Crypto Market 2025 Review: Lessons Learned & What to Expect in 2026

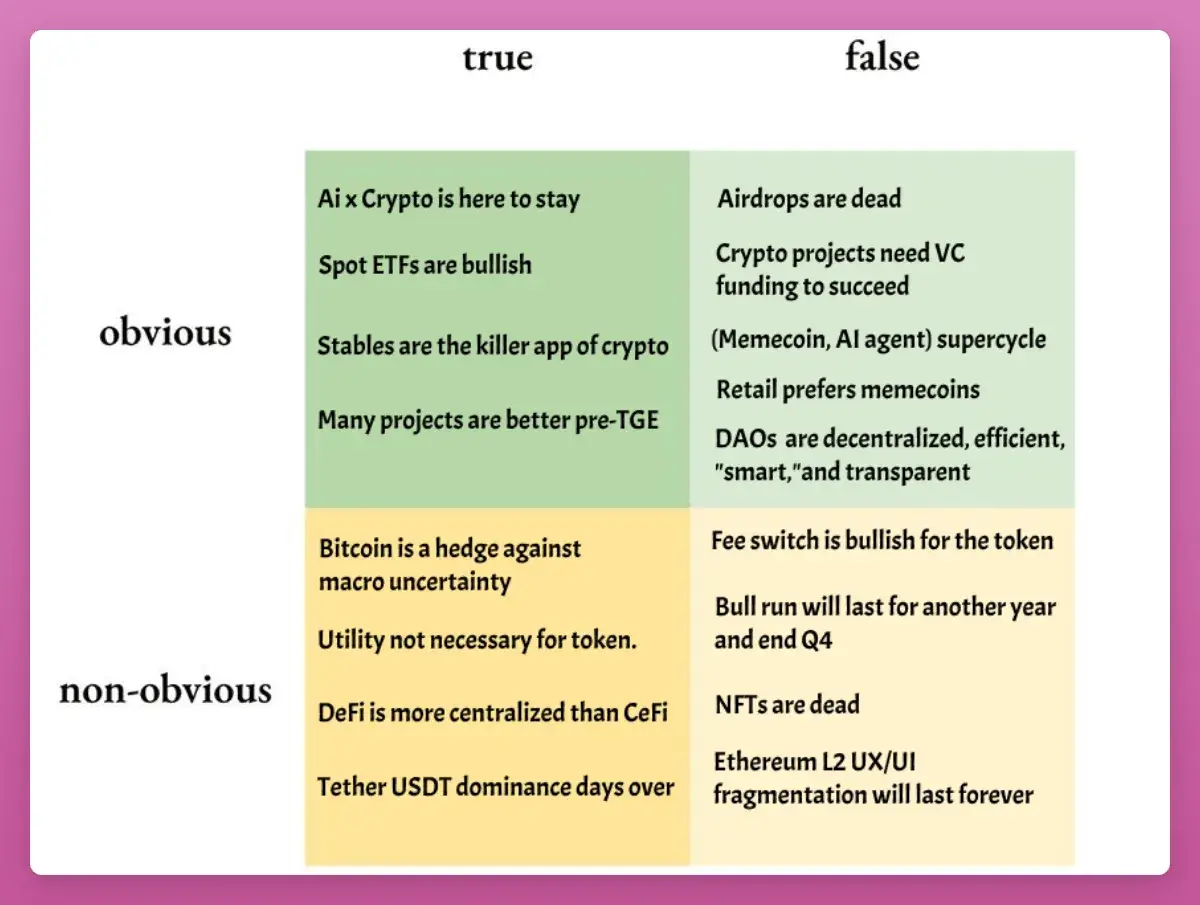

A year ago, I published “Truths and Lies of the Crypto Market in 2025.” While the prevailing sentiment was focused on ever-higher Bitcoin price targets, my aim was to explore a differentiated framework—to identify overlooked, misunderstood, or even disliked ideas that the mainstream might be missing. The goal was simple: uncover contrarian insights for strategic positioning.

A Critical Look Back at 2025: What We Got Right, What We Got Wrong

Before delving into my 2026 outlook, it’s crucial to conduct a candid review of 2025. What were our accurate predictions, where did we misstep, and most importantly, what vital lessons can we extract? Without rigorous self-assessment, investment becomes mere speculation.

Quick Summary of 2025 Predictions:

- “BTC to peak in Q4”: This was a widely anticipated outcome, almost too good to be true. It turned out to be correct, and my contrarian view was wrong (a costly lesson). Unless Bitcoin stages an unexpected surge and defies its established 4-year cycle patterns, I concede this point.

- “Retail favors Memecoins”: The reality was that retail investors showed little preference for crypto at all. Instead, they gravitated towards gold, silver, AI stocks, and virtually anything outside the crypto sphere. The predicted supercycle for memecoins or AI Agents simply did not materialize.

- “AI x Crypto remains strong”: This proved to be a mixed bag. Projects consistently delivered on development, the x402 standard evolved, and funding continued. However, the associated tokens largely failed to sustain any significant rallies, indicating a disconnect between innovation and market performance.

- “NFTs are dead”: Yes, unequivocally.

While these individual points offer quick insights, the true depth of understanding emerges from five broader themes that defined 2025.

Five Pivotal Themes from 2025 and Their Implications for 2026

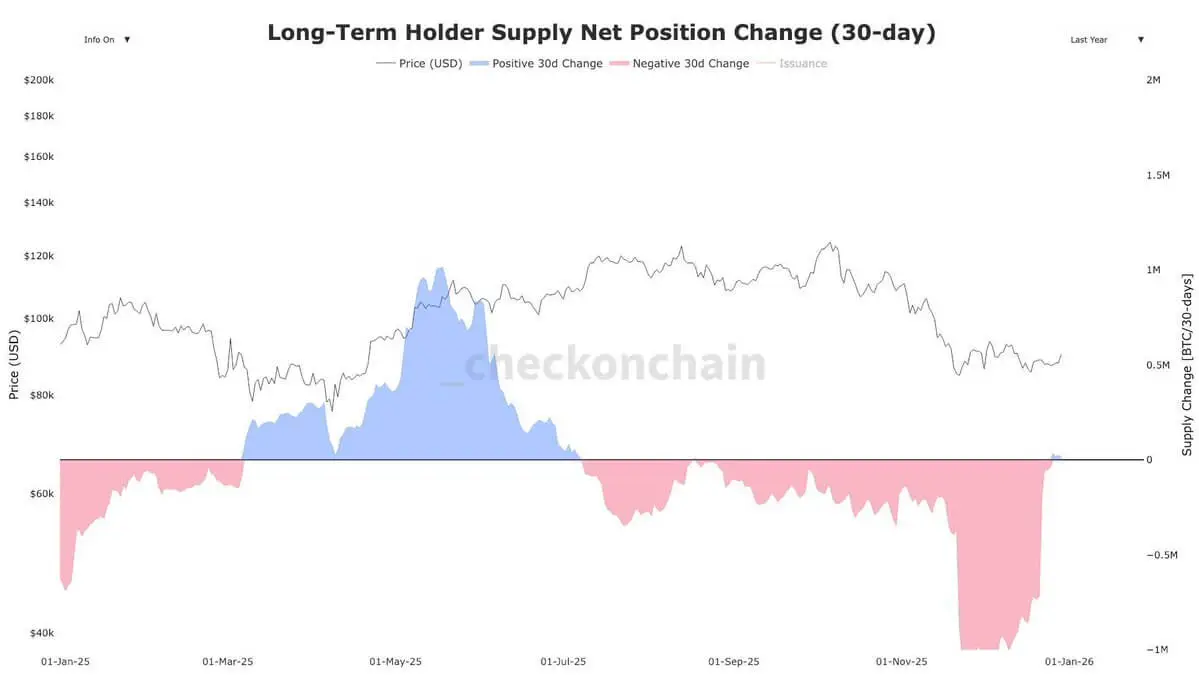

1. Spot ETFs: The Floor, Not the Ceiling

Since March 2024, long-term Bitcoin holders (OGs) have divested approximately 1.4 million BTC, equating to a staggering $121.17 billion. Imagine the potential market chaos without the advent of spot Bitcoin ETFs. Despite price declines, these ETFs maintained positive inflows, attracting $26.9 billion. This substantial selling pressure, coupled with ETF absorption, explains why Bitcoin underperformed nearly all other macro assets. It wasn’t an inherent flaw in Bitcoin itself, nor did it require deep dives into unemployment or manufacturing data. This was simply the “great rotation” orchestrated by large holders and “4-year cycle believers.”

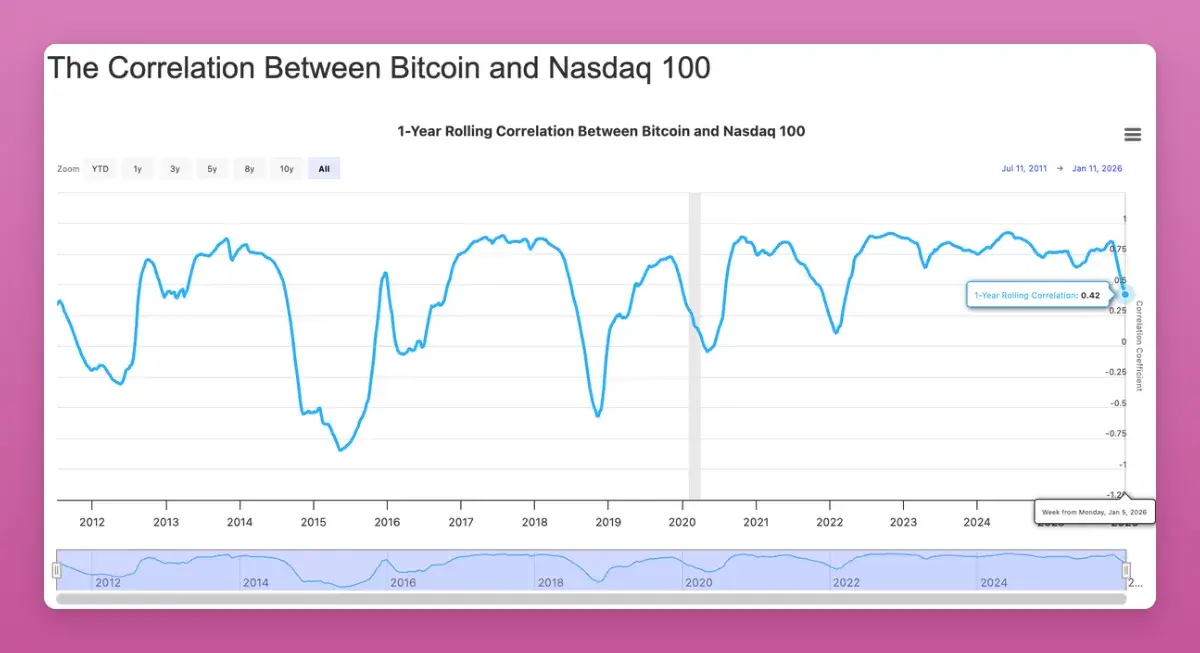

Crucially, Bitcoin’s correlation with traditional risk assets like the Nasdaq has plummeted to its lowest point since 2022 (-0.42). While many hoped for an upward correlation, this decoupling is a long-term bullish signal. It positions Bitcoin as the non-correlated portfolio asset that institutions are actively seeking.

Emerging signs suggest this supply shock is nearing its end. Therefore, I confidently project a Bitcoin price of $174,000 for 2026, representing approximately 10% of gold’s market capitalization.

2. Airdrops: Far From Dead, But Evolving

The crypto community (CT) once again prematurely declared the demise of airdrops. Yet, 2025 witnessed a remarkable distribution of nearly $4.5 billion across significant airdrops:

- Story Protocol (IP): ~$1.4B

- Berachain (BERA): ~$1.17B

- Jupiter (JUP): ~$7.91M

- Animecoin (ANIME): ~$7.11M

The landscape has undeniably shifted: “points fatigue” is rampant, Sybil detection mechanisms are more sophisticated, and valuations face downward pressure. Maximizing returns now often requires a “claim and sell” strategy. However, 2026 is poised to be another monumental year for airdrops, with heavyweights like Polymarket, Metamask, and potentially Base preparing for token launches. This isn’t a year to cease participation; it’s a year to abandon blind speculation. Successful airdrop farming in 2026 will demand focused, high-conviction engagement.

3. Fee Switches: The Price Floor, Not the Growth Engine

My prediction held true: fee switches do not automatically propel token prices higher. The vast majority of protocols simply do not generate sufficient revenue to justify their often-inflated market capitalizations. A fee switch, rather than dictating how high a token can soar, effectively establishes a “floor price.”

A fee switch doesn’t affect how high a token can rise, but rather sets a ‘floor price.’

Observing projects ranked by “Holder Revenue” on DeFillama reveals a consistent trend: with the sole exception of $HYPE, all tokens with high revenue-sharing models outperformed Ethereum (which, itself, is the current benchmark). The notable exception was $UNI. Uniswap finally activated its fee switch and even executed a $100 million token burn. Initially, UNI surged by 75%, only to subsequently retrace all its gains.

Three critical insights emerge from this:

- Token buybacks establish a price floor, not a ceiling for appreciation.

- In this current cycle, everything is fundamentally a trade (as exemplified by UNI’s rapid pump and subsequent dump).

- Buybacks represent only one facet of the equation; the persistent selling pressure from token unlocks must be rigorously considered, especially since most tokens still operate with low circulating supplies.

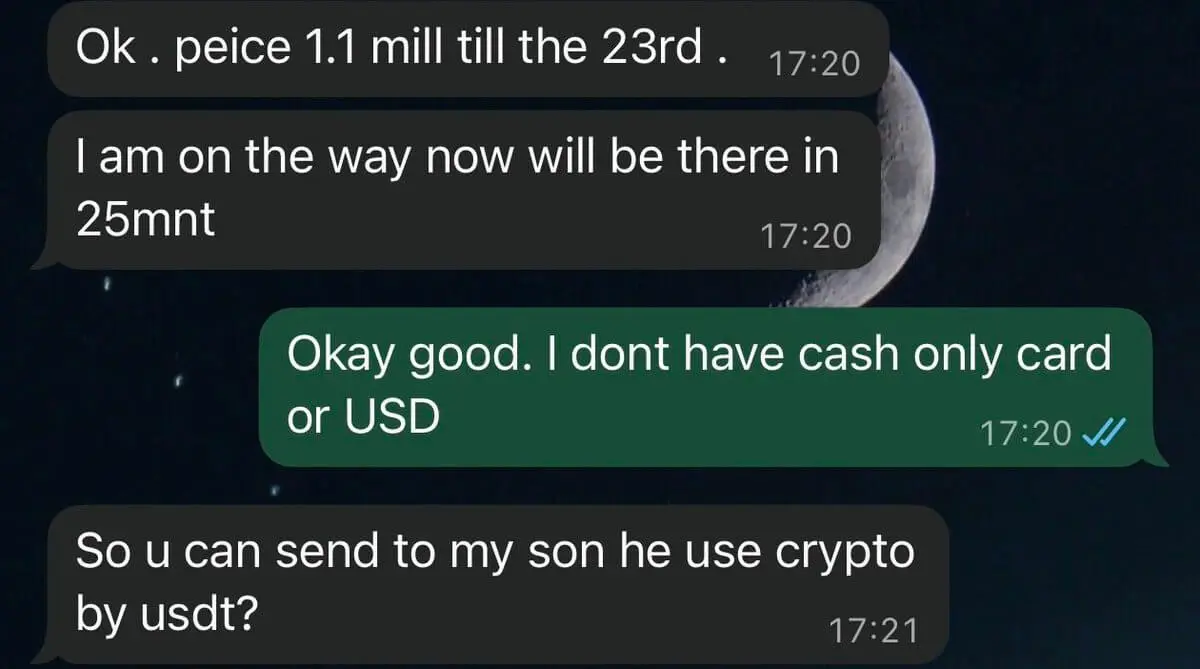

4. Stablecoins: Mainstream Mindshare, Challenging Trading Proxies

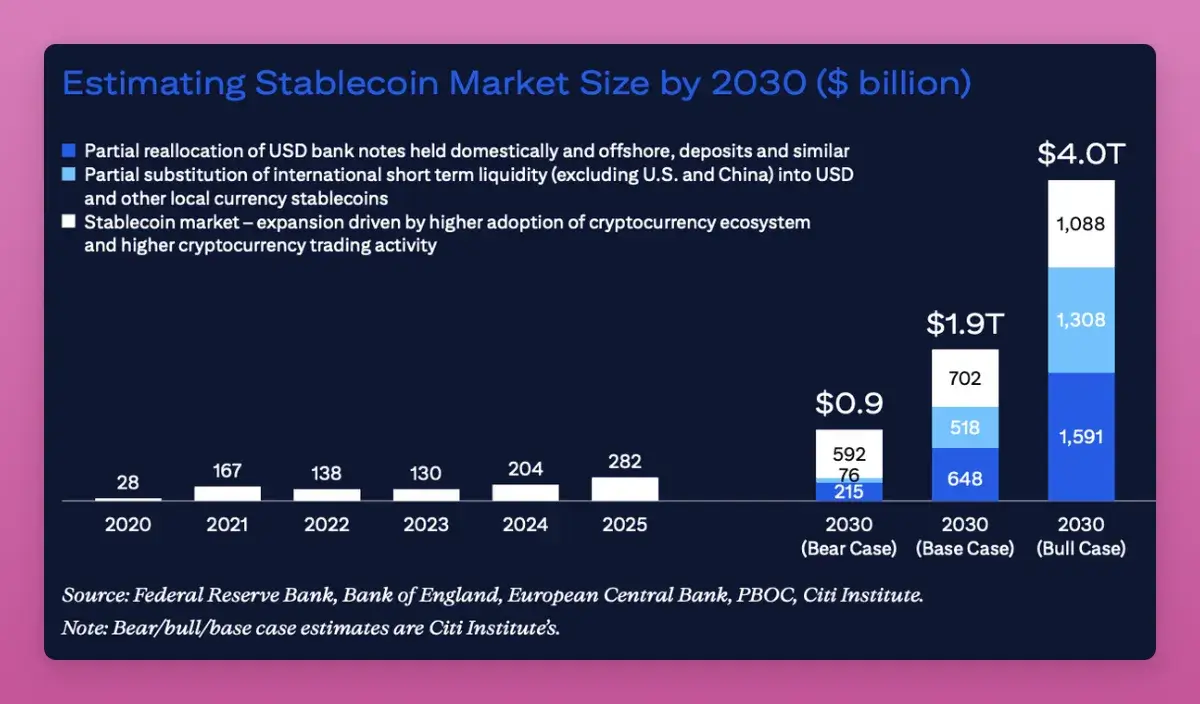

Stablecoins are undeniably entering the mainstream consciousness. A personal anecdote illustrates this perfectly: while renting a motorcycle in Bali, I was asked to pay in USDT on TRON. Although USDT’s dominance within the stablecoin market dipped from 67% to 60%, its overall market capitalization continued to expand. Citibank’s projections are even more ambitious, estimating the stablecoin market could swell to $1.9 trillion to $4 trillion by 2030.

In 2025, the narrative around stablecoins decisively shifted from pure “trading” to foundational “payment infrastructure.” However, the trading proxy narrative proved challenging; Circle’s IPO, for instance, saw its initial surge completely erased, and other proxy assets generally underperformed.

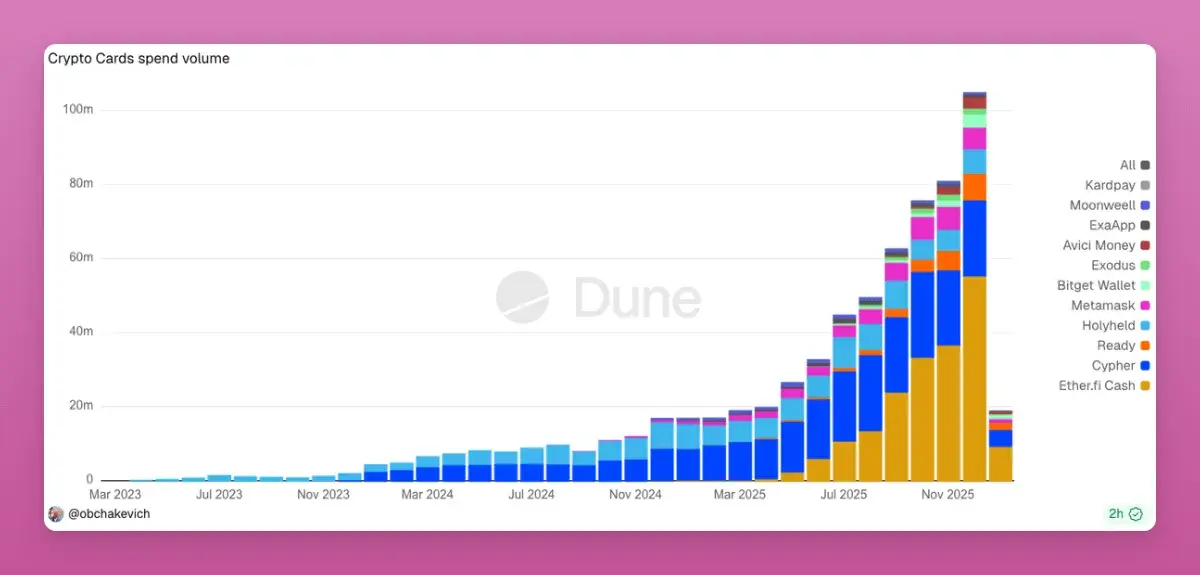

The overarching truth of 2025, even for stablecoins, was that everything is ultimately a trade. Currently, crypto payment cards are experiencing explosive growth, primarily due to their convenience in circumventing stringent bank AML requirements. Each card swipe translates directly into an on-chain transaction. If 2026 can usher in truly direct peer-to-peer payments that bypass traditional giants like Visa and Mastercard, that would represent a potentially 10,000x opportunity.

5. DeFi: A Paradox of Centralization

Here’s a bold assertion: Decentralized Finance (DeFi) exhibits a higher concentration of business and Total Value Locked (TVL) than many segments of Traditional Finance (CeFi). Consider these examples:

- Aave commands over 60% of the lending market share (compared to JPMorgan’s mere 12% in the US banking sector).

- The majority of Layer 2 protocols are effectively multi-billion dollar, unregulated multisigs.

- Chainlink maintains near-total control over the provision of value oracles across the DeFi ecosystem.

Throughout 2025, the inherent conflict between “centralized equity holders” (the Labs or founding teams) and “token holders/DAOs” became starkly apparent. The fundamental question emerged: Who truly owns the protocol, its intellectual property rights, and its revenue streams? Internal disputes, such as those within Aave, revealed that token holders often wield far less power than commonly perceived.

If “Labs” ultimately prevail in these power struggles, many DAO tokens risk becoming uninvestable. 2026 will be a pivotal year for establishing clear alignment between the interests of equity stakeholders and token holders.

Conclusion: The End of HODL, The Rise of Onchain Finance

2025 unequivocally demonstrated one core principle: everything is a trade. Exit windows were fleetingly short, and genuine long-term conviction in individual tokens was a rare commodity.

Consequently, 2025 marked the symbolic death of the “HODL” culture. DeFi is rapidly transforming into “Onchain Finance,” a more mature and regulated iteration. Concurrently, as regulatory clarity improves, many DAOs are shedding their “pseudo-decentralized” disguises, confronting the realities of governance and ownership. The crypto landscape is maturing, demanding a more dynamic and discerning approach from investors.