The cryptocurrency market is currently experiencing a significant shift in investor sentiment. After a prolonged three-month period characterized by caution and a wait-and-see approach, the market’s prevailing mood has officially transitioned from “Fear” to “Greed.” This marks the first instance since last October that investors have embraced a notably bullish outlook.

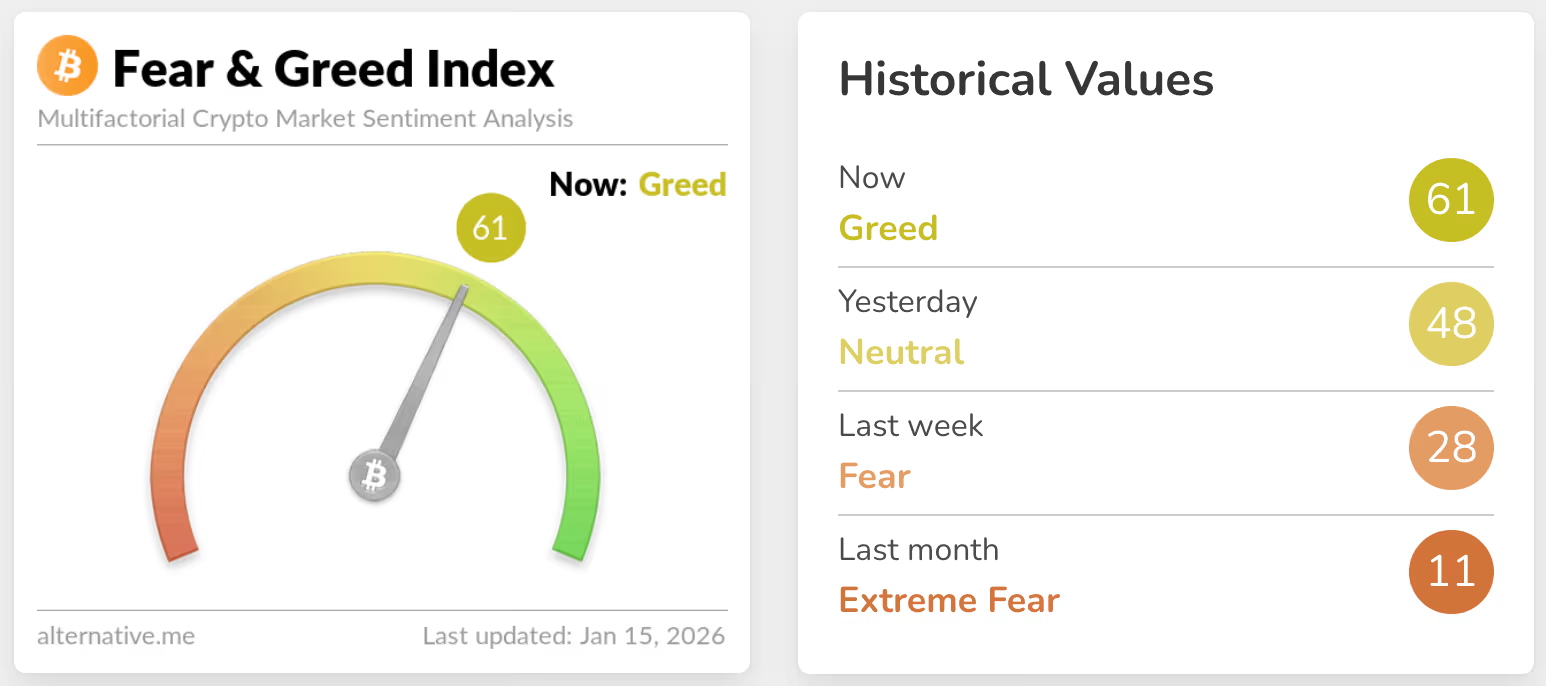

According to Alternative.me data, the widely observed Crypto Fear & Greed Index surged to 61 points (out of 100) today, officially entering the “Greed” zone. Just the day prior, the index registered a neutral 48 points. For several weeks leading up to this, market sentiment had consistently hovered in the “Fear” or even “Extreme Fear” territories.

This recent shift stands in stark contrast to the preceding downturn, which commenced with a devastating “liquidation massacre” on October 11 last year. That single event witnessed a staggering $19 billion in derivatives positions wiped out, severely eroding market confidence. Altcoins experienced a collective crash, prompting investors to retreat into a risk-off mode.

Throughout November and December, the index repeatedly plunged to single and low double-digit figures, vividly illustrating the extreme panic and subdued activity that gripped the market during that period.

The recent turnaround in market sentiment has coincided almost perfectly with Bitcoin’s impressive price trajectory. In just the past seven days, Bitcoin has surged from $89,800, breaking through key resistance levels, to reach $97,704 in the early hours of today. This marks a two-month high for the cryptocurrency, successfully restoring market confidence and morale.

It is crucial to remember that the Fear & Greed Index serves as a sentiment reference indicator, not a direct trading signal. Historically, “Extreme Fear” often signals that the market is nearing a bottom, potentially presenting opportune buying moments. Conversely, prolonged periods of “Extreme Greed” frequently precede market highs, suggesting that caution might be warranted.

With the index currently at 61 points, it undeniably signifies a notable increase in risk appetite. However, it has not yet reached the “Extreme Greed” state (typically above 80 points) often observed during the peak phases of past bull markets.

As Bitcoin successfully reclaims the critical price levels seen before October’s major shake-up, global traders are now keenly watching: Can this burgeoning wave of “Greed” establish a firm foothold and propel Bitcoin back towards the coveted $100,000 mark?

Disclaimer: This article is provided for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views or positions of the BlockBeats. Investors should make their own decisions and trades. The author and BlockBeats will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.