2025 Blockchain Investment Report: CeFi’s Resurgence, Web3 Gaming’s Retreat, and the Rise of Prediction Markets

In 2025, the blockchain investment landscape underwent a significant transformation, shifting from a broad-based speculative approach to a more focused, quality-driven strategy. This pivotal year saw Centralized Finance (CeFi) reclaim the spotlight with unprecedented funding, the convergence of Web3 and AI steadily gain traction, and core infrastructure alongside Decentralized Finance (DeFi) maintain their foundational strength. Conversely, the once-booming Web3 gaming sector experienced a dramatic cooling.

PANews meticulously tracked 839 disclosed primary market financing events within the blockchain sector in 2025. This comprehensive analysis, following over $23.7 billion in capital flow, offers critical insights into investor priorities and illuminates the trajectory of emerging high-value areas.

Overall Market Dynamics: Funding Surges Amidst Fewer Deals

The 2025 blockchain primary market witnessed a compelling paradox: a substantial increase in total capital inflow despite a reduction in the number of individual financing events. PANews’ statistics reveal over $23.7 billion poured into 839 deals, marking a significant leap from 2024’s $9.3 billion. However, the transaction count fell by approximately 33.6% from 1,259 deals in 2024. This trend signals a maturing market where larger, more strategic investments are prioritized.

This resurgence brings 2025’s investment levels to roughly half of the peak seen during the 2022 bull market, which recorded 1,660 deals totaling over $34.8 billion. The market’s recovery, though substantial, was not uniform, exhibiting two distinct peaks in capital inflow.

Similar to previous years, 2025 experienced pronounced funding surges, primarily concentrated between March-May and October-November. These periods were heavily influenced by several mega-financing events:

- March: Abu Dhabi’s MGX made a $2 billion minority stake investment in Binance.

- October: ICE, parent company of the NYSE, strategically invested $2 billion in Polymarket, valuing the prediction market at $9 billion.

- October/November: Prediction market Kalshi raised over $300 million at a $5 billion valuation, followed by another $1 billion round in November, boosting its valuation to $11 billion.

Beyond direct investments, significant M&A activities also shaped the landscape:

- March: Kraken acquired NinjaTrader for $1.5 billion.

- April: Ripple purchased Hidden Road for $1.25 billion.

- May: Coinbase made the largest transaction of the year, acquiring Deribit for $2.9 billion.

Following a tranquil second and third quarter, the market ignited in October, marking the primary market’s hottest month. It saw 87 deals and over $3.9 billion in capital, demonstrating a surge in both volume and value. However, November saw a sharp decline in deal count to 52, the year’s lowest, as the secondary market softened. Despite this, major single investments, such as Kalshi’s $1 billion round and Ripple’s $500 million strategic injection, maintained high monthly funding totals.

Overall, investor preferences gravitated towards Centralized Finance (especially stablecoins and payments), robust infrastructure companies, and the high-growth potential of exchanges and prediction markets.

[IMAGE-PLACEER-1]

For a detailed breakdown, PANews categorized projects into key verticals: DeFi, Web3 Gaming, Infrastructure & Tools, AI, Centralized Finance, and ‘Other Web3 Applications’ (encompassing prediction markets, DePIN, social, DeSci, etc.).

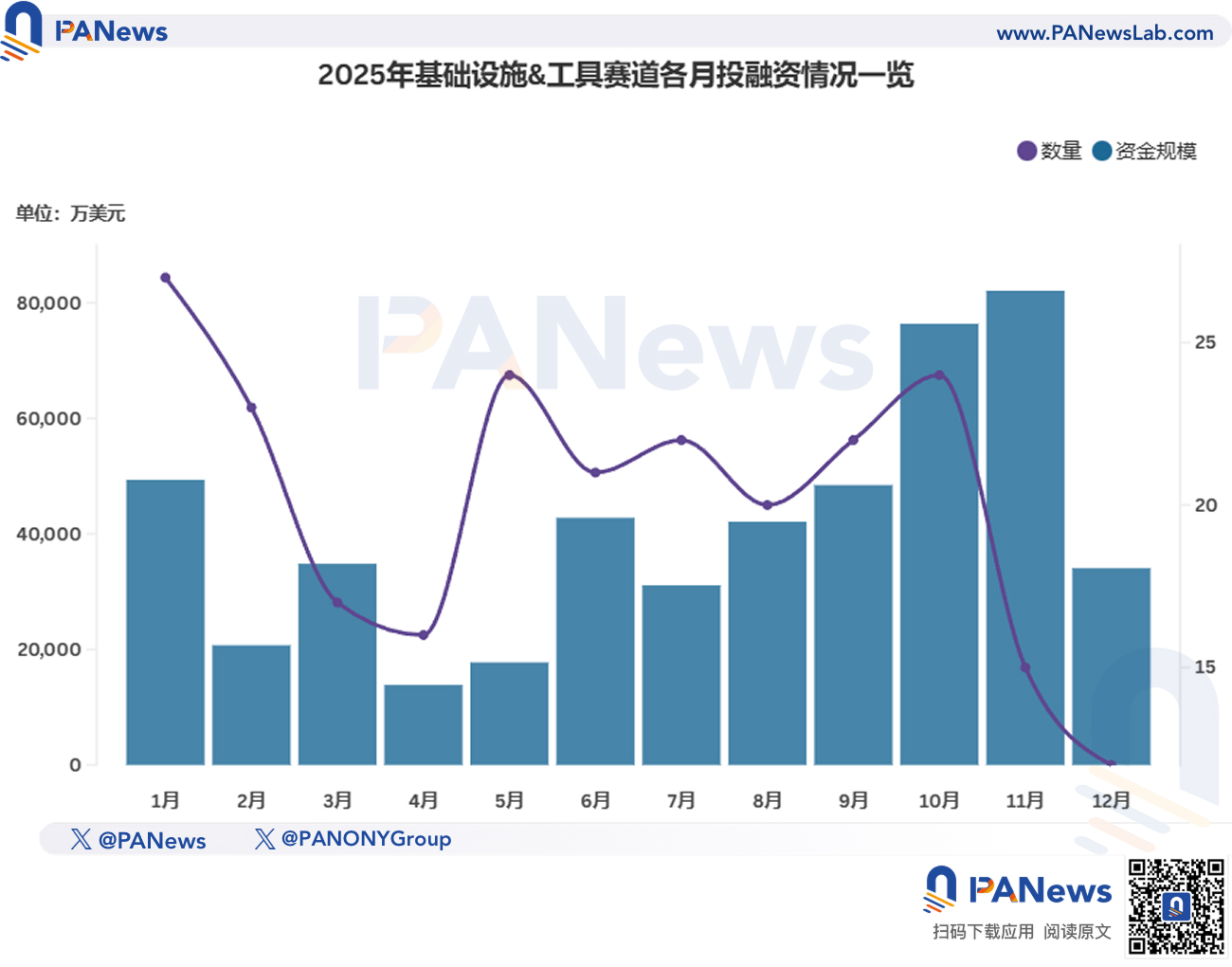

Infrastructure & Tools: Bolstering the Foundation with Mega-Investments

The Infrastructure & Tools sector remained a cornerstone of blockchain investment in 2025, attracting over $4.9 billion across 243 financing events, with an impressive average deal size of approximately $20.3 million.

While this sector accounted for roughly 28.96% of all financing events (consistent with 2024), its share of total capital decreased to 20.78% from 39.46% in 2024. This shift, however, belies a critical trend: a significant increase in large-scale investments within the sector. A remarkable 41.56% (101 deals) were $10 million or more, substantially higher than 27.82% in 2024. Moreover, 12 deals exceeded $100 million, double the previous year’s figure.

Key investments highlight a strong focus on crypto payment infrastructure:

- October: Tempo, a blockchain payment infrastructure project, secured a $500 million Series A round at a $5 billion valuation, led by Thrive Capital and Greenoaks, with participation from Sequoia and Ribbit Capital.

- November: Ripple raised $500 million from institutional investors including Fortress Investment and Citadel Securities, bringing its valuation to $4 billion.

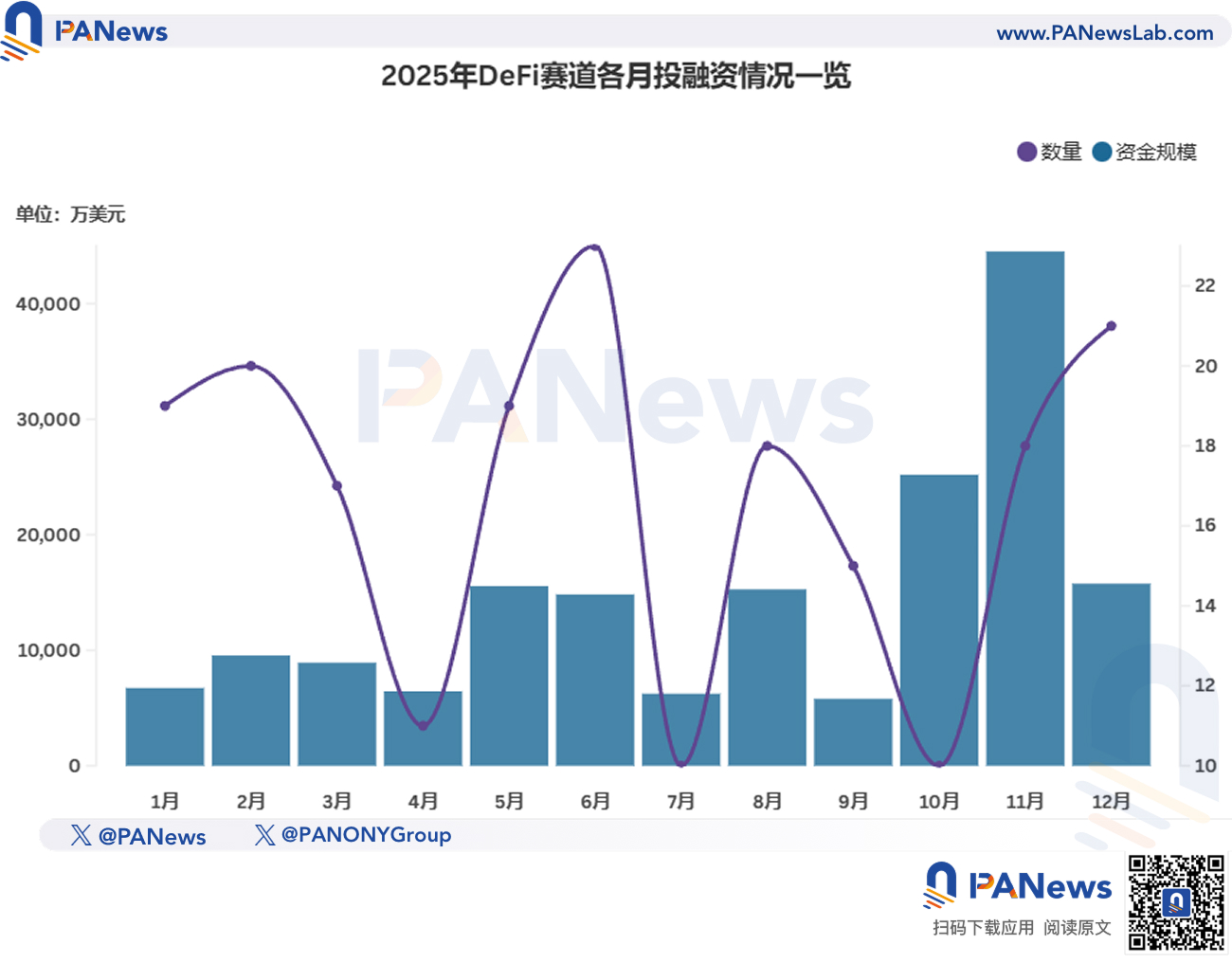

DeFi: A Resilient Core with a Strong Year-End Rally

Decentralized Finance (DeFi) continued to be a critical vertical in 2025, second only to infrastructure in investor attention. The sector recorded 201 financing events, attracting over $1.748 billion. While its share of total deals (24.04%) remained stable compared to 2024, its share of total capital (7.36%) saw a decrease from 18.22% in the previous year.

Despite the overall capital share dip, the quality of DeFi investments improved, with 41 deals (20.39%) exceeding $10 million, up from 13.51% in 2024. However, the majority of deals still fell within the multi-million dollar range.

Notably, November 2025, a month when overall primary market transaction counts hit their lowest, saw a significant rebound in DeFi funding. The sector recorded 18 deals, surpassing its annual average of 16, and achieved its highest capital inflow for the year, exceeding $445 million.

This late-year surge was propelled by several high-profile deals, with three of the top ten DeFi financing and M&A events occurring in November:

- Bitcoin lending platform Lava secured $200 million in new funding.

- Paxos acquired DeFi wallet startup Fordefi for over $100 million.

- Decentralized trading protocol Lighter raised $68 million.

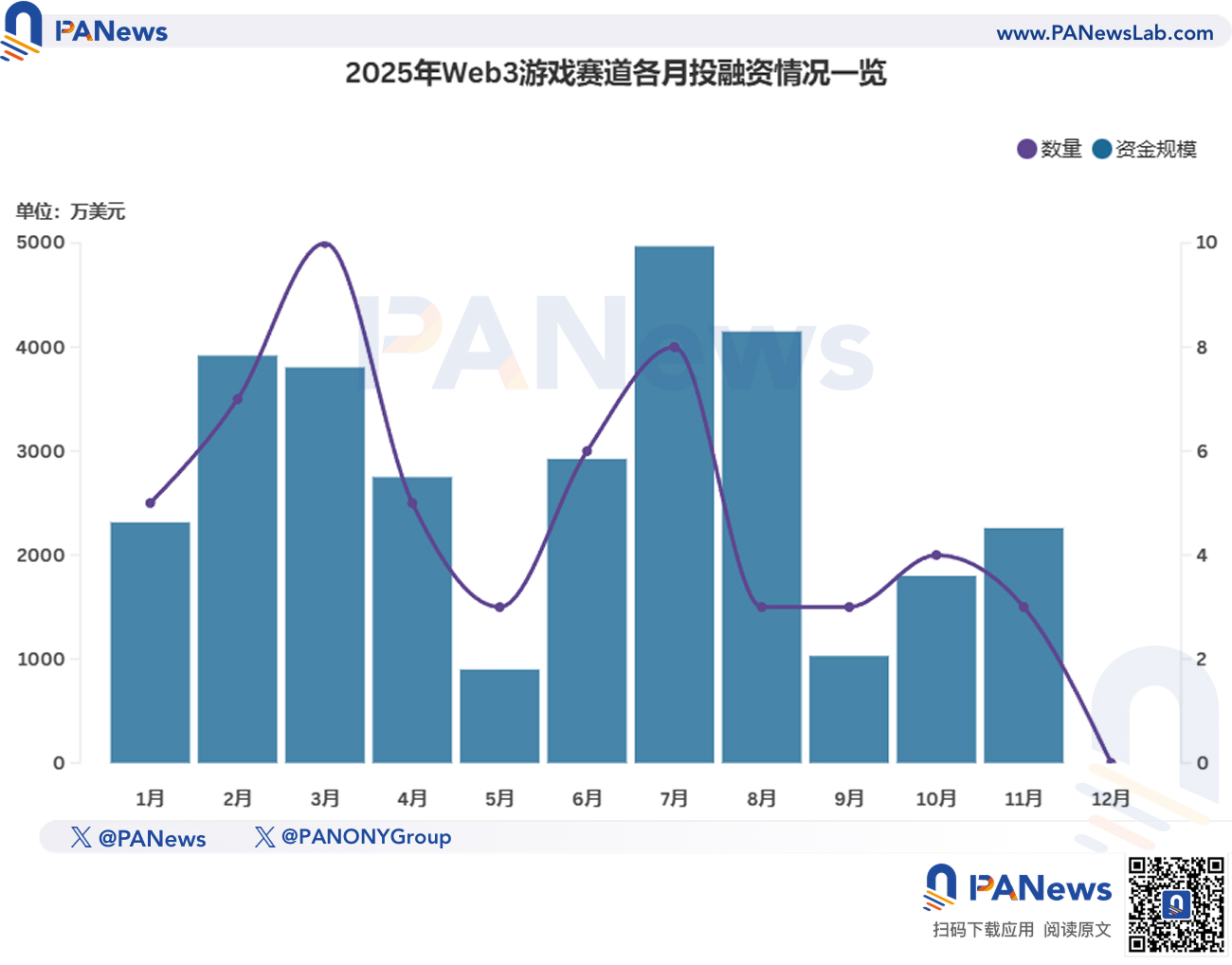

Web3 Gaming: A Steep Decline in Fortunes

The Web3 gaming sector experienced a dramatic downturn in 2025, a trend that was largely anticipated. The sector saw its financing volume and value more than halved compared to the previous year. Only 57 investment and financing events were disclosed, raising a modest $308 million. This represents a 67.98% drop in transaction count and a 63.72% decrease in capital from 2024’s figures of 178 deals and $849 million.

Throughout 2025, the decline in Web3 gaming was persistent, reaching its nadir in the fourth quarter. December notably recorded no financing news for any gaming project. This sustained decline suggests that by 2026, Web3 gaming may no longer warrant a standalone category in investment reports, potentially merging with broader NFT or social categories.

Investment activity in this sector was largely confined to specialized gaming VCs such as Bitkraft Ventures, Griffin Gaming Partners, and Animoca Brands. Animoca Brands, a prominent Web3 VC, continues to be a major player with approximately 200 of its 628+ portfolio companies focused on gaming.

Web3 + AI: A Steady Narrative of Convergence

The integration of Artificial Intelligence with Web3 technologies emerged as a steadily growing narrative in 2025. The Web3+ AI sector recorded 111 financing events, attracting $884 million in capital, with both metrics showing over 20% growth year-over-year.

It’s important to note that these figures might be an underestimate, as many blockchain projects integrate AI functionalities without being exclusively “AI projects,” suggesting that the total capital flowing into AI-related Web3 initiatives could be even higher.

The Web3+ AI sector demonstrated remarkable stability throughout the year, even thriving during the broader market downturn of Q2 and Q3. July marked its peak, with both the highest number of transactions and the largest financing volume for the sector.

In terms of deal size, AI projects securing $10 million or more accounted for 26.12% of the sector’s deals in 2025, a significant increase from 15.2% in 2024, indicating a trend towards larger, more impactful investments. A notable highlight was IVIX, an AI compliance platform combating crypto financial crime, which completed a $60 million Series B round in August 2025, setting a new record for a single financing event in this space.

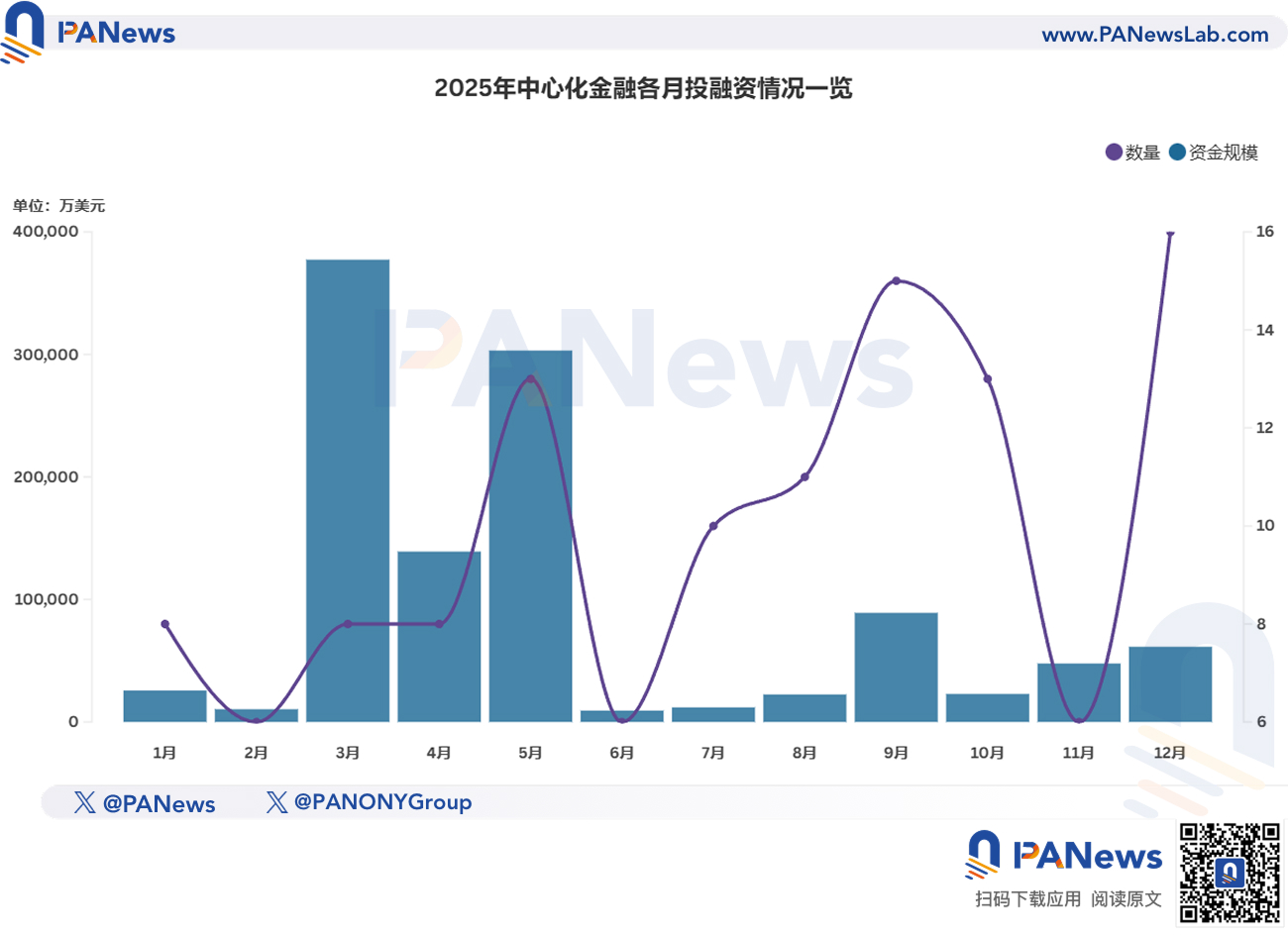

Centralized Finance (CeFi): A Banner Year of Mega-Deals and Soaring Valuations

2025 proved to be an exceptionally strong year for the Centralized Finance (CeFi) sector, witnessing a dramatic surge in both deal count and capital influx. The sector recorded 120 investment and financing events, amassing a staggering $11.2 billion. This represents a doubling of deal count and an almost eightfold increase in capital compared to 2024.

CeFi has historically commanded the highest average financing amounts within the industry, and 2025 was no exception, with an average deal size of $93.37 million. This figure was heavily influenced by monumental acquisitions, such as Coinbase’s $2.9 billion purchase of Deribit, and Binance’s singular $2 billion financing event. Even excluding these outliers, the CeFi sector performed robustly, with 73 deals (60.83%) reaching the tens of millions, an increase from 43.48% in 2024.

Furthermore, 2025 saw seven financing events exceed $100 million, a stark contrast to 2024, where only Hashkey approached this threshold. Notable examples include veteran U.S. crypto exchange Kraken securing over $100 million in funding twice, and Citadel Securities making a strategic investment of $200 million.

(Note: Korean tech giant Naver’s $10.3 billion all-stock acquisition of Dunamu, Upbit’s parent company, is anticipated to close in June 2026 and is therefore excluded from the 2025 statistics.)

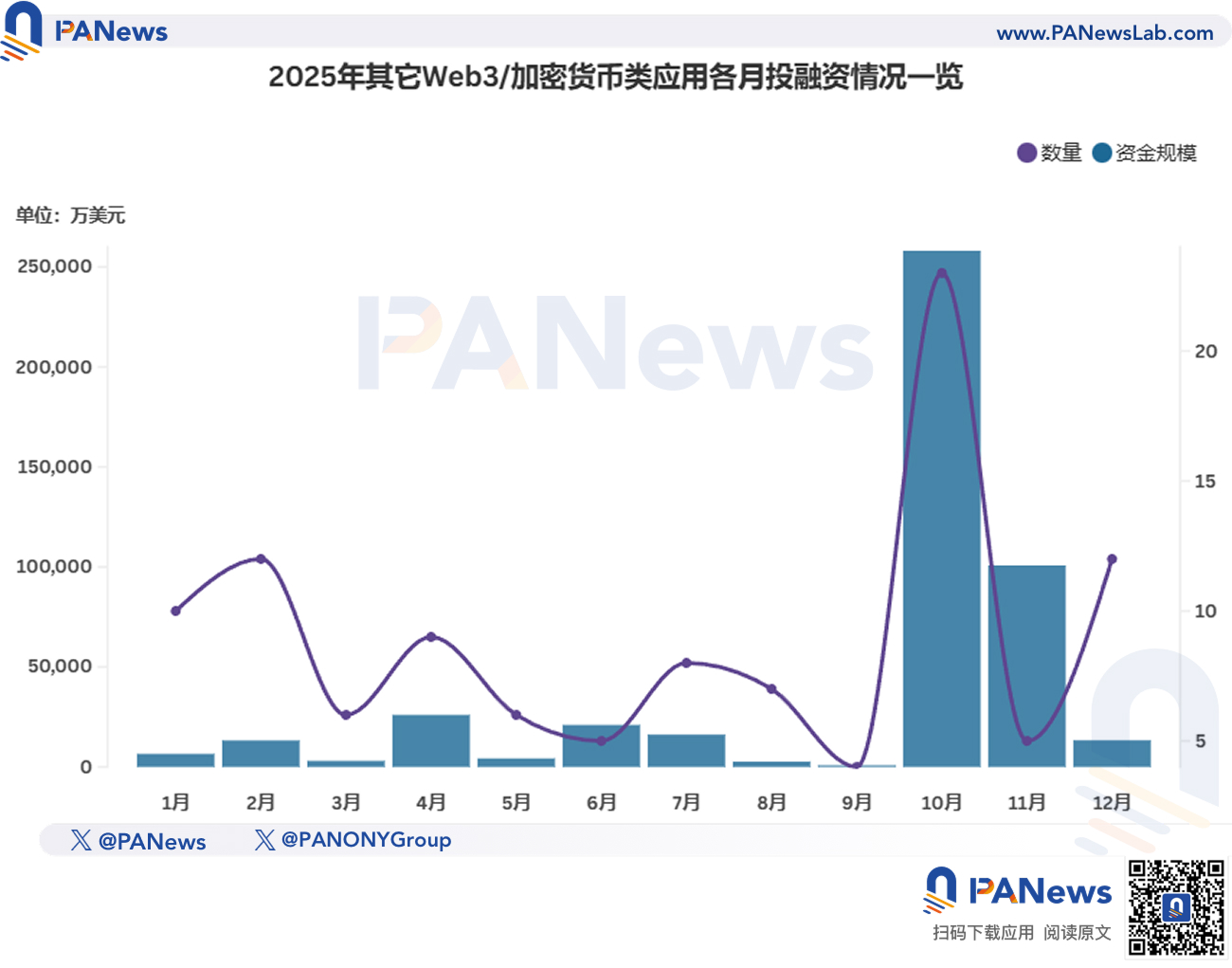

Other Web3 Applications: Prediction Markets Lead the Charge

The ‘Other Web3 Applications’ category encompasses a diverse range of blockchain applications, including prediction markets, DePIN (Decentralized Physical Infrastructure Networks), crypto mining, DAOs, DeSci (Decentralized Science), and social platforms. While prediction markets were arguably the hottest topic in 2025, they are grouped here due to their concentrated funding in a few giants and less continuous investment activity across the broader sub-sector.

This broad category recorded 107 investment and financing events, accumulating $4.376 billion in 2025. A significant portion of this, $3.561 billion, was driven by prediction markets alone. Polymarket secured a massive $2 billion in a single financing round, while Kalshi rapidly caught up, raising $1.485 billion across three rounds in just a few months starting mid-year.

Beyond prediction markets, crypto mining, DePIN, and consumer-focused projects also attracted substantial capital. A prime example is U.S. Bitcoin mining machine manufacturer Auradine, which completed a $153 million financing round with participation from notable investors including StepStone Group, Samsung, Qualcomm, and Premji Invest.

Investment Institutions: A Shift Towards Quality and the Rise of Family Offices

The landscape for crypto investment funds in 2025 mirrored the broader market’s focus on quality over quantity. PANews data shows 36 crypto investment funds launched, a decrease from 47 in 2024. However, the total capital raised surged to $5.082 billion, surpassing 2024’s $4.34 billion.

This trend signifies a maturing investment environment where many smaller crypto VCs have receded, making way for larger, more impactful funds. In 2025, 20 of the newly launched funds (55.5%) exceeded $100 million in fundraising, doubling the figure from 2024. This indicates a significant increase in the average size and strategic focus of new funds.

A notable development in October 2025 was the establishment of a $1 billion fund by YZi Labs, a family office that evolved from Binance Labs. This fund, dedicated to supporting the BNB ecosystem, represented the largest fund by capital size launched in 2025, underscoring the growing influence of well-capitalized family offices in the crypto investment space.