By June, Deep Tide TechFlow

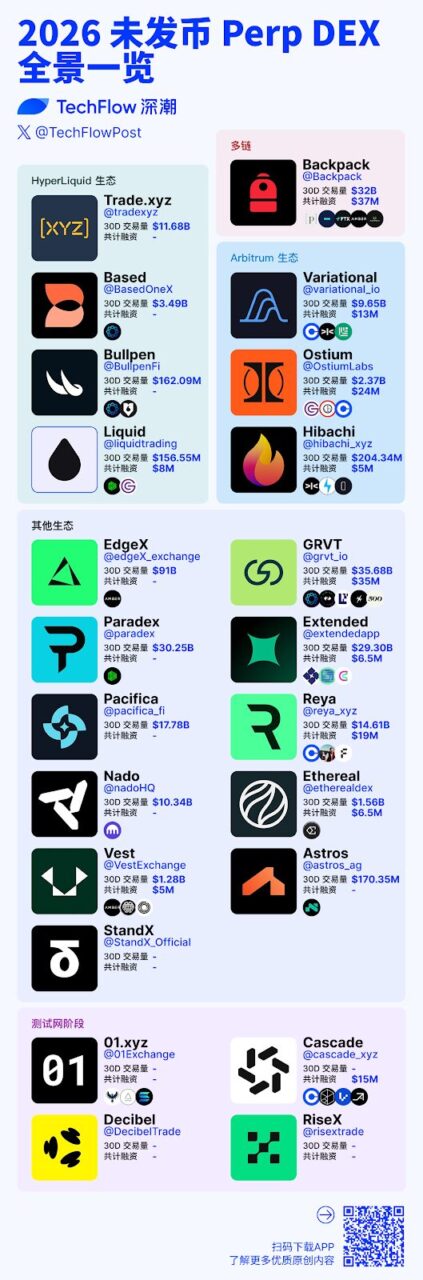

With Lighter’s Token Generation Event (TGE) slated for late 2025, the decentralized perpetual exchange (Perp DEX) landscape is undergoing a significant shift. The market’s attention is now firmly fixed on identifying and evaluating the next wave of projects poised for token launches.

Current trends strongly suggest that 2026 will usher in a robust cycle of new token releases. Many Perp DEXs are currently in their pre-TGE phase but have already implemented sustained points or incentive programs. Crucially, these platforms are demonstrating substantial on-chain trading volumes, indicative of genuine user engagement and robust ecosystem activity.

For discerning participants aiming to strategically position themselves ahead of the curve, a data-driven understanding of these projects’ actual performance is paramount, far outweighing the appeal of mere speculative narratives.

Drawing upon DefiLlama’s 30-day perpetual contract trading volume data, we’ve compiled an exclusive list of top-ranked Perp DEXs that have yet to launch their native tokens. This comprehensive guide serves as an an invaluable resource for research and proactive investment strategies.

Top Unlaunched Perp DEXs to Watch in 2026, Ranked by Trading Volume

EdgeX (@edgeX_exchange)

- 30-Day Perpetual Volume Rank: #4

- 30-Day Trading Volume: $91.005 Billion

- Funding: Incubated by Amber Group

EdgeX stands out as a high-performance perpetual and spot DEX, engineered on StarkEx, an Ethereum L2 ZK-rollup technology. It delivers ultra-low latency execution, profound liquidity, and self-custodial trading accessible via mobile and web applications.

Specializing in professional-grade order book trading, EdgeX boasts an impressive throughput of up to 200,000 transactions per second (TPS) and incorporates a robust forced withdrawal safety net, ensuring both speed and security for its users.

GRVT (@grvt_io)

- 30-Day Perpetual Volume Rank: #6

- 30-Day Trading Volume: $35.683 Billion

- Funding: $35 Million (QCP Singapore, ABCDE Capital, Further Ventures, etc.)

GRVT is a pioneering hybrid cryptocurrency derivatives exchange built on ZKsync Validium L2. It seamlessly merges a centralized exchange (CEX)-level user experience with full self-custody and zero-knowledge privacy technology, tailored for perpetual contracts and options trading.

GRVT champions a “hybrid exchange” model designed to bridge traditional finance (TradFi) and decentralized finance (DeFi), placing a strong emphasis on compliance and scalability for both institutional and retail users.

Paradex (@paradex)

- 30-Day Perpetual Volume Rank: #7

- 30-Day Trading Volume: $30.249 Billion

- Funding: Incubated by Paradigm (crypto derivatives institutional liquidity platform)

Paradex offers a privacy-enhanced, zero-fee perpetual DEX, architected on Starknet’s high-performance application chain. It supports deep liquidity across hundreds of markets, including cryptocurrencies and pre-market assets.

The platform is dedicated to fostering a unified DeFi ecosystem, featuring atomic settlement, institutional-grade privacy, and a trading experience optimized for mobile users.

Extended (@extendedapp)

- 30-Day Perpetual Volume Rank: #8

- 30-Day Trading Volume: $29.309 Billion

- Funding: $6.5 Million (StarkWare, Semantic Ventures, Cherry Crypto)

Extended is a high-performance decentralized perpetual futures exchange on Starknet. It provides access to over 50 markets, including cryptocurrencies and traditional financial assets like gold, oil, S&P 500, and Nasdaq, with up to 100x leverage, deep liquidity, and low fees. It also offers seamless EVM wallet connectivity without bridging.

Founded by former Revolut executives, with CEO Ruslan Fakhrutdinov previously leading Revolut’s crypto business, Extended migrated from StarkEx to Starknet in 2025 to achieve full composability.

Pacifica (@pacifica_fi)

- 30-Day Perpetual Volume Rank: #9

- 30-Day Trading Volume: $17.783 Billion

- Funding: Self-funded

Pacifica is a Solana-native hybrid perpetual futures DEX, augmented with AI-assisted tools. It employs off-chain order matching for superior speed and on-chain settlement for guaranteed security and transparency.

The team brings a wealth of expertise from Binance, FTX (including former COO Constance Wang), Jane Street, Fidelity, and OpenAI. Pacifica prioritizes a trader-first design and operates without native token incentives, focusing purely on performance and user experience.

Reya (@reya_xyz)

- 30-Day Perpetual Volume Rank: #10

- 30-Day Trading Volume: $14.615 Billion

- Funding: $19 Million (Coinbase Ventures, Stani Kulechow, Framework Ventures, etc.)

Reya is a high-performance perpetual futures DEX built on Reya Chain, a trading-optimized L2 based on Ethereum’s rollup architecture. It features millisecond execution, gas-free transactions, deep shared liquidity via passive pools, and an MEV-resistant FIFO matching mechanism.

Founded by DeFi veterans behind Voltz Protocol, Reya specializes in highly capital-efficient margin mechanisms (up to 3.5x efficiency for traders), cross-collateralization with interest-bearing assets, and institutional-grade performance secured by Ethereum validators.

Trade.xyz (@tradexyz)

- 30-Day Perpetual Volume Rank: #11

- 30-Day Trading Volume: $11.684 Billion

- Funding: Self-funded

Trade.xyz is a professional perpetual contract DEX deployed on Hyperliquid L1 (via HIP-3). It offers direct access to Hypercore’s high-speed on-chain order book, with a strong focus on 24/7 trading for non-crypto assets like US stocks and indices.

Built by the Hyperunit team, its distinguishing features include round-the-clock liquidity for traditional stock perpetuals, ultra-low fees, and permissionless market deployment within the Hyperliquid ecosystem.

Nado (@nadoHQ)

- 30-Day Perpetual Volume Rank: #12

- 30-Day Trading Volume: $10.341 Billion

- Funding: Undisclosed

Nado is a high-performance Central Limit Order Book (CLOB) DEX built on Ink (Kraken’s Ethereum L2). It offers unified cross-margin trading for spot, margin, and perpetual futures, boasting CEX-like 5-15 millisecond latency and full self-custody capabilities.

Developed by core contributors from the Kraken team, Nado excels in delivering superior capital efficiency through dynamic collateral netting, integrated money markets, and liquidity provider vaults that capture yield from trading flows.

Variational (@variational_io)

- 30-Day Perpetual Volume Rank: #17

- 30-Day Trading Volume: $9.65 Billion

- Funding: $13 Million (Coinbase Ventures, Dragonfly, Sequoia Capital, etc.)

Variational is a peer-to-peer derivatives trading protocol on Arbitrum, powering applications like Omni (a retail perpetuals platform). It supports hundreds of markets with zero trading fees and aggregates liquidity through a Request for Quote (RFQ) model.

Founded by former Genesis Trading executives with deep market-making expertise, Variational’s standout innovations include bilateral settlement for customizable derivatives (including exotic options and options), rapid asset listing, and direct revenue redistribution to users and liquidity providers.

Based (@BasedOneX)

- 30-Day Perpetual Volume Rank: #29

- 30-Day Trading Volume: $3.491 Billion

- Funding: Undisclosed (Delphi Ventures, Ethena)

Based is a professional-grade trading frontend (super-app) built on Hyperliquid L1. It provides seamless access to Hyperliquid’s high-performance on-chain order book for perpetual futures trading, featuring advanced tools, points farming, and integrated rewards.

It has rapidly emerged as a dominant application on Hyperliquid, capturing significant market share through an exceptional user experience and robust revenue generation for both traders and liquidity providers.

Ostium (@OstiumLabs)

- 30-Day Perpetual Volume Rank: #34

- 30-Day Trading Volume: $2.377 Billion

- Funding: $24 Million (General Catalyst, Jump Crypto, Coinbase Ventures, etc.)

Ostium is a decentralized perpetual exchange on Arbitrum, specializing in synthetic exposure to real-world assets (such as commodities like gold/oil, forex, stocks, indices) alongside cryptocurrencies. It utilizes an RFQ model for tight spreads and deep liquidity, all without requiring tokenization.

Founded by Harvard alumni, Ostium is committed to disrupting traditional Contract for Difference (CFD) brokers by offering a transparent, self-custodial, and on-chain alternative with verifiable execution and no broker counterparty risk.

Ethereal (@etherealdex)

- 30-Day Perpetual Volume Rank: #37

- 30-Day Trading Volume: $1.563 Billion

- Funding: Undisclosed

Ethereal is a non-custodial spot and perpetual DEX built on the Ethena Network, operating as a high-performance L3 application chain. It leverages USDe as its primary collateral, achieving CEX-grade execution with sub-20ms latency and full self-custody.

As an Ethena-native project, approved by ENA governance for deep integration, Ethereal aims to be the flagship on-chain venue for hedging and trading around USDe, offering interest-bearing stablecoin rewards and potential token distribution to ENA holders.

Vest (@VestExchange)

- 30-Day Perpetual Volume Rank: #39

- 30-Day Trading Volume: $1.286 Billion

- Funding: $5 Million (Jane Street, Amber Group, Big Brain Holdings, etc.)

Vest is a decentralized perpetual futures exchange on Arbitrum, featuring a zkRisk engine for real-time risk pricing, infinite position capacity, rapid asset listing (including long-tail and real-world assets), and highly capital-efficient liquidity without insolvency risk.

The platform specializes in providing mass access to thousands of markets (cryptocurrencies, stocks, forex) with fair, manipulation-resistant pricing and no position size limits.

Astros (@astros_ag)

- 30-Day Perpetual Volume Rank: #58

- 30-Day Trading Volume: $170.35 Million

- Funding: Incubated by NAVI Protocol (Sui’s leading liquidity protocol)

Astros is a Sui-native perpetual futures DEX offering high-leverage trading with deep liquidity through direct integration with NAVI Protocol’s lending pools. This enhances capital efficiency and generates real yield for users.

Founded by Jerry Liu, Astros leverages Sui’s high-performance blockchain to create a self-sustaining trading and lending ecosystem independent of token incentives, positioning Sui as a premier derivatives hub.

Hibachi (@hibachi_xyz)

- 30-Day Perpetual Volume Rank: #64

- 30-Day Trading Volume: $204.34 Million

- Funding: $5 Million (Dragonfly, Electric Capital, echo)

Hibachi is a privacy-first decentralized perpetual exchange on Arbitrum and Base. It features an off-chain CLOB for sub-10ms latency, zk-encrypted positions and balances via Celestia DA, and fully on-chain settlement with solvency proofs.

Founded by an elite team from Citadel, Tower Research, IMC, Meta, Google, and Hashflow, Hibachi pioneers “provable” trading with institutional-grade privacy, CEX-comparable speed, and uncompromising self-custody.

Bullpen (@BullpenFi)

- 30-Day Perpetual Volume Rank: #71

- 30-Day Trading Volume: $162.09 Million

- Funding: Undisclosed (Delphi Ventures, 6th Man Ventures)

Bullpen is an on-chain trading terminal providing seamless access to perpetual futures and spot trading on Hyperliquid L1, Solana spot markets (including meme coins), and prediction markets via Polymarket, all through a unified, mobile-friendly interface.

Co-founded by KOL Ansem, Bullpen focuses on delivering professional-grade tools, one-click execution, and cross-protocol aggregation for both retail and professional traders.

Liquid (@liquidtrading)

- 30-Day Perpetual Volume Rank: #72

- 30-Day Trading Volume: $156.55 Million

- Funding: $7.6 Million (Paradigm, General Catalyst, Alpen Capital, etc.)

Liquid is a non-custodial perpetual DEX aggregator that integrates top venues like Hyperliquid, Lighter, and Ostium into a single, mobile-first application. It offers cross-platform position management, yield vaults, real-time analytics, and automated risk tools.

Founded by Franklyn Wang (former Head of AI at Two Sigma), Liquid specializes in simplifying fragmented perpetual trading, providing optimal execution, reduced fees, and institutional-grade features while maintaining full self-custody across multiple chains.

StandX (@StandX_Official)

- Funding: Self-funded

StandX is a decentralized perpetual futures DEX operating on Solana and BNB Chain, featuring high-performance trading capabilities. It utilizes DUSD, a native interest-bearing stablecoin, as its exclusive margin collateral, automatically generating passive yield without staking or locking.

Founded by an experienced team including former Binance Head of Contracts and Goldman Sachs engineers, StandX innovates by making idle margin capital productive while maintaining a Delta-neutral platform design and engaging points activities for traders and LPs.

Backpack (@Backpack)

- 30-Day Trading Volume: $32 Billion (Perpetual Futures)

- Funding: $37 Million (Placeholder, FTX Ventures, Wintermute, etc.)

Backpack Exchange is a regulated centralized cryptocurrency exchange (CEX) offering spot, margin, and perpetual futures trading. It features cross-collateralization, lending, and low fees, seamlessly integrated with the multi-chain Backpack self-custodial wallet.

Founded by Armani Ferrante (of the Coral team behind Mad Lads xNFTs), Backpack stands out as a hybrid wallet-exchange platform with strong Solana roots. It gained EU regulation through the acquisition of FTX EU, and its significant perpetual contract trading volume rivals major CEXs.

Public Testnet Phase

Decibel (@DecibelTrade)

- Funding: Undisclosed

Decibel is an entirely on-chain trading engine natively built on Aptos. It unifies spot trading, perpetual futures, and yield strategies within a single cross-margin, multi-collateral interface, boasting CEX-like speed and sub-second finality. Developed in collaboration with Aptos Labs and the Decibel Foundation, it is directly supported by Aptos Labs.

Designed as a neutral, composable execution layer for global on-chain markets, Decibel is currently in its public testnet phase.

How to Participate:

- Visit app.decibel.trade, connect your Aptos wallet, mint test USDC, and engage in trading (perpetuals, spot, vaults) to earn XP and rank based on trading volume.

- Participate in trading arena competitions.

- Join the pre-deposit waitlist at decibel.trade.

RiseX (@risextrade)

- Funding: Undisclosed

RiseX (RISEx) is the flagship integrated perpetual DEX on Rise Chain, a high-performance Ethereum L2. It features a fully on-chain order book, shared liquidity via MarketCore, CEX-grade execution, and programmable market deployment capabilities for spot and perpetuals, with future support for options and prediction markets.

Powered by Rise Chain’s ultra-low latency infrastructure (integrating acquired BSX Labs technology), RiseX is positioned as the home for global on-chain markets. It is currently in its public testnet phase, with mainnet launch planned for early 2026.

How to Participate:

- Head to testnet.rise.trade, connect your EVM wallet, and claim test USDC.

- Engage in daily trading to earn points.

Other Notable Projects

01.xyz (@01Exchange)

- Current Status: Private Testnet (invite-only)

- Funding: Undisclosed

01.xyz is a decentralized perpetual futures exchange powered by the N1 blockchain, which utilizes the high-performance NordVM engine. It delivers CEX-grade speed, low latency, and a feature-rich order book, all while maintaining full on-chain transparency and self-custody. Built by veteran traders focused on precision and edge, it is currently in its private testnet phase.

01.xyz is positioned as the next-generation venue for infinitely scalable perpetual contract trading, built on dedicated Layer 1 infrastructure.

How to Participate:

- Strictly invite-only; no public codes available yet.

- To gain access, follow/reply to @01Exchange posts, interact with community members sharing codes, or DM active users.

- Once in, trade extensively, invite friends, and participate in events/leaderboards.

Cascade (@cascade_xyz)

- Current Status: Early access deposits live (invite-only); trading not yet live

- Funding: $15 Million (Coinbase Ventures, Polychain Capital, Variant Fund, etc.)

Cascade is a high-performance perpetual DEX on Arbitrum, emphasizing deep liquidity, tight spreads, and institutional-grade execution for cryptocurrencies and potentially broader asset classes.

It is currently building momentum through liquidity strategies and reward points accumulation ahead of its full trading launch.

How to Participate:

- Strictly invite-only; an access code is required for deposits/pre-allocation.

- Codes are distributed in limited quantities/randomly to waitlist users or via community giveaways.

- Once you have a code: deposit/pre-allocate into the CLS (recent caps around $1-3 million total, $10k per account) to earn points.

Note: Data sources: DefiLlama (as of January 5th), SoSoValue, CryptoRank. Information compiled and structured with the assistance of Grok.

(The above content is excerpted and reproduced with authorization from partner PANews, original link | Source: Deep Tide TechFlow )

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice, nor do they represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses resulting from investor transactions.