Cryptocurrency’s Quiet Christmas: Bitcoin Stagnates While Precious Metals Shine Amidst Shifting Market Tides

As the festive season of Christmas 2025 unfolded, a stark contrast emerged in the global financial landscape. While silver jubilantly celebrated breaking past the $70 mark to reach new historical highs, Bitcoin remained notably subdued, languishing in a narrow band around the $88,000 level. This quiet performance fueled a resurgence of “crypto is dead” narratives across social media and within the cryptocurrency community.

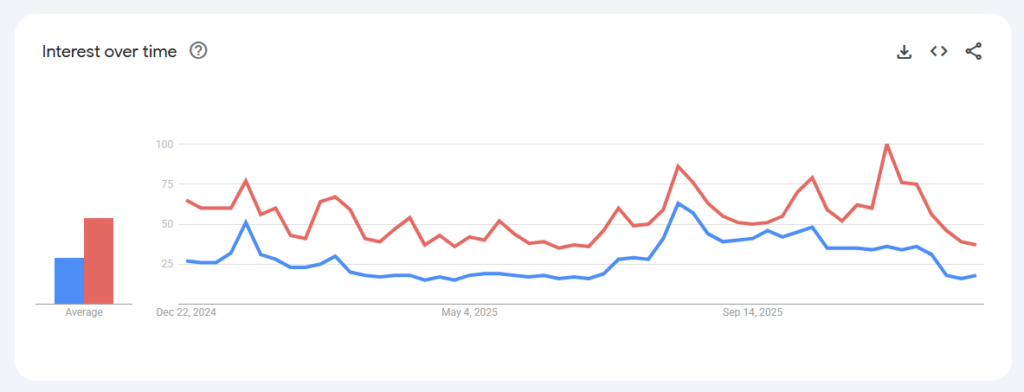

A significant indicator of this flagging interest was the Google keyword search trend. Searches for “cryptocurrency” and “Bitcoin” plummeted to a new low for 2025. Historically, Google search trends have served as a reliable barometer for the crypto market; periods of declining interest, often coinciding with price drops and a lack of compelling new narratives, typically see a corresponding dip in search volumes, signaling a bear market sentiment.

This downturn in market interest isn’t entirely new. Following a major market crash on October 11th, which saw an estimated $20 billion in cryptocurrency positions liquidated, Google search trends for “cryptocurrency” have been on a consistent downward trajectory. While “Bitcoin” searches briefly spiked immediately after this event—likely as investors sought to understand the unfolding crisis—this surge was short-lived, with search volumes quickly resuming their sharp decline, ultimately hitting their annual low by Christmas.

Beyond the immediate impact of investor liquidations forcing participants out of the market, several factors contributed to this subdued performance. The crypto space has been grappling with a dearth of fresh, compelling narratives to attract new capital. Simultaneously, traditional markets, including US stocks, artificial intelligence (AI) related assets, gold, and silver, have been consistently hitting new all-time highs. This robust performance in conventional sectors has siphoned off significant liquidity, leading to capital flight from the cryptocurrency market and contributing to its sustained price stagnation.

As 2025 draws to a close, it is almost certain that holding Bitcoin or other cryptocurrencies from the beginning of the year would have resulted in underperforming the broader market. Surprisingly, the true champions of 2025 were gold and silver. This unexpected rally in precious metals can be interpreted as a clear signal of investor pessimism regarding the economic outlook, perhaps even anticipating a “black swan” event that could trigger a wider economic collapse. Consequently, investors flocked to these traditional safe-haven assets.

This trend further challenges the long-standing narrative of Bitcoin as a digital safe-haven asset. In times of perceived risk and uncertainty, investors appear to have prioritized traditional precious metals, even selling off their crypto holdings earlier than conventional stocks. This behavior has unfortunately positioned cryptocurrency holders as significant underperformers in the 2025 investment landscape.

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of the author or BlockBeats. Investors should make their own decisions and trades, and the author and BlockBeats will not bear any responsibility for direct or indirect losses resulting from investor transactions.