As 2026 officially kicks off, Bitcoin bulls are finally witnessing a long-awaited glimmer of hope. A confluence of on-chain indicators is simultaneously flashing bullish signals, including a rebound in the Coinbase Premium, a recovery in the Fear & Greed Index, and the Long/Short Ratio holding firm above 1.0 even after a period of deleveraging. These metrics collectively suggest a gradual repair of the underlying market structure.

As of 10 AM today (the 5th), Bitcoin has impressively climbed back to $93,000, shaking off the gloom of its late December dip below $87,000. However, despite the improving price action, market sentiment remains notably fragile. Analysts caution that until broader macroeconomic uncertainties fully dissipate, investors should maintain a prudent stance, advising against overly aggressive short-term plays.

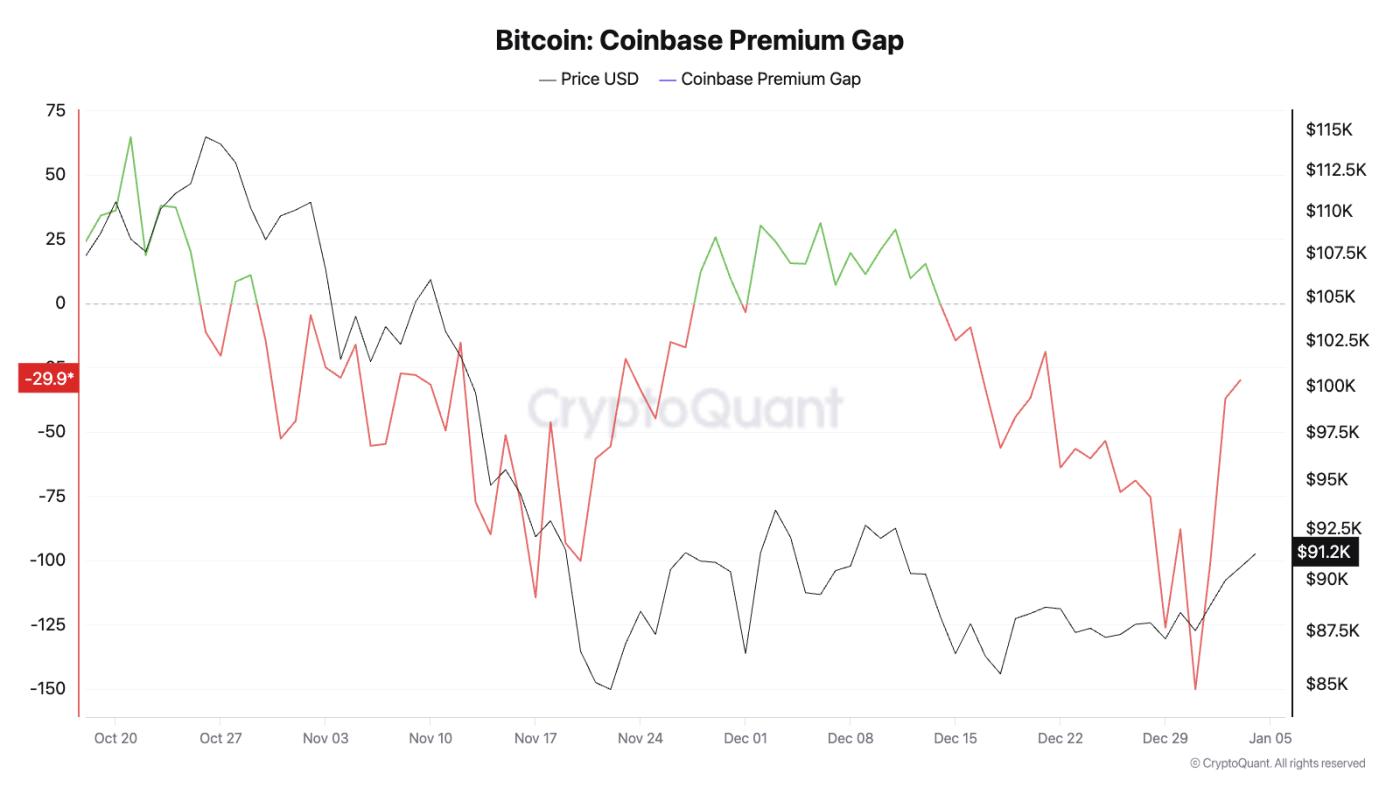

Institutional Resurgence: The Coinbase Premium Reversal

Among the most compelling bullish signals is the renewed capital flow from U.S. investors, particularly institutions. The “Coinbase Premium Index,” a vital gauge measuring the disparity in buying power between the U.S. and global markets, is currently staging a significant V-shaped reversal. After plummeting to -150 in late December, it has now substantially recovered, nearing the crucial zero axis.

This shift indicates that following the year-end accounting and selling pressure, U.S. institutional investors are re-entering the “buy side.” Should the Coinbase Premium Index decisively turn positive and stabilize, it would unequivocally confirm the official return of “USD buying pressure”—a historically reliable leading indicator for sustained Bitcoin rallies.

Escaping “Extreme Fear”: Market Sentiment Warms

Market sentiment has also shown concurrent improvement. The “Crypto Fear & Greed Index,” which synthesizes data from volatility, trading volume, social media sentiment, and market momentum, has rebounded from 29 last week to a more encouraging 40.

This upward movement signifies a formal exit from the “extreme fear” capitulation zone. While values may vary across platforms (e.g., CoinGlass showing 26, Binance at 40), the overarching trend of subsiding panic and returning confidence is now distinctly clear.

Derivatives Stability: Bulls Maintain Their Edge

Support for the bullish narrative also emanates from the derivatives market. Bitcoin’s “Long/Short Ratio,” despite a recent pullback due to deleveraging activities, has steadfastly held above the critical 1.0 threshold.

A Long/Short Ratio exceeding 1.0 indicates that the capital deployed in futures contracts betting on price increases (longs) outweighs that betting on decreases (shorts). Current data suggests a healthy cooling of the market structure rather than a panic-driven collapse, thereby mitigating the risk of large-scale cascading liquidations in the near future.

The Persistent Call for Prudence

Despite these encouraging indicators, the market is not without its discernible risks. Firstly, while the Fear & Greed Index has improved, it still resides within the broader “fear” zone, reflecting ongoing investor skepticism regarding the U.S. Federal Reserve’s (Fed) policy trajectory. This uncertainty has been particularly amplified after the hawkish signals embedded within the December FOMC meeting minutes, prompting a readjustment of market expectations for interest rate cuts.

Furthermore, the recent price rebound might partly be attributed to the conclusion of year-end “tax-loss selling pressure”—where investors sell losing assets to offset capital gains. This could represent a technical rebound rather than a comprehensive return of conviction.

Analysts underscore that to confirm a complete trend reversal, a “decisive positive turn” and sustained stability in the Coinbase Premium Index will be essential to validate the full-scale entry of institutional capital.

Outlook for Early 2026

Overall, the confluence of returning institutional buying interest, improving sentiment, and stable bullish positioning lays an optimistic foundation for Bitcoin’s performance in early 2026.

However, with fear not entirely dissipated and macroeconomic headwinds still present, traders’ current strategies are leaning towards “cautious accumulation” rather than “blindly chasing highs.” In navigating the recent market volatility, this measured approach may prove to be the most rational choice.

Disclaimer: This article is intended solely for market information purposes. All content and opinions are for reference only and do not constitute investment advice, nor do they represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not be liable for any direct or indirect losses incurred by investors’ trading.