Original Article by: Arthur Hayes

Translated and Compiled by: Yuliya, PANews

Imagine a provocative video call between former U.S. President Trump and Venezuelan President Pepe Maduro, mid-flight from Caracas to New York:

Trump: “Pepe Maduro, you’re a bad dude. Your country’s oil is mine now! Long live America!”

Pepe Maduro: “Trump, you lunatic!”

*Note: Arthur Hayes refers to the Venezuelan President as “Pepe Maduro” in the article, rather than his official name Nicolás Maduro. “Pepe” is a common Spanish nickname for “José,” even though Maduro’s first name is Nicolás.

This hypothetical scenario — the “kidnapping” or “legal arrest” of a sovereign nation’s leader by the U.S. — is a historic, disruptive, authoritarian, and militarized event. It could be labeled with countless superlatives, both positive and negative. AI-assisted writers would undoubtedly churn out endless analyses, dissecting these events and forecasting their implications, often from a moral standpoint or offering advice to other nations. However, this article takes a different path. Our central inquiry is singular: how would a U.S. “colonization” of Venezuela impact Bitcoin and the broader cryptocurrency market? Is it bullish or bearish?

The Unyielding Rule of Politics: Re-election

To unravel this complex question, we must first grasp a fundamental, often brutal, political reality: all elected politicians are perpetually driven by one overarching objective — winning re-election. Lofty narratives about God or country invariably take a backseat to securing votes. This relentless pursuit of power is, in a sense, rational; without it, the ability to enact change is nonexistent.

For figures like Donald Trump, two elections loom critical: the 2026 midterm elections and the 2028 presidential election. While he won’t be on the ballot in 2026 and is constitutionally barred from seeking a third presidential term in 2028, the loyalty and obedience of his political base hinge on their own re-election prospects. Those who might stray from the “Make America Great Again” (MAGA) fold do so precisely when they perceive their electoral future dimming under his directives.

So, how would Trump ensure that the crucial swing voters, those yet to firmly align with either Democrats (the “Blue Team”) or Republicans (the “Red Team”), cast the “correct” ballot in November 2026 and 2028?

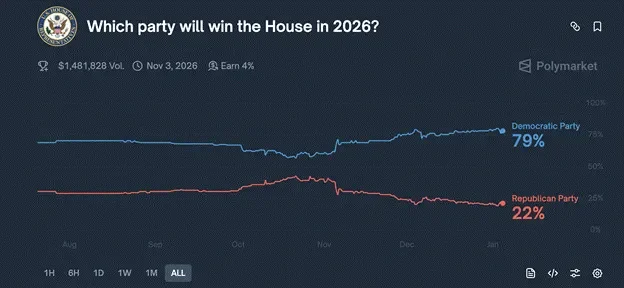

Current projections suggest the Blue Team Democrats are poised to regain control of the House of Representatives. For Trump to emerge victorious, decisive action is paramount. The window for policy adjustments that could sway voter sentiment is rapidly closing.

Voter Priorities: The Economy, Especially Oil Prices

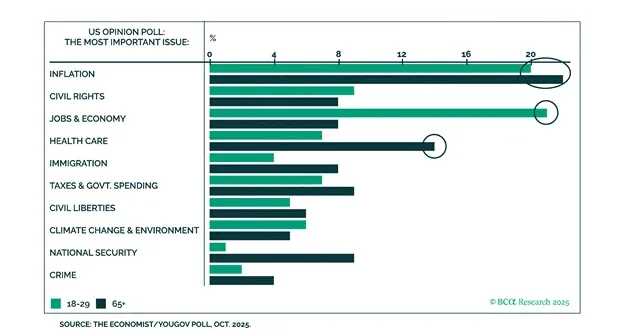

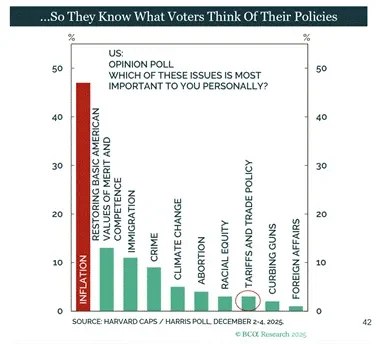

How then, does one appeal to the swing voter? All the flamboyant cultural wars pale in comparison to the contents of a voter’s wallet. The economy is the singular concern for voters – whether they feel prosperous or impoverished when they cast their ballot.

For Trump, the most straightforward path to economic stimulation involves unleashing the printing press to inflate nominal GDP. This strategy tends to boost financial asset prices, thereby currying favor with the wealthy elite who “reciprocate” with campaign donations. However, in a one-person, one-vote system like the U.S., unchecked money printing can lead to severe inflation, causing the cost of living to skyrocket for the general populace. Such an outcome inevitably results in the incumbent party being voted out.

Trump and his Treasury Secretary, Besant, have signaled their intent to run the economy “hot.” The critical question, then, is how they plan to suppress inflation – specifically, the kind of inflation that obliterates re-election chances: food and energy inflation.

For the average American, the most acutely felt inflation indicator is gasoline prices. Given the underdeveloped public transportation system in the U.S., nearly everyone drives, making fuel costs a direct determinant of daily living expenses.

This brings us to the core of the matter: Trump and his administration’s hypothetical “colonization” of Venezuela would be primarily motivated by its vast oil reserves.

While many are quick to highlight Venezuela’s status as possessing the world’s largest proven oil reserves, the sheer volume underground is less important than the ability to extract it profitably. Trump evidently believes that by developing Venezuela’s oil resources, crude can be channeled to Gulf Coast refineries, leading to cheaper gasoline. This, in turn, would appease the public by suppressing energy inflation.

The efficacy of this strategy will be revealed by the West Texas Intermediate (WTI) and Brent crude oil markets. As nominal GDP and U.S. dollar credit supply expand, will oil prices rise or fall? If GDP and oil prices both climb, the Blue Team Democrats stand to gain. Conversely, if GDP rises while oil prices remain flat or decline, the Red Team Republicans will likely emerge victorious.

The beauty of this framework is its comprehensive nature: oil prices will inherently reflect all reactions from other major oil-producing and military powers (notably Saudi Arabia, Russia, and China) to a U.S. “colonization” of Venezuela. Furthermore, the market’s reflexive nature is a key advantage. We know Trump adjusts policies based on stock prices, U.S. Treasury yields, and oil prices. As long as equities continue their ascent and oil prices stay subdued, he will persist with money printing and the “colonization” agenda for oil acquisition. As investors, our ability to react within the same timeframe as Trump presents an optimal scenario, reducing the need to predict the intricate outcomes of complex geopolitical systems. Traders can simply read the charts and adapt.

The following charts and statistical analyses clearly illustrate why Trump must simultaneously boost nominal GDP while keeping oil prices low to secure electoral wins:

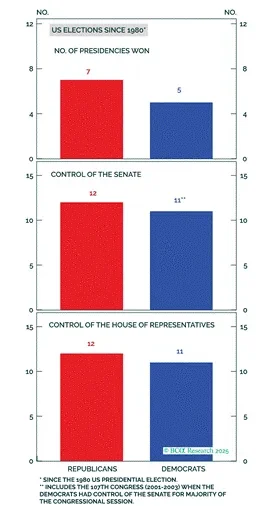

- Political Landscape: The Red and Blue teams are closely matched, with a small segment of American voters ultimately determining which party controls the government.

- Voter Focus: The economy and inflation are the paramount concerns for voters; all other issues are secondary.

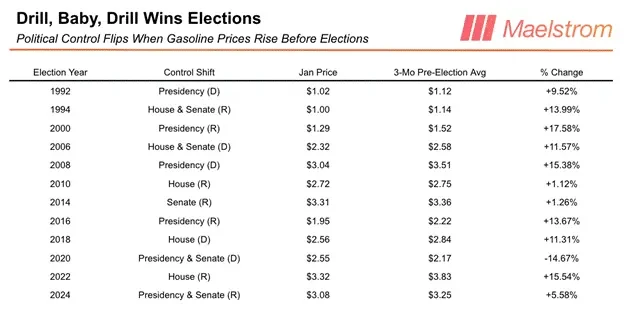

- The “10% Rule”: Historically, if the national average gasoline price in the three months preceding an election rises by 10% or more compared to January of the same year, control of at least one branch of government tends to change hands.

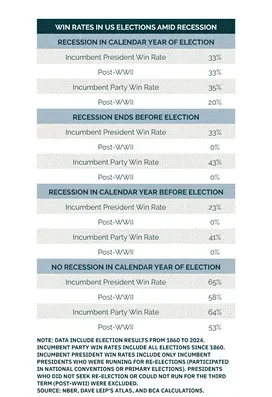

- Election Outlook: Assuming no economic recession, the Red Team holds the strongest chance of winning the 2028 presidential election.

These graphical insights unequivocally demonstrate that Trump’s imperative is to ignite economic growth without triggering an escalation in gasoline prices.

Bitcoin’s Trajectory: Two Scenarios

We are presented with two distinct scenarios: one where nominal GDP/credit and oil prices both climb, and another where nominal GDP/credit rises while oil prices decline. How would Bitcoin respond under each?

To grasp this, a fundamental principle must be established: oil prices are critical not because they directly influence Bitcoin mining costs, but because they possess the power to compel politicians to halt the printing presses.

Bitcoin, through Proof-of-Work (PoW) mining, consumes energy, positioning it as a pure monetary abstraction. Consequently, energy prices themselves are not inherently correlated with Bitcoin’s price, as mining costs fluctuate synchronously across all miners, without altering Bitcoin’s intrinsic value proposition.

The true potency of oil prices lies in their capacity to act as a “trigger” for political and financial upheaval.

The Ripple Effect of Uncontrolled Oil Prices

Should economic expansion lead to oil prices rising too quickly and too high, a series of devastating chain reactions would be unleashed:

Uncontrolled oil prices translate directly into soaring living costs for the populace, which would inevitably ignite voter fury and place incumbents at significant risk of being ousted. To cling to power, politicians would be forced to suppress oil prices at all costs – whether through “stealing” oil from other nations or by decelerating credit creation. The 10-year U.S. Treasury yield and the MOVE index, a gauge of U.S. Treasury market volatility, will serve as indicators of when oil prices become excessively high.

Investors would then confront a stark choice: allocate capital to financial assets or real assets. When energy costs are low and stable, investing in financial instruments like government bonds is a sensible strategy. However, when energy costs are high and volatile, a pivot towards energy commodities becomes far more prudent. Thus, as oil prices reach a certain threshold, investors will demand higher yields on government bonds, particularly the 10-year U.S. Treasury.

As the 10-year U.S. Treasury yield approaches 5%, market volatility could surge dramatically, potentially sending the MOVE index soaring. Current U.S. political dynamics struggle to rein in deficit spending, with “free benefits” often holding sway in electoral campaigns. Yet, with rising oil prices and yields nearing critical levels, markets could face immense pressure. Given the substantial leverage embedded within the prevailing fiat financial system, escalating volatility would compel investors to liquidate assets to avoid catastrophic losses.

A prime example of this dynamic occurred last year with “Liberation Day” on April 2nd, followed by Trump’s “TACO” (Tariff Action) on April 9th. Trump’s threat to impose extremely high tariffs would have reduced global trade and financial flow imbalances, creating a powerful deflationary effect. The market reacted with a sharp downturn, and the MOVE index briefly surged to 172 intraday. The very next day, Trump “suspended” the tariffs, leading to a market bottom and a vigorous rebound.

MOVE Index (white) vs. Nasdaq 100 Index (yellow)

In such matters, attempting to precisely pinpoint the exact levels of oil prices and 10-year yields that would force Trump to tighten monetary policy using historical data is largely futile. We will discern it when it occurs. Should oil prices and yields climb sharply, it would be prudent to reduce bullish exposure to risk assets.

The prevailing baseline scenario, however, posits that oil prices will remain flat or even decline, while Trump and Besant will engage in aggressive money printing, reminiscent of 2020. This is predicated on the market’s initial belief that U.S. control over Venezuelan oil will significantly boost daily crude output. Whether engineers can realistically achieve millions of barrels per day in Venezuela becomes secondary.

What truly matters is this: Trump’s pace of money printing will outstrip Israeli Prime Minister Benjamin Netanyahu’s shifting justifications for striking Iran. If these arguments still fail to convince one to go long on all risk assets, simply recall that Trump is arguably the most socialist U.S. President since Roosevelt. In 2020, he authorized the printing of trillions of dollars, directly distributing funds to citizens – a stark departure from previous administrations. One can be confident he will not lose an election due to insufficient money printing.

Based on statements from Trump and his inner circle, credit expansion is a certainty. Red Team Republican lawmakers will pursue deficit spending, Besant’s Treasury will issue debt to finance it, and the Federal Reserve (regardless of whether Jerome Powell or his successor is at the helm) will print money to purchase these bonds. As Lyn Alden aptly put it, “Nothing can stop this train.” As the supply of U.S. dollars expands, the prices of Bitcoin and select cryptocurrencies are poised to surge.

Strategic Trading Outlook

Last year, Arthur Hayes’ most significant losses stemmed from trading the PUMP token post-launch. Furthermore, a crucial lesson is to steer clear of meme coins; his sole profitable meme coin trade last year was TRUMP. On a more positive note, the bulk of profits were generated from trades in HYPE, BTC, PENDLE, and ETHFI. While only 33% of his trades were profitable, disciplined position sizing ensured that the average profit from winning trades was 8.5 times the average loss from losing trades.

Arthur Hayes’ improvement strategy for the current year involves a sharpened focus on his strengths: deploying large-scale, medium-term positions predicated on clear macro liquidity theses, coupled with a credible altcoin narrative. Position sizes for speculative “shitcoins” or meme coins, traded purely for entertainment, will be significantly reduced.

Looking ahead, this year’s dominant narrative is anticipated to coalesce around “privacy.” ZEC is positioned as the bellwether in the privacy sector. Maelstrom has already established substantial long positions in ZEC for Q3 2025. The objective is to identify at least one altcoin within the privacy domain that can set trends and deliver outsized returns for the portfolio in the coming years. To achieve returns surpassing Bitcoin (BTC) and Ethereum (ETH), a portion of these flagship cryptocurrencies is planned for divestment, in favor of more potent opportunities within the privacy and DeFi sectors.

Once oil prices ascend and signal a deceleration in credit expansion, the strategy will shift to opportunistically taking profits, accumulating more Bitcoin, and simultaneously acquiring some mETH.

(This content is an authorized excerpt and reproduction from our partner PANews. Original Article Link)

Disclaimer: This article provides market information for reference purposes only. All content and views expressed herein are not investment advice and do not represent the opinions or positions of BlockBeats. Investors should exercise their own judgment and make independent trading decisions. The author and BlockBeats disclaim any responsibility for direct or indirect losses incurred by investors as a result of transactions.