Bitcoin Navigates Critical Juncture: Price Levels, On-Chain Signals, and Macroeconomic Headwinds

Following a notable breach of the $94,000 mark two days prior, Bitcoin (BTC) encountered a sharp correction yesterday. Despite this, the daily price has commendably held above the vital $92,000 threshold. This resilience is crucial, as a sustained dip below $91,000 would signal a potential return to a bearish trend, as previously highlighted. Should BTC demonstrate a decisive rebound in the immediate future, it could align with a broader rally in US equities. However, a confirmed resumption of a bullish ascent hinges on a definitive break above $97,000. Given the substantial selling pressure currently observed around the $94,000 level, achieving this higher resistance point appears challenging in the near term. Consequently, maintaining the $91,000 support level remains the paramount objective for now.

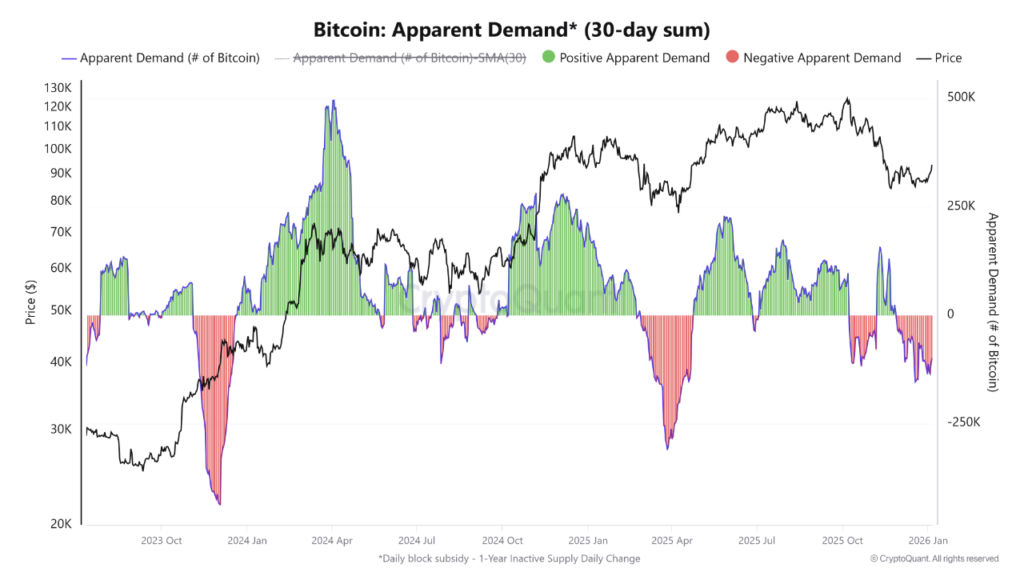

Transitioning to on-chain analytics, despite BTC’s recovery above $92,000, the underlying demand within the network remains subdued. A more robust surge in on-chain activity is imperative to furnish the necessary support for a sustained push past the $97,000 barrier. In an environment characterized by ambiguous market sentiment and diminished trading volumes, a significant uptick in on-chain engagement has yet to materialize. Nevertheless, with the holiday period drawing to a close, a return of previously less active investors is anticipated, potentially catalyzing a shift in this landscape over the coming days.

Adding another layer of complexity, the United States is set to unveil a series of critical economic data releases over the next three days, commencing today. Tonight’s ‘small non-farm payrolls’ report is particularly under the spotlight. The significance of this December data is amplified by the fact that November’s figures were impacted by a government shutdown, leading to delayed or incomplete reporting. Therefore, the upcoming December release will serve as a crucial benchmark for economic health. While current market consensus largely discounts an interest rate cut by the Federal Reserve this month, these forthcoming data points will be instrumental in shaping expectations for future rate adjustments. Investors should brace for potential market volatility as these figures are absorbed and interpreted.

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice, nor do they represent the views and positions of the author or publication. Investors should make their own decisions and trades. The author and publication will not be held responsible for direct or indirect losses incurred by investors’ transactions.