Binance Research’s comprehensive annual report for 2025 unveils a pivotal shift in the cryptocurrency landscape: far from signaling the end of a speculative frenzy, 2025 marked the definitive dawn of market maturity. The report highlights stablecoins evolving into “network fiat,” Decentralized Finance (DeFi) transforming into a robust “revenue-generating sector,” and tokenization moving closer to “quant-grade finance.” This transformation signifies crypto’s graduation from a niche playground for enthusiasts to a sophisticated financial ecosystem. This article provides a distilled look into Binance Research’s seminal work, navigating through the “data fog” of 2025 to offer strategic insights for the adoption-driven, risk-recalibrated structural new wave anticipated in 2026.

2025: A Year of Structural Evolution Amidst Macroeconomic Headwinds

Despite a year marked by significant volatility, 2025 saw the cryptocurrency market achieve several critical milestones. The total crypto market capitalization surged past $4 trillion for the first time, with Bitcoin reaching an unprecedented high of $126,000. However, macroeconomic uncertainties—including shifts in monetary policy, escalating trade conflicts, and geopolitical risks—exerted a dominant influence on market dynamics. Binance Research aptly characterized 2025 as a period shrouded in “data fog,” citing factors such as a new US administration, “Liberation Day” tariff impacts, and economic signal distortions caused by government shutdowns. The market experienced a substantial expansion in its trading range, with total capitalization fluctuating between $2.4 trillion and $4.2 trillion, ultimately closing the year with an approximate 7.9% decline.

Crucially, the report underscores that structural progress persisted even when price movements did not align, serving as one of the clearest indicators of the market’s burgeoning maturity. Significant strides were made in developing robust channels, enhancing settlement infrastructure, and advancing regulatory clarity. The fastest-growing sectors were those rooted in practical applications and tangible utility, moving beyond mere speculative hype.

The Industrialization of Crypto: A Focus on Foundation and Compliance

A defining theme of 2025 was the pervasive industrialization of cryptocurrency. The market’s attention increasingly gravitated towards solid infrastructure and trustworthy channels. This shift was bolstered by growing regulatory clarity, particularly concerning stablecoins, and the expansion of regulated investment products, which collectively broadened avenues for institutional and professional investor participation. Concurrently, the industry’s core focus continued its migration towards compliance-friendly cornerstones: stablecoins designed for efficient settlement, tokenized treasury bills for sophisticated on-chain fund management, and applications capable of monetizing recurring value flows rather than fleeting viral trends.

This evolving emphasis also explains the observed moderation in raw “activity volume” signals. The report meticulously differentiates between mere usage metrics and genuine economic relevance, stressing that the true measure of success lies in a network or protocol’s ability to capture sustainable value, consistently generate fees or revenue, and facilitate reliable settlement and transactions over time.

Bitcoin’s Ascent: Solidifying Its Role as a Macro Asset

In 2025, Bitcoin demonstrated a notable divergence between escalating market demand and its underlying on-chain activity. While Bitcoin’s market dominance remained robust at 58% to 60%, with its market capitalization approaching $1.8 trillion, a significant portion of its liquidity and demand increasingly channeled through off-chain financial avenues. This shift underscores a maturing integration into traditional finance.

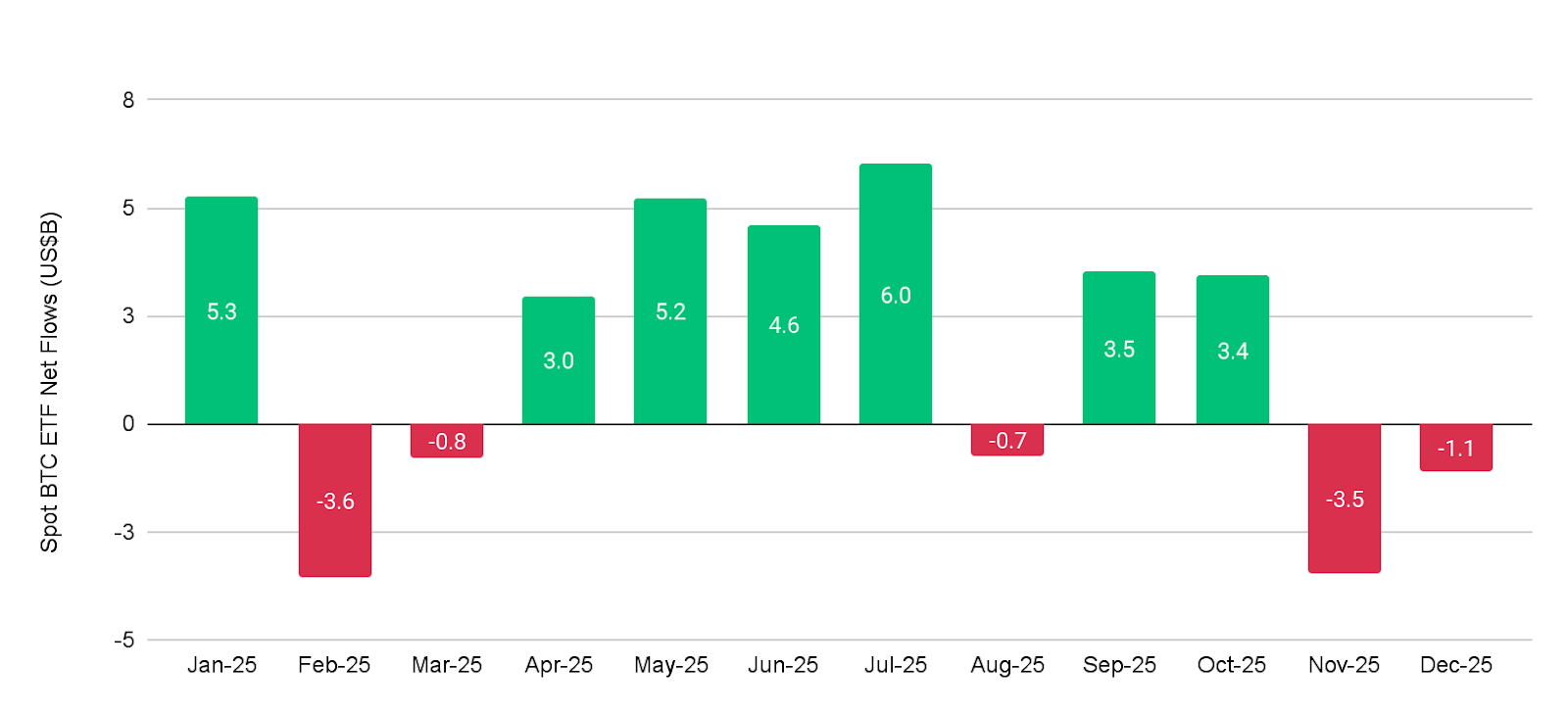

Two key metrics vividly illustrate this transformation:

- US Bitcoin spot ETFs witnessed an impressive net inflow exceeding $21 billion.

- Corporate holdings of Bitcoin surpassed 1.1 million BTC, representing approximately 5.5% of the total circulating supply.

Conversely, active addresses experienced an annual reduction of approximately 16%, and transaction counts did not set new records. This trend does not imply a diminished relevance for the underlying blockchain; rather, it highlights that Bitcoin’s market role is increasingly defined by its circulation and custodianship within macro investment portfolios and compliant financial frameworks. Concurrently, network security continued its upward trajectory, with hashrate exceeding 1 ZH/s and mining difficulty increasing by roughly 36% year-on-year, signaling sustained and robust investment in the network’s foundational security, even as on-chain usage normalized.

In essence, Bitcoin is firmly progressing towards establishing itself as a highly liquid, institutionally recognized macro asset, transcending its earlier identity as merely a transaction-driven network.

DeFi’s “Blue-Chip” Evolution: Efficiency, Compliance, and Real-World Value

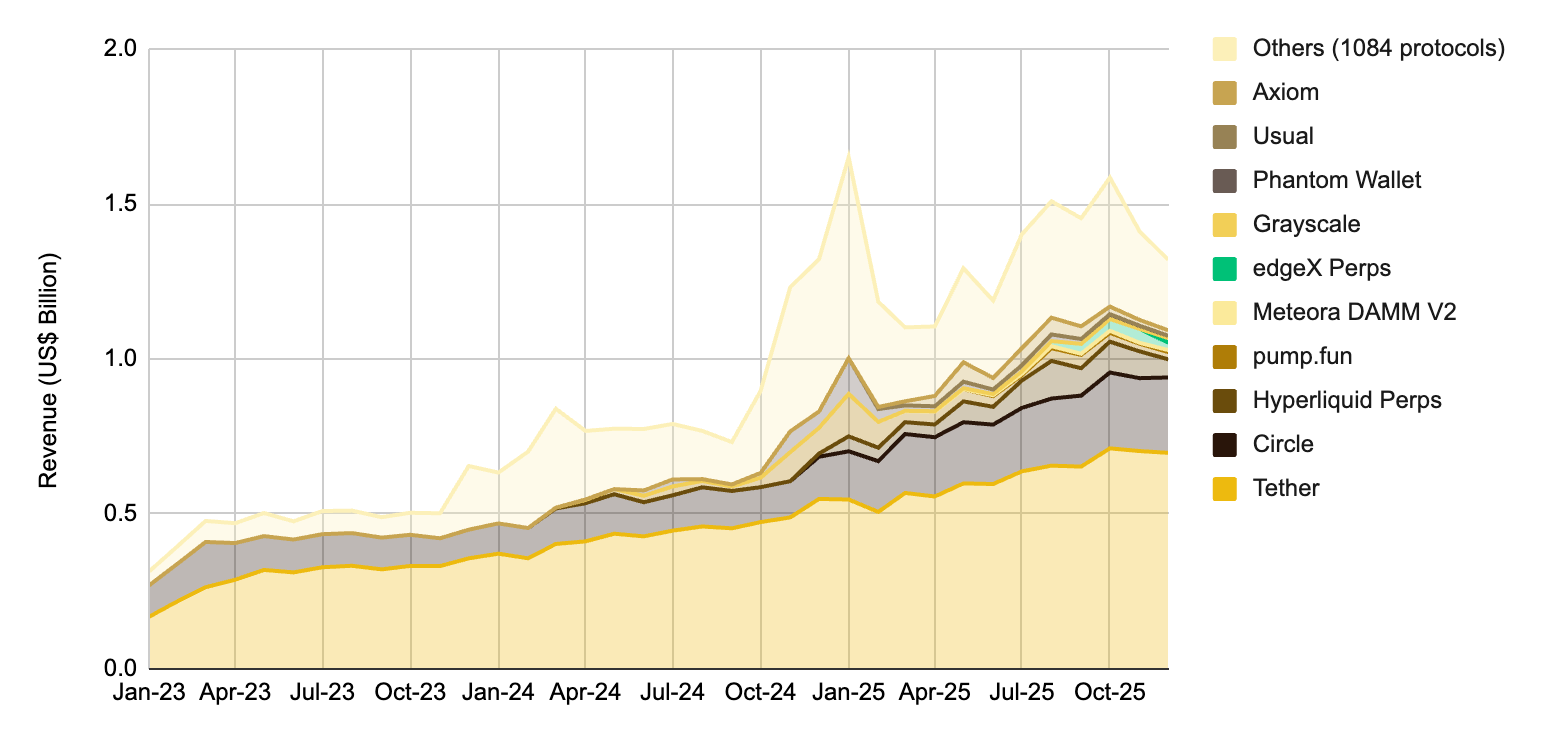

The year 2025 marked a significant pivot for Decentralized Finance (DeFi), moving beyond incentive-driven expansion towards a profound emphasis on capital efficiency and regulatory compliance. The Total Value Locked (TVL) in DeFi protocols remained robust, stabilizing at approximately $124.4 billion. Notably, the capital structure underwent a significant transformation, shifting towards stablecoins and yield-bearing assets while reducing reliance on inflationary tokens. This strategic realignment bolstered DeFi’s economic output, with total protocol revenue reaching an impressive $16.2 billion—a figure the report equates to the revenue generation capabilities of major traditional financial institutions.

A dominant trend observed was the maturation of tokenization, transitioning from a speculative narrative to a tangible form of collateral. Real-World Assets (RWA) locked value soared to $17 billion, surpassing the total value locked in decentralized exchanges (DEXs), primarily driven by the tokenization of treasury bills and stocks. This fundamental shift redefines the foundational support for on-chain finance. As collateral increasingly comprises yield-bearing real assets, DeFi applications become more intrinsically linked to sustainable, circular financial demands.

Furthermore, the report highlights the escalating importance of on-chain transaction execution. The ratio of DEX to Centralized Exchange (CEX) spot trading volume peaked at 20% at one point. Despite inherent fluctuations, this overarching trend indicates that decentralized execution is solidifying its position as a crucial venue for specific trading flows, a phenomenon amplified by the expanding scale of stablecoins and enhanced liquidity of RWA collateral.

Stablecoins: Ushering in the “Network Fiat” Epoch

Without question, the most conspicuous cryptocurrency sector to achieve mainstream integration in 2025 was stablecoins, which firmly established themselves as critical settlement infrastructure.

Key highlights regarding stablecoins from the report include:

- The total stablecoin market capitalization experienced nearly 50% growth, surging past $305 billion.

- Average daily transaction volume reached approximately $3.54 trillion.

- The annual transaction volume soared to $33 trillion, a figure notably surpassing Visa’s approximate $16 trillion.

- Regulatory clarity accelerated significantly, largely spearheaded by the US GENIUS Act.

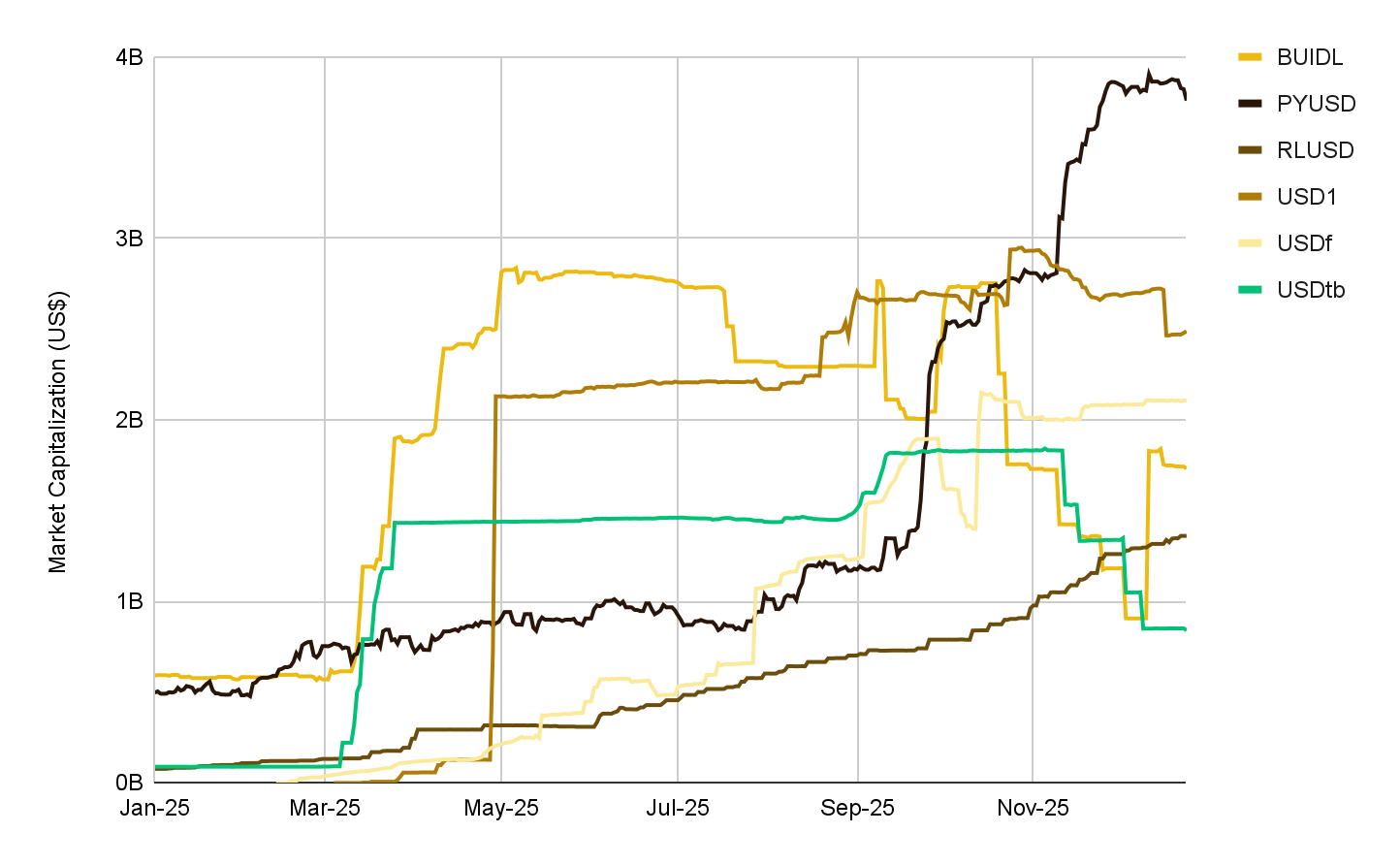

- The traditional duopoly was challenged by new entrants, with BUIDL, PYUSD, RLUSD, USD1, USDf, and USDtB all breaking the $1 billion market capitalization threshold.

The optimistic narrative is unequivocal: stablecoins are increasingly becoming the primary medium of exchange within the broader cryptocurrency market, simultaneously serving as a practical and efficient conduit for cross-border settlements, payments, and various fintech applications. In numerous scenarios, stablecoins empower users and businesses to seamlessly access crypto channels while effectively mitigating the volatility that often deters new entrants.

Layer-1 Dynamics: The Imperative of Monetizable Value

The year 2025 underscored a critical lesson for Layer-1 networks: raw transaction volume alone is no longer sufficient. Many networks struggled to translate their activity into sustainable fees, tangible value capture, or robust token price support. The decisive differentiator increasingly hinges on the ability to generate recurring, monetizable flows, such as those derived from trading, payments, and institutional settlements.

- Ethereum maintained its dominance in developer activity, DeFi liquidity, and total value. However, the compression of fees due to the prevalence of Rollup execution exerted pressure on ETH’s performance relative to Bitcoin.

- Solana demonstrated sustained high usage, expanded its stablecoin supply, and achieved robust protocol revenue, even as speculative fervor subsided. Its institutional appeal was further enhanced by the approval of a US spot ETF, simplifying institutional participation.

- BNB Chain capitalized on strong retail trading demand and compelling market narratives, facilitating large-scale stablecoin settlements and Real-World Asset (RWA) deployments. The report notably identified BNB as the best-performing mainstream crypto asset of 2025.

Layer-2 networks collectively accounted for over 90% of Ethereum-related transaction execution in 2025, benefiting significantly from reduced data access costs. While activity and fees largely concentrated within a select few Rollups (e.g., Base, Arbitrum), many others gradually faded as initial incentives diminished. The fragmentation across over a hundred Rollups and persistent challenges in sequencer decentralization remain significant constraints. This further reinforces a key theme for 2026: value capture is likely to “ascend” to the application layer, where applications are better positioned to cultivate and control user relationships, rather than solely at the blockspace layer.

2026 Outlook: Resurgent Risk Appetite and Adoption-Led Growth

Binance Research’s outlook for 2026 anticipates a confluence of a more favorable policy environment and a profound transformation towards adoption-driven growth within the crypto sector.

From a macroeconomic perspective, a “triple policy combination” is poised to reset risk appetite: monetary easing, fiscal stimulus propelled by cash injections and tax rebates, and a general loosening of regulatory constraints. Historically, looser financial conditions have proven beneficial for risk assets, and the cryptocurrency market has demonstrated exceptional sensitivity to shifts in global liquidity. The report also speculates on the potential for a US Bitcoin strategic reserve to emerge as a significant policy catalyst.

In terms of product and market structure, the focus for 2026 transcends singular narratives, shifting instead to the ability of innovations to foster sustained, long-term utility:

- PayFi: The seamless integration of neobanks with crypto wallets, powered by yield-bearing stablecoins, will drive novel consumer financial applications.

- Institutionalization: On-chain money markets, treasury bills, and Real-World Asset (RWA) settlements are expected to become deeply embedded within existing business processes.

- Value Capture: As blockspace costs continue to decrease, applications such as wallets, aggregators, Decentralized Exchanges (DEXs), and prediction markets are positioned to capture an increasing share of value.

- Smart Finance and Agency Finance: The rise of AI-driven execution, automated financial processes, and advanced trust tools will redefine efficiency and security.

- Prediction Markets: These platforms will increasingly price information, offering a data-driven alternative to opinion-based narratives.

In essence, 2026 is poised to favor systems characterized by verifiability, compliance, and a core focus on repetitive, tangible utility.

Conclusion

The year 2025 undeniably showcased the cryptocurrency industry’s resilient progress, even amidst prevailing macroeconomic headwinds. Bitcoin’s demand progressively channeled through regulated avenues, stablecoins achieved significant scale as foundational settlement infrastructure, DeFi matured into a robust revenue-generating sector, and tokenization advanced towards quant-grade financial sophistication. Binance Research’s forward-looking 2026 outlook builds upon these foundational shifts, emphasizing deeper institutional integration, widespread application-layer adoption, and a potentially more accommodating macroeconomic environment. For an in-depth understanding, including all charts, methodologies, and comprehensive 2026 insights, readers are encouraged to consult the full report.

(Content provided by Binance Research)

Disclaimer: This article is intended solely for market information purposes. All content and views expressed herein are for reference only and do not constitute investment advice. They do not represent the views or positions of BlockTempo. Investors are advised to make their own decisions and conduct their own trades. The author and BlockTempo shall not be held liable for any direct or indirect losses incurred by investors’ transactions.