Meme Coins Lead the Charge: A Surprising Crypto Market Revival in Early 2026

Following a particularly challenging fourth quarter of 2025, the cryptocurrency market is finally exhibiting encouraging signs of recovery as we step into early 2026. What has caught many observers by surprise is the unexpected catalyst for this nascent rally: not Bitcoin or Ethereum, but the volatile yet captivating world of meme coins. After a period of subdued holiday trading and overall market lethargy, these digital assets are making a formidable comeback, reigniting investor interest and liquidity across the board.

Is the Capital Rotation Cycle Repeating? Unpacking the Meme Coin Surge

The current resurgence of meme coins, while seemingly sudden, is not entirely without precedent. The tail end of 2025 was marked by significant market illiquidity and pervasive FUD (fear, uncertainty, and doubt), pushing retail investor risk appetite to its lowest point of the year. Meme coin market capitalization plummeted by over 65%, hitting a yearly low of $35 billion on December 19th. However, in the post-Christmas period, as Bitcoin remained range-bound and mainstream assets lacked clear directional momentum, capital naturally gravitated towards more agile, high-beta opportunities. Meme coins, with their inherent volatility and potential for rapid gains, perfectly filled this vacuum.

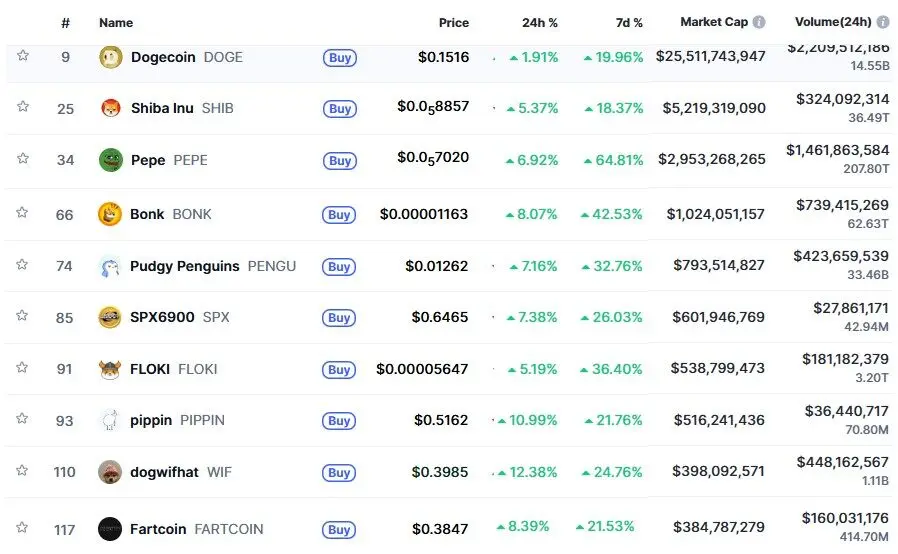

The data unequivocally supports this narrative. According to CoinMarketCap, the total market capitalization for meme coins has now exceeded $47.7 billion, representing a robust increase of nearly $10 billion from its $38 billion valuation on December 29, 2025. Leading this charge are the top three meme coins: DOGE, which saw a weekly surge of nearly 20%; SHIB, climbing 18.37%; and PEPE, which impressively gained 64.81%.

Accompanying this market cap explosion, trading volumes for meme coins have also skyrocketed. From $2.17 billion on December 29, 2025, daily trading volume dramatically leaped to $8.7 billion this past Monday – a staggering 300% increase.

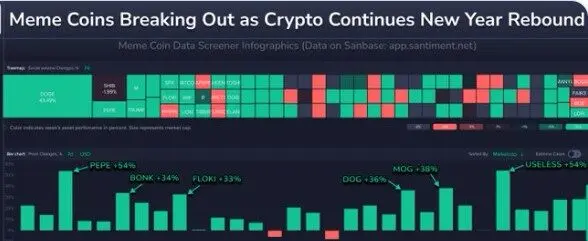

Crucially, this isn’t merely an isolated “pump” of a single token. The current meme coin rally signifies a broad-based sector recovery, characterized by widespread participation. The synchronized amplification of social media discussions and on-chain trading volumes further indicates a genuine return of attention and liquidity to this segment, rather than a superficial price manipulation.

Technical Alignment: A Solid Foundation for the Meme Coin Rebound

As one of the highest-risk categories within cryptocurrency, a robust rebound in meme coin prices often signals a renewed willingness among investors to embrace higher risk. A look at the broader technical landscape supports this view. The TOTAL3 indicator, which represents the total market capitalization of all crypto assets excluding Bitcoin, illustrates a crucial shift. As depicted in the accompanying chart, the market has transitioned from a definitive downtrend into a recovery phase, suggesting a change in investor sentiment from “sell the bounce” to a more optimistic “buy the dip” mentality.

Currently, TOTAL3 is rigorously testing a pivotal resistance level around $848 billion. This zone is significant as it converges with both the 200-day moving average and the mid-term trend line. A decisive breakout above this level, supported by strong trading volume, could propel the technical target towards $900 billion, thereby creating substantial headroom for sustained rallies across both altcoins and meme coins.

Internally, the meme coin sector displays clear characteristics of systemic strengthening. The recent surge isn’t confined to a single asset but encompasses a diverse range of tokens including PEPE, BONK, DOGE, FLOKI, and MOG, spanning both the Ethereum and Solana ecosystems. Such widespread participation typically indicates a sector-wide allocation of capital, rather than mere speculative plays on individual assets. Historical market cycles further corroborate this pattern: during periods of Bitcoin consolidation, high-beta assets frequently lead the initial rebound, effectively testing the market’s overall risk appetite.

Leverage and Sentiment: Bulls Charge In, But Risks Accumulate

The meme coin derivatives market is also experiencing a rapid escalation in activity. Coinglass data reveals a significant surge in open interest (OI) over the past 24 hours. DOGE’s OI climbed an impressive 45.41%, reaching $1.941 billion, while PEPE saw a 33.32% increase, pushing its OI to $514 million. SHIB recorded a substantial 93.66% growth, and WIF surged by 126%. (Note: Specific data for PENGU was not available in the original source).

Open interest is a crucial metric, often considered the litmus test for “real money” entering the market, as it reflects the total volume of outstanding derivative contracts that have yet to be settled. The current meme coin price rally is unequivocally validated by a synchronized increase in both open interest and trading volume. Leading assets like PEPE and DOGE demonstrate this trend, with derivatives trading volume significantly amplifying alongside price appreciation. This synchronicity typically signals robust bullish momentum, indicating that leveraged traders are actively opening new contracts in anticipation of further price increases, suggesting genuine long position building rather than mere short covering.

However, the rapid expansion of open interest simultaneously implies a growing accumulation of leverage exposure. Given the inherently limited fundamental support for meme coin assets and their high reliance on sentiment for pricing, increased activity on high-leverage platforms can dramatically amplify short-term volatility. Historically, meme coins have often served as the “canary in the coal mine” for market trends: they are among the first to reflect shifts in risk appetite but also the most susceptible to sharp declines when sentiment reverses. Should market conditions turn or external shocks emerge, an overconcentration of long positions could trigger rapid deleveraging and cascading liquidation risks. Thus, while derivatives data currently offers positive validation for the rebound, its underlying structure also necessitates a vigilant awareness of potential short-term pullback risks.

Altcoins Poised to Follow? Solana’s Potential Gains from the Meme Coin Wave

According to analysis from on-chain platform Santiment, shared on X (formerly Twitter), the current meme coin rebound commenced just days after Christmas, a period when FUD among retail traders had reached its zenith. This aligns with a historical pattern where the crypto market’s earliest rebounds often occur in asset classes least favored by retail investors at their lowest sentiment points.

As market capital begins to diversify beyond the traditional majors and into “other” segments like meme coins, altcoins could soon experience their own rally. Historical data suggests that among altcoins, Solana (SOL) has consistently been a primary beneficiary of meme coin frenzies.

Meme coins have undeniably served as a significant growth engine for Solana, fueling user activity and cultural relevance over recent years. This vibrant engagement has been instrumental in attracting both developers and traders to the network, playing a crucial role in the resurgence of Solana’s decentralized finance (DeFi) ecosystem. Yet, the prominence of meme coin trading has also shaped investor and institutional perceptions, frequently associating Solana’s growth trajectory with speculative cycles.

Igor Stadnyk, Co-founder and Head of AI at True Trading, acknowledges that meme coins are now an integral part of Solana’s cultural identity and a powerful liquidity magnet for users. However, he posits that Solana’s next phase of sustainable growth will likely stem from applications that rely less on viral speculation and more on consistent, robust execution – such as on-chain perpetual futures and AI-native trading agents.

A Prelude to Recovery, or a Classic Bull Trap?

Despite the undeniable excitement, the lingering question within the crypto community is whether this meme coin frenzy is a genuine prelude to a broader market recovery or merely another sentiment-driven, fleeting rebound – a classic bull trap. The market, after all, has yet to fully escape its prolonged slump.

Optimists interpret the robust meme coin rally as a definitive return of risk appetite to the crypto market, anticipating a subsequent surge in altcoins and eventually, mainstream assets. However, a more cautious perspective points to unsettling similarities with past “bull traps”: the heavy reliance on social media momentum, amplified leverage, and prices still significantly below historical highs. For discerning traders, this is not a signal for unbridled FOMO (fear of missing out), but rather a critical phase demanding rigorous discipline, swift responsiveness, and stringent risk management.

One thing, however, is unequivocally clear: meme coins have ignited the first significant market movement of 2026. Whether this momentum will illuminate the path to a new bull run or prove to be an unsustainable blaze that ultimately harms the market remains to be seen. The answer, undoubtedly, will unfold rapidly.