Despite a weekend filled with significant geopolitical headlines concerning Iran, the cryptocurrency market remained remarkably subdued, as major military actions from the U.S. and Israel did not materialize. Bitcoin (BTC) continued its struggle to maintain ground above the $90,000 mark. However, with daily charts indicating a persistent downward trend and global political uncertainties clouding the outlook, market sentiment currently lacks the conviction needed to support a decisive breakout.

This week, while key U.S. economic data, including CPI figures, are slated for release, the market’s primary focus is expected to remain squarely on former President Trump’s actions and the evolving situation in the Middle East and Iran. Consequently, the crypto landscape is anticipated to be largely news-driven, reacting swiftly to geopolitical developments.

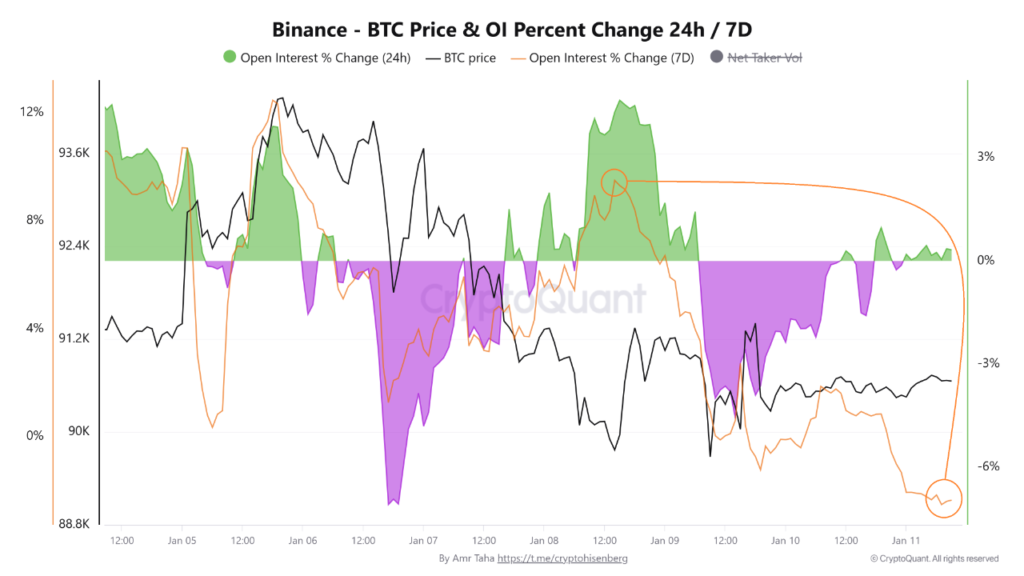

Further insights from CryptoQuant’s latest data reveal a pronounced contraction within Binance’s Bitcoin derivatives market over the past week. Bitcoin Open Interest (OI) saw its 7-day change rate plummet from a +9% increase on January 8th to a -2% decline by January 11th—a significant 11% swing. This sharp reversal signals a widespread unwinding of positions by traders, particularly a reduction in long exposures, likely due to active closures or forced liquidations.

Concurrently, the Cumulative Volume Delta (CVD) has been on a consistent downtrend since January 8th, indicating a strengthening of active selling pressure in the market. The synchronized decline of both CVD and OI corroborates a scenario where bullish positions are being withdrawn, and selling momentum is gaining traction.

Shifting to capital flows, Binance observed a modest increase in large capital inflows (30-day rolling total), climbing from $3 billion to $3.6 billion. This pattern, exhibiting preliminary signs of distribution, bears a striking resemblance to the market behavior witnessed in early October of the previous year. Historically, an uptick in such “whale” activity often precedes a short-term profit-taking phase in the market.

While the current volatility has not yet escalated to explosive levels, the combined signals of declining Open Interest and significant capital injections by large holders into exchanges strongly suggest a shift towards a more cautious market sentiment. Investors are advised to closely monitor potential distribution activities and the inherent risks of price corrections in the near future.

Disclaimer: This article is intended for market information purposes only. All content and views expressed herein are for reference only, do not constitute investment advice, and do not represent the opinions or positions of the publisher. Investors should exercise their own judgment and make independent trading decisions. The author and publisher will not assume any responsibility for direct or indirect losses incurred by investors as a result of their trading activities.