In recent days, rumors of integrated trading functionalities on Twitter have sparked a fresh wave of discussions around the “gateway narrative” in the crypto space. Yet, amidst the intensifying competition for user entry points, BNB Chain has quietly carved out a distinct path, poised for continued significant growth into 2026.

For years, BNB Chain has been a bustling hub for retail traders. Its low transaction fees, rapid processing speeds, and seamless user experience, combined with the inherent user traffic from Binance, have made it the initial touchpoint for countless individuals entering the crypto market. While 2025 saw a resurgence in Meme coin activity on BSC, BNB Chain didn’t enter a cooling-off period after the hype. Instead, it strategically attracted a growing number of traditional institutions. Giants like BlackRock, Franklin Templeton, China Merchants Bank International (CMBI), and Circle have successively deployed assets onto BNB Chain, forging a novel ecosystem where institutions, retail investors, and projects coexist.

This article will delve into how BNB Chain has transformed into a pivotal platform fostering a symbiotic relationship between TradFi and the crypto world, examining this evolution from multiple perspectives.

1. By 2025, BNB Chain Transcends Its Role as a Mere Retail Haven

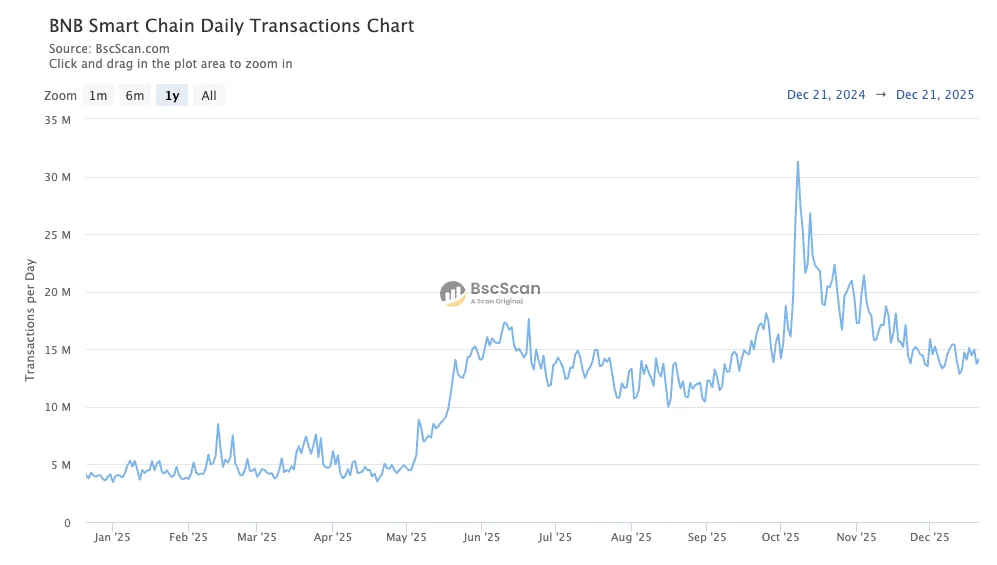

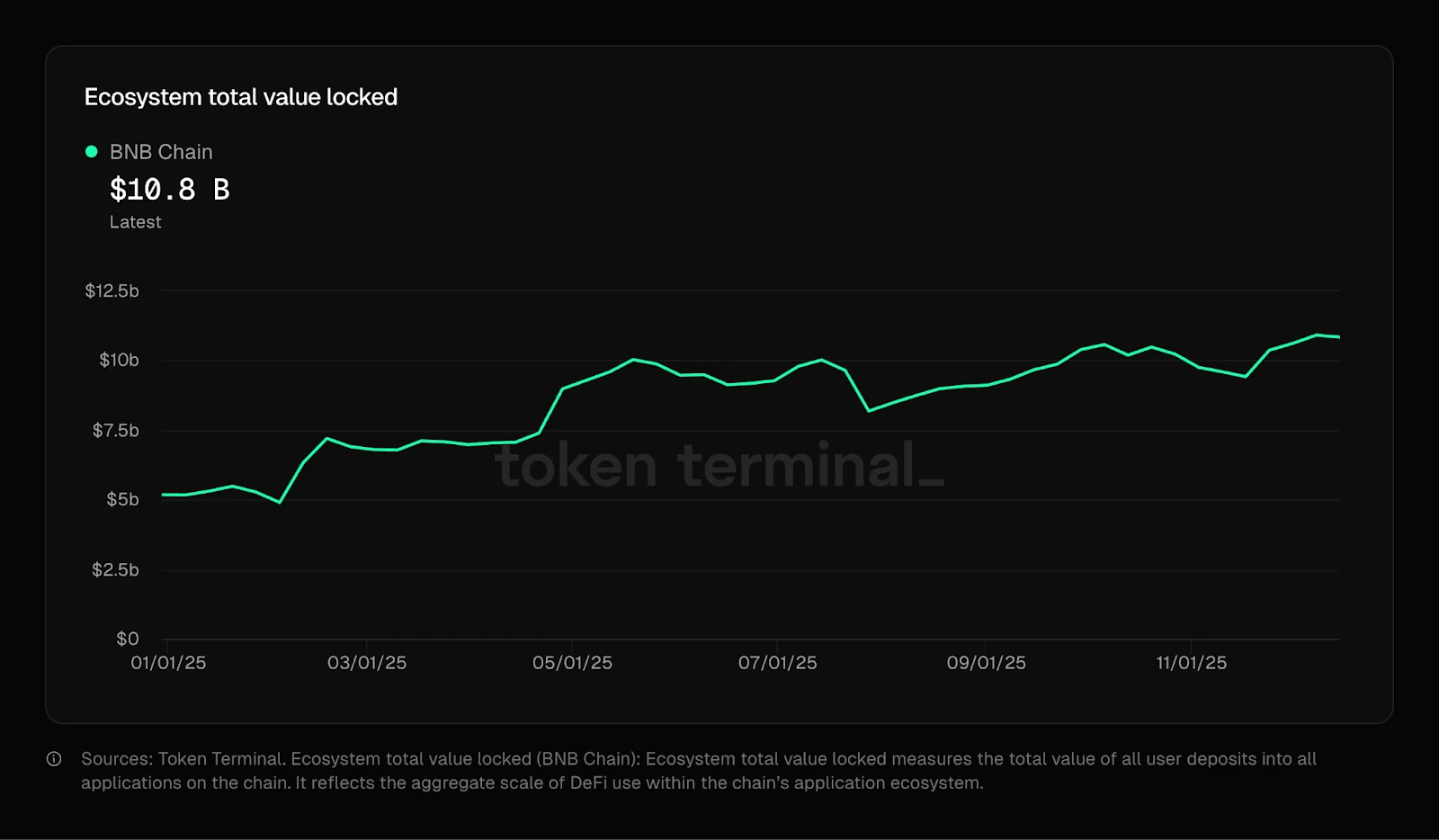

A look at the data reveals BNB Chain’s comprehensive growth throughout 2025:

- Total unique addresses surpassed 700 million, with daily active users exceeding 4 million.

- Average daily transaction volume peaked at 31 million in October.

- Total Value Locked (TVL) saw a 40.5% year-on-year increase.

- The total stablecoin market capitalization doubled to $14 billion.

- On-chain compliant Real World Asset (RWA) volume reached $1.8 billion.

These metrics underscore that BNB Chain has undergone rigorous, long-term validation across diverse real-world use cases, including stablecoin transactions, asset transfers, and high-frequency interactions.

Beyond the raw data, the chain’s vibrant activity is palpable to users. The first half of 2025 witnessed multiple Meme coin rallies, spearheaded by platforms like @Four_FORM_. Meme tokens such as $FLOKI, $Cheems, and $BROCCOLI experienced rapid surges, re-establishing BNB Chain as a hotbed for retail investors. The latter half saw a fresh wave of rallies, exemplified by Chinese Meme coins like $幣安人生, igniting enthusiasm within the Chinese community.

While Meme coin trading volumes saw a slight dip after the initial frenzy, stablecoin activity continued its upward trajectory. Stablecoins like $USDC, $USDT, $USD1, and $U became widely integrated into payment, lending, and yield-generating products. Concurrently, institutions such as Circle and BlackRock began onboarding stablecoins and money market funds onto the blockchain, with BNB Chain emerging as one of the primary hosting platforms. This signifies a gradual and sustained accumulation of assets on-chain.

In 2025, BNB Chain experienced simultaneous growth in two key areas: the cyclical explosion of Meme coin-driven traffic and the steady onboarding of traditional financial assets, alongside the expanding utility of stablecoins and real-yield products. This dual growth trajectory indicates BNB Chain’s increasing capacity to support long-term capital application scenarios.

2. Why BNB Chain? Three Reasons for Traditional Institutions’ Preference

In 2025, several heavyweight financial institutions strategically chose BNB Chain, covering various sectors including stablecoins, money market funds, and interest-bearing assets:

- BlackRock: The world’s largest asset manager tokenized its USD Institutional Digital Liquidity Fund (BUIDL) via Securitize and deployed it on BNB Chain.

- China Merchants Bank International (CMBI): Issued CMBMINT, a $3.8 billion money market fund token, allowing qualified investors to subscribe and redeem on-chain.

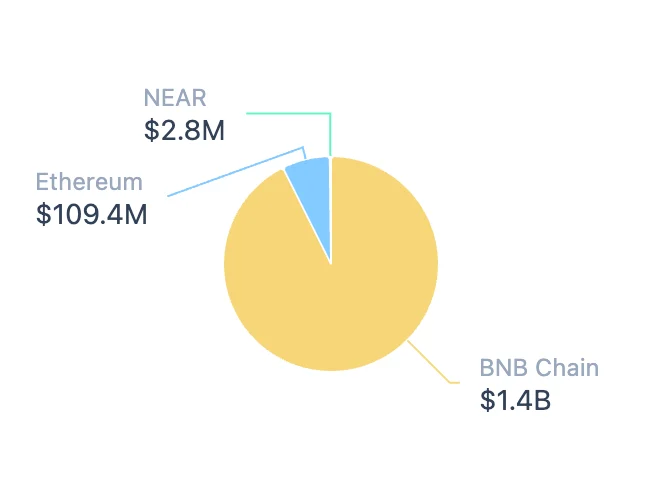

- Circle: Deployed its yield-bearing stablecoin, USYC, on BNB Chain. According to RWA.xyz data, Circle’s on-chain supply of USYC has surpassed $1.5 billion, with over $1.4 billion deployed on BNB Chain.

Why do traditional institutions favor BNB Chain? These cases highlight three primary reasons:

1. Low Cost, High Performance: BNB Chain is renowned for its exceptional performance and low gas fees, making it ideal for high-frequency financial applications. Compared to the high-fee, often congested Ethereum mainnet, BNB Chain offers a more user-friendly transaction environment, ensuring more efficient on-chain operations for institutional products.

2. Massive User Base: Leveraging Binance’s years of development, BNB Chain boasts one of the most diverse global user bases, spanning Asia and emerging markets. This broad reach ensures that institutional assets, once deployed, gain immediate and extensive audience access. For instance, BUIDL can serve as trading collateral within the Binance ecosystem, opening access to tens of millions of CEX users.

3. Robust Infrastructure and Capital Flow Pathways: After years of development, BNB Chain’s DeFi ecosystem is comprehensive, featuring a full suite of stablecoins, DEXs, lending platforms, and derivatives. This robust environment allows tokens issued by traditional institutions to seamlessly integrate with various on-chain applications. For example, CMBMINT can be used as collateral on protocols like @VenusProtocol, @lista_daocol, and Delista_dao.

In essence, BNB Chain combines technological prowess with a mature ecosystem. It satisfies TradFi’s demands for performance and compliance while offering extensive user and application support, naturally positioning it as the platform of choice for traditional institutions entering the blockchain space in 2025.

3. BNB Chain’s Symbiotic Ecosystem: How Retail, Institutions, and Projects Find Their Place

With the influx of TradFi institutions, BNB Chain’s user structure has become more complex. An intriguing phenomenon emerged in 2025: retail investors, institutions, and project developers operated distinctly yet collaboratively on the same chain.

Retail Investors: Active and Profit-Driven

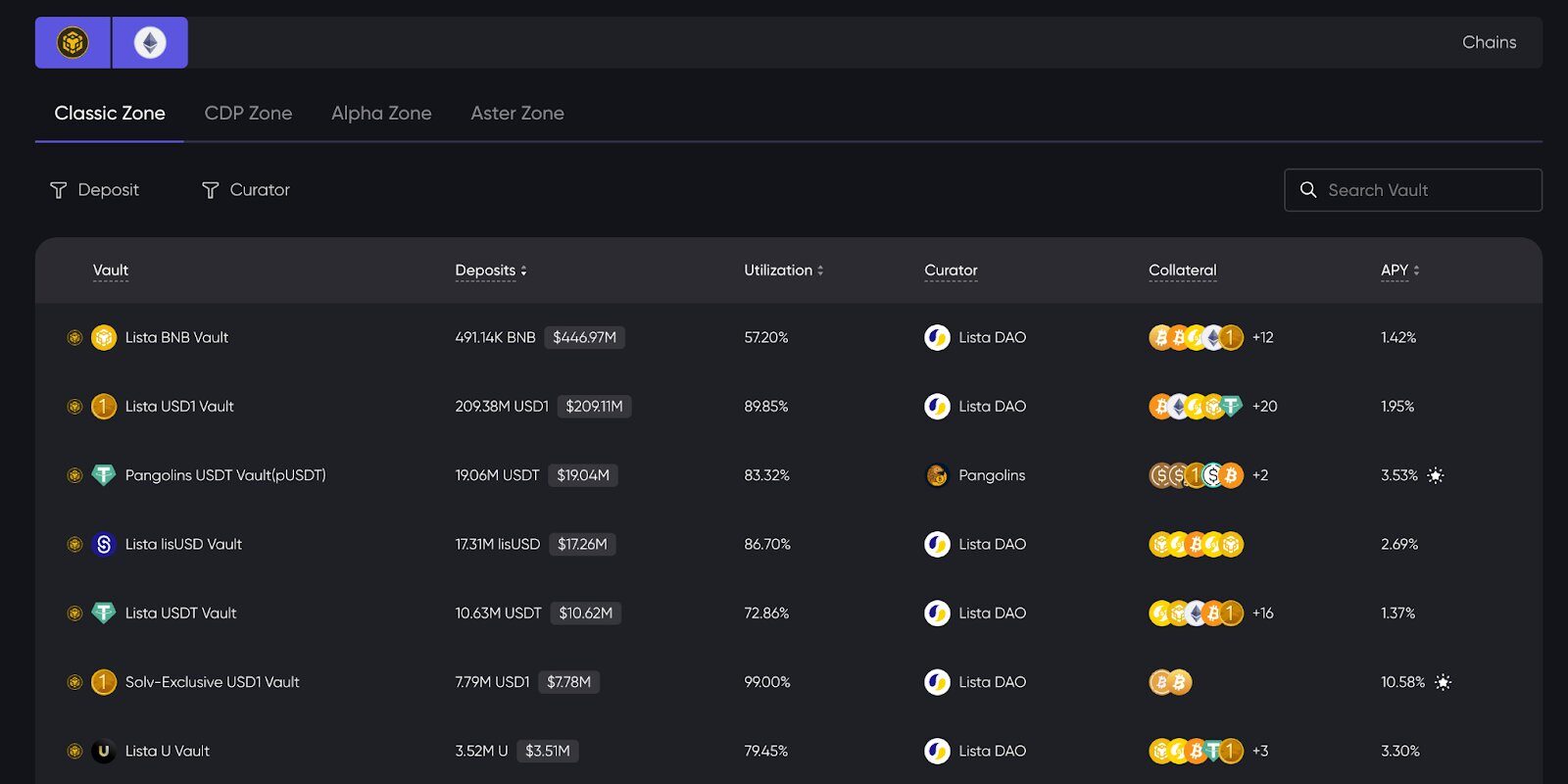

Despite significant institutional entry, retail activity on BNB Chain remained robust. 2025 saw multiple Meme coin rallies erupt on platforms like Four.meme, boosting BNB Chain’s transaction volume and briefly driving the BNB price to a new all-time high of nearly $1300. Furthermore, PerpDex platform Aster offered high-leverage tools, while the low gas and high TPS environment enabled frequent intra-day trading. Beyond trading, retail investors also earned passive income by participating in on-chain vaults, with ListaDAO, for example, offering over a dozen vaults including BNB, USD1, and USDT.

The presence of institutional products did not diminish the retail trading experience; instead, a richer asset base and deeper liquidity pools unlocked more possibilities for sophisticated trading strategies.

Institutions: Issuing Assets, Anchoring Yields

Upon entering BNB Chain, TradFi institutions primarily assumed the roles of issuers and capital providers, bringing real-world assets (such as fund shares, bonds, and stablecoins) onto the blockchain.

On BNB Chain, institutional capital flow extends beyond merely subscribing to fund products. The Venus protocol, for instance, supports on-chain lending against RWA and stablecoins as collateral, thereby reducing idle capital. This process significantly cuts down the procedural and time costs inherent in traditional finance through automated liquidation, real-time settlement, and disintermediated workflows.

Project Developers: The Nexus Connecting Retail Traffic and Institutional Assets

On one hand, native projects like PancakeSwap, Lista DAO, and Venus continued to serve a vast audience of retail and crypto investors, offering decentralized trading, lending, and yield aggregation. On the other hand, these projects actively integrated RWA assets and yield-bearing stablecoins issued by institutions, creating utility for traditional assets on-chain. The lending protocol Venus, for example, quickly supported CMBMINT fund tokens as collateral, and the yield protocol Lista DAO deeply integrated the institutional stablecoin USD1. Crucially, this integration did not conflict with existing retail users; rather, it expanded the entire ecosystem’s potential.

Overall, BNB Chain stands out as one of the few ecosystems where retail investors, institutions, and project developers can mutually benefit, operate independently, and yet collaborate on the same chain:

- Retail investors drive transaction activity and usage frequency.

- Institutions contribute capital volume and asset diversity.

- Project developers design yield structures, integrating both into a cohesive system.

This harmonious coexistence is primarily due to BNB Chain’s commitment to maximum openness and compatibility. It is not a chain exclusive to one type of user but an open platform capable of accommodating diverse roles.

4. BNB Chain Projects: Shifting from Traffic Speculation to Real Revenue

As Meme coin hype subsided, BNB Chain’s ecosystem projects adapted to market changes by incorporating more real-yield models:

- ListaDAO: By anchoring stablecoins like USD1 and U, ListaDAO built a collateral-lending-yield generation capital circulation system, achieving a TVL exceeding $2 billion.

- Aster: Evolved from perpetual futures to on-chain US stock derivatives trading, and then to issuing its USDF series of stablecoins. Aster moved beyond solely relying on trading fees, strategically diversifying into a multi-financial product platform.

- PancakeSwap: As the longest-standing DEX on BNB Chain, PancakeSwap also quietly underwent a transformation. It reduced CAKE inflation, retired older staking products, launched stock perpetual contracts, and announced the rollout of an AI-driven prediction market called Probable.

These shifts reveal three key signals of ecosystem reconstruction on BNB Chain:

1. Declining Meme Traffic in the Crypto Market, Users Prioritize Viable Yield Structures

Past methods of generating hype and trading volume through token issuance are becoming less effective at retaining capital. Users are now focused on whether yields are genuinely sustainable, rather than merely how compelling a narrative sounds.

2. Integration with Real-World Assets to Build Robust and Sustainable Product Structures

On-chain products are proactively integrating with traditional capital to meet both users’ demand for stable returns and institutions’ need for compliant assets.

3. Inter-Protocol Collaboration Towards Organic Symbiosis

A single stablecoin can simultaneously participate in lending, farming, and collateralization, meaning asset pathways are no longer isolated. This signifies that projects on BNB Chain are collaboratively building a powerful, interconnected on-chain network.

5. Outlook 2026: BNB Chain’s Next Strategic Positioning

As 2026 approaches, the landscape facing BNB Chain is subtly changing. The decline in Meme coin popularity is merely a symptom; the deeper challenge stems from a reconfiguration of the competitive sector:

New user growth may enter a plateau phase. The past reliance on Meme coins to drive traffic is unlikely to be replicated, and new institutional yield strategies have not yet been fully proven, potentially leading to a slowdown in new user acquisition.

Against this backdrop, BNB Chain’s trajectory for 2026 becomes increasingly clear:

1. The Preferred Channel for Onboarding Real-World Assets

BNB Chain has largely validated its capability to handle high-frequency transactions and stable assets, offering traditional institutions a “secure, controllable, and low-friction” channel for asset tokenization. As stablecoin market capitalization grows, RWA projects proliferate, and more countries and financial institutions adopt an open stance towards on-chain assets, BNB Chain is anticipated to become one of the preferred infrastructure platforms in the Asia-Pacific region and globally.

2. A Testing Ground for New Sectors: Prediction Markets, Privacy Modules

Beyond stablecoins and RWA, BNB Chain is also exploring more futuristic sectors:

- Prediction Markets: Experiencing diversified growth on BNB Chain. @opinionlabsxyz, with its macro trading perspective, has emerged as a leading platform. @predictdotfun innovatively integrates prediction positions into DeFi operations, enhancing capital efficiency. @0xProbable offers a zero-fee experience, aiming to gamify prediction markets and create new composable, social interaction forms.

- Privacy Modules: In 2025, privacy coins outperformed the broader market, with their on-chain usage steadily increasing. In 2026, BNB Chain is expected to introduce privacy technologies like zero-knowledge proofs (ZKPs) to help financial institutions manage isolated private data on-chain.

3. Continuous Protocol Layer Optimization to Lower Entry Barriers

Technologically, BNB Chain will continue to upgrade its underlying protocol in 2026. For example:

- Targeting 20,000 transactions per second (TPS) with instantaneous confirmation times, potentially leading to even lower gas fees.

- A privacy framework: Configurable, compliance-friendly privacy mechanisms supporting high-frequency transactions and ordinary transfers while maintaining DeFi composability.

- An AI Agent framework: Providing an AI Agent identity registration system, reputation scoring, and more.

What sparks will fly when retail capital meets institutional long-term funds, and when on-chain native yields converge with off-chain real cash flow? BNB Chain’s performance in 2025 provides a resounding positive answer.

As we move into 2026, a new chapter unfolds. Coexistence, perhaps, will emerge as the defining keyword for the next phase of crypto, and BNB Chain is undoubtedly one of its most compelling testing grounds.