The cryptocurrency market experienced a significant downturn yesterday, with Bitcoin (BTC) sharply breaking below the 90,000 mark. Market tensions escalated further in the evening, triggered by a confluence of events: former President Trump’s address at the World Economic Forum in Davos, Switzerland, and the European Parliament’s decision to freeze the approval process for the EU-US trade agreement. These factors collectively led to another substantial market decline, pushing BTC below 88,000 and Ethereum (ETH) under the $2,900 threshold. With BTC’s daily candle closing definitively bearish, it is anticipated to continue consolidating below its current downtrend line. The market remains highly sensitive, with potential for further notable declines in BTC around Friday’s Bank of Japan interest rate announcement or any adverse news emerging from the ongoing World Economic Forum.

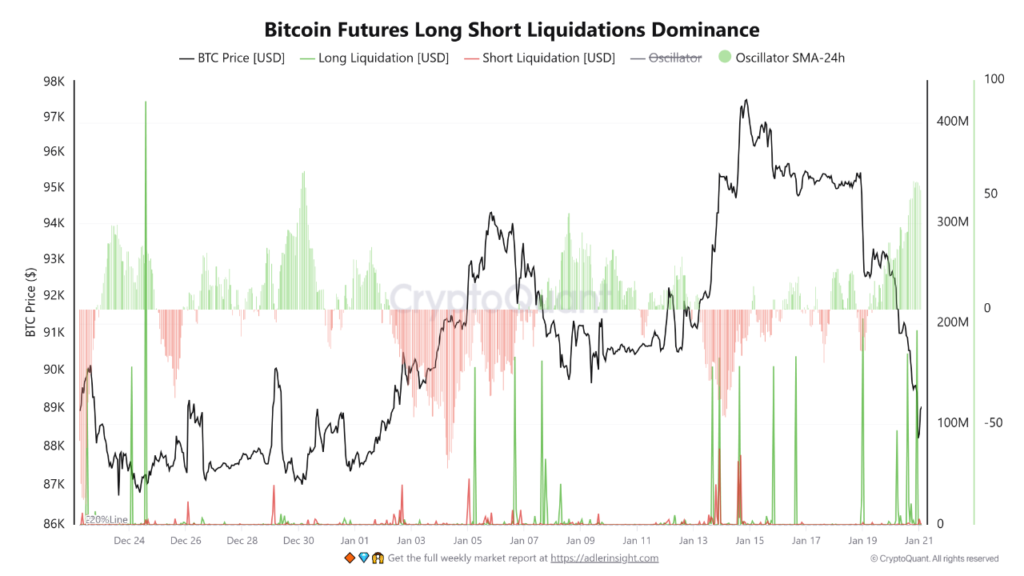

Beyond macroeconomic shifts, a deeper look into Bitcoin futures liquidation data reveals a crucial transformation in leveraged positioning over recent weeks. Periods characterized by a dominance of short liquidations (marked in green on the chart) have consistently coincided with upward price movements. This pattern suggests that recent rallies were not primarily fueled by organic spot demand but rather by aggressive ‘short squeezes’ – forced closures of short positions. While these events can generate intense, momentum-driven surges, the underlying impetus tends to dissipate rapidly once the liquidation pressure abates.

Conversely, a high frequency of long liquidations (depicted in red) typically aligns with localized price pullbacks or consolidation phases. This indicates a necessary market cleansing, flushing out excessive optimistic leverage. Although these events often lead to temporary price weakness, they play a vital structural role in reducing overall market leverage and resetting funding rates, thereby contributing to greater stability in the subsequent market environment.

In summary, Bitcoin’s recent price action underscores a market heavily influenced by leverage, where liquidations act as the primary catalyst for volatility. Until these extreme, liquidation-driven phenomena stabilize and genuine spot demand reasserts its dominance, BTC’s price trajectory is likely to remain reactive. Significant price swings will predominantly stem from imbalances in leveraged positions rather than reflecting sustained, directional conviction from broader market participants.

Disclaimer: This article is intended solely for providing market information. All content and views are for reference only and do not constitute investment advice, nor do they represent the views and positions of BlockBeats. Investors should make their own decisions and conduct their own transactions. The author and BlockBeats will not be held liable for any direct or indirect losses incurred by investors’ transactions.