Tether Gold (XAU₮): Why This Digital Asset is Primed for Strategic Allocation Amidst Global Uncertainty

In an era where strategic foresight is paramount, the sentiment “survival is king” resonates deeply within the financial landscape, particularly for those navigating the dynamic world of cryptocurrency. Our previous analysis, “2026, Survive: A Bear Market Survival and Counterattack Handbook for Crypto Enthusiasts,” underscored the critical importance of diversified asset allocation, with precious metals like gold taking center stage. For investors seeking to fortify their portfolios against inflation, fiat currency depreciation, and currency fluctuations, the question then shifts to the most effective means of acquiring gold-related assets.

For the crypto-native investor, Tether Gold (XAU₮) emerges as a uniquely compelling solution. This digital asset, issued by Tether, offers a streamlined pathway to gold exposure. Furthermore, Tether’s recent introduction of “Scudo,” a novel unit of account for XAU₮, has dramatically lowered the entry barrier, making gold ownership accessible with just a few dollars.

This article delves into the merits of XAU₮, examining its potential as a strategic allocation within a diversified investment portfolio.

The Resilient Rise of Gold: Key Drivers and Forecasts

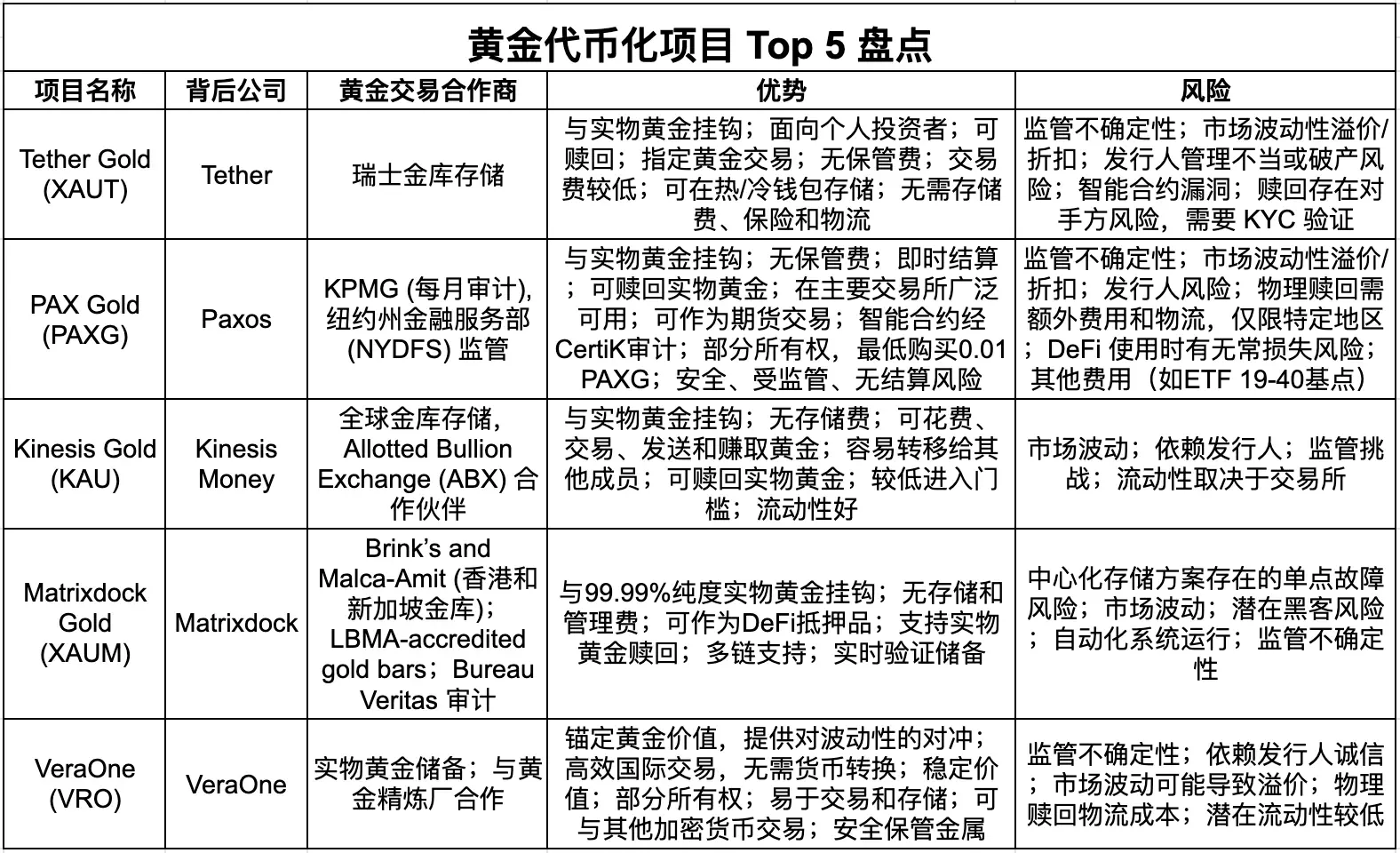

Just last September, spot gold prices hovered around $3,400-$3,500 per ounce. As detailed in our earlier piece, “Gold Price Expected to Continue Rising to $3,900/ounce, A Review of 5 Major Gold Tokens,” XAU₮ was already highlighted among leading digital gold offerings. Fast forward three months, and the price of an ounce of spot gold remarkably surged to approximately $4,550. This impressive rally underscores gold’s enduring appeal as a safe-haven asset.

Despite recent minor price corrections, gold’s upward trajectory remains robust, supported by a confluence of macroeconomic and geopolitical factors:

Geopolitical and Policy Influences: World Gold Council Insights

The World Gold Council’s recent report indicates that while short-term market volatility may arise from December’s surge in precious metals (including silver and platinum) and commodity index rebalancing, gold’s fundamental drivers are expected to persist. Upcoming decisions by the U.S. Supreme Court on tariff policy could significantly impact U.S. trade, potentially offering complex but supportive dynamics for gold. Moreover, the continuous escalation of geopolitical conflicts, exemplified by recent U.S. actions in Venezuela, further bolsters gold’s safe-haven appeal.

Unprecedented ETF Inflows and Central Bank Demand

The year 2025 witnessed gold prices hitting historical records 53 times, catalyzing an unprecedented influx of capital into gold ETFs globally. North American funds led these inflows, while Asian gold holdings nearly doubled, and Europe demonstrated significant demand. This widespread institutional and retail interest, coupled with ongoing “de-dollarization” efforts by global central banks, who continue to accumulate gold, positions the metal as a standout performer.

Exceptional Performance and Bullish Forecasts

In 2025, spot gold emerged as a “star asset,” appreciating by approximately 65% throughout the year and setting over 50 new highs, peaking at $4,549.96 per ounce. Silver also saw remarkable gains, rising by about 150%. Looking ahead, UBS Group maintains a bullish stance, raising its gold price targets for March, June, and September 2026 to $5,000 per ounce (up from $4,500), with a slight anticipated adjustment to $4,800 per ounce by the end of 2026. These forecasts collectively paint a promising picture for gold’s performance in the coming year, making the case for digital gold solutions like XAU₮ even stronger.

XAU₮: A Digital Gold Standard with Distinct Advantages

Given the optimistic outlook for gold, Tether’s XAU₮ presents a particularly attractive avenue for digital asset investors. Its appeal is underpinned by several key advantages:

1. Robust Backing and Proven Liquidity

Tether’s formidable financial strength provides a solid foundation for XAU₮. As recently disclosed by CEO Paolo Ardoino, Tether acquired 8,888 Bitcoin (worth approximately $780 million) on New Year’s Eve 2025, bringing its total public Bitcoin holdings to over 96,000. Tether also consistently allocates 15% of its quarterly profits to Bitcoin. Beyond crypto, Tether significantly expanded its physical gold reserves, purchasing 26 tons in Q3 2025, elevating its total gold holdings to 116 tons—ranking it among the top 30 global gold holders. This substantial backing, combined with XAU₮’s market capitalization of approximately $2.3 billion, ensures ample liquidity for investors.

2. Enhanced Accessibility with Scudo

Tether’s innovative “Scudo” unit of account for Tether Gold (XAU₮) marks a significant step towards democratizing gold ownership. Defined as one-thousandth of a troy ounce of gold or one-thousandth of an XAU₮ (approximately $4.4), Scudo simplifies gold’s utility as a medium of exchange. By eliminating the need to manage lengthy decimal places in transactions or pricing, Scudo enhances gold’s practicality in everyday economic activities without altering XAU₮’s fundamental structure or its full backing by physical gold in secure vaults.

3. Broad Exchange Availability and Trading Flexibility

XAU₮ boasts widespread accessibility across major centralized (CEX) and decentralized (DEX) exchanges. According to Coingecko, XAU₮ is readily available for trading on platforms such as Bybit, OKX, and Bitget, as well as DEXs like Uniswap, Fluid, and Curve. This broad listing allows investors to engage in both spot purchases and leveraged contract operations, offering flexibility to suit various trading strategies.

4. Leveraging Tether’s Market Dominance

Tether’s undisputed leadership in the stablecoin market, coupled with its robust business revenue, provides a powerful tailwind for XAU₮’s growth and adoption. Bloomberg, citing Artemis Analytics data, reported a 72% year-on-year surge in global stablecoin transaction volume in 2025, reaching a record $33 trillion. While Circle’s USDC led with $18.3 trillion, Tether’s USDT maintained a strong position with $13.3 trillion, together dominating stablecoin trading activity. This established market presence and operational excellence are expected to further elevate XAU₮’s industry application and ubiquity in 2026.

Conclusion: XAU₮ as a Strategic Diversifier in a Changing Economic Landscape

In light of persistent global economic uncertainties and the ongoing depreciation of fiat currencies like the USD against the RMB, the strategic allocation of assets into gold has never been more relevant. For the average investor with limited liquid capital and a lower risk tolerance, converting a portion of fiat holdings into Tether Gold (XAU₮) presents a particularly advantageous solution.

XAU₮ combines the time-honored stability of gold with the efficiency and accessibility of blockchain technology. Backed by Tether’s financial strength and physical gold reserves, enhanced by the innovative Scudo unit, and widely available across major trading platforms, XAU₮ stands out as a superior choice for those seeking a robust inflation hedge and a strategic diversifier in their digital asset portfolio.

(This content is an authorized excerpt and reproduction from our partner PANews. Original Article Link | Source: Odaily Planet Daily)

Disclaimer: This article is provided for market information purposes only. All content and views are for reference and do not constitute investment advice, nor do they represent the opinions or positions of BlockBeats. Investors should exercise their own judgment and make independent trading decisions. The author and BlockBeats shall not be held responsible for any direct or indirect losses incurred by investors as a result of their transactions.