Author: Nancy & Frank, PANews

Ethereum Layer2 Ecosystem Rebounds: Vitalik’s ZKsync Endorsement Ignites Renewed Interest

The Ethereum Layer2 ecosystem is experiencing a significant resurgence, sparked by a recent tweet from Ethereum co-founder Vitalik Buterin that sent veteran Layer2 ZKsync’s token soaring. This renewed attention, coupled with continuous innovation from leading projects, is driving a steady increase in transaction activity across the entire Layer2 landscape.

Vitalik Buterin’s Nod to ZKsync: Activity Rises Amidst a Broader Downturn

In a period of general decline across the cryptocurrency market, Vitalik’s endorsement acted as a powerful catalyst, propelling ZKsync and the broader Layer2 ecosystem into the spotlight as a rare counter-trend success story.

On November 1st, ZKsync co-founder Alex published an insightful article titled “Ethereum is now the main capital hub of ZKsync.” Vitalik swiftly retweeted the piece, commending ZKsync for its “underestimated but valuable work” within the Ethereum ecosystem and expressing keen anticipation for its upcoming features.

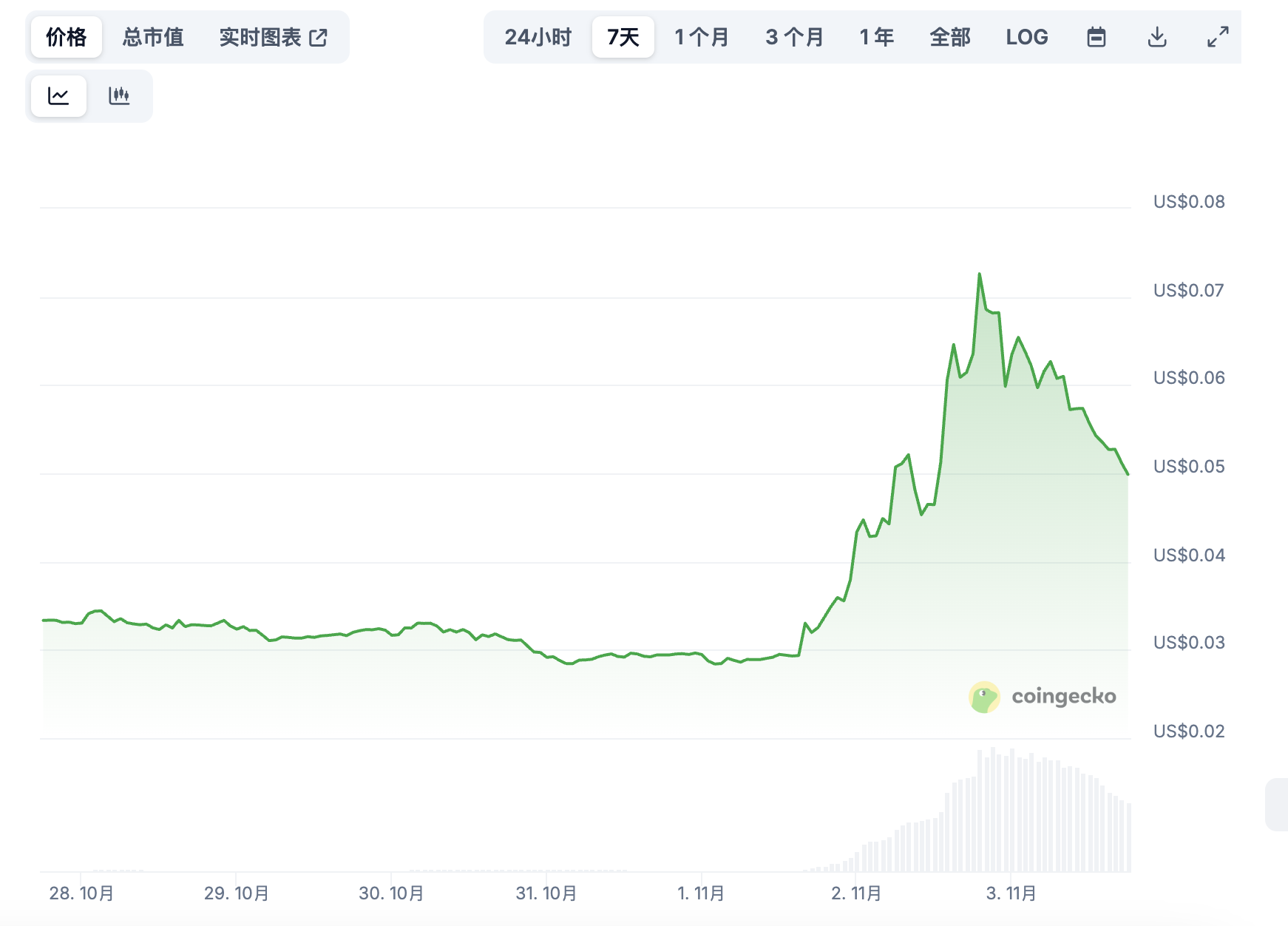

The impact was immediate and dramatic. According to Coingecko data, the ZKsync token (ZK) price surged by an astonishing 150.34% at its peak, hitting a six-month high. This rally also positively influenced other Layer2 tokens, including MINA, SCR, and STRK, which saw notable gains.

The Atlas Upgrade: ZKsync’s Transformative Leap

While Vitalik’s attention undoubtedly contributed to ZKsync’s rise, a more fundamental driver has been the groundbreaking Atlas upgrade. ZKsync’s co-founder Alex explained that the Atlas upgrade fundamentally redefines the capital structure between Layer1 (Ethereum) and Layer2. It establishes Ethereum as ZKsync’s primary capital hub, enabling ZKsync-based chains to directly access Ethereum’s vast liquidity without needing separate, independent funding pools.

This pivotal upgrade not only facilitates instant liquidity interoperability between L1 and L2 but also delivers substantial performance enhancements. These include a remarkable 15,000+ Transactions Per Second (TPS), 1-second ZK finality, and near-zero transaction fees. Such capabilities position Ethereum as a robust, institutional-grade real-time settlement layer.

Beyond raw performance, the Atlas upgrade’s true innovation lies in its ability to break down liquidity silos across various L2s. Through the “ZK Gateway” middleware component, ZK chains can communicate seamlessly, allowing L2-to-L2 transactions to finalize in approximately one second. If this technology continues its projected development, it holds the potential to genuinely unify Ethereum’s disparate L2s into a cohesive, interconnected network—a monumental step for the entire Ethereum ecosystem.

ZKsync’s Institutional Focus and the Power of Zero-Knowledge Proofs

The enhanced performance and interoperability unlocked by Atlas also open new avenues for institutional engagement, particularly in areas like Real-World Assets (RWA). ZKsync has been proactively cultivating its institutional business, already ranking as the third-largest RWA asset public chain. Recently, the platform introduced Prividium, an institutional private blockchain infrastructure designed to offer enterprise-grade privacy, built-in compliance, and seamless integration with Ethereum. Official reports confirm that over 30 traditional institutions, including Citibank, Deutsche Bank, and Mastercard, have joined Prividium since its launch.

At the core of ZKsync’s innovation is Zero-Knowledge Proof (ZK) technology—a critical advancement in Ethereum scaling that simultaneously ensures high scalability and robust privacy. The industry widely recognizes ZK as a production-ready foundational technology. A recent “Crypto 2025 Report” by a16z crypto underscored that application prosperity hinges on mature infrastructure. Over the past five years, blockchain transaction throughput has surged by 100-fold, with Ethereum L2s driving average transaction costs below a single cent, making Ethereum-connected block space both affordable and abundant. Among emerging technologies, ZK is rapidly transitioning from academic research to essential infrastructure, now integrated into Rollups, compliance tools, and mainstream network services.

ZKsync’s Mixed Activity Metrics: A B2B Powerhouse in the Making

Despite the positive stimuli, ZKsync’s active addresses, while experiencing a rare 26% rebound in the past 30 days, remained relatively low at 10,400 daily active users as of October 27th. This places ZKsync 60th among all public chains and in the lower tier among Ethereum L2s.

Similarly, ZKsync’s mainnet Total Value Locked (TVL) stands at a modest $44.55 million. However, a broader view reveals ZKsync’s elastic network encompasses 18 chains with a combined TVL of $3.3 billion. This suggests ZKsync is evolving primarily as a B2B technology service provider, excelling in enabling other ecosystems. While it serves as an excellent “green leaf” supporting the wider Ethereum L2 ecosystem, its own “red flower” (native ecosystem) is still in its nascent stages.

Broader L2 Ecosystem: Transaction Volume Soars, Valuations Face Headwinds

Beyond ZKsync, the entire Layer2 ecosystem is showing strong signs of recovery, particularly driven by leading projects. According to recent Routescan data, all top five blockchain ecosystems by transaction activity in October reported positive growth. This includes major L2s like Optimism Superchain, which processed 486 million transactions, and Boba, with 1.9 million transactions, signaling a robust revitalization of L2 activity.

Overall, the Layer2 ecosystem, propelled by its flagship projects, is exhibiting a clear warming trend. Several key metrics are rebounding, with some even reaching new historical highs.

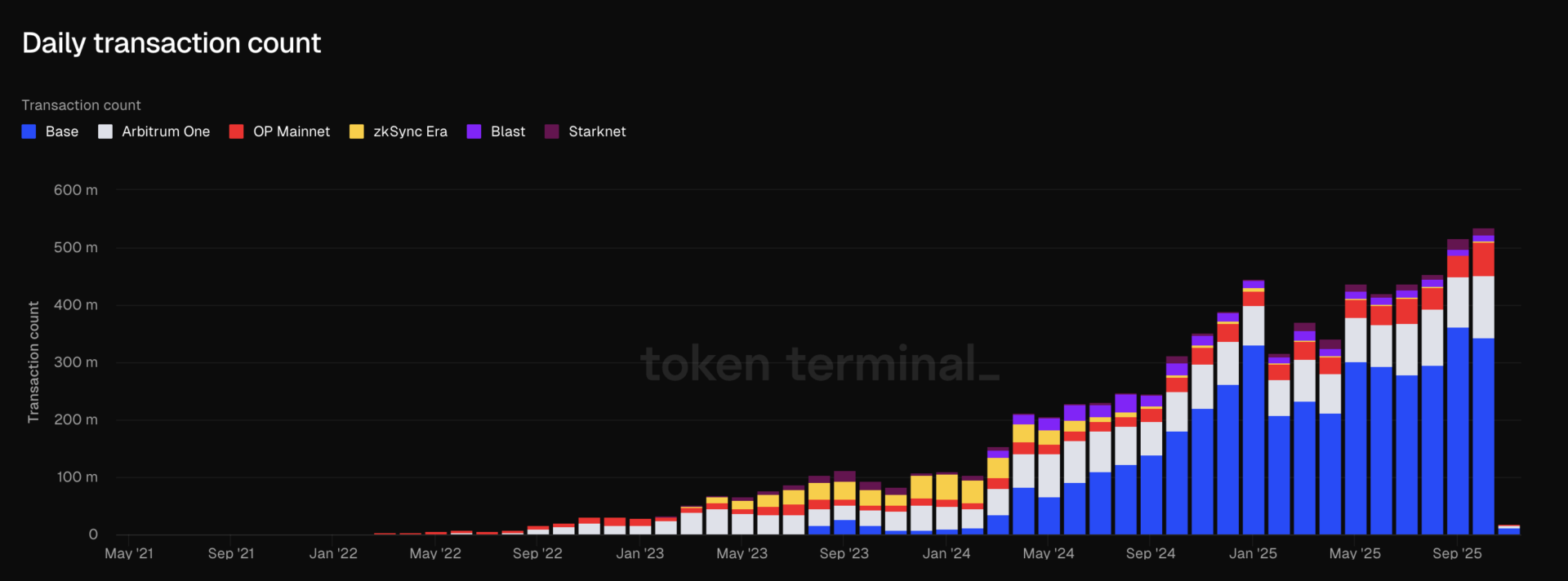

Latest data from Token Terminal confirms a sustained and powerful growth in monthly transaction volume for Ethereum Layer2 networks. In October, L2s collectively processed over 530 million transactions, setting a new all-time record—approximately 11 times the Ethereum mainnet’s 48 million transactions during the same period. Among individual L2 networks, Base emerged as the dominant force, contributing an overwhelming 64.2% of the total transaction volume (around 340 million transactions), making it the most active chain. This surge in Base activity is likely fueled by token issuance projects. Arbitrum One and OP Mainnet followed, accounting for approximately 15% and 12% of transactions, respectively.

Active Users and Fee Recovery: A Divergent Landscape

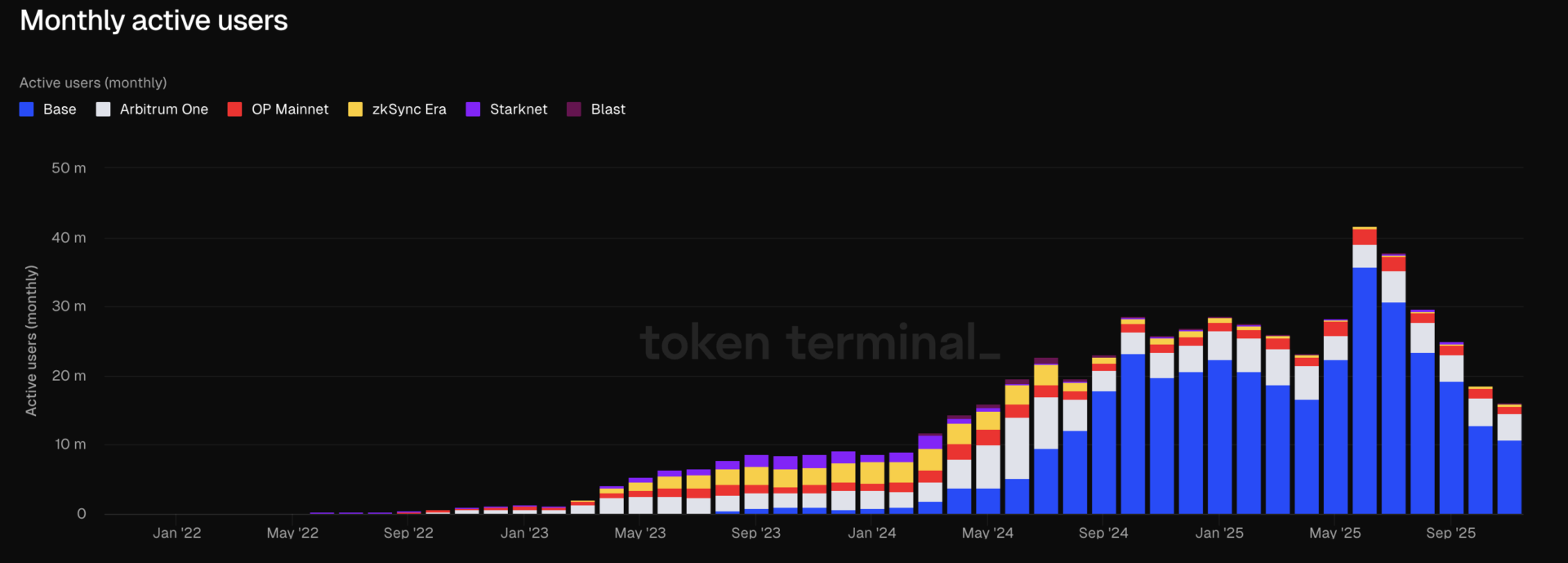

In contrast to transaction volume, monthly active user data for L2 networks in October revealed a trend of decline and increasing divergence. Token Terminal’s latest figures show L2 monthly active users at 16.1 million, a 61.4% decrease from the historical peak of 41.7 million in June. Nevertheless, this figure remains significantly higher than the Ethereum mainnet’s 8.3 million. Base maintained its strong lead, accounting for 22.9% of users with relatively stable performance, while other chains such as zkSync Era, Starknet, and Blast experienced more pronounced user attrition from their historical highs.

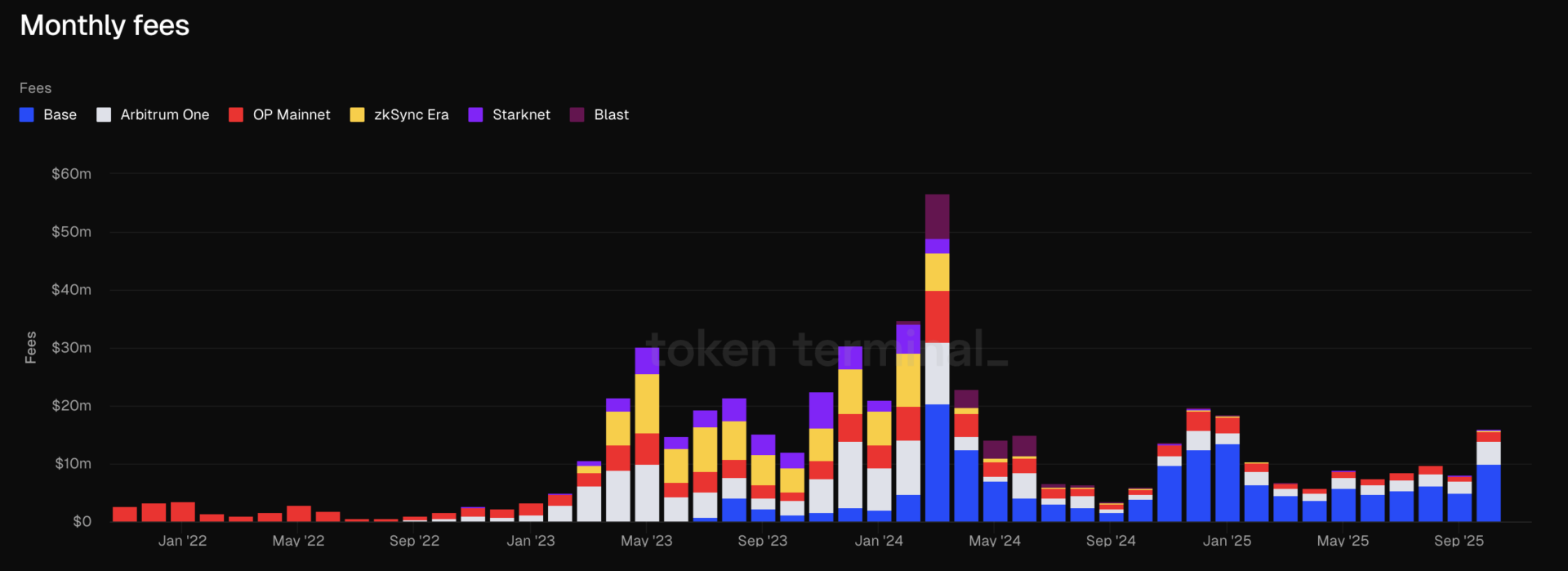

Encouragingly, L2 network fees have recently shown a significant recovery. After reaching a historical peak of over $560 million in May, the L2 sector’s daily fee revenue experienced a sharp decline. Despite the Dencun upgrade (then anticipated) significantly reducing data costs and more L2 projects scaling up, fee revenue initially struggled to rebound. This was attributed to waning on-chain activity, cooling “Gas narrative,” and unmet ecosystem expectations. However, by October, the entire L2 sector’s monthly fees neared $160 million. While this is only 28.1% of its peak, it represents a new high since February. Base, Arbitrum One, and OP Mainnet collectively generated approximately 98.3% of these total fees.

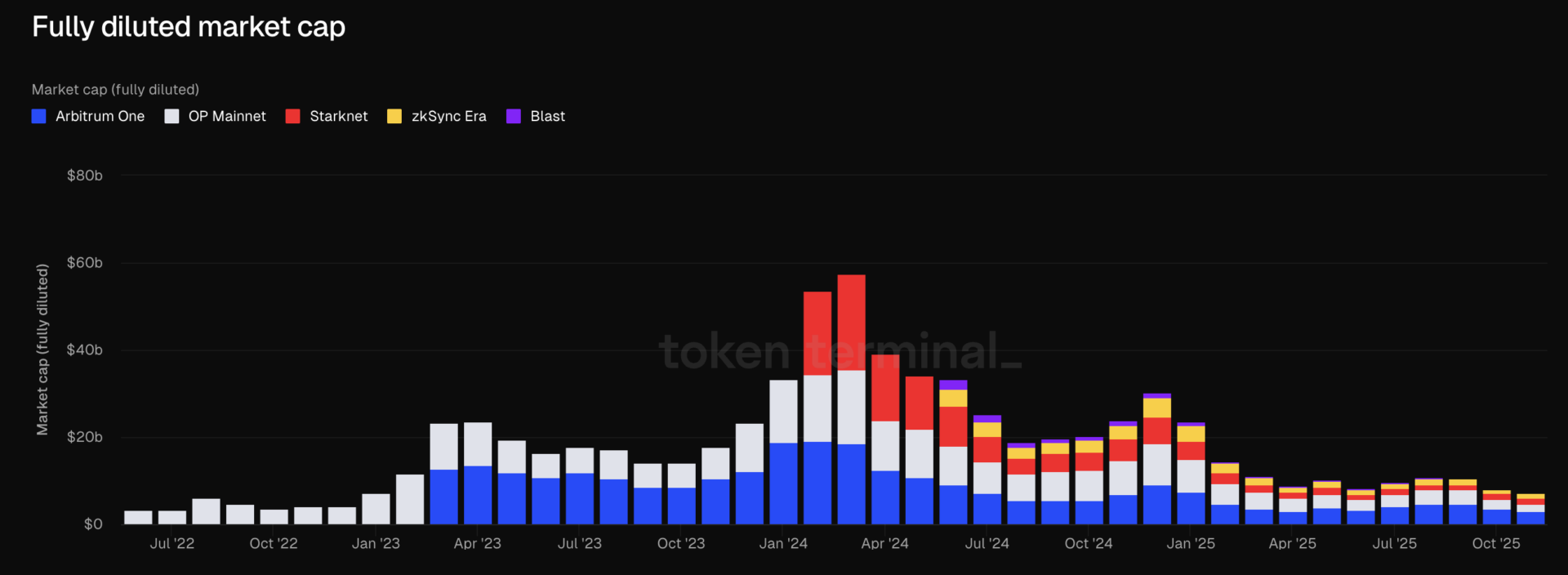

FDV Contraction: A Valuation Reset

From a Fully Diluted Valuation (FDV) perspective, the L2 sector has been on a continuous downward trajectory since peaking at over $57.37 billion in July of the previous year. Even with more L2 projects launching tokens during this period, market capitalization failed to recover. Instead, it accelerated its evaporation due to factors like token unlocking events, narrative fatigue, and ecosystem deliverables falling short of expectations. By October, the entire L2 sector’s FDV stood at approximately $7.23 billion—a mere 12.6% of its peak. This signifies the evaporation of nearly 90% of its valuation bubble within just 15 months. Arbitrum, OP Mainnet, zkSync Era, and Starknet together accounted for roughly 85% of this total FDV.

Looking Ahead: The Dencun Upgrade’s Impact

It is important to note that Ethereum developers had officially set the highly anticipated Dencun upgrade (then scheduled for December 3rd). This upgrade is designed to significantly lower L2 operating costs and boost throughput, further catalyzing explosive growth and mainstream adoption within the L2 ecosystem.

In conclusion, the Layer2 ecosystem is experiencing a phased yet promising recovery. Ongoing technological upgrades and infrastructure improvements are actively solidifying the long-term value proposition of L2s. However, the sustained and robust development of this ecosystem will ultimately hinge on the practical implementation capabilities of its core projects, the successful delivery of ecosystem promises, and the optimization of market capital structures.

(The above content is an authorized excerpt and reprint from our partner PANews. Original Link)

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.