California’s ambitious proposal to levy a 5% wealth tax on its wealthiest residents has ignited a firestorm of opposition from prominent cryptocurrency executives and technology titans. Critics vehemently argue that such a measure, targeting even unrealized gains, would trigger a mass exodus of entrepreneurs and capital from the Golden State, threatening its status as a global innovation hub.

The controversial “2026 Billionaire Tax Act” aims to impose a one-time 5% wealth tax on individuals and entities with net assets exceeding $1 billion. This legislative initiative is designed to bolster California’s healthcare system and state aid programs, particularly as impending federal funding cuts loom. A key point of contention is that the proposed tax would apply to unrealized gains, potentially forcing some billionaires to liquidate stocks or parts of their businesses to meet the tax obligation. While taxpayers would have the option to pay the sum upfront or in installments over five years with interest, the implications for illiquid assets are significant.

The “Final Straw” for Silicon Valley?

Crypto executives and tech leaders are sounding alarm bells, warning of a potential mass exodus of capital and talent from California. The “2026 Billionaire Tax Act,” slated for a vote in November 2026, specifically targets unrealized gains from assets such as stocks and digital currencies. This provision could compel asset holders to sell off holdings simply to cover their tax bill.

The proposal, filed with the California Attorney General in November 2025 as “Initiative 25-0024A1,” would apply to individuals residing in the state as of January 1, 2026, taxing all forms of personal wealth, encompassing both tangible and intangible assets.

Backed by the SEIU United Healthcare Workers West union, the bill is projected to generate up to $100 billion in revenue. Proponents argue that this substantial sum is crucial for strengthening the state’s healthcare system, childcare, housing, and education, especially in anticipation of federal funding reductions.

However, critics contend that taxing “phantom profits” on unsold holdings, particularly in volatile sectors like cryptocurrency, is fundamentally flawed and could disproportionately impact these industries. The payment structure, allowing for a lump sum or five-year installments with interest, does little to assuage concerns about liquidity and the potential need for forced asset sales.

Industry Outcry and Economic Warnings

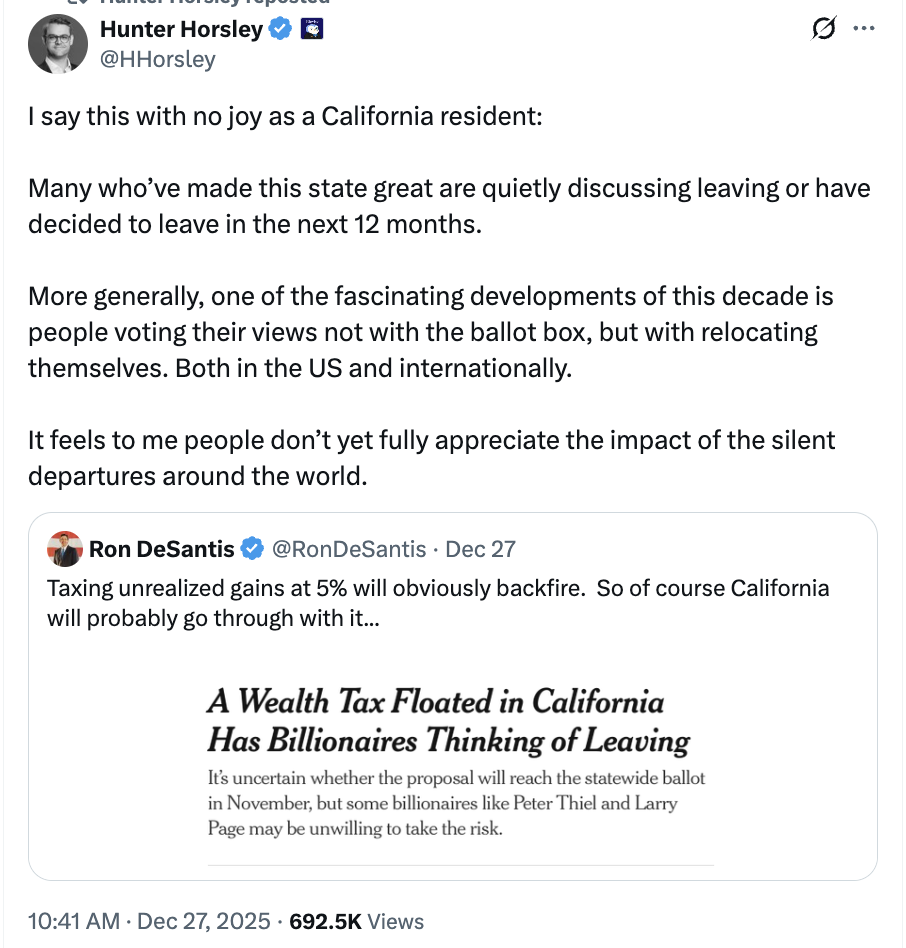

Leaders in the cryptocurrency space have been vocal in their opposition, branding the tax as a direct threat to innovation and economic growth. Hunter Horsley, CEO of Bitwise Asset Management, highlighted a recent California State Auditor’s report uncovering billions in unaccounted or unsubstantiated expenditures. He urged legislators to address fiscal waste, stating, “Politicians have long forgotten their duty is to be servants.”

Jesse Powell, co-founder of crypto exchange Kraken, branded the proposal the “final straw,” predicting that billionaires, along with their spending, philanthropy, and job creation, would simply relocate.

A 5% theft of unrealized gains and assets taxes were already paid on is about the most retarded thing I’ve ever heard. I promise you this will be the final straw. Billionaires will take with them all of their spending, hobbies, philanthropy and jobs. Solve the waste/fraud issue. https://t.co/DKcNWni2kB

— Jesse Powell (@jespow) December 28, 2025

Nic Carter, founding partner at Castle Island Ventures, questioned the proposal’s understanding of capital fluidity, suggesting that a one-time wealth tax often signals future levies and likening it to a “sovereign default.” He cited Norway’s experience, where a similar tax led to over half of its top 400 taxpayers leaving, resulting in lower-than-expected revenue. Fredrik Haga, co-founder of Dune, echoed this sentiment, stating it left the country “poorer and worse off.”

The Specter of an “Innovation Death Spiral”

Discussions on the X platform have amplified these concerns, with users warning of an impending “innovation death spiral” that could see California’s tech dominance shift to other states like Wyoming or international hubs such as Singapore.

The opposition extends beyond the crypto sector. Reports suggest that tech giants like PayPal co-founder Peter Thiel and Alphabet (Google’s parent company) co-founder Larry Page are reportedly preparing contingency plans to depart California should the bill pass, reflecting broader anxieties across Silicon Valley.

Peter Thiel is leaving California if we pass a 1% tax on billionaires for 5 years to pay for healthcare for the working class facing steep Medicaid cuts.

I echo what FDR said with sarcasm of economic royalists when they threatened to leave, “I will miss them very much.” https://t.co/5N8FxBqJww

— Ro Khanna (@RoKhanna) December 27, 2025

Defending the tax is Democratic Congressman Ro Khanna from California’s 17th district, a self-described crypto-friendly legislator. Through a series of X posts, Khanna argued that the tax would fund improvements in childcare, housing, and education, which he believes would ultimately benefit American innovation. He contends that investing in human capital will foster long-term innovation, emphasizing the societal benefits. The initiative, conceptualized by a law professor at the University of Missouri, aims to address wealth inequality amidst California’s budgetary pressures.

Economic Realities and Unpredictable Outcomes

Economists remain divided on the potential consequences. While wealth taxes have faced challenges elsewhere—like Norway, which scaled back its version after capital outflows—supporters point to California’s unique, resilient venture capital and startup ecosystem. However, critics highlight significant practical hurdles, including the complex valuation of illiquid assets such as private equity or art, liquidity issues, and the challenge of enforcing collections, with an estimated 20-40% underreporting rate.

The California Legislative Analyst’s Office (LAO) noted that revenue from such a tax is “highly unpredictable.” Furthermore, the LAO warned that an exodus of billionaires could cost the state billions of dollars annually in ongoing income, capital gains, property, and sales taxes—far exceeding the one-time gain. Even if the full $100 billion is raised, it would only cover about one year’s expenses and would not resolve structural deficits or the projected $30 billion annual federal funding loss.

An analysis by Pillsbury Law termed it “the billion-dollar question,” pointing out that the tax’s broad scope could trap crypto treasuries and other illiquid assets, exacerbating volatility in an industry still recovering from the 2022 market downturn. As one X post succinctly put it: “Crypto capital may vote with its feet,” underscoring fears of offshore migration.

As the 2026 election approaches, this heated debate underscores the inherent tension between progressive taxation goals and California’s enduring ambition to maintain its preeminent position as a global technology and innovation hub.

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockTempo. Investors should make their own decisions and transactions. The author and BlockTempo will not bear any responsibility for direct or indirect losses resulting from investor transactions.