Bitcoin Futures Trading Sees Sharp Decline in December, Investor Interest Shifts

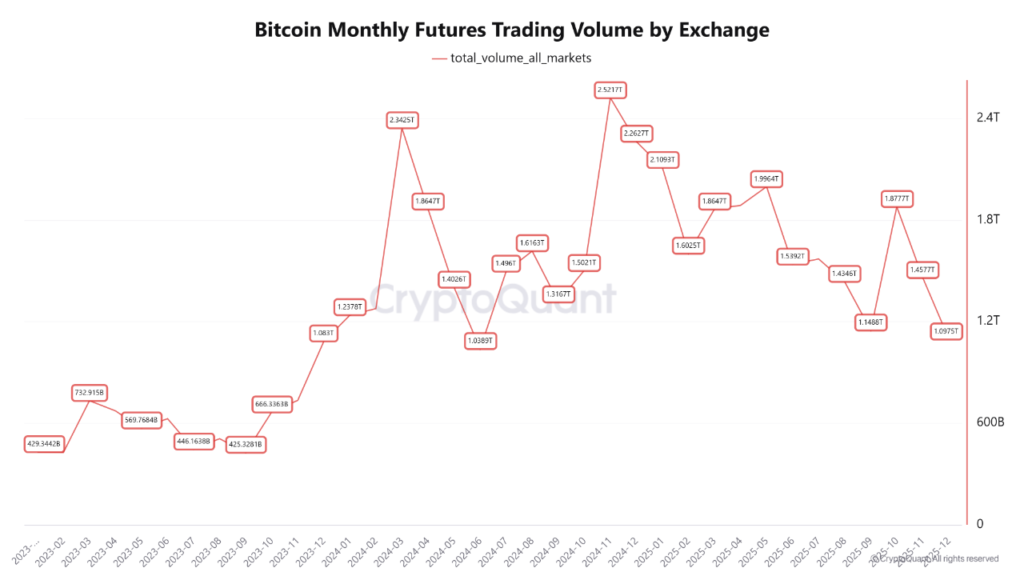

The landscape of cryptocurrency derivatives witnessed a significant cooling in December, with Bitcoin futures trading volume on centralized exchanges reaching its lowest point since June 2024. According to data from CryptoQuant, the total trading volume across major platforms plummeted to approximately $1.09 trillion. This marks a substantial deceleration compared to the peak of $2.52 trillion recorded in December 2023, signaling a notable decline in investor appetite for futures contracts. Intriguingly, December’s figures also fell below the activity seen in September 2024, which had previously been the year’s weakest month.

Despite the overall market slowdown, specific exchanges maintained their competitive standings. Binance continued to assert its market dominance, processing an impressive volume of approximately $443.28 billion. Following its lead were OKX, with roughly $193.08 billion, and Bybit, contributing about $184.5 billion to the total. The remaining volume was distributed among other platforms, including Bitget, which recorded around $80.92 billion. Binance’s overwhelming market share, accounting for over 40% of the total futures trading volume, underscores its enduring position as a leader in the crypto derivatives space.

The primary driver behind this widespread reduction in trading activity appears to be the decreased volatility of Bitcoin prices during the final quarter of 2024. A more stable price environment often diminishes the appeal of high-risk futures contracts for traders seeking opportunities in price swings. Consequently, a discernible portion of liquidity has seemingly migrated towards alternative markets. Notably, traditional assets like U.S. equities and, more recently, the burgeoning precious metals futures market have attracted capital that might otherwise have flowed into crypto derivatives.

While the derivatives market remains active, the intense enthusiasm and high-frequency trading characteristic of previous periods have evidently subsided. The persistent downtrend in trading volume suggests that investors are actively re-evaluating the risk-reward proposition of cryptocurrency futures in a less volatile price climate. Unexpectedly, the latter half of 2024 saw precious metals, particularly gold and silver, exhibit greater price volatility than cryptocurrencies, proving to be a compelling magnet for short-term speculative capital.

Disclaimer: This article is intended solely to provide market information. All content and views are for reference only, do not constitute investment advice, and do not represent the opinions or positions of BlockTempo. Investors should make their own decisions and conduct their own transactions. The author and BlockTempo shall not be held liable for any direct or indirect losses incurred by investors as a result of their trading activities.