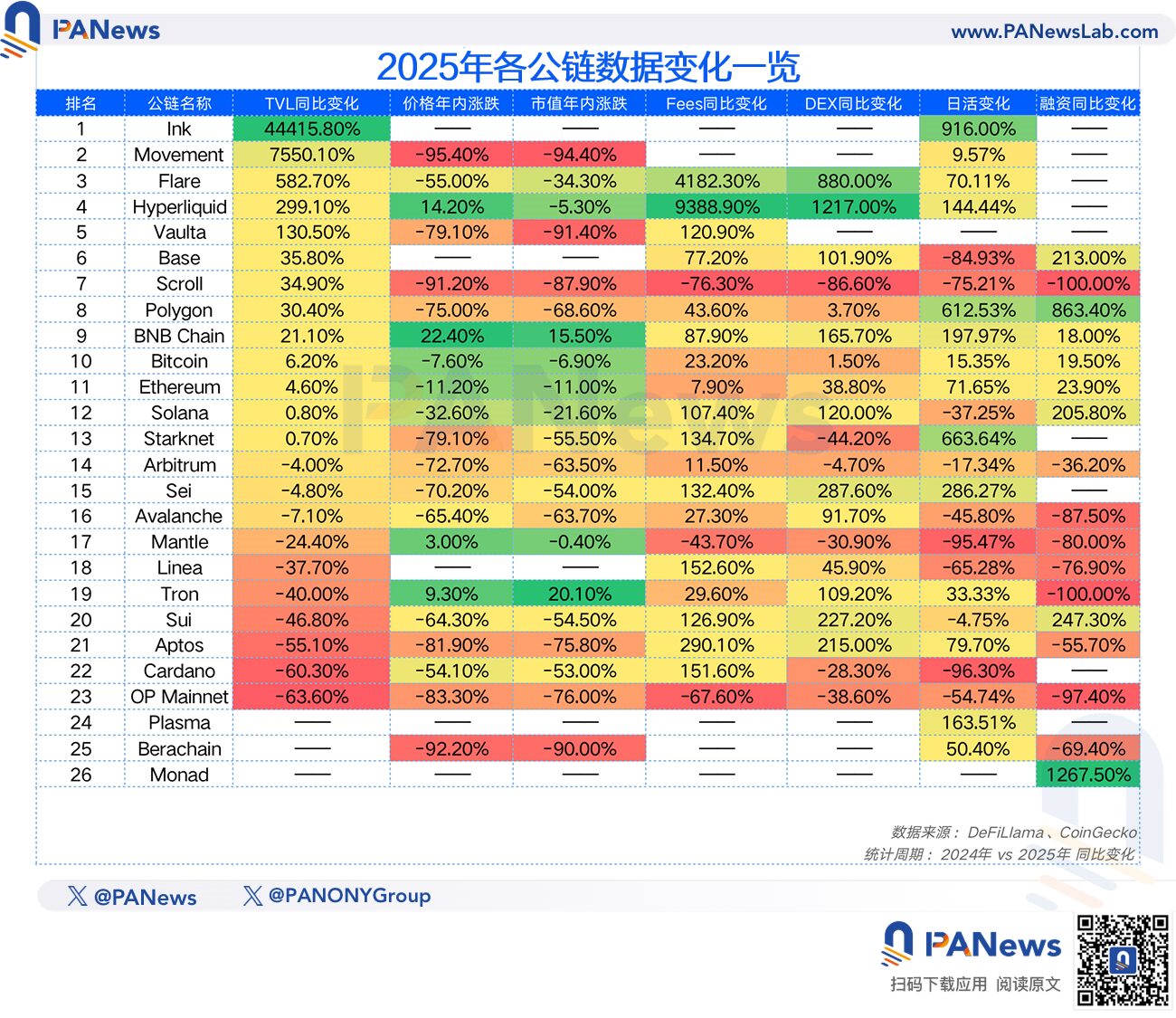

The PANews data team meticulously compiled core data for 26 mainstream public blockchains throughout 2025. Analyzing metrics from TVL, token prices, fee revenue, and activity levels to investment and financing trends, we sought to peel back the layers of these cold statistics. Our goal was to reconstruct the “bubble-bursting” process that the public blockchain market underwent this year and to identify the true winners who managed to build robust moats even in a crypto winter.

(Data Notes: TVL, stablecoin, financing, and fee data are sourced from Defillama. Daily active users and daily transaction volume data come from Artemis and on-chain information. Token price and market capitalization data are from Coingecko. The data period spans from January 1, 2025, to December 16, 2025.)

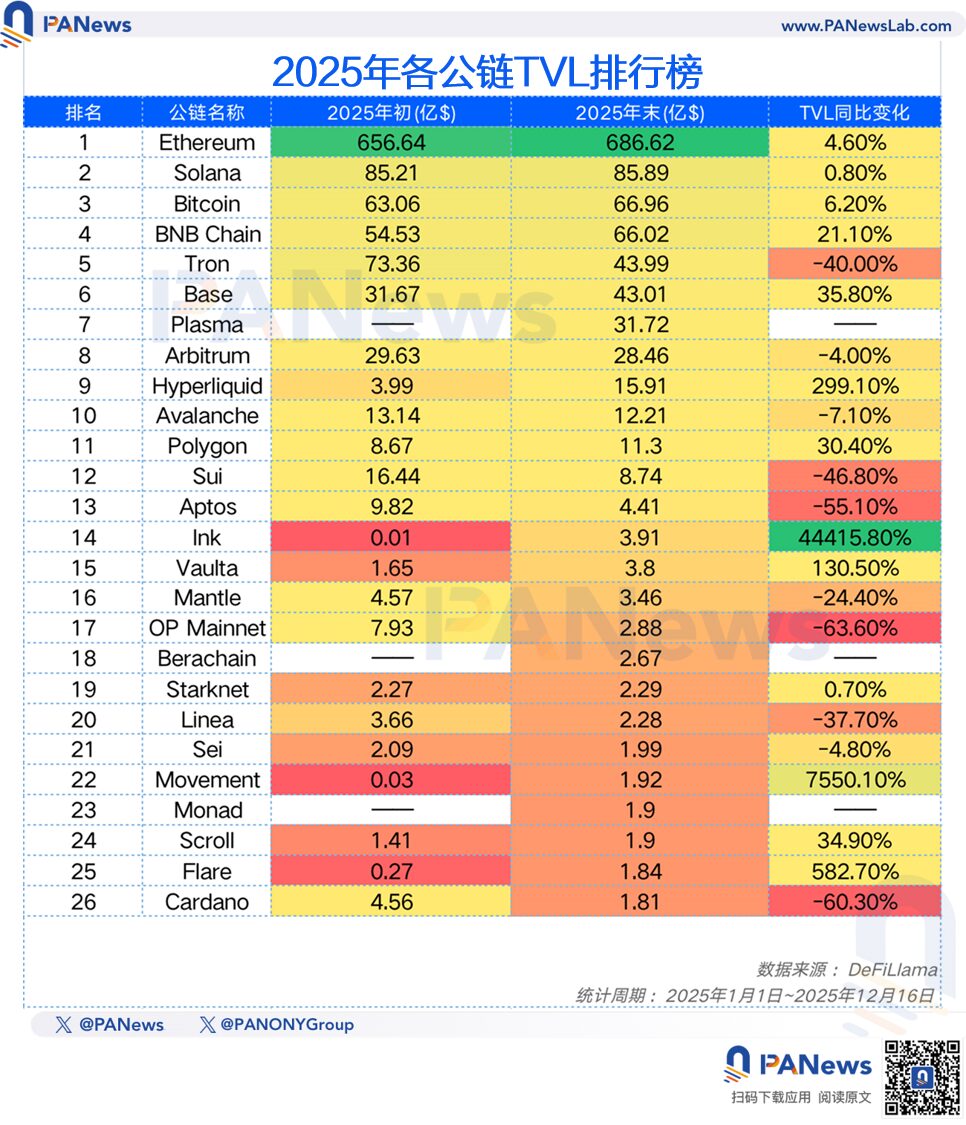

TVL: A Mixed Bag – Growth Plummets as DeFi Endures Deleveraging Pains

Examining TVL, the foremost indicator of a public chain’s prosperity, we observe a modest overall growth for top public chains this year, albeit with a significant slowdown. The total TVL for the 26 major public chains tracked by PANews grew by a mere 5.89% this year. This figure includes five newly added public chains that started with zero TVL. Furthermore, only 11 public chains (approximately 42%) achieved positive TVL growth. This stands in stark contrast to 2024, where the 22 mainstream public chains tracked saw an aggregate TVL growth of 119%, with 78% of them experiencing positive growth.

The decelerated TVL growth reflects a palpable chill across the broader crypto market. However, 2025 was not entirely uneventful. Industry-wide, the total TVL reached a peak of $168 billion in October, a 45% increase from $115.7 billion at the start of the year. Yet, a market crash post-October led to a sharp downturn in overall TVL. This decline was partly due to falling prices of underlying public chain tokens and partly a result of capital withdrawing from the DeFi ecosystem amidst risk-off sentiment.

Among the top ten public chains, Hyperliquid emerged as the clear winner in 2025, boasting a 299% TVL growth this year, dwarfing the single-digit increases of its peers. Conversely, Solana proved to be the most disheartened, with a meager 0.8% growth. As the MEME coin market cooled, this public chain giant appeared to be facing a crisis. Additionally, among the 26 public chains analyzed, Flare recorded the fastest growth rate at over 582%, while OP Mainnet’s TVL plummeted by 63.6%, marking the most severe decline.

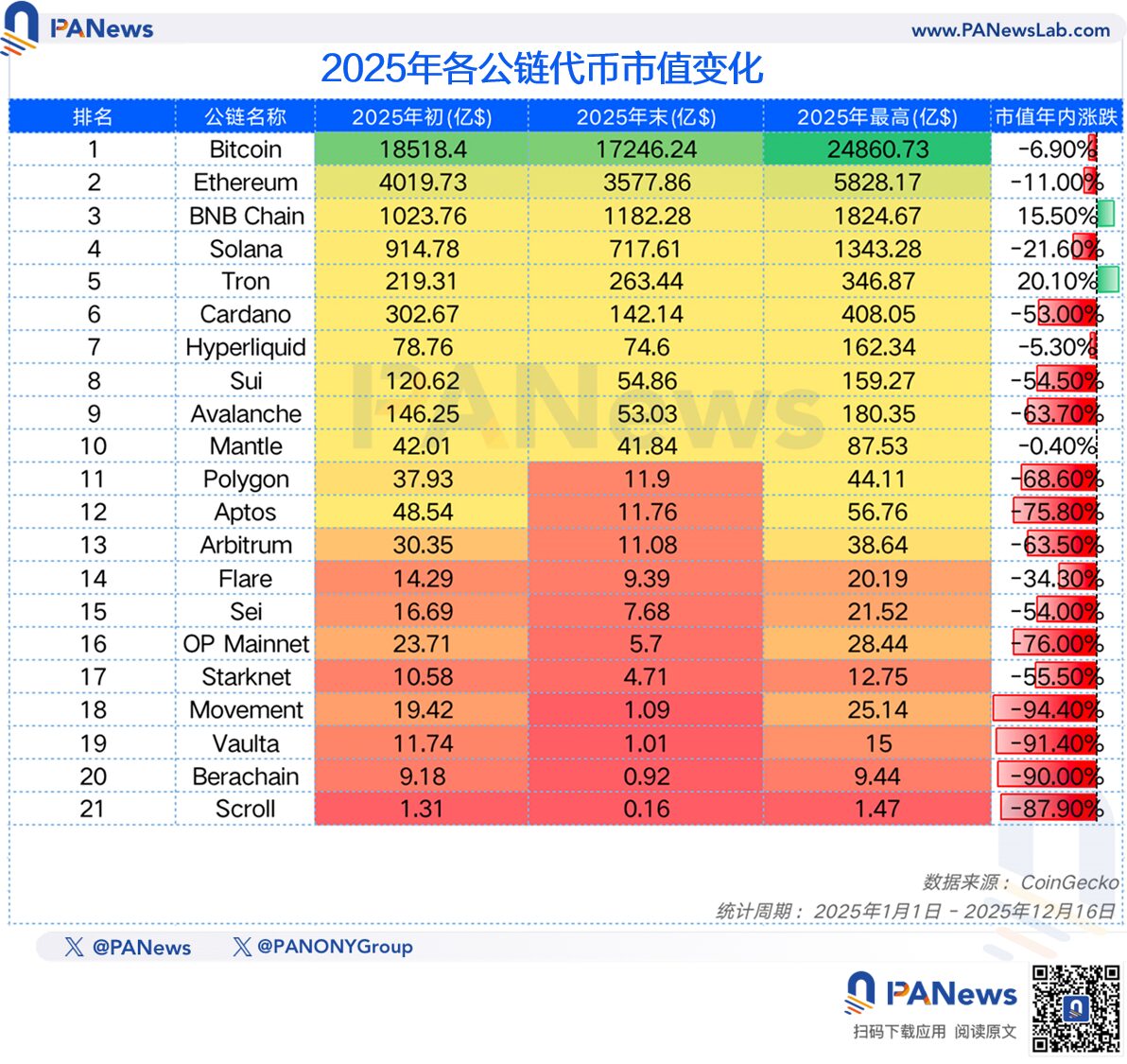

Token Prices Halved by 50%: Market Shuns New Public Chains

In terms of token prices, the performance of these mainstream public chains this year was equally disappointing. Compared to their prices at the beginning of the year, the tokens of these 26 public chains saw an average decline of 50%. Notably, Movement’s token price fell by 95%, Berachain by 92%, and Scroll by 91%. These newer public chains largely failed to gain market validation.

Within the surveyed public chains, only four managed to achieve price increases this year: BNB Chain (22%), Hyperliquid (14.2%), Tron (9.30%), and Mantle (3%). All other tokens experienced declines.

However, the fluctuations in TVL and price primarily reflect changes in crypto market liquidity. A deeper analysis of public chain ecosystem development indicators reveals a different picture altogether.

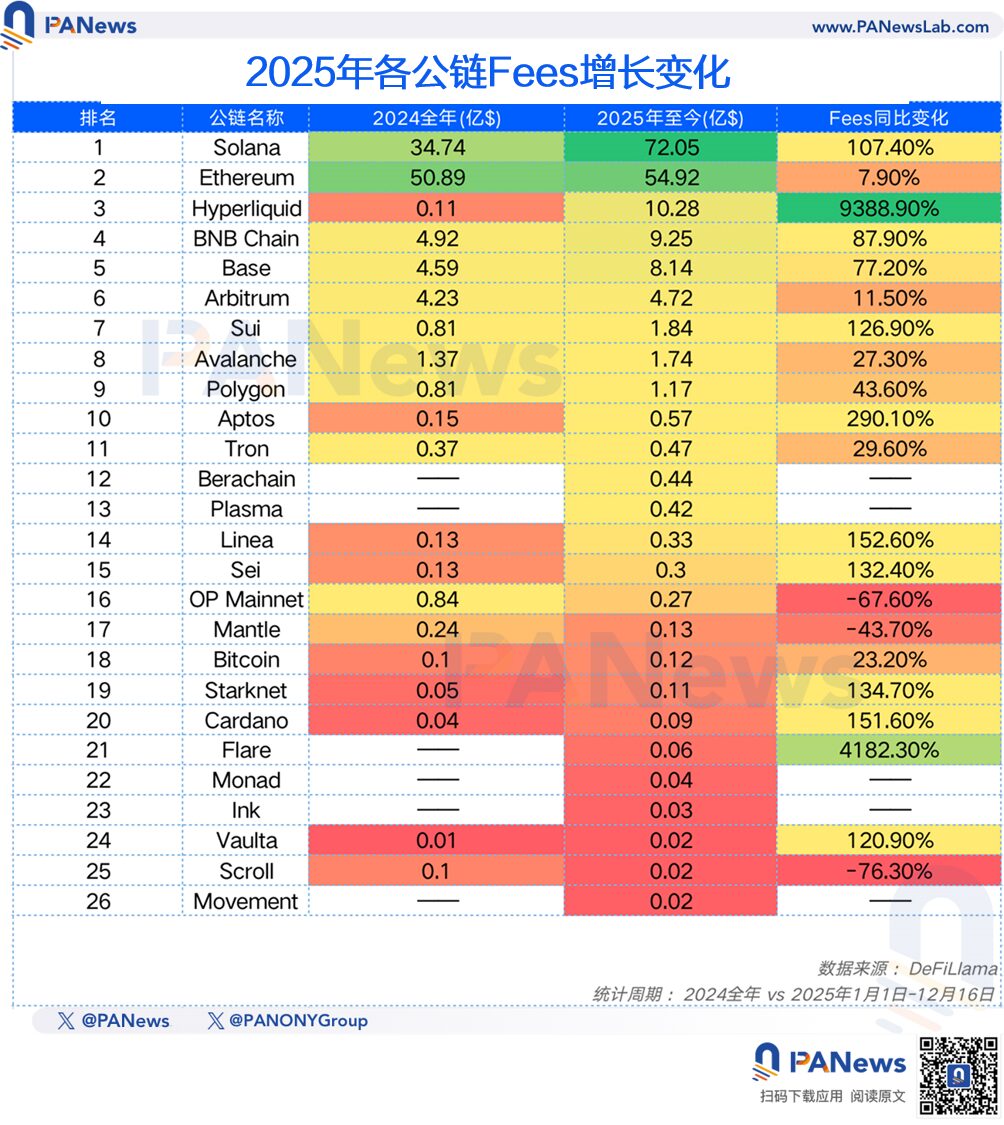

Protocol Revenue Explosion: Public Chains Collectively Enter a New Era of Self-Sustainability

Regarding on-chain fee generation, the surveyed public chains collectively generated $10.4 billion in on-chain fees throughout 2024. In 2025, this figure surged to $16.75 billion, representing an overall increase of 60%. Moreover, with the exception of OP Mainnet, Mantle, and Scroll, all other public chains achieved growth in fee generation in 2025.

Hyperliquid once again led in fee increases (9388.9%), primarily due to its relatively small initial base upon launching in late 2024. Furthermore, Solana’s fees grew by 107%, BNB Chain by 77%, Sui by 126%, and Aptos by 290%. It is evident that mainstream public chains significantly enhanced their revenue-generating capabilities in 2025.

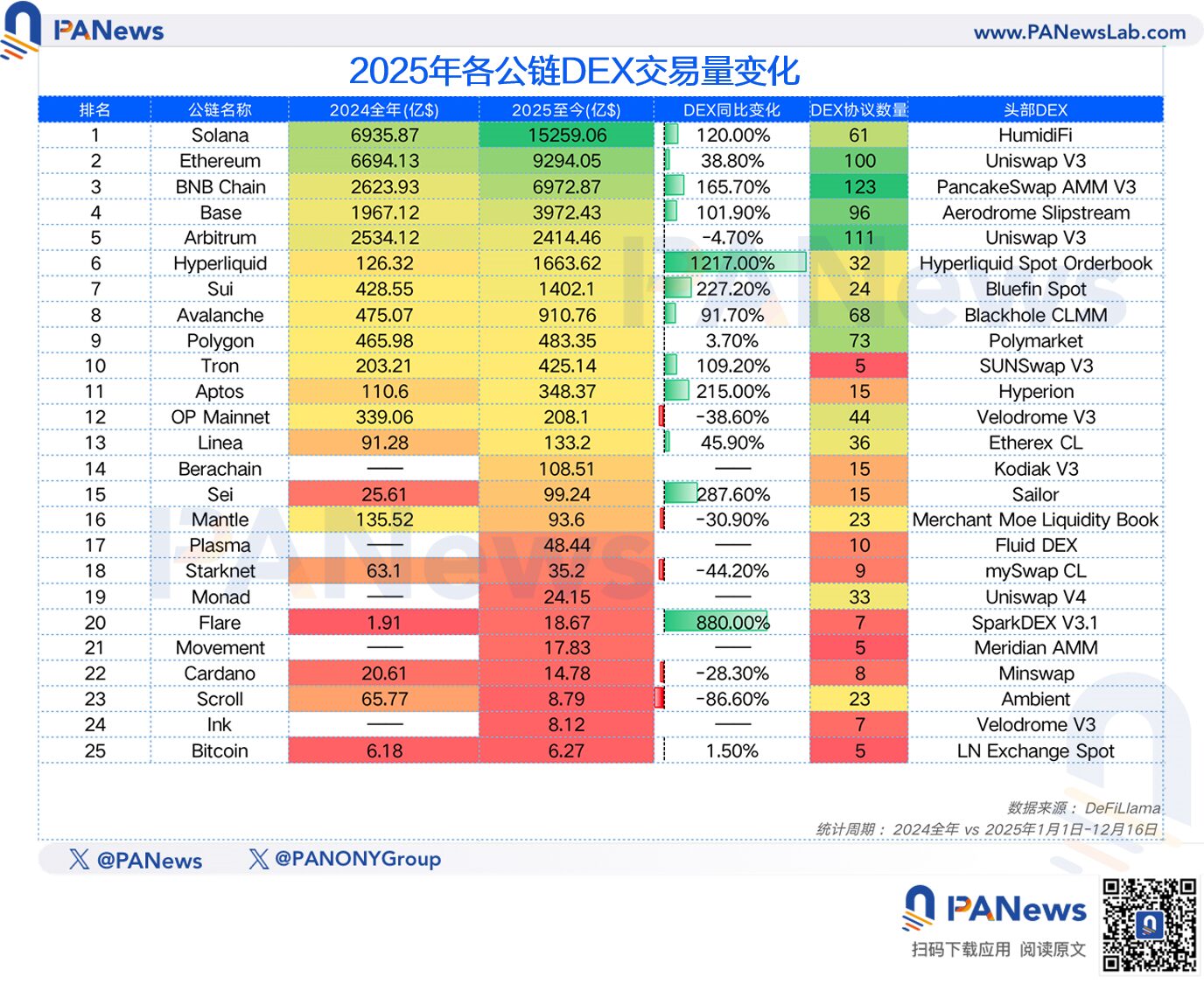

Beyond fee generation, the total DEX trading volume across these public chains collectively grew by 88%, with an average increase of 163%. Solana notably surpassed Ethereum, topping the charts with $1.52 trillion in trading volume. BNB Chain closely followed Ethereum with $697.2 billion in volume, positioning itself for a potential overtake in 2026. Hyperliquid remained the fastest-growing, with an annual DEX trading volume increase of 1217.00%, followed by Flare with an 880% increase.

As “Airdrop Hunters” Depart, New Public Chains Struggle with User Retention

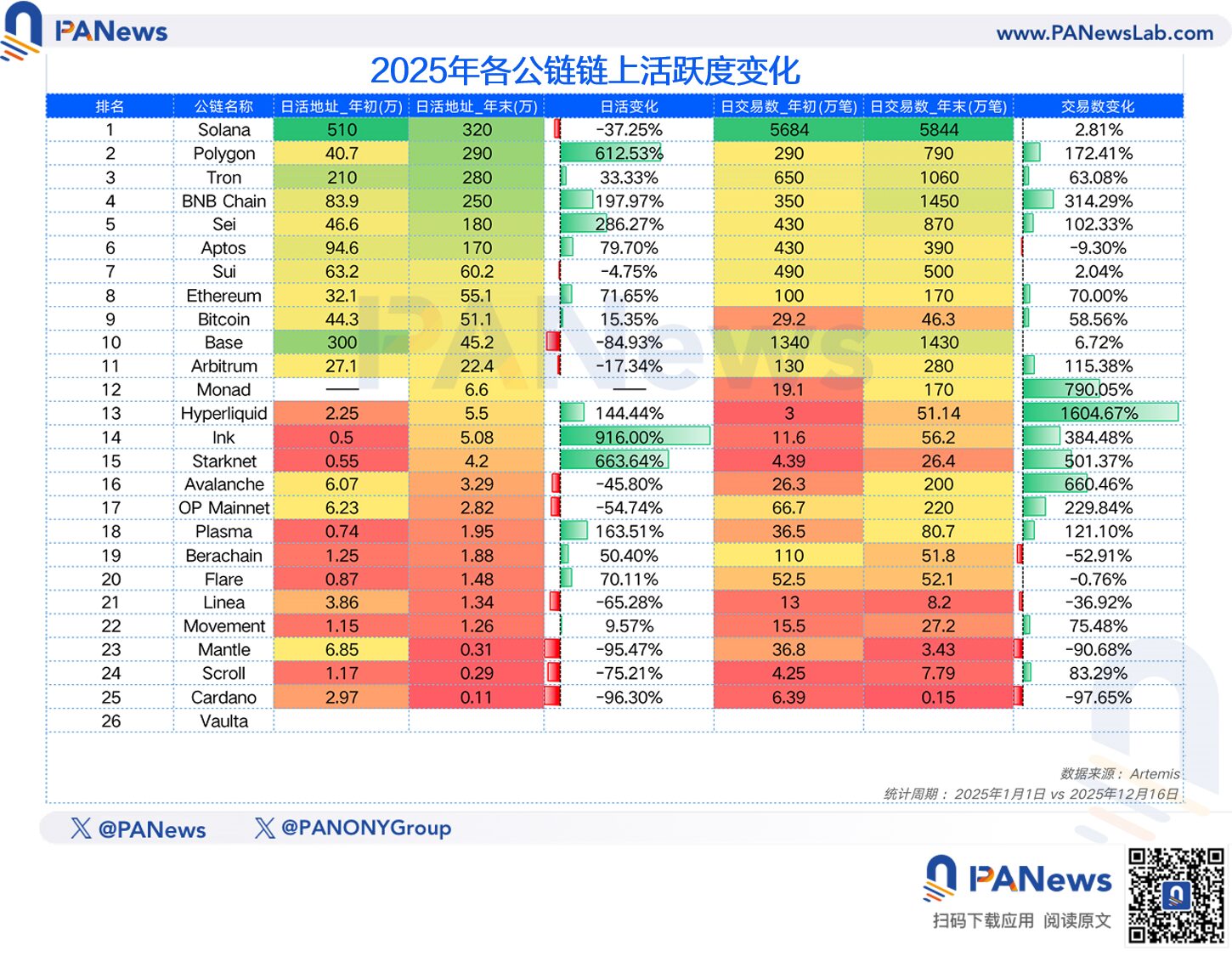

Daily active user (DAU) data presented a mixed picture.

Overall, the daily active addresses across these public chains grew from 14.86 million to 17.60 million, an 18% increase. Achieving such growth amidst a market downturn is a relatively positive sign.

However, several public chains that previously represented high retail investor activity, such as Solana, Base, and Sui, experienced varying degrees of decline. Base’s daily active users dropped by 84.9% from the beginning of the year, and Solana saw a 37% decrease. In contrast, Polygon’s daily active addresses witnessed exponential growth, reaching 2.9 million on December 19, a 612% increase from the start of the year. BNB Chain, Sei, and Aptos also recorded significant increases in daily active users.

Regarding daily transaction counts, these public chains collectively saw a 33% increase by year-end compared to the beginning of the year. BNB Chain’s performance was particularly outstanding, growing from 3.5 million transactions at the start of the year to 14.5 million, demonstrating remarkable scale and growth. While Solana still led with 58.44 million transactions, its annual growth was a mere 2.8%, showing signs of fatigue.

Stablecoins: The Only Universal Bull Market of 2025

2025 was a year of explosive growth for the stablecoin market, a trend unequivocally confirmed by public chain data. Compared to 2024, most public chains saw substantial increases in stablecoin market capitalization. Solana was the standout performer, with its stablecoin market cap surging by 196% within the year, making it the public chain with the largest stablecoin growth. Ethereum and Tron, the two largest public chains by stablecoin volume, maintained robust annual growth rates of 46% and 37%, respectively. Additionally, active public chains like BNB Chain and Hyperliquid also experienced significant stablecoin growth.

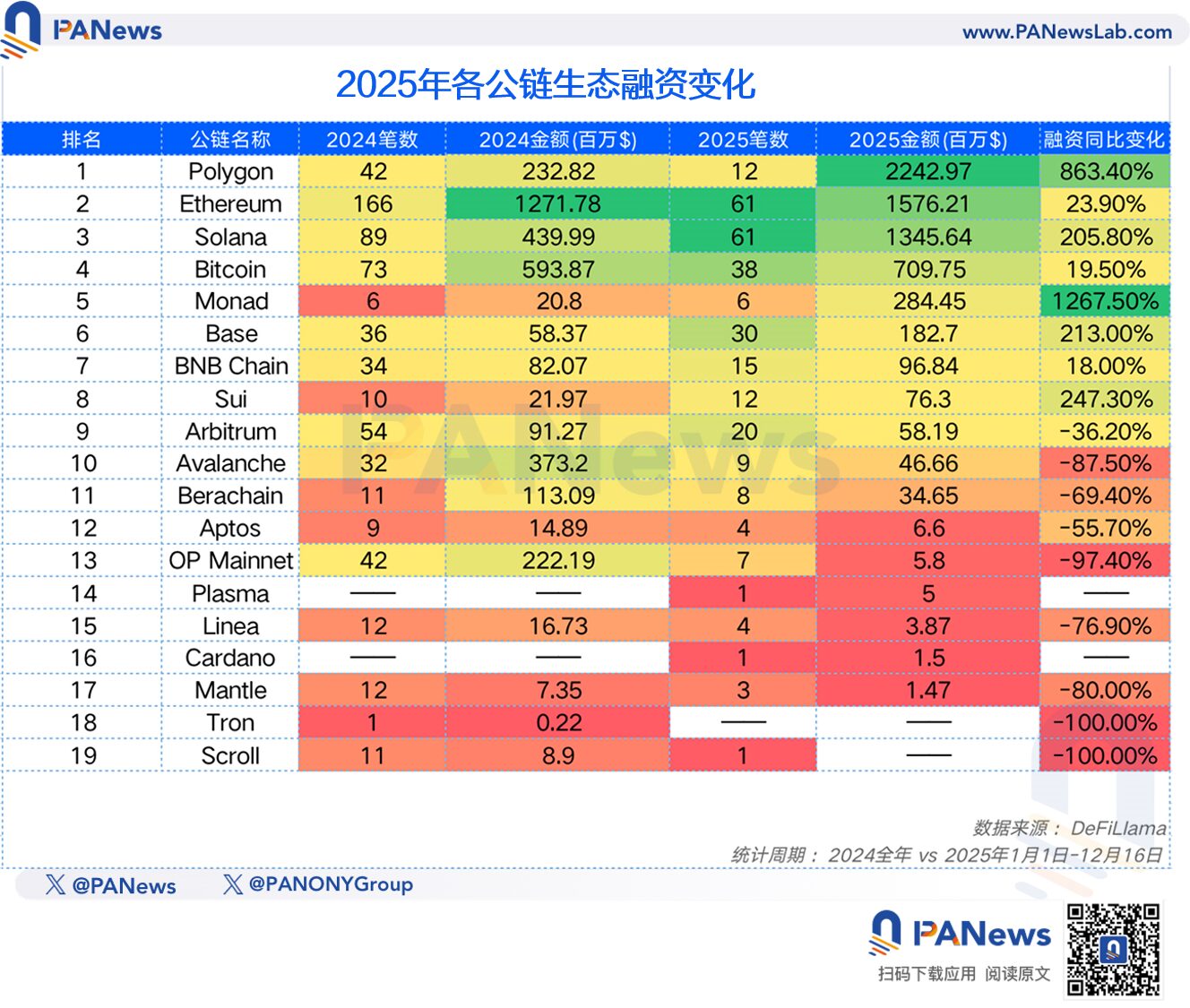

Ecosystem Funding: Polygon Leads with Star Projects, Ethereum & Solana Remain Hot

Another crucial data dimension is financing. The crypto industry reached new highs in funding in 2025. PANews tracked 6,710 financing events and categorized them by their respective public chains. The data revealed a significant drop in the number of financing deals for these public chains, from 640 to 293. However, the total amount raised surged from $350 million to $667 million, with the average single financing amount increasing from $5.57 million to $22.79 million. This indirectly suggests that securing funding has become more challenging for small and medium-sized startup teams, while capital is increasingly concentrated in prominent “star projects.”

By public chain, Polygon led in total funding with $2.24 billion, followed by Ethereum with $1.57 billion and Solana with $1.34 billion. However, Polygon’s top position was primarily driven by a single massive investment of over $2 billion into Polymarket. Upon closer inspection of the number of financing events, the majority still occurred within the Ethereum, Solana, Bitcoin, and Base ecosystems.

Below is an analysis of several key public chains:

Ethereum: The Worst Is Over – A Dislocation Between Fundamental Recovery and Stagnant Prices

As the leading public chain, Ethereum’s development in 2025 can be described as having “passed through ten thousand mountains” – meaning the worst is over. After experiencing ecosystem stagnation in 2024 due to significant L2 diversion and a stagnant market price, Ethereum saw a notable recovery in its ecological data in 2025. This was particularly evident in DEX trading volume (up 38.8%), stablecoin market cap (up 46%), and on-chain active addresses (up 71%). Furthermore, it continued to lead most public chains in both the number and total amount of ecosystem financing events. These metrics indicate a robust recovery in Ethereum’s mainnet ecosystem development during 2025.

However, its price and TVL data remained stagnant, still affected by the broader market pullback. Nevertheless, compared to other public chain tokens, Ethereum’s price performance demonstrated stronger resilience.

Solana: Made by MEME, Broken by MEME – Fragility Revealed After the Bubble Bursts

Compared to 2024, Solana in 2025 presented a different state: ecological fragility exposed after a period of extreme volatility. Following the decline of the MEME market at the beginning of the year, Solana failed to develop new compelling narratives, instead witnessing intense internal competition among various launch platforms in the MEME coin space. Consequently, while it achieved significant growth in fee capture and DEX trading volume this year, its token price, year-end active users, and transaction counts all experienced severe declines. This indirectly suggests that the market is “voting with its feet,” and Solana’s prosperity bubble appears to have burst.

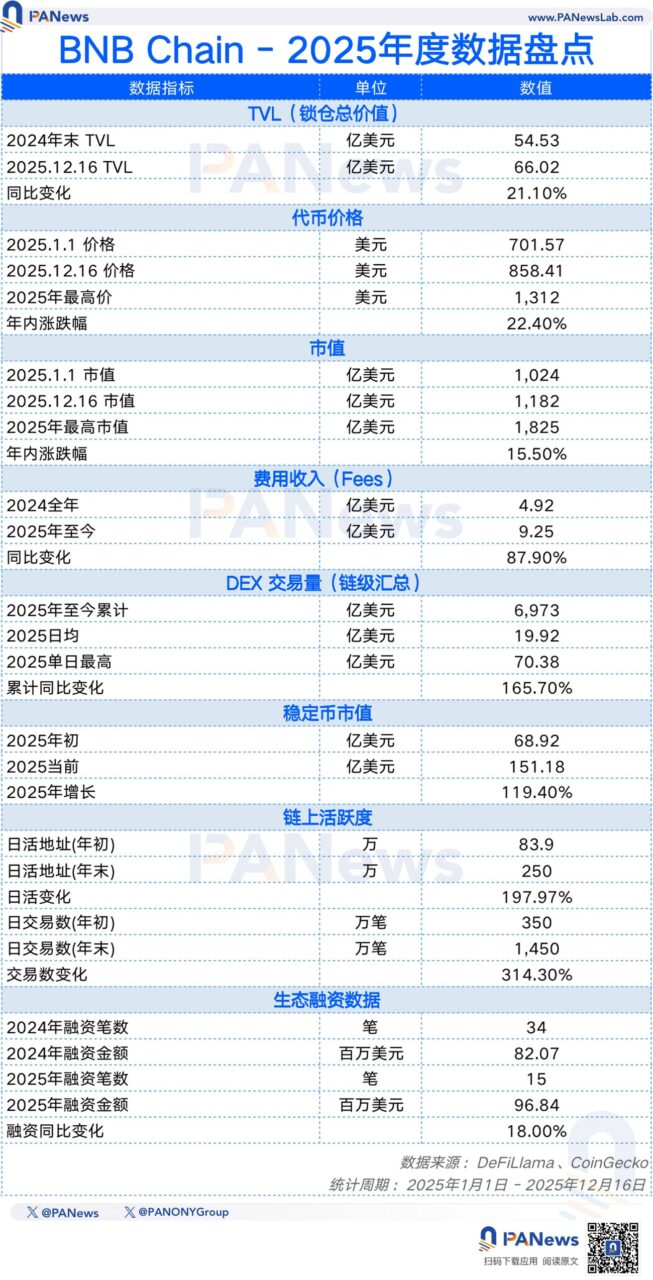

BNB Chain: From Defense to Full Offense – The “All-Rounder” with Holistic Growth

BNB Chain experienced a comprehensive breakout in 2025, achieving positive growth across almost all data dimensions surveyed. Notably, metrics like fee revenue, DEX trading volume, stablecoin market cap, and on-chain activity all saw increases of over 100%. This is a rare feat in an otherwise sluggish public chain market.

Naturally, this success is inextricably linked to Binance. From key executives like CZ actively participating in marketing to the launch of Binance Alpha becoming a “must-do” for many retail airdrop hunters, and new derivatives exchanges like Aster targeting Hyperliquid, BNB Chain’s counterattack from 2024 has evolved into a full-scale offensive. This aggressive push is formidable, making BNB Chain an undeniable force for all other public chains to contend with.

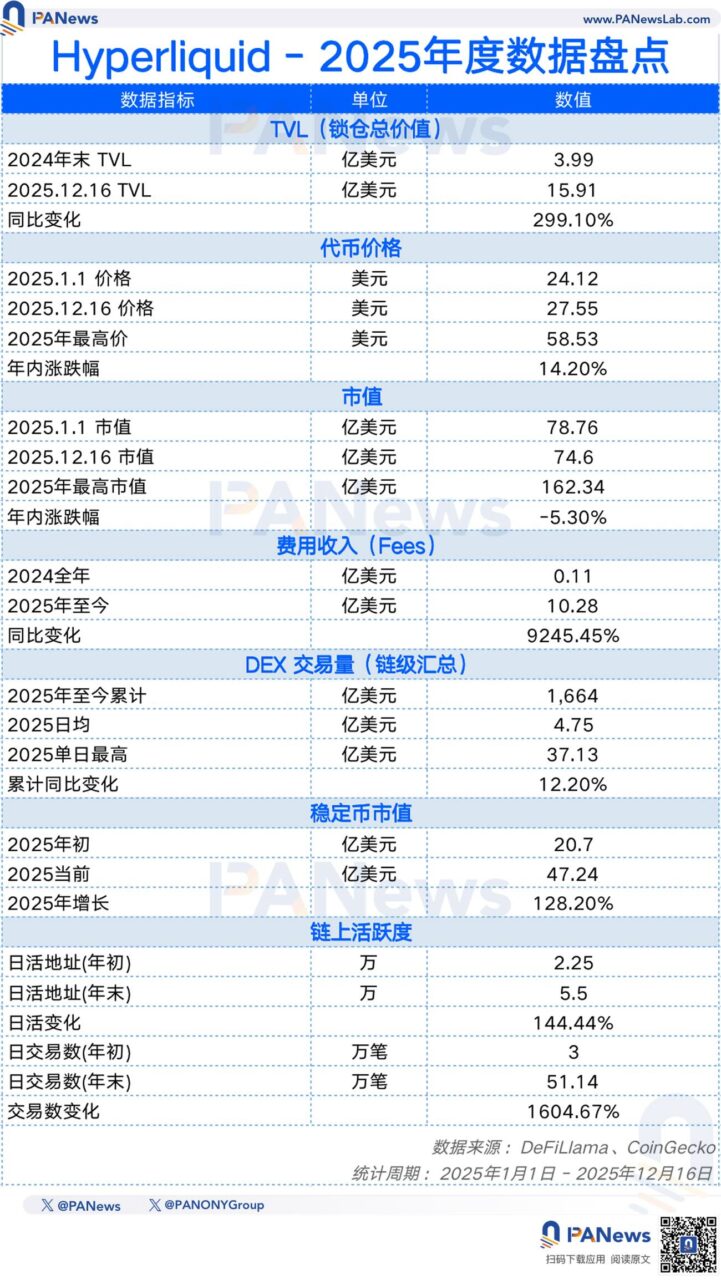

Hyperliquid: The Year’s Dark Horse – Teaching the Industry a Lesson in “Real Yield”

Similar to BNB Chain, Hyperliquid shone brightly in 2025. Aside from a slight decrease in market capitalization (-5.3%) from the beginning of the year, all other metrics showed positive growth, with many experiencing the largest increases among all public chains.

In 2025, Hyperliquid ranked ninth in overall TVL, third in fee generation, sixth in DEX trading volume, and fifth in stablecoin market capitalization. These rankings indicate that Hyperliquid has become a truly mainstream public chain, an impressive achievement for a newcomer in this market. Moreover, it was one of the very few public chains in 2025 that could sustain its entire ecosystem through real revenue, without relying on inflationary incentives.

However, Hyperliquid has recently faced strong competition, with rival platforms like Aster and Lighter rapidly catching up in trading volume. Unbeknownst to many, Hyperliquid, which was a challenger just a year prior, may find its main theme in 2026 shifting to defending its position.

Sui: A Deep Squat Under Unlock Pressure – Poised for Redefinition Post-Bubble Burst

As an emerging public chain that strongly pursued Solana in 2024 and garnered high market expectations, Sui remained relatively quiet in 2025. Data such as its token price decline (-64%) and TVL decrease (-46.8%) among mainstream public chains highlighted the market pressure it faced. This was primarily attributed to Sui entering an “intensive unlock period” in 2025. A significant influx of tokens from early investors and the team entering the market, coupled with a cooling overall market, led to price pressure.

Simultaneously, in terms of ecosystem activity, daily active users and daily transaction counts remained largely flat compared to the beginning of the year, reflecting the root cause of Sui’s dormancy this year: a lack of new narratives and an inability to fully capitalize on the MEME market. However, judging by the growth in financing amounts and DEX trading volume, the capital market has not entirely abandoned Sui. 2026 could be a year of redefinition after the bubble has burst.

Tron: The Ultimate Pragmatist – “Cash Flow King” Deeply Rooted in the Payment Sector

Tron’s trajectory in 2025 established an alternative narrative style for the public blockchain market: quietly flourishing by leveraging the stablecoin boom. Although it experienced approximately a 50% retracement in both TVL and token price, Tron’s consistent performance in the stablecoin market still generated $184 million in on-chain fees (a 126.9% increase) and saw its DEX trading volume expand by 224%. For Tron, rather than chasing hot trends and new narratives, its pragmatic focus on perfecting global stablecoin settlement has made it a public chain with stable cash flow and strong user stickiness.

Reflecting on the public blockchain landscape of 2025, this is more than just an annual report; it’s a panorama of public chain evolution.

The clear “red and black lists” of data tell us that the “wild west” era of a thousand public chains galloping forward is over. It has been replaced by a brutal “zero-sum game” and a trend towards “oligopolization.” Whether it’s Solana’s traffic anxiety after the MEME tide receded, Sui’s price pains under the pressure of token unlocks, or the severe market declines of new public chains like Movement and Scroll, all demonstrate that the false prosperity sustained by VC funding and “points PUA” is no longer viable.

However, amidst widespread declines, we can also discern the evolution of industry resilience. BNB Chain’s explosive ecosystem-wide growth, Hyperliquid’s reliance on exceptional real yield, and Tron’s pragmatic deep dive into the payment sector collectively illuminate the survival rules for 2026: survive not by telling stories, but by making money; not by inflating metrics, but by attracting real users.

The chill of 2025 may have been bone-piercing, but it successfully squeezed out years of accumulated bubbles from the public blockchain space. For the coming 2026, we have reason to believe that on this cleaner, more pragmatic foundation, public chains will no longer merely be speculative casinos but will truly become global financial infrastructure capable of supporting large-scale value exchange.

(The above content is an authorized excerpt and reprint from our partner PANews. Original link)

Disclaimer: This article is for market information purposes only. All content and opinions are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses resulting from investor transactions.