Telegram recently found itself back in the spotlight following the release of financial information to investors, revealing a curious paradox: an upward trajectory in revenue juxtaposed with a downturn in net profit. The primary culprit behind this divergence isn’t a slowdown in user growth, but rather the fluctuating price of TON tokens, which has significantly impacted the company’s asset valuations and, consequently, its profitability. The recent sale of over $450 million worth of TON tokens has further compelled external observers to scrutinize the intricate financial relationship between Telegram and the TON ecosystem.

Despite Soaring Revenue, Telegram Reports Net Loss Amid TON Price Slump

According to a report by the Financial Times, Telegram experienced a substantial surge in revenue during the first half of 2025. Unaudited financial statements indicate the company generated $870 million in revenue, marking a 65% year-on-year increase and significantly surpassing the $525 million recorded in the first half of 2024. This impressive growth also translated into nearly $400 million in operating profit.

A closer look at the revenue breakdown reveals diverse growth drivers. Advertising revenue saw a 5% increase, reaching $125 million, while premium subscription income soared by 88% to $223 million, nearly doubling the figure from the previous year. However, the most significant contributor to Telegram’s revenue expansion stemmed from an exclusive partnership with the TON blockchain. Under this agreement, TON serves as the sole blockchain infrastructure for Telegram’s burgeoning mini-app ecosystem, generating close to $300 million in related revenue for the messaging giant.

This robust performance in the first half of last year continued the strong growth momentum initiated by the mini-game craze of 2024. In that year, Telegram achieved its first-ever annual profit of $540 million, with total revenue reaching an impressive $1.4 billion, a substantial leap from $343 million in 2023.

Of the $1.4 billion in revenue for 2024, approximately half was attributed to “partnerships and ecosystem” initiatives. Advertising contributed roughly $250 million, and premium subscription services added $292 million. It is evident that Telegram’s growth has been fueled not only by a surge in paying users but also, crucially, by the strategic benefits derived from its cryptocurrency-related collaborations.

However, the inherent volatility of the cryptocurrency market has also introduced considerable risk for Telegram. Despite achieving nearly $400 million in operating profit in the first half of 2025, the company reported a net loss of $222 million. Insiders attribute this loss to the necessity of revaluing Telegram’s substantial holdings of TON token assets. The persistent downturn in altcoin prices throughout 2025 led to a continuous decline in TON’s value, which at its lowest point, had fallen by over 73%.

$450 Million Token Sale: Profit-Taking or Decentralization Strategy?

Given the prolonged slump in altcoin prices and the unrealized losses faced by numerous crypto-listed companies, retail investors were largely unsurprised by Telegram’s losses resulting from virtual asset depreciation. What truly stirred dissatisfaction and controversy within the community, however, was the FT’s report detailing Telegram’s significant sell-off, with TON token sales exceeding $450 million. This figure represents more than 10% of the token’s current circulating market capitalization.

The combination of TON’s continuous price decline and Telegram’s large-scale token divestment fueled accusations among some TON community members and investors, who questioned whether Telegram was “cashing out” and “betraying” TON investors.

Manuel Stotz, Chairman of the Board of TONStrategy (NASDAQ: TONX), a TON treasury company, provided a public explanation. He clarified that all TON tokens sold by Telegram are subject to a four-year phased vesting schedule. This crucial detail means these tokens cannot immediately enter secondary market circulation, thereby mitigating any immediate selling pressure on the market.

Stotz further stated that Telegram’s primary buyers were long-term investment entities, including TONX itself, which he leads. These entities acquired the tokens for long-term holding and staking, rather than speculative trading. As a US-listed investment company focused on TON ecosystem projects, TONX’s acquisition of Telegram’s tokens is primarily for strategic, long-term objectives.

Stotz also emphasized that Telegram’s net holdings of TON tokens did not significantly decrease post-transaction and may have even increased. This is attributed to Telegram exchanging a portion of its existing holdings for vested token distributions and its continuous acquisition of new TON revenue through business activities like advertising revenue sharing, thus maintaining a high overall holding position.

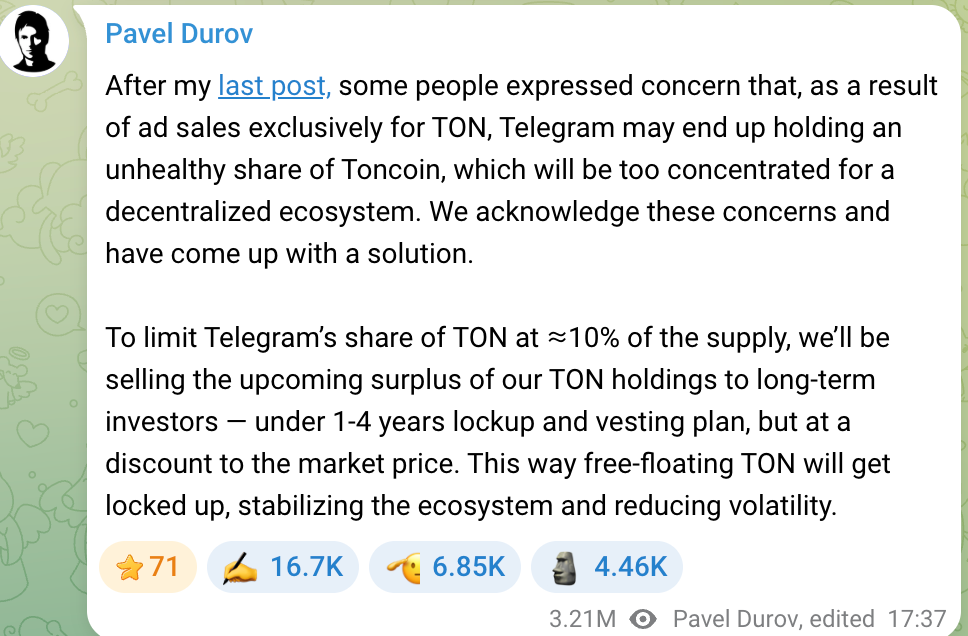

Telegram’s long-standing business model of continuously acquiring TON tokens had previously raised concerns among some community members regarding over-concentration, which could impede TON’s decentralization. Pavel Durov, Telegram’s founder, took these concerns seriously. As early as 2024, he stated that the team would cap Telegram’s TON holdings at no more than 10%. Any excess holdings beyond this threshold would be sold to long-term investors, ensuring broader token distribution while simultaneously securing development funds for Telegram.

Durov stressed that these sales would occur at a slight discount to market price, accompanied by lock-up and vesting periods, specifically to prevent short-term selling pressure and safeguard the stability of the TON ecosystem. This initiative aims to prevent the concentration of TON in Telegram’s hands, which could raise concerns about price manipulation, and to uphold the project’s foundational principle of decentralization. Therefore, Telegram’s token sales are framed more as a strategic adjustment of asset structure and liquidity management, rather than a simple opportunistic sell-off for profit.

It is important to note that while TON’s sustained price decline in 2025 undoubtedly placed impairment pressure on Telegram’s financial statements, the long-term, deep integration between Telegram and TON creates a scenario of shared prosperity and shared risk. Through its profound involvement in the TON ecosystem, Telegram has unlocked new revenue streams and product innovations but must also contend with the financial ramifications of cryptocurrency market volatility. This “double-edged sword” effect is a critical factor for investors to consider when evaluating Telegram’s valuation as it contemplates a potential Initial Public Offering (IPO).

Telegram’s IPO Prospects: Navigating Debt, Regulation, and Vision

With its improving financial performance and business diversification, Telegram’s prospects for an IPO have become a central focus for the market. Since 2021, the company has raised over $1 billion through multiple rounds of bond financing. In 2025, it issued another $1.7 billion in convertible bonds, attracting participation from globally renowned institutions such as BlackRock and Abu Dhabi’s Mubadala.

These financing activities have not only injected capital into Telegram but are also widely perceived as strategic preparations for an IPO. However, Telegram’s path to a public listing is not without its challenges, as its debt arrangements, the prevailing regulatory environment, and factors related to its founder will all significantly influence the IPO timeline.

Telegram currently has two primary outstanding bonds: a bond with a 7% coupon maturing in March 2026, and a convertible bond with a 9% coupon maturing in 2030. Of the recent $1.7 billion convertible bond issuance, approximately $955 million was allocated to replace older bonds, while $745 million represented new capital for the company.

A distinctive feature of the convertible bond is its IPO conversion clause: should the company go public before 2030, investors have the option to redeem or convert their shares at approximately 80% of the IPO price, effectively a 20% discount. This arrangement indicates that these investors are banking on Telegram’s successful IPO and the achievement of a substantial valuation premium.

Through its debt replacement initiatives in 2025, Telegram has largely redeemed or repaid the majority of its bonds due in 2026. Pavel Durov has publicly stated that the legacy debt from 2021 has been mostly cleared, posing no current risk. Addressing concerns about a $500 million freeze on Russian bonds, Durov clarified that Telegram does not rely on Russian capital and that no Russian investors participated in the recently issued $1.7 billion bond.

Consequently, Telegram’s primary debt now consists of the convertible bonds maturing in 2030, providing a relatively ample window for an IPO. Nevertheless, many investors anticipate Telegram will seek a listing around 2026-2027 to facilitate debt-to-equity conversion and open new avenues for equity financing. Missing this opportune window could expose the company to prolonged debt interest pressures and potentially squander the chance to transition to equity-based funding.

When assessing Telegram’s IPO valuation, investors will also closely examine its profitability outlook and monetization strategies. With approximately 1 billion monthly active users and an estimated 450 million daily active users, Telegram possesses an immense user base that offers considerable commercialization potential. While the business has grown rapidly in the past two years, Telegram must still demonstrate its business model can achieve sustained profitability.

Encouragingly, Telegram currently maintains absolute control over its ecosystem. Durov recently reaffirmed that he remains the company’s sole shareholder, with creditors having no involvement in corporate governance. This unique position potentially allows Telegram to prioritize long-term user engagement and ecosystem prosperity over short-term profits, unconstrained by the often-short-sighted demands of diverse shareholders. This “delayed gratification” strategy aligns with Durov’s consistent product philosophy and will be a core narrative in presenting Telegram’s growth story to prospective investors during its IPO journey.

However, it is crucial to emphasize that an IPO is not solely determined by financial health and debt structure. The Financial Times highlighted that Telegram’s potential listing plans are currently impacted by judicial proceedings against Durov in France. The uncertainties surrounding this investigation make it difficult to establish a clear IPO timetable. Telegram has also acknowledged in its communications with investors that this ongoing inquiry could indeed present a significant obstacle.