2026 Crypto Outlook: A Tale of Two Markets – Institutional RWA vs. Retail Meme & Privacy

By Nikka / WolfDAO (X: @10xWolfdao)

The cryptocurrency market in 2026 is poised for a significant divergence, with Real World Assets (RWA), Meme coins, and Privacy coins forming distinct investment battlegrounds. Institutions are placing massive bets on the RWA tokenization revolution, anticipating a multi-trillion dollar market, yet grappling with challenges like low liquidity and regulatory hurdles. Meanwhile, Meme coins are experiencing a resurgence, but largely within a zero-sum game, shadowed by the threat of token unlock pressures. Privacy coins, despite a limited rebound, find themselves at a crossroads between their foundational ideals and tightening regulatory compliance. This article argues that true Alpha will not be found in single-track plays, but rather in the innovative intersections of these sectors. For retail investors, the optimal strategy may involve holding core assets like BTC/ETH and patiently awaiting clearer signals, thereby mitigating the risks of chasing highs and premature exits.

A Deepening Divide: Wall Street vs. Web3 Culture

As 2026 approaches, investors face a critical choice: commit to institutional narratives surrounding RWA, or pursue the rapid, potentially 100x gains offered by Meme and Privacy coins? This decision could determine your financial standing in the coming year.

Wall Street is championing a monumental “tokenization revolution.” Bernstein projects 2026 as the dawn of a tokenization supercycle, while Grayscale boldly forecasts a thousandfold growth for Real World Assets (RWA) by 2030. The institutional blueprint is clear: bring real estate, bonds, and treasuries onto the blockchain, unlocking trillions in traditional capital.

Yet, a vastly different narrative unfolds on the other side of the market. Meme coins surged 23% early this year, and QUAI, a privacy coin once under regulatory scrutiny, skyrocketed an astounding 261%. In the vibrant Discord communities, retail investors remain fixated on discovering “the next 100x gem,” often dismissing institutional “slow money” plays.

This isn’t merely a difference in investment philosophy; it’s a fundamental clash of two worlds. On one side, suited institutional investors meticulously analyze RWA risk-reward ratios in corporate boardrooms. On the other, agile retail traders pore over candlestick charts at 3 AM, chasing the latest Meme coin pumps.

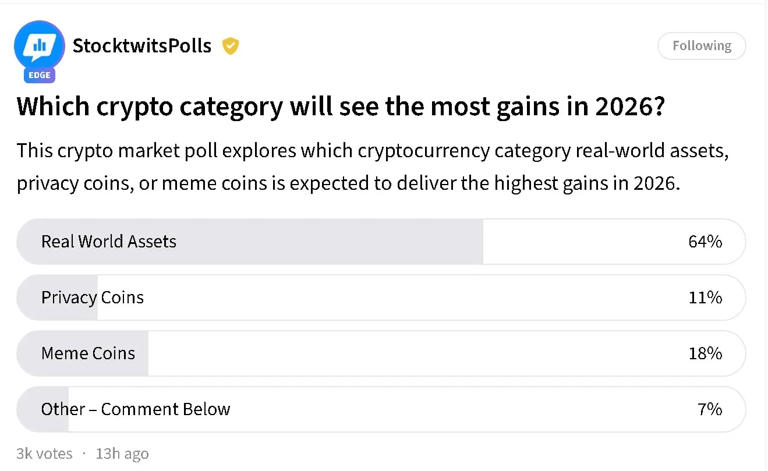

A recent Stocktwits poll highlights this divergence: 64% of investors believe RWA will deliver the strongest returns in 2026, dwarfing Meme coins at 12% and privacy coins at 8%. However, this statistic raises a crucial question: when retail investors universally embrace RWA, is it a genuine evolution in understanding, or merely a post-traumatic stress response following the 2025 Meme market crash?

RWA: The Institutional Promised Land or an Overcrowded Path?

Let’s delve into Wall Street’s fervent interest in RWA. With the crypto market cap hovering around $3.2 trillion and Bitcoin consolidating near $95,000, the industry is actively seeking its next major growth catalyst.

The fundamental logic behind RWA appears impeccable: tokenizing traditional assets like real estate and government bonds on-chain promises to harness blockchain’s inherent efficiencies while tapping into trillions of dollars from conventional finance. This isn’t mere speculation; it’s seen as foundational “infrastructure development.”

Grayscale’s “2026 Digital Asset Outlook: Dawn of the Institutional Era” report identifies RWA as a central theme, predicting its expansion from a current $21 billion to a multi-trillion dollar market by 2030. This projected growth is underpinned by a progressively clearer regulatory landscape, exemplified by the potential passage of the US CLARITY Act and the increasing allowance for US banks to allocate 1-4% of client portfolios to crypto assets.

Pioneers are already making significant strides. Ondo Finance, specializing in RWA lending, boasts a market capitalization of approximately $1.5 billion. Chainlink, as a vital oracle infrastructure, underpins RWA data integration onto blockchains, with a market cap exceeding $20 billion. Bernstein has explicitly endorsed these projects, alongside Coinbase and MicroStrategy, as indirect beneficiaries of the tokenization wave.

Yet, a critical paradox emerges: if RWA is universally recognized as the “correct answer,” can it still offer outsized returns?

Currently, the total RWA market capitalization is a modest $20 billion, characterized by extremely low liquidity. While a concentrated influx of institutional capital could indeed trigger a price explosion, the reverse is equally true: should early institutional players begin to realize profits, retail investors might find themselves holding illiquid RWA tokens.

A more immediate risk lies in regulatory delays. Should the CLARITY Act face postponements or the Federal Reserve’s rate-cutting cycle extend beyond expectations, the entire RWA narrative could endure another year or two of volatility and uncertainty.

Institutions are better positioned to weather such delays, benefiting from a lower cost of capital and long-term allocation mandates. But can the average retail investor afford this patience? This often-overlooked dimension of RWA investment demands not only foresight but also substantial patience and liquidity to navigate the pre-adoption vacuum.

Meme Coins: Cultural Phenomenon or a Final Frenzy?

In stark contrast to the rational RWA narrative, Meme coins serve as a potent barometer of the crypto market’s collective sentiment. Early 2026 witnessed the Meme coin market cap climb from $150 billion at the close of 2025 to $185 billion, marking a 23% increase.

While this growth pales in comparison to the explosive rallies of 2021 or early 2025, it unequivocally demonstrates that Meme culture remains a formidable force.

Jesse Pollak, founder of the Base chain, offers an insightful perspective, emphasizing that Memes transcend mere speculative tools to become the “core of on-chain culture.” Through compelling images, videos, and music, Memes possess the unique ability to onboard millions of new users, serving as a crucial gateway for Web3 mass adoption.

Meme projects on the Base chain, such as TYBASEGOD, TOSHI, and BLOOFOSTERCOIN, exemplify this thesis, functioning less as simple tokens and more as vessels for vibrant community culture.

However, it’s essential to acknowledge that this “cultural theory” often serves to legitimize platform ecosystems rather than providing a robust investment thesis. At their core, Meme coins remain a zero-sum game: early adopters profit from community consensus and viral spread, while later entrants ultimately provide the exit liquidity.

The Stocktwits poll, showing only 12% favoring Memes, reflects a collective caution among institutional and rational retail investors. More significantly, the 2025 Meme market crash left deep scars, trapping numerous retail investors who chased highs, many of whom have yet to recover their capital.

So, what does the 2026 Meme rebound signify? One interpretation suggests that Layer 2 solutions like Base, with their low transaction costs and high throughput, have lowered the barriers to Meme creation and trading, enabling the sector to maintain activity with smaller capital injections.

A more pessimistic view, however, posits that this is merely a “stock game“—experienced traders profiting from each other, without significant new capital entering the market. If 2026 fails to produce new 100x legends akin to Shiba Inu in 2021, Meme coins could gradually recede into a niche playground for dedicated enthusiasts.

Furthermore, a critical, often overlooked risk is the substantial unlock pressure from concentrated Token Generation Events (TGEs) in Q1. When a large volume of tokens unlocks, market liquidity can be severely strained, and Meme coins, as the most volatile asset class, are typically the first to feel the pressure. This structural vulnerability is rarely discussed within Meme communities but could be a primary driver of retail losses in 2026.

Privacy Coins: Last Stand of Idealism or Next Regulatory Target?

Privacy coins occupy a particularly precarious position in this market discourse. On one hand, Quai Network saw an impressive 261% surge early in the year, climbing from $0.03 to $0.11, reaching a market cap of approximately $86 million. Monero and Zcash also experienced rebounds ranging from 10-50%.

Conversely, the entire privacy coin sector commands a modest market capitalization of only $5-10 billion, representing a negligible fraction of the overall $3.2 trillion crypto market.

Proponents of privacy coins argue that they embody the foundational principles of cryptocurrency: financial freedom and transactional privacy, upholding decentralization and censorship resistance. Quai’s recent surge was partly fueled by the introduction of new mining hardware and enhanced DEX liquidity, demonstrating that technological advancements can still generate short-term Alpha for privacy assets.

However, the reality is often harsher than the ideal. The European Union’s anti-money laundering regulations are tightening their grip on privacy coins, leading to the delisting of assets like Monero from several exchanges. The Stocktwits poll, with only 8% of investors favoring privacy coins, reflects not only regulatory apprehension but also a broader lack of market consensus for privacy as a primary investment theme.

A more profound question looms: can privacy and compliance coexist within the current regulatory framework? If not, privacy coins risk being marginalized as tools for tech enthusiasts and illicit activities, or being forced to compromise their core principles into “pseudo-privacy” projects.

This inherent dilemma makes it challenging for privacy coins to achieve mainstream investment status. For unwavering privacy advocates, however, this very uncertainty might present a long-term accumulation opportunity. Buying at historical lows after regulatory clarity could yield substantial returns, but it demands enduring 3-5 years of volatility and uncertainty—a timeline too protracted for most investors.

Divergence is Inevitable, Where Lies True Alpha?

So, among RWA, Meme, and Privacy, which will be the genuine source of Alpha in 2026?

The answer may be surprising: none of them, at least not in the conventional sense.

The core of this market divergence lies in a misalignment of time horizons—RWA plays out over years, Meme coins over weeks, and Privacy coins over quarters. Institutions possess the patience to lock up RWA, while retail investors, chasing quick gains, often suffer repeated stop-outs amidst volatility. The greatest risk isn’t “choosing the wrong sector,” but rather “chasing highs and lacking the conviction to hold.”

True Alpha will likely emerge from two distinct areas:

1. Intersections: Innovation Bridging Time Mismatches

Genuine Alpha won’t be found at the culmination of a single track, but rather in the converging intersections of narratives:

- Privacy-Enhanced RWA: Tokenized bonds and real estate on-chain, where transaction intent and holdings are fully encrypted, only revealed during audits. This transforms RWA from an “institutional exclusive” into a playground for “institutions + high-net-worth retail.”

- Meme IP Tokenization: Once viral Meme intellectual property is RWA-ized, generating cash flow from copyrights, merchandise, and community segmentation. This shifts Memes from a “casino” to a “cultural fund.”

- Compliant Privacy Layers: Solutions offering default privacy with selective disclosure. Private stablecoins and private cross-chain bridges address critical pain points for institutions (data leakage) and retail users (front-running).

The essence of these intersections is to leverage institutional patience to satisfy retail FOMO, and to activate institutional liquidity through retail’s viral propagation. Pure single-track players are susceptible to being washed out by temporal mismatches; it’s the intersectional innovators who will uncover asymmetric opportunities.

2. Strategic Non-Participation: Retail’s Most Underestimated Advantage

If the complexities of this market divergence remain unclear, the most effective strategy might simply be non-participation. Hold core assets like BTC/ETH and await clearer market signals. FOMO often leads to losses across all sectors; patient waiting, conversely, enables strategic, high-conviction investments at opportune moments. Retail investors’ greatest strength is their inherent flexibility.

(The above content is an excerpt and reproduction authorized by partner PANews, original link | Source: WolfDAO)

Disclaimer: This article is for market information purposes only. All content and opinions are for reference only and do not constitute investment advice, nor do they represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.