Massive ETH Inflows to Binance Signal Potential Selling Pressure and Bearish Outlook

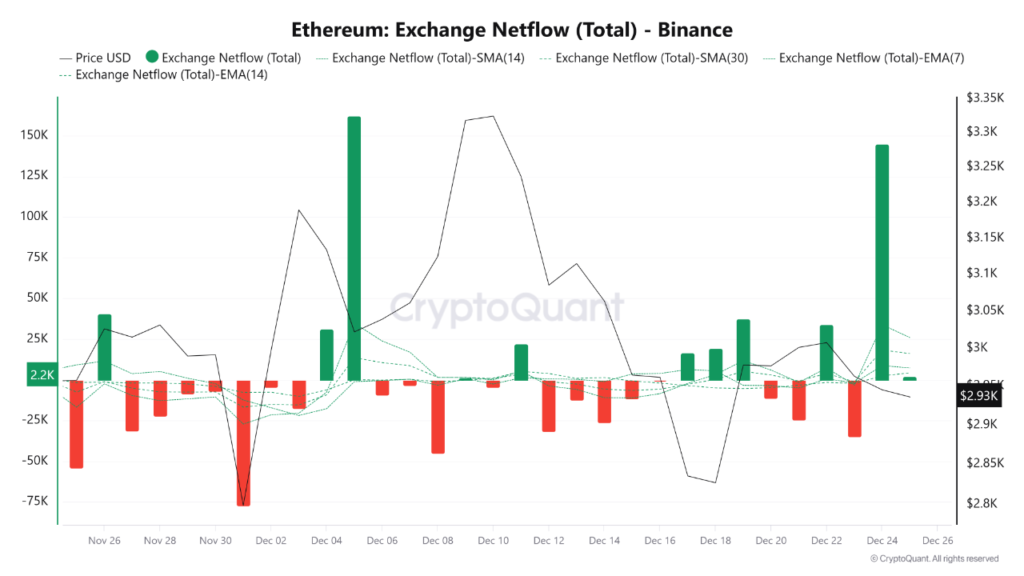

Recent data from CryptoQuant reveals a significant surge in Ethereum (ETH) net inflows to Binance, particularly over the Christmas period from December 24th to 26th. During these three days, over 140,000 ETH flowed into the exchange – marking the largest such influx recorded this year. While the pace of inflows has slightly decelerated since this peak, a consistent positive netflow persists. Historically, such substantial, one-off inflows are often interpreted as a precursor to investors preparing to liquidate their spot ETH holdings.

Analyzing the Netflow Trends: A Signal for Short-Term Weakness

A closer examination of the Netflow indicator’s moving averages further illuminates this trend. Both the 7-day (EMA(7)) and 14-day (EMA(14)) Exponential Moving Averages are showing an upward trajectory, while the 30-day Simple Moving Average (SMA(30)) remains relatively flat. This particular structure is a strong indicator of escalating short-term selling intent. It suggests that investors are strategically positioning themselves to offload ETH as its price approaches key resistance levels.

A closer examination of the Netflow indicator’s moving averages further illuminates this trend. Both the 7-day (EMA(7)) and 14-day (EMA(14)) Exponential Moving Averages are showing an upward trajectory, while the 30-day Simple Moving Average (SMA(30)) remains relatively flat. This particular structure is a strong indicator of escalating short-term selling intent. It suggests that investors are strategically positioning themselves to offload ETH as its price approaches key resistance levels.

Given this underlying pressure, where every upward price movement is likely to be met with selling activity, Ethereum is expected to face considerable challenges in achieving significant short-term gains. The market appears poised for a period of constrained upside potential.

The “Net Inflow-Price Divergence” and Strategic Investor Behavior

While historically, large positive net inflows frequently precede immediate price corrections, the recent influx on December 24th presented a unique scenario. Instead of a sharp price decline, ETH experienced sideways consolidation. This phenomenon points to a “net inflow-price divergence,” indicating that not all ETH transferred to exchanges is being sold instantly. Rather, it suggests a more calculated approach: investors are likely executing a gradual, layered selling strategy, particularly as the price tests crucial resistance zones.

Critical Price Levels: Resistance at $3,080, Support at $2,500

With the net inflow metric firmly in positive territory, the $3,080 level emerges as a formidable price resistance. Should this positive net inflow continue unabated, Ethereum’s price could be challenged to break downwards towards the $2,500 support level. Unless a substantial increase in short-term net outflows is observed, any upward price movement should be viewed with caution, potentially acting merely as a counter-trend rally—an opportune moment for sellers to exit positions.

In its current state, Ethereum appears to be firmly entrenched in a bear market. Until a clear and definitive bottom is established, the prevailing trend is anticipated to remain downward.

Disclaimer: This article is provided for market information purposes only. All content and opinions are for reference only and do not constitute investment advice. They do not represent the views or positions of Blockcast. Investors should make their own decisions and conduct their own trades. The author and Blockcast will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.