Author: Nancy, PANews

Bitcoin’s Tumultuous November: Unpacking the Market’s Structural Shifts and Emerging Opportunities

November ushered in a period of intense volatility for the cryptocurrency market. On November 5th, Bitcoin’s price plummeted below the critical $100,000 psychological threshold, marking a five-month low. This sharp decline triggered a widespread sell-off across altcoins, rapidly escalating market anxiety and prompting a deeper look into the underlying dynamics.

Bitcoin Faces Capital Outflow: Long-Term Holders Reduce Exposure

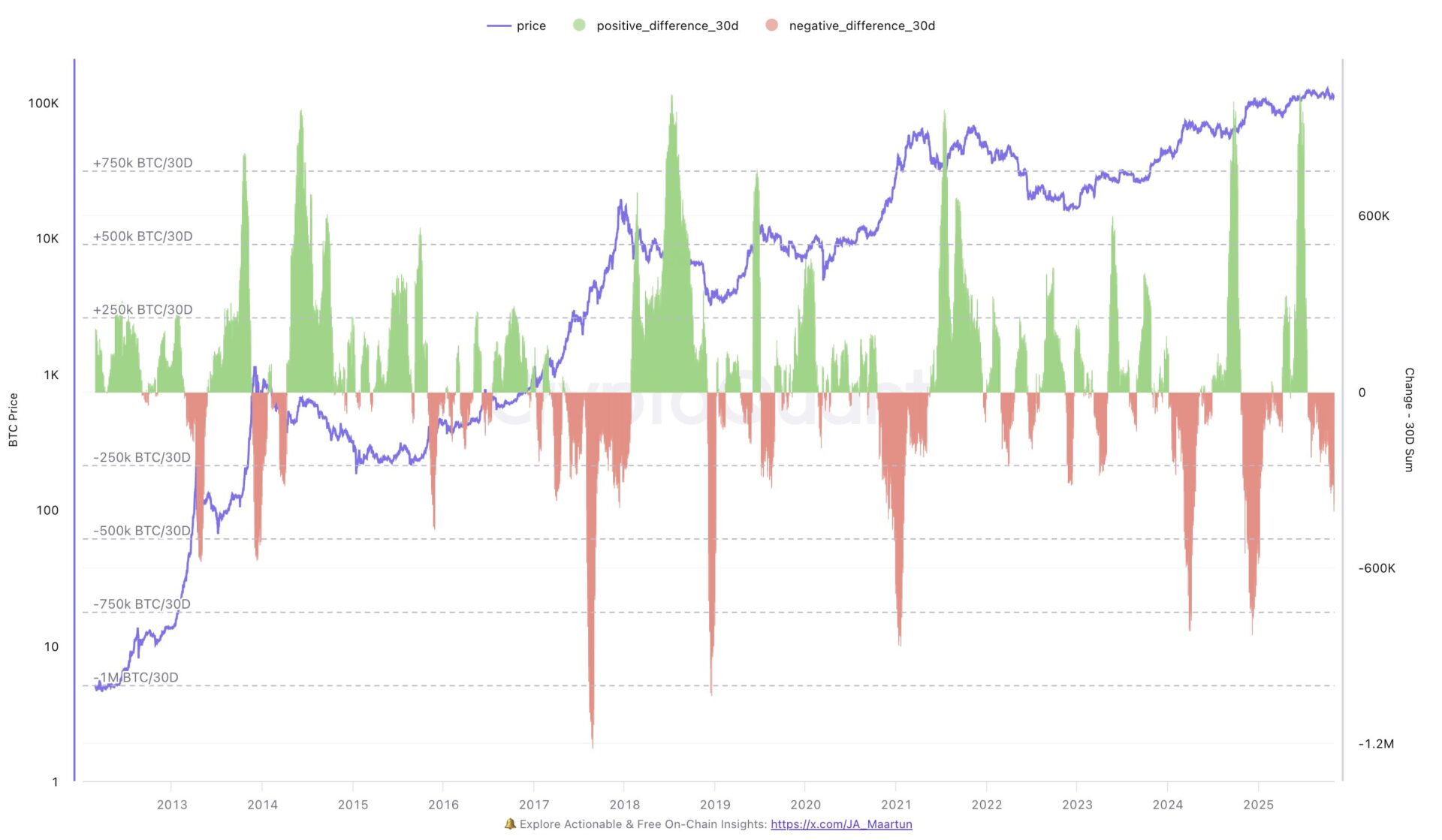

Bitcoin’s recent price weakness isn’t solely attributable to broader macroeconomic uncertainties; a significant shift in capital flow is the primary driver. Data from CryptoQuant reveals that long-term Bitcoin holders have collectively divested over 327,000 BTC in the past 30 days. This trend of continuous net outflows has been observed since early October, with selling pressure from long-term holders consistently hovering around 300,000 BTC. This persistent selling indicates waning market confidence and mounting liquidity pressure. Despite several attempts by Bitcoin to rally in mid-to-late October, each upward movement was met with substantial capital outflows, signifying a lack of fresh buying interest and insufficient market momentum to sustain recovery.

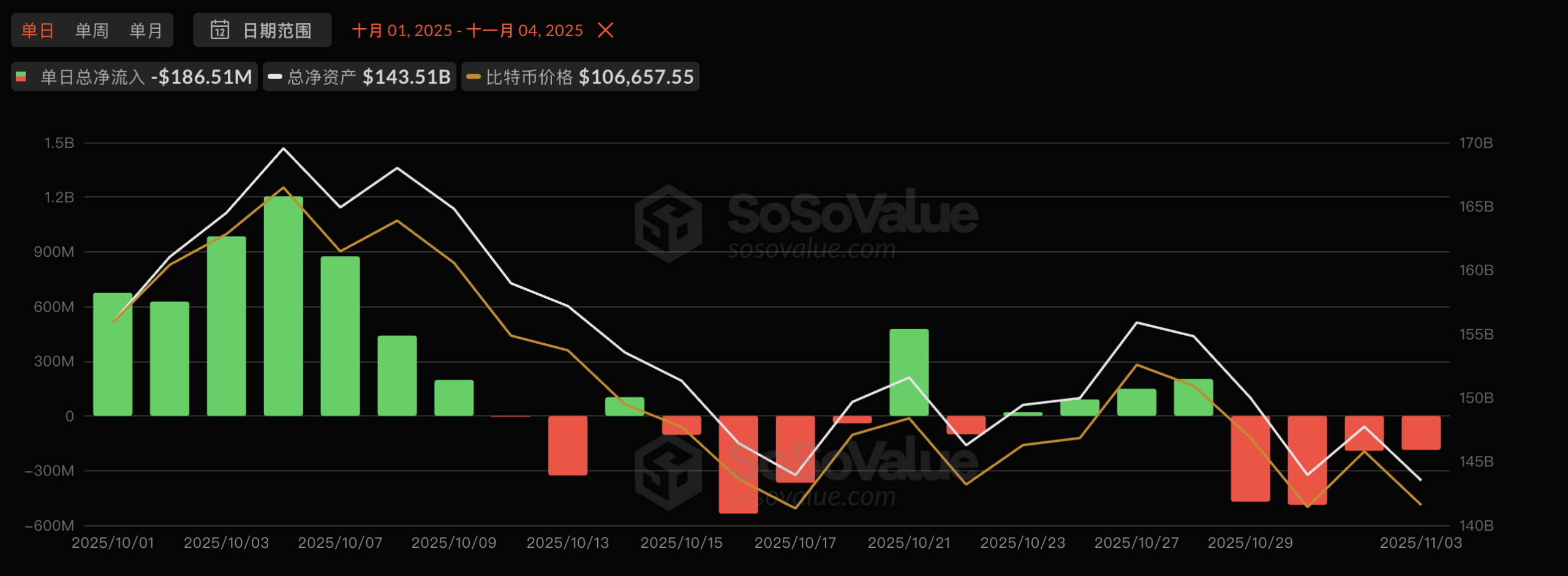

Concurrently, the Bitcoin ETF market has witnessed a subtle but significant shift in capital dynamics. SosoValue data indicates that U.S. spot Bitcoin ETFs recorded a cumulative net inflow of $3.42 billion in October, providing robust support for Bitcoin’s spot price early in the month. However, this trend dramatically reversed towards month-end, with a staggering $1.33 billion in net outflows observed over just four days. Notably, BlackRock’s IBIT, typically a magnet for capital, experienced a single-day redemption of $291 million—its largest daily outflow since early August. ETF capital movements often serve as a barometer for institutional sentiment, and these recent shifts suggest a clear pivot towards caution among institutional investors, signaling a cooling of market optimism.

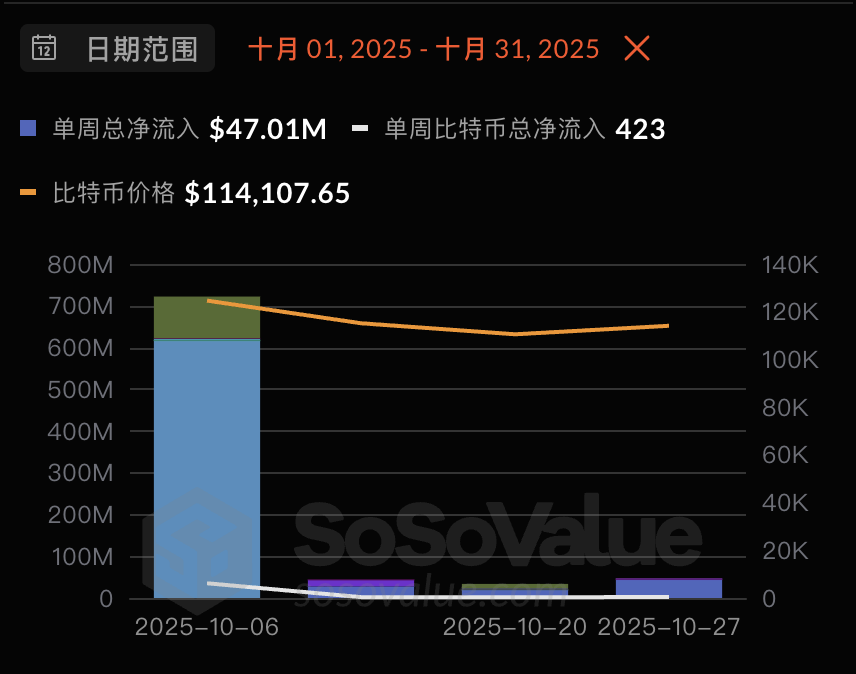

Similar trends are evident at the corporate level. SosoValue data shows that global public companies (excluding mining firms) collectively made net purchases of approximately 7,251 BTC in October. Yet, beneath this seemingly steady figure lies a structural shift: roughly 85.1% of these purchases occurred within the first week of the month, followed by a substantial deceleration in accumulation. Major corporate buyers, including Strategy and Metaplanet, have notably slowed their acquisition pace.

Evidently, the current volume and sustainability of new capital inflows into Bitcoin are insufficient to counteract the persistent selling pressure from long-term holders, indicating that the market’s supply-demand dynamics are facing a period of structural imbalance.

Miners and Institutions Under Pressure: The Battle for Cost Basis

Bitcoin’s recent price trajectory has once again put the market on edge. As Bitcoin breached the $100,000 mark, multifaceted pressures are becoming increasingly apparent. While widespread panic selling has not yet materialized, several indicators suggest Bitcoin is navigating a critical phase characterized by a battle around cost bases and a structural test of its foundations.

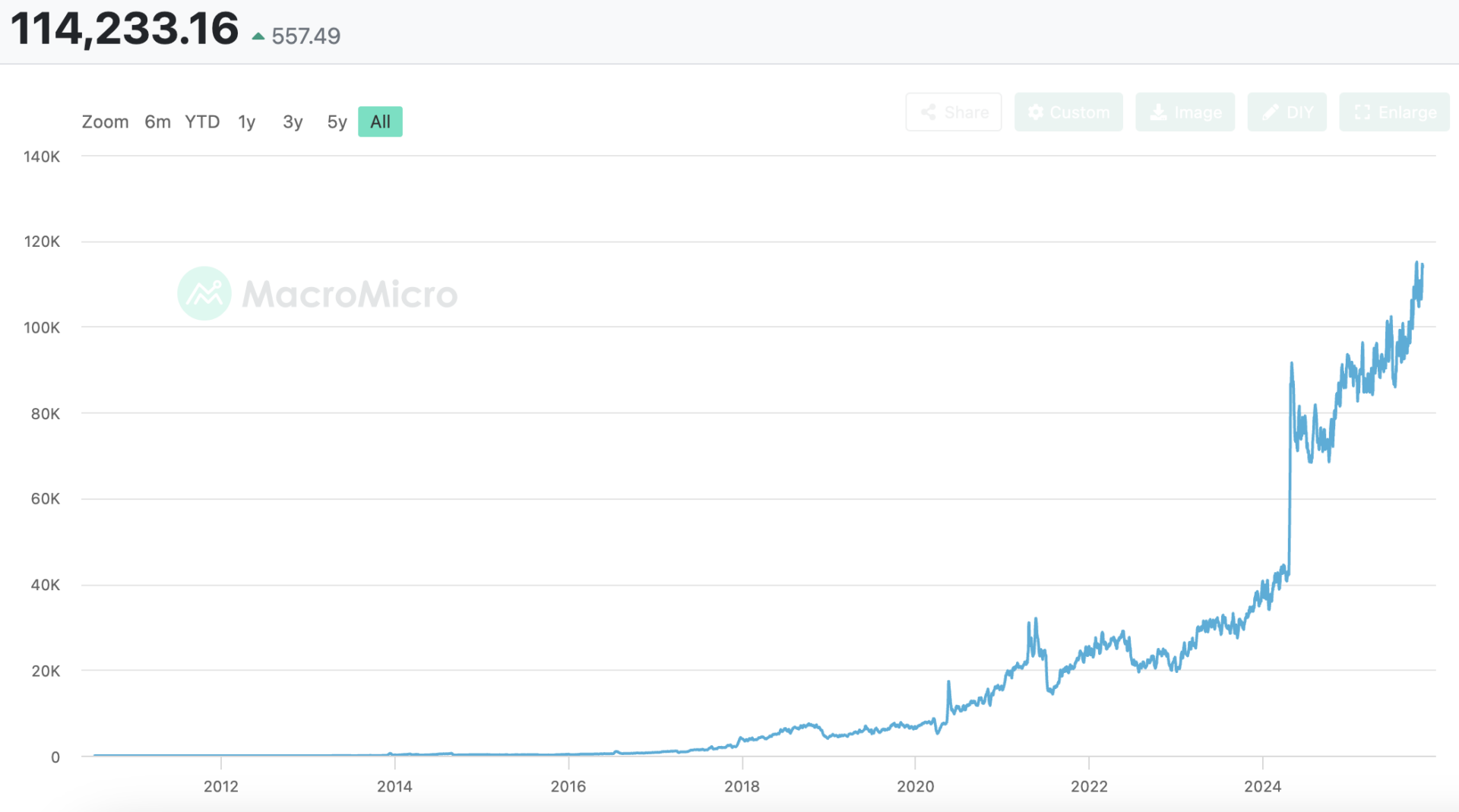

Data from MarcoMicro reveals that as of November 4th, Bitcoin’s average production cost has climbed to approximately $114,000. This implies that the mining costs for a significant portion of mining operations now exceed or closely approach the market price. Under current economic conditions, many mining companies are not only experiencing sharply reduced mining profits but also grappling with additional cost pressures from sales, administration, and energy. Consequently, cost reduction has become a paramount objective for miners to sustain operations. Should market demand further contract, some miners are already exploring business diversification strategies, such as pivoting towards AI infrastructure development and computing power leasing, to hedge against cyclical risks.

Institutional holders are also under considerable strain. SosoValue data indicates that among 38 public companies globally holding Bitcoin, at least 24 now find their holdings below their cost basis. This list includes prominent names like Metaplanet, Bullish, Galaxy Digital, and Next Technology. Even top-tier industry institutions are struggling to maintain paper profits in the current range. Furthermore, some smaller Digital Asset Treasury (DAT) companies have initiated selling due to liquidity pressures; for instance, US-listed Sequans confirmed the sale of 970 Bitcoins to reduce debt.

From a technical analysis perspective, several industry experts foresee further short-term downside risk. Katie Stockton, founder of Fairlead Strategies, points out that Bitcoin has fallen below its critical 200-day moving average (approximately $109,800). The 200-day MA is one of the most widely observed indicators for defining long-term trends and historically acts as a significant support level for Bitcoin. This breach could signal further declines, with a potential next target around $94,200. Markus Thielen, CEO of 10x Research, recently stated that Bitcoin is approaching the support line established since its October 10th flash crash, suggesting a break below $107,000 could lead to a retest of $100,000. Matrixport analysis, meanwhile, highlights that Bitcoin is currently nearing its 21-week moving average, an indicator that has historically served as a reversal signal. While the current trajectory might imply further downward exploration, it does not necessarily signify the end of the market cycle. This advises investors to rely on time-tested indicators as a stable basis for decision-making rather than being swayed by short-term market fluctuations.

Bitcoin’s Structural Adjustment: Opportunities for Patient Investors Emerge

Despite the prevailing concerns, market sentiment isn’t entirely pessimistic. Glassnode data analysis indicates that Bitcoin maintained a range-bound trading pattern this week, showing some improvement in market momentum despite slower capital inflows. ETF outflows and declining profitability suggest the market is in a sustained consolidation phase, operating under a relative equilibrium. Since July, Bitcoin has repeatedly encountered resistance at the cost basis of high-volume buyers, indicating significant overhead selling pressure. In the short term, a retest of the critical support zone around $104,000 is plausible. Historically, periods where short-term holders face significant pressure, or even capitulation, have often presented attractive accumulation opportunities for patient investors.

Wintermute’s analysis highlights that while global liquidity is expanding, this capital is not yet flowing into the cryptocurrency market. ETF inflows have stagnated since summer, with BTC ETF assets under management hovering around $150 billion, and Digital Asset Treasury (DAT) activity has dried up. Wintermute argues that the traditional four-year cycle concept is no longer applicable to a maturing market. They assess the current market structure as healthy, with leverage cleared and positions orderly. Liquidity is identified as the critical driver of performance, and they will closely monitor ETF inflows and DAT activity as key signals for liquidity’s return to the crypto space.

Matt Hougan, Chief Investment Officer at Bitwise, offers a more optimistic outlook. Despite Bitcoin’s dip below $100,000—a low not seen since June—and the ensuing fears of a ‘crypto winter,’ Hougan believes the current market is closer to a bottom than the onset of a new long-term bear market. He observes that retail investors are currently in a state of extreme despair, marked by frequent leverage liquidations and record-low market sentiment. In contrast, institutional investors and financial advisors maintain a bullish stance, consistently allocating to Bitcoin and other crypto assets via ETF channels. Hougan asserts that institutions are becoming the primary driving force in the market. With retail crypto investor selling pressure nearing exhaustion, he anticipates Bitcoin’s price bottom to emerge sooner than expected. He even suggests Bitcoin could reach new highs this year, potentially climbing into the $125,000 to $130,000 range, and possibly even touching $150,000 under ideal conditions. As institutional buying continues to grow, the next phase of the crypto market will be propelled by more rational capital.

Arthur Hayes, co-founder of BitMEX, recently published an extensive piece suggesting that the U.S. Treasury and the Federal Reserve are orchestrating a ‘Stealth Quantitative Easing (QE),’ which could become a pivotal catalyst for the next leg up in Bitcoin and the broader crypto market. Hayes outlines that the U.S. government is expanding spending, favoring debt issuance over tax increases. Foreign central banks are increasingly opting for gold purchases due to perceived risks in dollar-denominated assets, while the U.S. private savings rate is insufficient to absorb the volume of Treasury issuances. Furthermore, the four largest commercial banks have only absorbed a small fraction of new debt. This scenario positions ‘relative value hedge funds’ as the marginal buyers of U.S. Treasuries, financing their purchases through leveraged repurchase agreements. With the U.S. Treasury projected to issue approximately $2 trillion in new debt annually to cover its deficit, Hayes argues that during periods of liquidity strain, the Federal Reserve’s Standing Repo Facility (SRF) injects capital into the market, effectively acting as ‘disguised QE.’ As the utilization of this mechanism rises, global dollar liquidity expands, yielding effects akin to traditional QE. Hayes predicts this will reignite a bull market for Bitcoin and the crypto sector. He advises investors to preserve capital and await opportune moments, anticipating a robust market rebound once ‘Stealth QE’ fully takes hold, despite short-term liquidity tightening due to government shutdowns and Treasury auctions.

From the perspective of on-chain capital and holding structure, the Bitcoin market is currently undergoing a structural test of supply-demand imbalance. On-chain data analyst @Murphy highlights that long-term holders have recently engaged in significant selling, while market demand has been insufficient to fully absorb this pressure. These holders are selling due to still-existing, albeit shrinking, profit margins as prices experience volatile corrections. Historically, the market tends to stabilize once the average daily distribution from long-term holders drops below 15,000 BTC. Furthermore, when their realized profit/loss ratio falls below a ‘warning line,’ the motivation to sell significantly diminishes, alleviating market pressure. Following historical patterns, this adjustment period could persist for another 1-2 months, potentially presenting opportune entry points for trend traders.

Ki Young Ju, CEO of CryptoQuant, observes that the unrealized profits of whales are not currently high, indicating that the market has not yet entered a euphoric phase. This could also be attributed to the expanded scale of the Bitcoin market, making exceptionally high-profit margins harder to replicate. Concurrently, Bitcoin’s hash rate continues to reach new all-time highs, and mining operations are still expanding, signaling a clear long-term bullish trend. Current demand primarily stems from ETFs and corporate strategies, but buying activity from both has recently slowed. A resumption of growth in these areas could reignite market momentum. Short-term whales (predominantly ETFs) are near breakeven, while long-term whales hold approximately 53% in profit. The traditional four-year cycle rule appears to be weakening, making future liquidity sources and scale more challenging to predict. Additionally, Bitcoin’s average holding cost is around $55,900, with holders averaging 93% profit. On-chain capital inflows remain robust, yet price stagnation is primarily due to weak demand rather than overwhelming selling pressure.

Crypto investment firm QCP Capital notes that the recent sell-off lacks clear macroeconomic drivers, especially given the strong performance of other risk assets amid favorable policies. Over the past month, the market absorbed approximately 405,000 Bitcoins from original (OG) holders without the price breaking below $100,000. While corporate accumulation has slowed and some smaller digital asset treasury companies have sold, the spot price has maintained support. Currently, long-term holders are taking profits, while institutional capital inflows and broader adoption are reinforcing the market’s foundational strength.

This article is an authorized excerpt and reproduction from PANews. The original link can be found here.

Disclaimer: This article is intended solely for market information purposes. All content and opinions expressed herein are for reference only and do not constitute investment advice. They do not represent the views or positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo shall not be held responsible for any direct or indirect losses incurred by investors’ trading activities.