Bitcoin’s $87,000 Fortress: On-Chain Data Signals Potential Bullish Shift

As Bitcoin (BTC) navigated a period of tight consolidation over the Christmas holidays, market speculation regarding its next directional move reached a fever pitch. Renowned cryptocurrency trend analyst Murphy (@Murphychen888) recently unveiled a compelling on-chain data analysis on social platform X, asserting that Bitcoin has established formidable support at the $87,000 mark, with the market equilibrium progressively shifting in favor of the bulls.

这段时间 BTC 始终被压制在一个极小的价格区间内盘整,经过换手后,我们看到目前在 $87,000 和 $84,500 这 2 处出现了明显高于其他价格的筹码分布(巨量柱)。

前者累计有 67w 枚 BTC,后者有 65w… https://t.co/JLKpIpBVMn pic.twitter.com/XmW3OJ1HHO

— Murphy (@Murphychen888) December 26, 2025

Unpacking On-Chain Insights: The $87,000 “Massive Volume Bar”

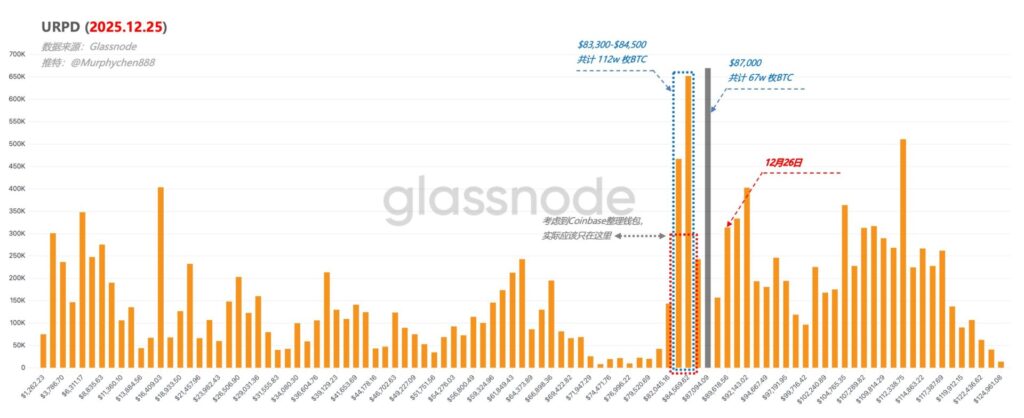

Murphy’s analysis leverages Glassnode’s UTXO Realized Price Distribution (URPD) data, which tracks the price at which unspent transaction outputs (UTXOs) last moved. Following recent periods of significant market turnover and price oscillation, the data reveals a pronounced accumulation of “chips” or coin supply at two key price points: $87,000 and $84,500. These concentrations, significantly higher than other price bands, are what Murphy refers to as “massive volume bars,” indicating strong historical transaction activity.

Filtering the Noise: True Support at $87,000

While both $87,000 and $84,500 show substantial turnover, Murphy emphasizes the importance of discerning true economic activity from “noise” in the data. He highlights a critical factor: “On November 22, Coinbase executed a large-scale wallet consolidation. This event generated a significant volume of UTXO records in the $83,300 to $84,500 range that do not represent genuine buying and selling transactions.” Murphy clarifies, “Of the 112,000 BTC currently observed in the $83,300-$84,500 range, at least half should be discounted as true turnover. When adjusted, the $87,000 level emerges as the most substantial ‘massive volume bar’ and, crucially, the strongest structural support in the current chip distribution.”

This refined perspective underscores a pivotal moment for Bitcoin. Should the $87,000 support pillar hold firm, it would unequivocally signal a bullish market shift, potentially propelling prices beyond the recent $85,000-$87,000 range to new highs. Despite prevailing concerns, recent trading patterns show BTC hovering near these critical thresholds, testing resistance at $85,200. Concurrently, consistent ETF inflows and ongoing whale accumulation hint at an underlying resilience that could bolster this upward trajectory.

The Bull-Bear Confluence: Price Action Above Key Accumulation Zones

Murphy elaborates on the broader market implications of such concentrated chip accumulation. “Historically, when a significant volume of chips converges within a narrow price band to form a ‘massive volume bar,’ it typically presages an imminent market direction decision. This accumulation fundamentally represents a divergence between bullish and bearish forces, where the outcome becomes clear once the tug-of-war reaches its critical inflection point.”

Offering an optimistic interpretation of the latest movements on December 26, Murphy observed a crucial development: “As of midnight GMT, BTC’s price has begun to move ‘to the right’ of the $87,000 ‘massive volume bar’—meaning the current price is now above this significant cost accumulation zone.” This, Murphy states, is a strong indicator that “this support level is effective, and the balance of power between diverging market participants is now tilting in favor of the bulls.”

Broader Market Dynamics and the Road Ahead

Murphy’s assessment is further reinforced by broader market dynamics. Bitcoin has been grappling with a downtrend originating from its $126,000 peak, struggling to decisively break above $90,000, yet consistently finding strong buying interest in the $84,000-$84,500 region. While data from CryptoQuant suggests some large holders are offloading assets, counter-signals such as oversold indicators and an average ETF entry price of $86,530 imply the formation of a higher market bottom. A successful defense of the $87,000 level could lay the groundwork for a significant rally towards $100,000.

The $84,500 support level aligns with previous lows and key technical retracement points. A failure to hold this level could see BTC retest $80,000, although optimistic analysts like BitBull anticipate robust buying activity there, positioning it as a potential foundational level for 2026.

As year-end low liquidity often fuels heightened volatility, Murphy’s analysis positions $87,000 as the definitive line in the sand between bullish and bearish dominance. A sustained hold above this level could ignite substantial upward momentum, particularly as alternative cryptocurrencies show signs of waning, bringing renewed focus to BTC’s market dominance. Traders are keenly observing for a confirmed breakout above the $88,000-$90,000 resistance zone. Current strategies lean towards initiating long positions on bounces from $85,000, with targets set above $87,000. This intricate market setup leaves Bitcoin at a pivotal directional crossroads as 2025 draws to a close, blending cautious observation with significant potential opportunity.

For investors, the $87,000 mark transcends a mere short-term bull-bear divide; it stands as a crucial barometer for whether this anticipated Christmas rally can sustain its momentum and extend robustly into early 2026.

Disclaimer: This article is provided for market information purposes only. All content and views are for reference only and do not constitute investment advice, nor do they represent the views and positions of BlockBeats. Investors should make their own decisions and trades, and the author and BlockBeats will not bear any responsibility for direct or indirect losses resulting from investor transactions.