Author: Frank, PANews

Unlocking BNB’s Potential: A Deep Dive into Binance’s 2025 Earning Strategies

The cryptocurrency landscape is ever-evolving. While 2024 offered straightforward “set it and forget it” opportunities like staking BNB in Launchpool for easy gains, 2025 presented a more complex environment. With on-chain PvP draining capital through fees and the secondary market rife with “VC vaporware” tokens, investors sought robust strategies to navigate the volatility.

Amidst this dynamic backdrop, a crucial question emerged: Could the “low-effort, low-risk” BNB strategy still deliver? The answer, as explored by PANews through Binance’s official 2025 report and proprietary data analysis, is a resounding yes – albeit with a strategic evolution. While 2024 was about communal gains from Launchpool, 2025 pivoted towards personalized rewards through Binance Alpha.

This article delves into the actual returns for an investor holding 10 BNB throughout 2025, dissecting various participation levels and revealing how different approaches shaped their financial outcomes.

The Enduring Value of BNB’s Passive Income Streams

Let’s first examine the most conservative approach: simply holding BNB and participating in Binance’s foundational activities. This “lazy” strategy involves engagement with Hodler Airdrop, Launchpool, and Megadrop, bypassing more intensive operations like Alpha. What kind of baseline income could this generate?

According to Binance’s recently published 2025 Annual Report, each BNB held yielded an impressive $71.5 in additional income solely from core platform activities.

A breakdown of this $71.5 per BNB reveals:

- Hodler Airdrop: $43.32

- Launchpool (New Coin Mining): $18.37

- Megadrop (Web3 Tasks): $9.81

For an investor holding 10 BNB, with an initial cost of approximately $7,000 at the start of the year, this passive income stream would amount to $715. Crucially, this doesn’t account for BNB’s capital appreciation. BNB’s price surged from $700 at the year’s outset to a peak exceeding $1,375. Using a conservative median of $1,000 for calculation, 10 BNB would have appreciated by roughly $3,000.

Combining these, the most conservative strategy would yield a guaranteed total return of approximately $3,715, translating to an impressive 53% annual return. This “floor price” performance demonstrably outpaces the majority of traditional financial products.

However, in 2025, those who stuck solely to this “lying flat” approach to “farm” Binance rewards captured only a fraction of the full potential.

Binance Alpha: The Game-Changer for 2025 Returns

The defining feature of the Binance ecosystem in 2025 was undoubtedly Binance Alpha. While Binance’s annual report remained discreet about Alpha’s specific earnings – labeling them as “rewards for the diligent” due to their variability across capital and engagement levels – its significance is undeniable. The key shift from 2024 to 2025 wasn’t just about holding assets, but actively participating.

PANews’ analysis indicates that Binance Alpha hosted a staggering 288 airdrop activities throughout 2025. Theoretically, securing all of them could have led to earnings as high as $16,300. Yet, practical execution often diverges from theoretical maximums.

For a typical user holding 10 BNB, our “de-risked” calculation provides a more realistic picture:

- Opportunity Filtering: We excluded projects with high thresholds (over 240 points) that might be out of reach, leaving 260 viable opportunities. This reduced the theoretical total income to approximately $15,200.

- Real-World Participation: Factoring in “first-come, first-served” mechanics post-August, potential missed trades, or slower execution, we applied a 30% missed rate. This refined the estimated income to around $12,600.

Of course, Alpha is a “paid game,” and participation costs must be considered. A 10 BNB holding automatically generates about 2 points daily. To meet the average 240-point participation standard, users would need to actively generate an additional 14-18 points daily.

This translates to approximately $30,000 in daily trading volume. With an estimated daily trading cost (wear and tear) of $4-$8, the annual trading friction cost from Alpha’s launch in late April would be around $1,250.

Net Profit from Alpha: $12,600 (income) – $1,250 (cost) ≈ $11,350.

Comparing this to the $715 earned from the passive “basic income” strategy, the diligent Alpha participant earned over 15 times more. This stark difference underscores a critical lesson for 2025 Binance activities: active engagement was the most potent secret to maximizing returns.

Three Strategies, Three Outcomes: A Financial Snapshot

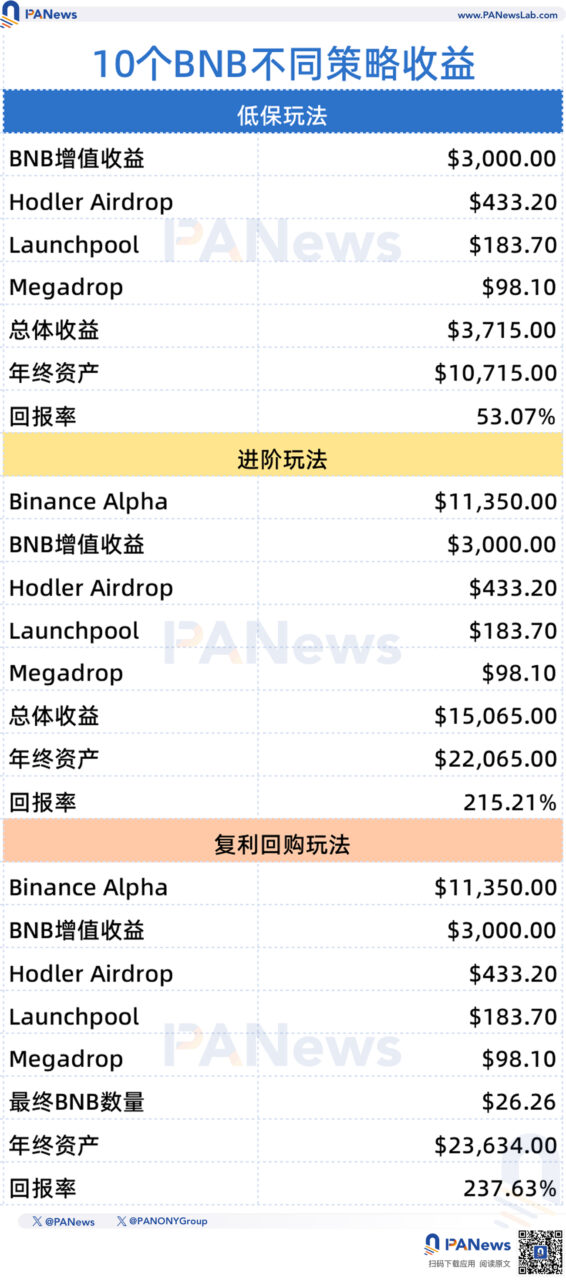

Combining official data with our Alpha calculations, let’s see how that initial $7,000 investment at the start of 2025 performed under three distinct operational strategies:

Strategy A: The “Passive Holder”

Operation: Simply held BNB, collected rewards from the three core official activities (Hodler Airdrop, Launchpool, Megadrop), and ignored Alpha.

- Net Gain: $715 (cash flow) + $3,000 (BNB appreciation) = $3,715

- Final Asset Value: $10,715

- Annualized Return: Approximately 53%

Strategy B: The “Diligent Earner”

Operation: Maxed out official passive income and consistently dedicated time daily to maintain Alpha points.

- Net Gain: $715 (official) + $11,350 (Alpha net) + $3,000 (BNB appreciation) = $15,065

- Final Asset Value: $22,065

- Annualized Return: Approximately 215%

This strategy more than tripled the initial principal, likely outperforming the vast majority of crypto investors in 2025.

Strategy C: The “Compounding Investor”

Operation: Building on Strategy B, this investor immediately reinvested approximately $1,000 in monthly cash flow back into BNB.

- Income: Based on the average BNB price in 2025, the initial 10 BNB would grow to approximately 26.26 BNB by year-end. Valued at roughly $900 per BNB at year-end, total assets would reach $23,634.

- Annualized Return: Approximately 237%

While this strategy offered the highest return rate, it also involved greater exposure to price volatility. Interestingly, its advantage over the non-compounding diligent strategy (Strategy B) was not overwhelmingly significant, suggesting that active participation was the primary driver of superior returns.

BNB’s “Certainty” Outperforms 99% of Crypto Assets

In a crypto world often captivated by tales of 100x or 1000x gains, an annualized return of around 200% might seem modest, especially considering the daily commitment required for Alpha. However, when assessed against the overall market performance and risk-reward dynamics of 2025, these returns are exceptionally valuable, surpassing most asset classes.

PANews’ analysis of 443 mainstream spot trading pairs in 2025 revealed a stark reality: these prominent crypto assets recorded an average decline of -54%. Only 40 tokens (less than 10%) achieved positive returns, and a mere 4 tokens (less than 1%) managed to exceed 200% gains.

In this context, the BNB strategies – whether passive or diligent – offered a far more advantageous and certain path than speculating on the rare 1% of high-performing tokens. For investors who prioritize calculated gains and predictability, this approach, though seemingly less glamorous, proved to be a remarkably rational crypto play.

The foundation of this “certainty” lies in the sheer scale and dominance of the Binance platform. According to Binance’s 2025 Annual Report, over 17 million users participated in Alpha, collectively receiving $782 million in rewards. These astronomical figures reaffirm Binance’s status as the “cosmic exchange.” In a year marked by significant industry consolidation, where many platforms struggled with liquidity, Binance leveraged its overwhelming data to effectively capture and redistribute market value. Its deep user engagement and broad reward distribution solidified its position at the absolute epicenter of the industry.

For users in the “no-one-takes-over” zero-sum market of 2025, holding BNB and engaging in activities like Alpha wasn’t about gambling against market makers. Instead, it was akin to becoming a “shareholder” of the exchange, contributing to its activity and directly benefiting from its success.

Ultimately, sometimes being strategically “lazy” proves far more effective than being diligently misguided.

Disclaimer: The content provided above is for informational purposes only and does not constitute investment advice.

(The above content is excerpted and reproduced with authorization from partner PANews, original link)

Disclaimer: This article is for market information only. All content and views are for reference only, do not constitute investment advice, and do not represent the views and positions of BlockTempo. Investors should make their own decisions and transactions. The author and BlockTempo will not bear any responsibility for direct or indirect losses resulting from investor transactions.