By Frank, PANews

Previous in-depth research by PANews into prediction market strategies revealed a critical insight: the primary hurdle for many arbitrage strategies isn’t their mathematical sophistication, but rather the sheer depth of liquidity within the prediction market itself.

This phenomenon has become even more apparent recently, following Polymarket’s launch of its US real estate prediction market. Despite considerable buzz on social media, the daily trading volume for these markets has barely reached hundreds of dollars – a stark contrast to expectations. This intriguing discrepancy prompted us to undertake a comprehensive investigation into prediction market liquidity, uncovering several fundamental truths about its dynamics.

PANews meticulously analyzed historical data from 295,000 markets on Polymarket, yielding the following key findings.

1. Short-Term Markets: A High-Stakes PVP Arena Akin to MEME Coins

Out of the 295,000 markets examined, a staggering 67,700 (22.9%) had a cycle of less than one day, with 198,000 (67.7%) concluding within a week. These ultra-short-term events dominate the landscape.

Among the 21,848 currently active ultra-short markets, a remarkable 13,800 (approximately 63.16%) recorded zero trading volume over 24 hours. This signifies a widespread state of illiquidity across a significant portion of Polymarket’s short-term offerings.

Does this sound familiar? The frenzied era of MEME coins on Solana saw tens of thousands launched, with the vast majority quickly fading into obscurity due to lack of interest. Prediction markets are mirroring this trend, though with a crucial difference: their event lifecycles are predefined, unlike the unpredictable longevity of MEME tokens.

Furthermore, over half of these short-term events boast less than $100 in liquidity, making meaningful participation challenging.

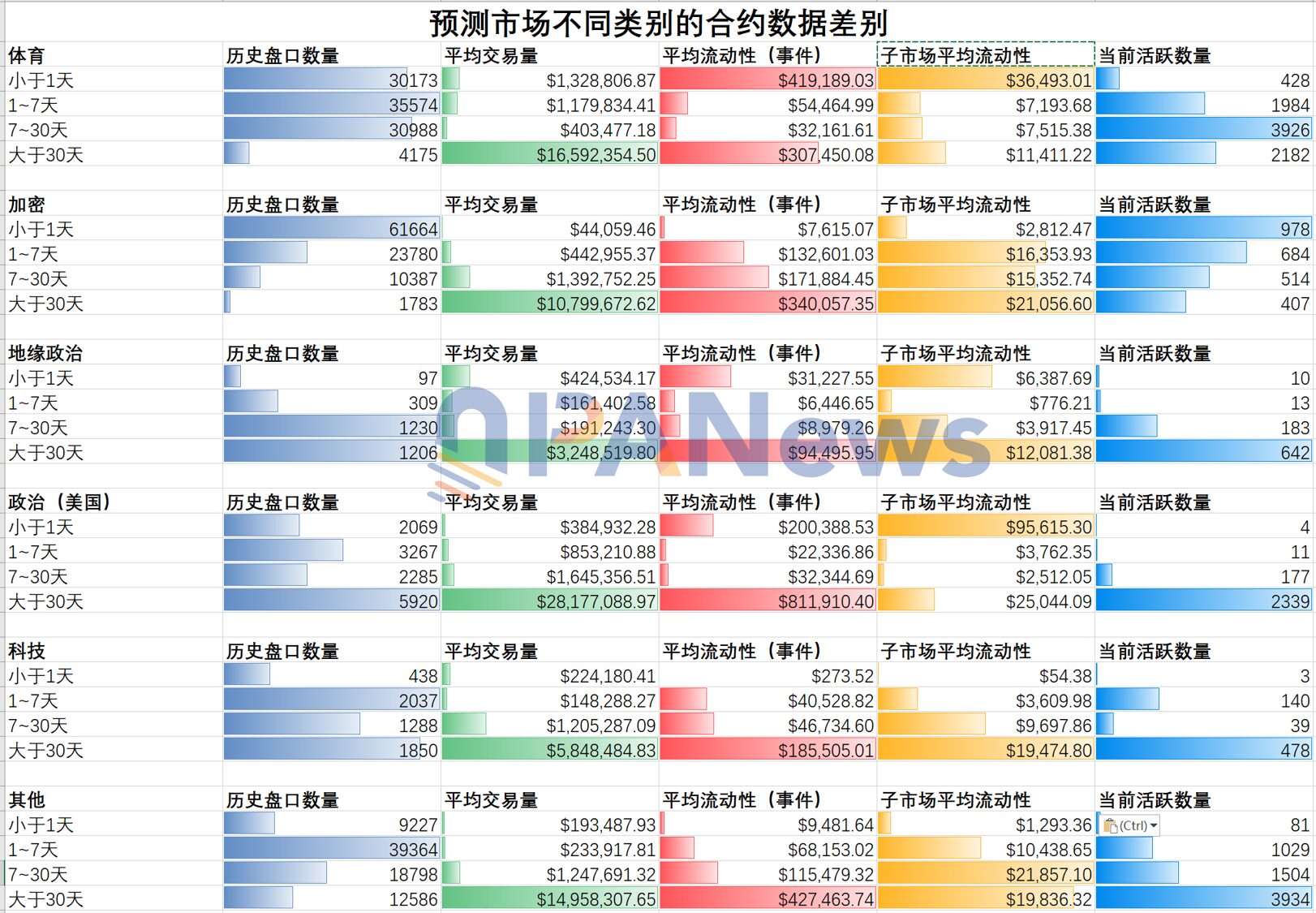

Categorically, short-term markets are predominantly split between sports and cryptocurrency price predictions. This is largely due to their straightforward and easily verifiable outcomes (e.g., “token up/down in 15 mins,” “team wins”). However, despite the hype, crypto predictions fall short as the “king of short-term” due to significantly poorer liquidity compared to traditional crypto derivatives.

Sports events, conversely, command absolute dominance. Our analysis shows that sports markets with a prediction cycle under one day on Polymarket average $1.32 million in trading volume, dwarfing crypto’s mere $44,000. This implies that attempting to profit from short-term cryptocurrency movements on prediction markets may be severely constrained by insufficient liquidity.

2. Long-Term Markets: The Deep Pools for Significant Capital

In stark contrast to the proliferation of short-term contracts, markets with longer time horizons are considerably fewer. While 141,000 markets span 1-7 days, only 28,700 extend beyond 30 days. Yet, these long-term markets are where the lion’s share of capital accumulates.

Markets exceeding 30 days average $450,000 in liquidity, a substantial increase compared to the mere $10,000 average for markets under one day. This clearly indicates a preference among larger capital holders for long-term predictions over short-term speculative gambles.

Within the long-term market segment (over 30 days), all categories except sports exhibit higher average trading volumes and liquidity. US politics stands out as the most attractive category for capital, boasting an average trading volume of $28.17 million and average liquidity of $811,000. The “other” category (encompassing popular culture, social topics, etc.) also performs well, attracting an average of $420,000 in liquidity.

Even within the crypto prediction space, capital gravitates towards long-term scenarios, such as forecasting whether “BTC will surpass $150,000 by year-end” or if a token’s price will drop below a certain threshold within several months. In this context, crypto predictions on Polymarket function more as simplified options hedging tools than vehicles for short-term speculation.

3. Sports Markets: A Tale of Bipolar Engagement

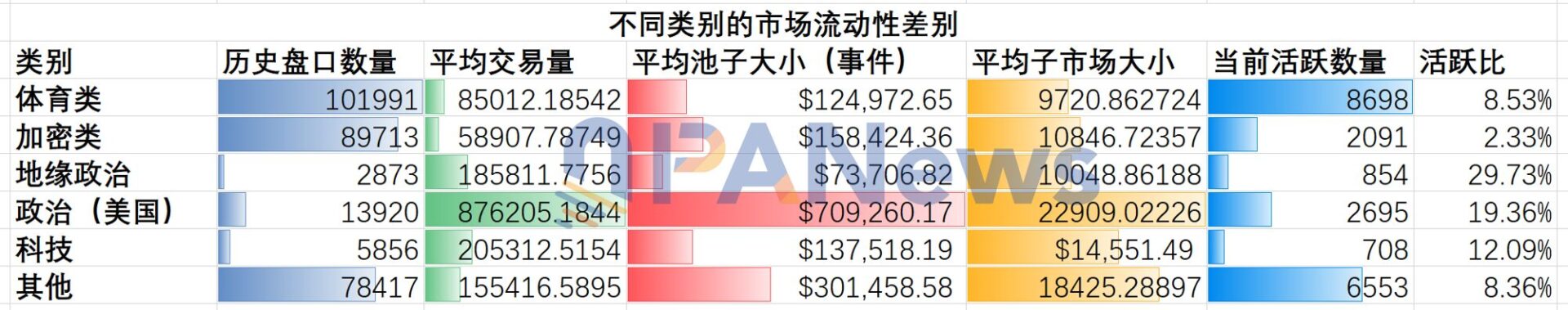

Sports predictions are a cornerstone of Polymarket’s daily activity, currently accounting for 8,698 active markets, or approximately 40% of the total. However, their trading volume distribution reveals a dramatic polarization across different timeframes.

Ultra-short-term sports predictions (less than one day) generate an impressive average trading volume of $1.32 million. Conversely, mid-term markets (7-30 days) see a modest average of $400,000. Strikingly, ultra-long-term markets (exceeding 30 days) surge again, with an average trading volume of $16.59 million.

This data suggests that users engaging in sports predictions on Polymarket are either seeking immediate results and dopamine hits, or they’re committing to grand, season-long wagers. Mid-term event contracts, it seems, hold little appeal.

4. Real Estate Predictions: A “Cold Start” Conundrum

While our analysis generally points to longer prediction events enjoying better liquidity, this logic falters when applied to highly specific or niche categories. The US real estate prediction market, for instance, despite its inherent certainty and long-term nature (over 30 days), struggles to gain traction. This is in sharp contrast to predictions for events like the 2028 US presidential election, which lead the market in both liquidity and trading volume.

This highlights a “cold start dilemma” for new asset classes, especially those requiring specialized expertise. Unlike intuitive event predictions, real estate markets demand higher professional knowledge and cognitive engagement from participants. Currently, this market appears to be in a “strategy incubation period,” with retail interest largely confined to observation. The inherently low volatility of real estate further exacerbates this issue; without frequent, event-driven fluctuations, the enthusiasm of speculative capital wanes. Consequently, these niche markets find themselves in an awkward state: professional players lack opposing bets, while amateur players are hesitant to enter.

5. Short-Term Hustle vs. Long-Term Capital: The Market Divide

Based on our analysis, prediction markets can be broadly categorized. Ultra-short-term markets like cryptocurrencies and sports represent “short-term hustle,” while categories such as politics, geopolitics, and technology lean towards “long-term capital sedimentation.”

These two market types cater to distinct investor profiles. Short-term markets are ideal for those with smaller capital or a need for high capital turnover. Conversely, “sedimentation” markets are better suited for investors with substantial capital and a preference for higher certainty.

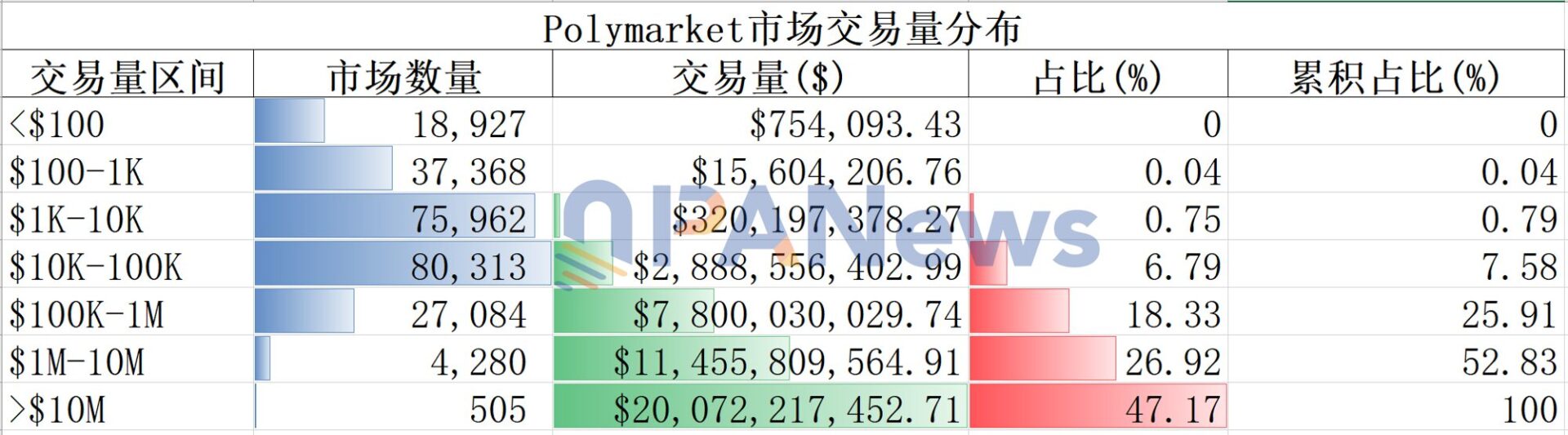

However, a closer look at trading volumes reveals a stark concentration of liquidity. Markets capable of attracting significant capital (over $10 million) account for 47% of the total trading volume, despite comprising the smallest number of contracts (just 505). In contrast, markets with trading volumes between $1,000 and $100,000 represent the vast majority of contracts (156,000) but contribute only 7.54% of the total trading volume. For most prediction contracts lacking a compelling narrative, “zeroing out upon launch” is the unfortunate norm. Liquidity, it appears, is not an evenly distributed resource but a concentrated spotlight illuminating a select few “super events.”

6. The Ascendance of Geopolitical Predictions

Examining the ratio of “current active count / historical count” provides a clear indicator of a category’s growth momentum. Currently, the “geopolitical” sector exhibits the most impressive growth efficiency. With only 2,873 historical event contracts, 854 are presently active, boasting an unparalleled active ratio of 29.7%—the highest across all sectors.

This data underscores the rapid increase in new contracts within the geopolitical category, signaling it as one of the most pressing concerns for prediction market users today. The frequent emergence of insider addresses linked to recent geopolitical contracts further corroborates this heightened interest.

Conclusion: The Evolving Landscape of Prediction Markets

In essence, our liquidity analysis of prediction markets reveals a fundamental truth: whether it’s the “high-frequency casino” of the sports sector or the “macro-hedging” of the political arena, their ability to capture liquidity hinges on either providing instant dopamine feedback or offering profound macro-strategic engagement. Markets lacking narrative density, burdened by excessively long feedback cycles, or devoid of volatility – essentially “chicken-rib” offerings – are destined to struggle within decentralized order books.

For participants, Polymarket is evolving beyond a utopian “predict-everything” platform into a highly specialized financial instrument. Recognizing this transformation is far more crucial than the futile pursuit of the next “100x prediction.” In this dynamic domain, value is only discovered where liquidity flows abundantly; where liquidity dries up, only pitfalls remain.

This, perhaps, is the most significant truth about prediction markets that the data unequivocally tells us.

(The above content is an excerpt and reproduction authorized by partner PANews. Original Link)

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses resulting from investor transactions.