Monero’s Unstoppable Rise: Decoding XMR’s Surge Amidst Regulatory Scrutiny

Monero (XMR), a leading contender in the privacy coin arena, recently captured headlines by hitting an all-time high of over $690 on January 13th, sparking renewed debate about the future of privacy-focused cryptocurrencies. This remarkable ascent saw XMR soar by an astounding 262% over the past year, from approximately $200, a truly exceptional performance in a period where many mainstream altcoins have shown considerable weakness.

What makes this rally even more intriguing is its timing: it unfolded against a backdrop of unprecedented global regulatory tightening. Major centralized exchanges, including Binance, had already delisted XMR spot trading due to compliance pressures. Just a day before the peak, on January 12th, Dubai’s Virtual Assets Regulatory Authority (VARA) officially banned the trading and custody of privacy tokens across Dubai and its free zones. Yet, this regulatory “paper ban” not only failed to cast a shadow on XMR but instead was met with a defiant new high, seemingly mocking the government’s efforts.

In a market where exchange liquidity for XMR is dwindling and regulatory hammers are swinging, who or what is truly fueling Monero’s ascent? This analysis peels back the layers to uncover the genuine demand driving this extraordinary rally.Centralized Exchanges: No Longer the Core Pricing Venue

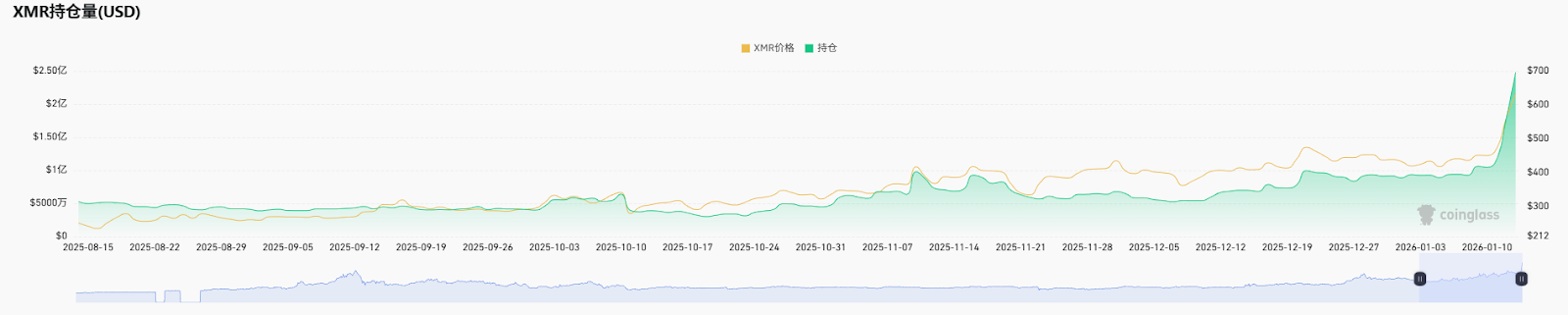

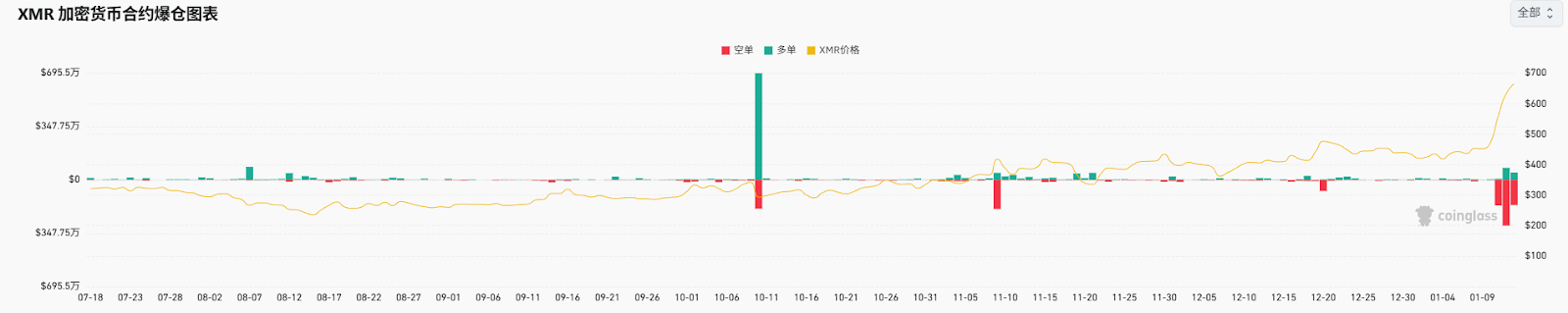

Despite the fervent market activity, the recent surge in XMR does not appear to be driven by capital within traditional exchanges.

On the spot market, while XMR’s trading volume has increased with the rally, it has largely remained within the range of tens of millions to $200 million. This pales in comparison to the significant peak of $410 million recorded on November 10th. This suggests that spot trading (or centralized exchange spot buying) was not the primary catalyst for the recent doubling in price.

A similar trend is observed in the futures market. Peak trading volumes also occurred around November 10th. Subsequently, until the most recent week, futures trading volume showed no significant increase; in fact, there were even signs of a decline. Examining open interest data, the dollar-denominated curve almost perfectly mirrors the price movement. There hasn’t been an abnormal surge in the number of XMR positions held in the market, indicating that the rise in open interest value is merely a reflection of the appreciating coin price, rather than a massive influx of new capital opening positions.

Evidently, mainstream centralized exchanges are not the primary venues dictating Monero’s current price.

The Silent Architects: Miner Dynamics and Strategic Positioning

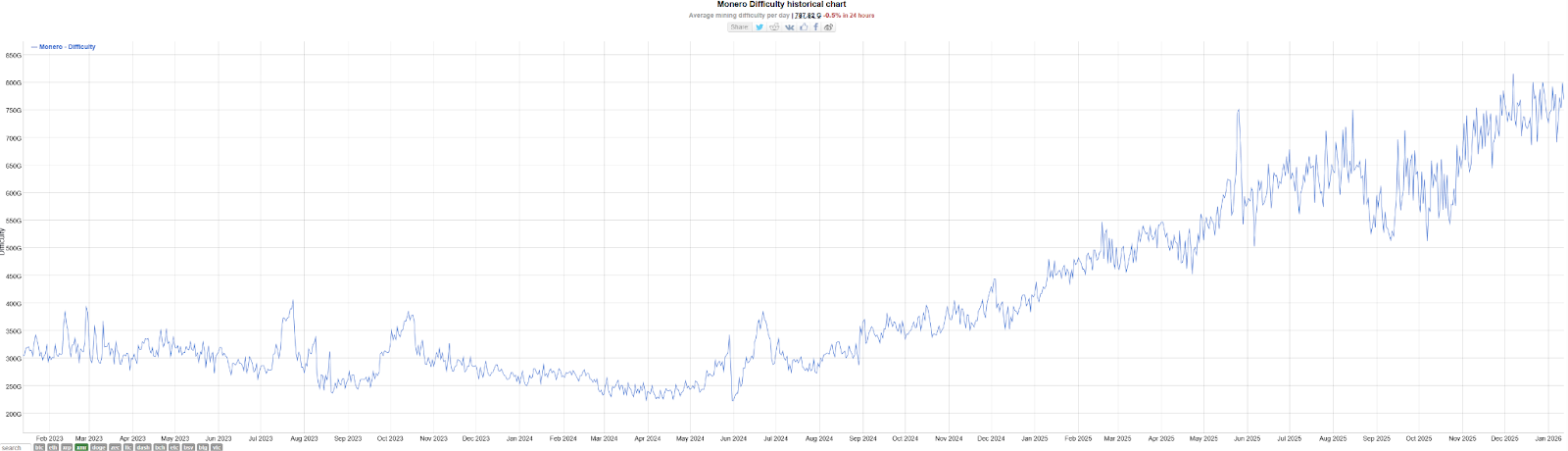

Given the unremarkable activity on “visible” financial platforms, our investigation must turn to the “shadow” world of on-chain data. As a network renowned for its robust privacy, Monero offers minimal exploitable information. However, changes in mining difficulty and profitability can provide crucial insights into how capital is being deployed on the supply side.

Historically, mining difficulty serves as a barometer for capital’s enthusiasm for network participation. Data reveals that XMR’s mining difficulty began a rapid ascent in late 2024, maintaining strong growth throughout the first half of 2025. While there were fluctuations between September and November, a new phase of difficulty climb has recently commenced.

It’s worth noting an interesting episode from September: the Qubic project claimed to control over 51% of Monero’s total network hashrate and conducted a “demonstration attack,” leading to an 18-block chain reorganization on the XMR network. This incident served as a wake-up call for the community, prompting a significant migration of miners to the established SupportXMR mining pool. This event was a major contributor to the dramatic fluctuations in mining difficulty at the end of 2024, but it also indirectly affirmed the vitality and resilience of the Monero hashrate market.

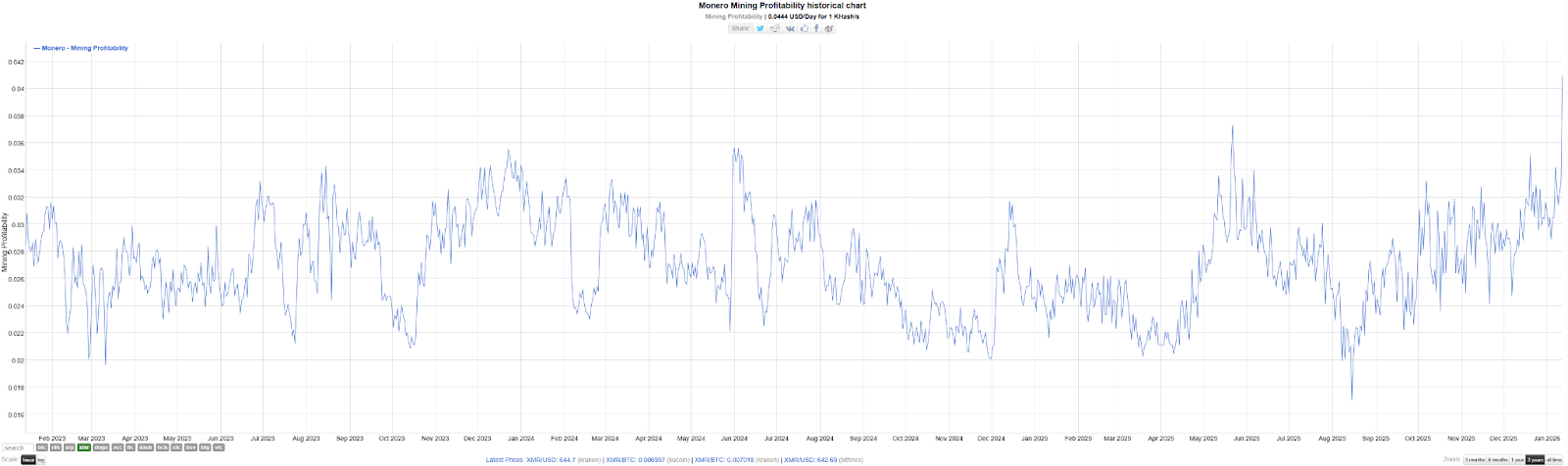

Even more telling is the connection between mining profitability and difficulty curves.

Prior to April 2025, the Monero network experienced a noticeable drop in mining profitability. When viewed alongside the difficulty chart from that period, it’s clear that hashrate surged while the coin price remained volatile. This divergence led to diluted profits, likely forcing smaller, higher-cost miners out of the market. The temporary retreat in mining difficulty in April corroborates this hypothesis.

This pattern represents a classic “miner capitulation” and “chip exchange.” Following this period, as prices surged significantly, both mining profitability and difficulty resumed their synchronized upward trend. The data from this phase suggests that as early as the beginning of 2025, large, resilient mining operations or sophisticated capital might have begun to strategically accumulate Monero tokens through mining, even in the face of lower initial profitability.

The Price of Privacy: Surging On-Chain Demand

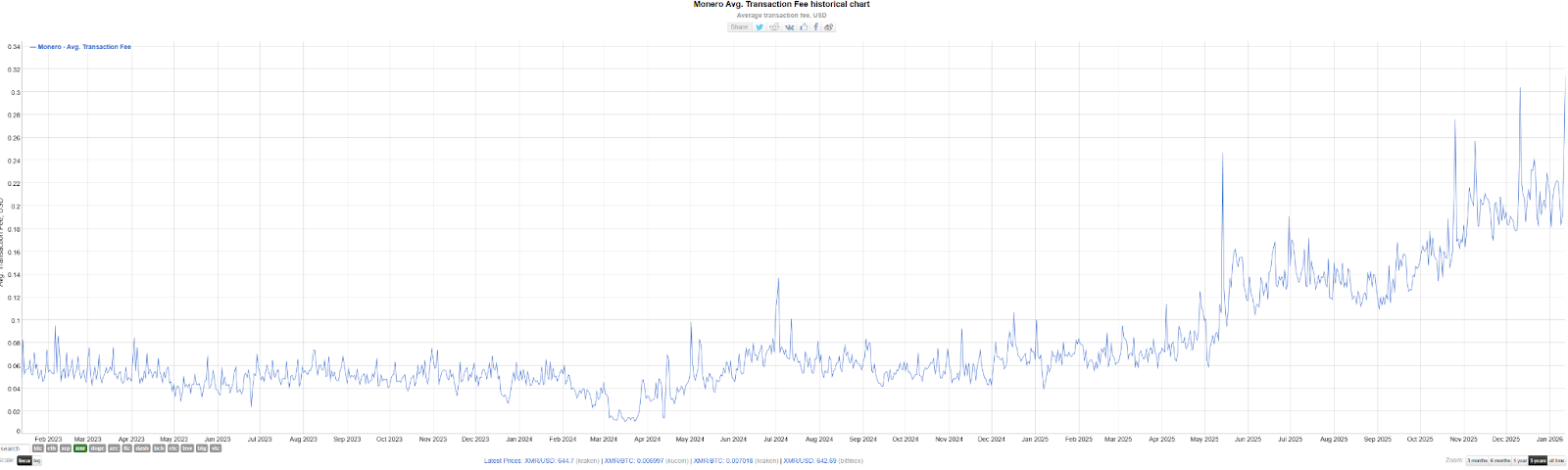

If miner activity reflects supply-side confidence, then average transaction fees offer the most authentic glimpse into user-side demand.

According to the charts, Monero’s average transaction fees remained relatively stable, mostly below $0.10, until the first half of 2025. However, starting in June, an upward trend became apparent; by December 11th, the highest average fee momentarily exceeded $0.30, more than tripling in just six months.

Given Monero’s dynamic block scaling mechanism, a spike in fees signifies a substantial number of users attempting to send transactions quickly and their willingness to pay a premium to compensate miners for the increased network load. This indirectly confirms that from the second half of 2025 onwards, real transaction demand on the Monero chain began to increase significantly.

An interesting pattern also emerged: spikes in on-chain fees frequently coincided with sharp price increases.

For instance, on April 28th, XMR suddenly jumped 14%, and the average transaction fee surged to $0.125 on the same day. During the subsequent period of gradual price climb, fees retreated to a low (reaching $0.058 on May 4th). This indicates that while market volatility can briefly stimulate on-chain demand, this demand tends to normalize once volatility subsides. Although the two aren’t always perfectly synchronized (e.g., fees rose on May 14th without a corresponding price movement), over the past six months, price increases have temporarily boosted on-chain demand, and in turn, genuine growth in on-chain demand has fueled market optimism for XMR. The two factors appear to be mutually reinforcing.

Unveiling the Dual Narrative: Resilience and Asymmetry

Synthesizing the data, Monero’s dramatic surge likely stems from a “dual narrative” — a blend of overt resilience and covert capital dynamics.

The “white” side of this truth is the “anti-fragile” rebound of privacy demand under intense regulatory pressure.

Regulation’s inverse effect is becoming increasingly evident. Dubai VARA’s ban, rather than crippling XMR, seemingly awakened market participants to a crucial realization: regulators can prohibit exchanges, but they cannot prohibit the underlying protocol itself. As major exchanges withdraw from XMR trading, the traditional pricing logic, reliant on market makers and derivatives contracts, is rewritten. Monero reverts to a model controlled by genuine users or significant, influential players. Detached from the exchange ecosystem, privacy coins are charting an independent course, distinct from the broader market.

The “black” side, however, points to a capital game driven by information asymmetry.

Beneath this veil of opacity, there might be “whales” or powerful entities orchestrating moves. The unimpressive trading data (even on the record-breaking day of January 13th, futures open interest was only $240 million, with liquidations barely exceeding $1 million) suggests that mainstream institutions largely failed to predict or participate in this rally proactively, relegated instead to merely following the trend.

Such information disparities, controlled by a select few, lead to extreme price volatility. When the broader market begins to notice and chase such rallies, it often signals short-term emotional overheating. Recalling the privacy coin ZEC in November, it experienced a retracement of over 50% after a similar surge. Ultimately, in the privacy coin market, significant “information asymmetry” exists, placing ordinary retail investors at a distinct disadvantage.

Amidst the wild fluctuations of privacy coins, on-chain data remains our most reliable guide. Yet, in the deep, opaque waters of these markets, the high premium for freedom invariably comes hand-in-hand with unknown risks.